OG 2025 Review: Everything You Need to Know

Executive Summary

This detailed og review shows major concerns about OG Forex Broker that potential traders must consider before opening an account. The company was established in 2009 and has its headquarters in Australia, presenting itself as a trading platform that offers forex and CFD services with high leverage up to 1:400 and a minimum deposit requirement of $1,000.

However, serious regulatory issues have emerged. These problems fundamentally undermine the broker's credibility and raise red flags for potential clients.

According to available information, the broker's regulatory license has been revoked. This development raises serious questions about its legal operating status and client fund protection measures. User feedback consistently warns against trading with this broker, and these warnings indicate widespread dissatisfaction with their services across multiple areas of operation.

The broker targets intermediate to advanced traders. They do this through their high leverage offerings and substantial minimum deposit requirement that excludes many retail traders.

While they provide demo accounts and claim to offer multiple trading services including currency pairs, commodities, and CFDs, the overall assessment remains highly negative. This negative assessment stems from regulatory non-compliance and poor user experiences that cannot be overlooked.

Given the revoked license status and user warnings, this og review concludes with a strong recommendation to avoid this broker. Traders should seek alternatives with proper regulatory standing and positive user feedback instead.

Important Disclaimers

Due to the revoked regulatory license status of OG Forex Broker, compliance situations may vary significantly across different regions. Traders should be particularly cautious because the broker may not have proper authorization to operate in many jurisdictions around the world.

This evaluation is based on publicly available information, user feedback, and regulatory data. Given the dynamic nature of regulatory compliance and the broker's current status, potential clients should independently verify all information before making decisions.

They should also consider consulting with financial advisors before making any trading decisions. The lack of current regulatory oversight means that standard investor protections may not apply to clients of this broker.

This situation significantly increases the risk for potential clients who choose to trade with this platform.

Rating Framework

Broker Overview

OG Forex Broker was established in 2009. The company positions itself as an Australian-based trading platform that specializes in foreign exchange and contracts for difference.

The company has operated for over a decade in the competitive forex market. Initially, they built their reputation by offering high leverage trading opportunities and targeting traders who seek substantial market exposure through their platform.

The broker's business model centers on providing access to international financial markets through forex trading and CFD services. Their approach has traditionally focused on attracting traders who are willing to make significant initial investments, and this focus is evidenced by their $1,000 minimum deposit requirement.

This requirement is considerably higher than many competitors in the retail trading space. However, the broker's operational status has become increasingly problematic due to recent regulatory developments.

Recent regulatory developments have resulted in the revocation of their trading license. This development fundamentally alters their market position and raises serious questions about their continued ability to provide legitimate trading services to clients.

This og review must therefore address these critical regulatory concerns. The platform claims to offer various trading assets including major and minor currency pairs, commodities, and CFD instruments across different markets.

They provide demo account access, which allows potential clients to test their trading environment before committing real funds. However, the value of this offering is questionable given the serious regulatory issues surrounding the broker.

Regulatory Status

The most critical aspect of this og review concerns the broker's regulatory standing. Reports indicate that OG Forex Broker's license has been revoked, though specific details about the regulatory authority responsible for this action are not clearly detailed in available information.

This development represents a fundamental red flag for potential clients. The revocation of a trading license is one of the most serious regulatory actions that can be taken against a broker.

Minimum Deposit Requirements

OG Forex Broker requires a minimum deposit of $1,000. This requirement positions them in the higher tier of initial investment requirements compared to many retail forex brokers.

This substantial entry barrier suggests targeting of more serious traders. However, it may exclude beginners and casual investors who want to start with smaller amounts.

Available Trading Assets

The broker offers access to currency pairs, commodities, and contracts for difference. However, the specific range and depth of available instruments are not comprehensively detailed in available documentation.

This lack of detail makes it difficult to assess the breadth of their trading offerings. Modern traders expect transparency about available instruments and market access.

Leverage Offerings

One of the broker's key features is high leverage availability up to 1:400. While this can amplify potential profits for experienced traders, it also significantly increases risk exposure.

This high leverage is particularly concerning given the regulatory uncertainties surrounding the broker's operations. Without proper oversight, high leverage becomes even more dangerous for traders.

The broker provides demo account access. This feature allows potential clients to evaluate their trading environment before committing real funds.

However, specific details about the underlying trading platforms, technology infrastructure, and advanced trading tools are not clearly specified in available information. This lack of transparency makes it difficult to assess the quality of their trading technology.

Cost Structure and Fees

Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available in the source materials. This absence makes it impossible to provide a comprehensive cost analysis for potential clients.

Transparency about trading costs is essential for traders to make informed decisions. The lack of this information is another concerning factor in this evaluation.

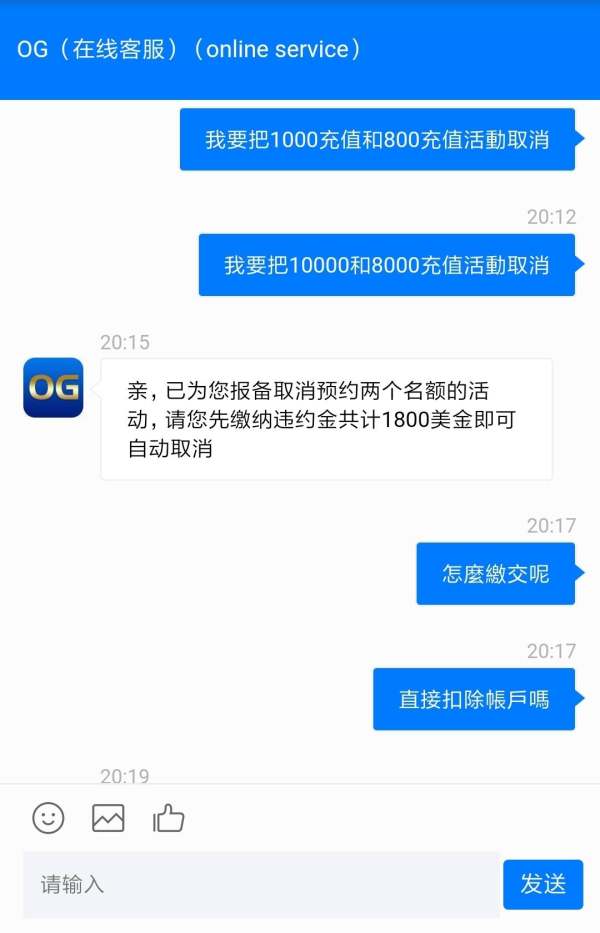

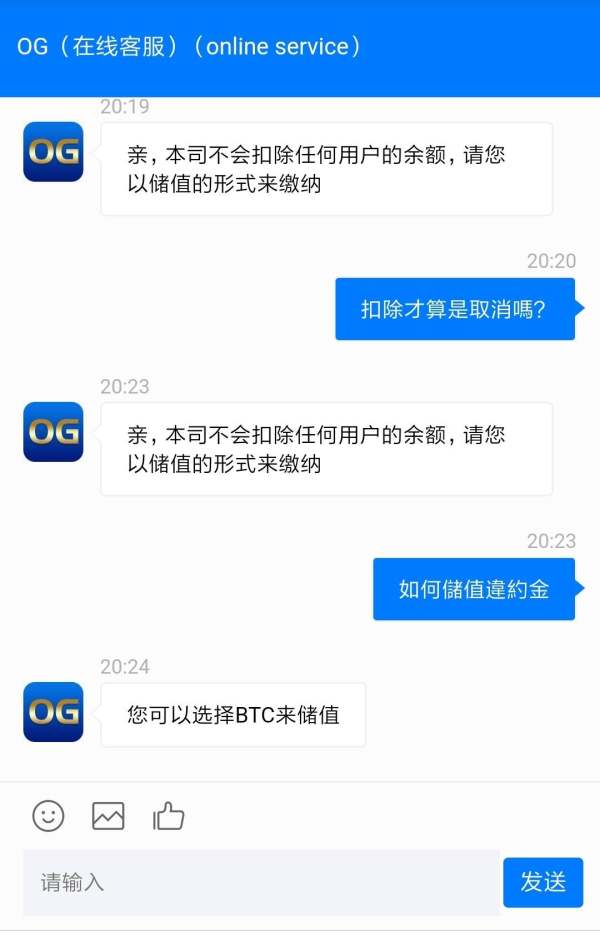

Payment Methods and Processing

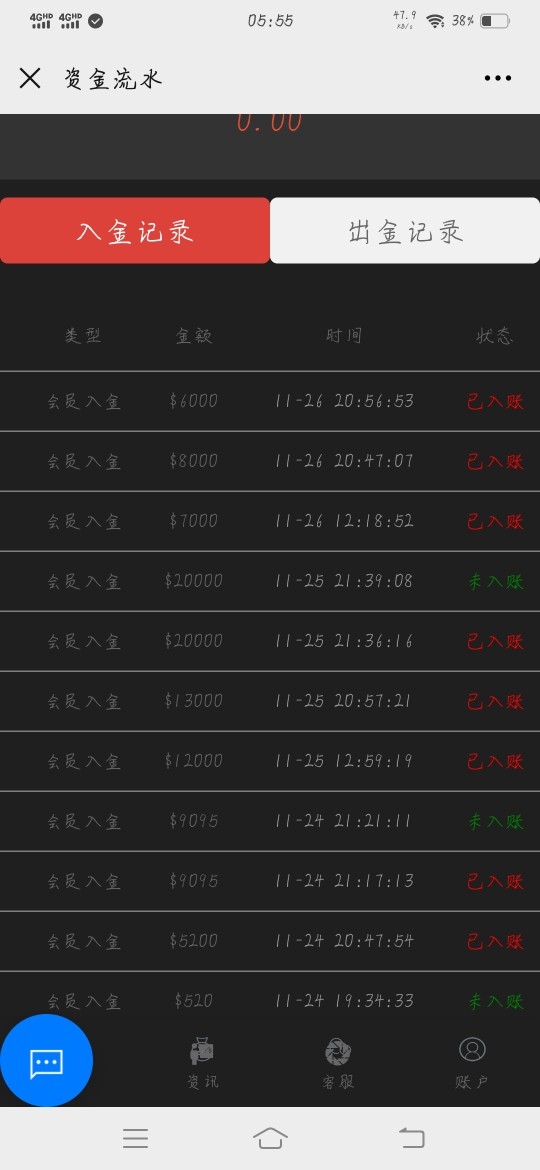

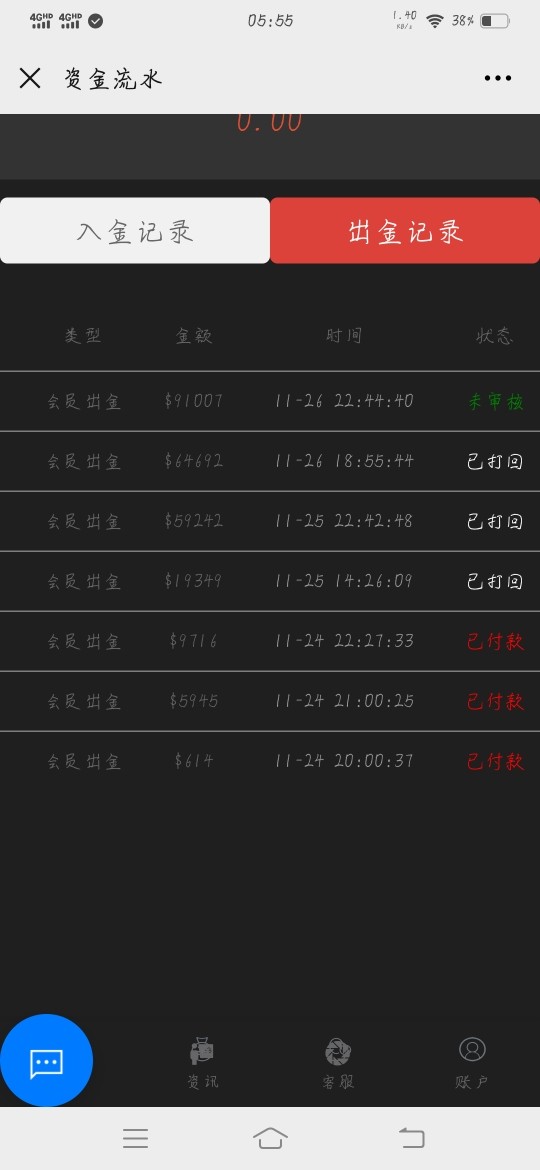

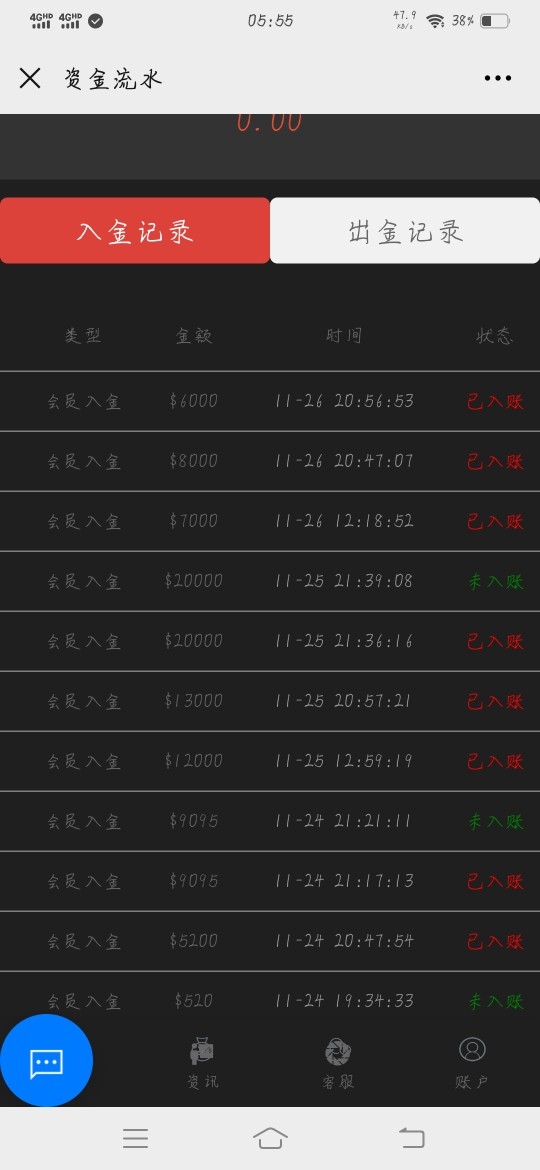

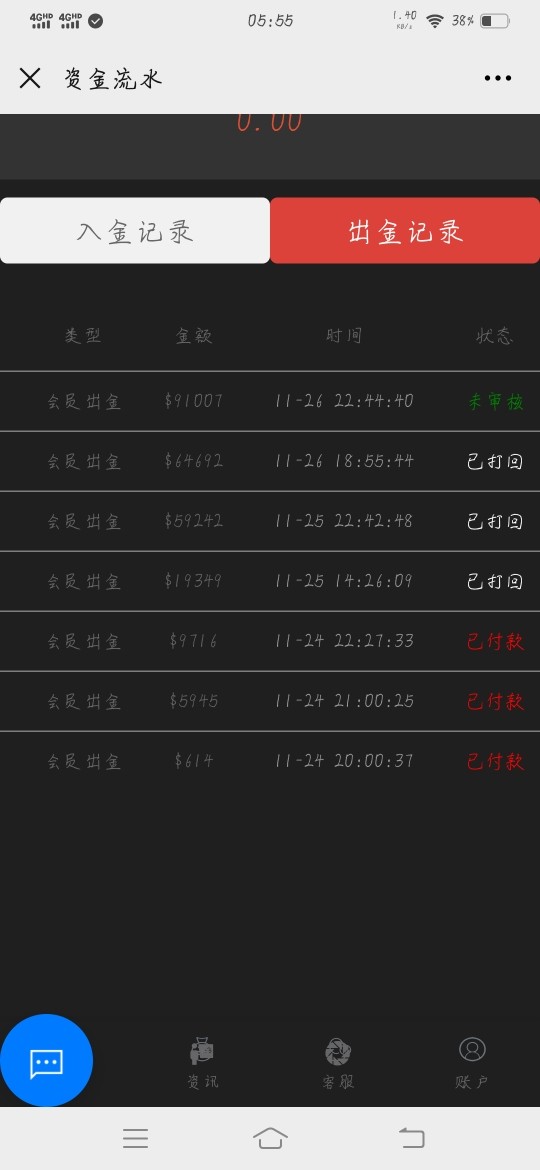

Specific information about deposit and withdrawal methods, processing times, and associated fees is not detailed in available documentation. This represents a significant information gap for potential clients who need to understand how they can fund their accounts and withdraw profits.

Clear payment processing information is a basic requirement for any legitimate broker. The absence of this information raises additional concerns about the broker's operations.

Geographic Restrictions

Available information does not specify which regions or countries may be restricted from accessing the broker's services. However, the revoked license status likely impacts service availability globally.

Traders need to understand whether they can legally access services from their jurisdiction. The lack of clarity on this important issue is problematic for potential clients.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions at OG Forex Broker present several concerning factors that contribute to a below-average rating. The $1,000 minimum deposit requirement is significantly higher than industry standards, where many reputable brokers offer account opening with deposits as low as $10-$100.

This high barrier to entry immediately excludes many retail traders and beginners. These traders might want to start with smaller amounts to test the waters before committing larger sums to trading.

While the broker offers demo accounts, which is a positive feature allowing potential clients to test the trading environment without financial risk, this benefit is overshadowed by the regulatory concerns. The account opening process details are not clearly specified in available information, and this lack of clarity raises questions about transparency and client onboarding procedures.

User feedback consistently warns against trading with this broker. These warnings suggest that even those who meet the minimum deposit requirements have encountered significant problems with the broker's services.

The lack of detailed information about different account types, special features, or Islamic account options further limits the appeal for diverse trading needs. This og review finds that the combination of high minimum deposits, regulatory issues, and negative user feedback makes the account conditions particularly unattractive.

Properly regulated alternatives in the market offer much better account conditions. These alternatives provide lower minimum deposits, clear account structures, and proper regulatory protections for client funds.

OG Forex Broker's tools and resources receive an average rating. This rating is primarily based on the limited information available about their offerings and the basic nature of what they provide.

The broker does provide demo account access, which serves as a basic educational and testing tool for potential traders. This feature allows users to familiarize themselves with the platform and test trading strategies without financial risk, which is valuable for new traders.

However, the quality and comprehensiveness of additional trading tools remain unclear from available documentation. Modern forex trading requires sophisticated analytical tools, real-time market data, economic calendars, and comprehensive charting capabilities that help traders make informed decisions.

The absence of detailed information about these essential resources raises concerns about the broker's technological infrastructure. Educational resources, which are crucial for trader development, are not specifically mentioned in available materials.

Reputable brokers typically offer webinars, tutorials, market analysis, and educational content to support their clients' trading journey. The lack of information about such resources suggests either their absence or inadequate promotion of available educational materials.

Automated trading support, expert advisors, and API access details are also not specified. This lack of information limits the assessment of their suitability for algorithmic traders or those requiring advanced trading automation capabilities.

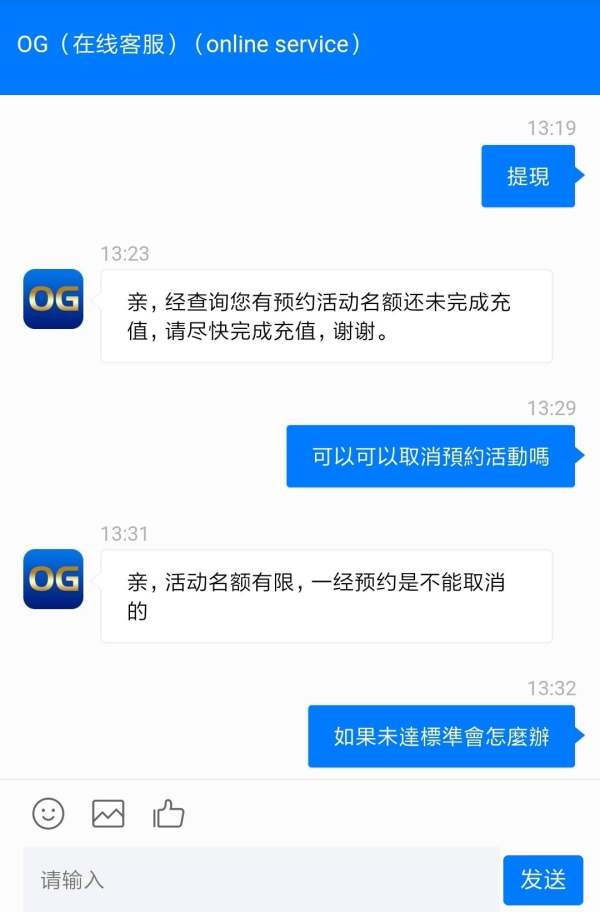

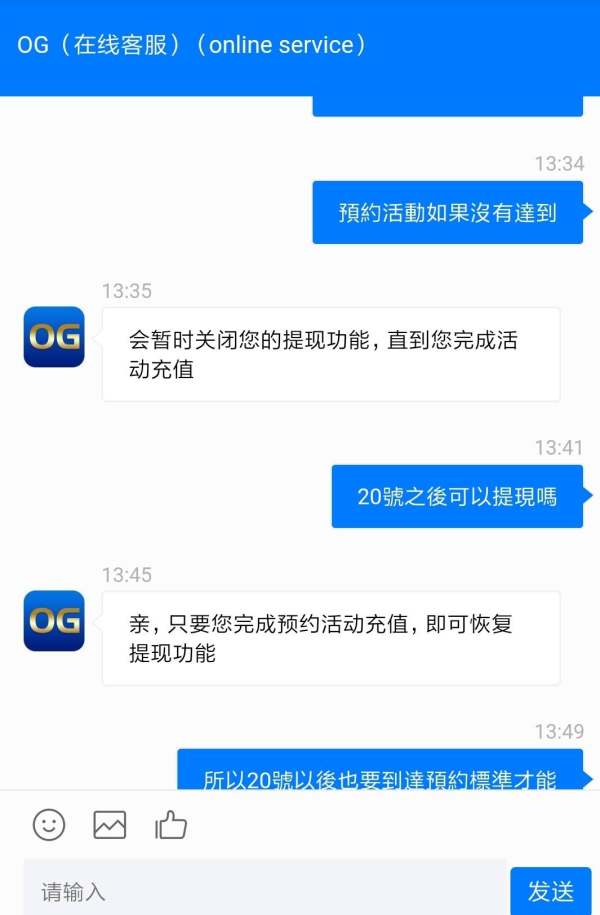

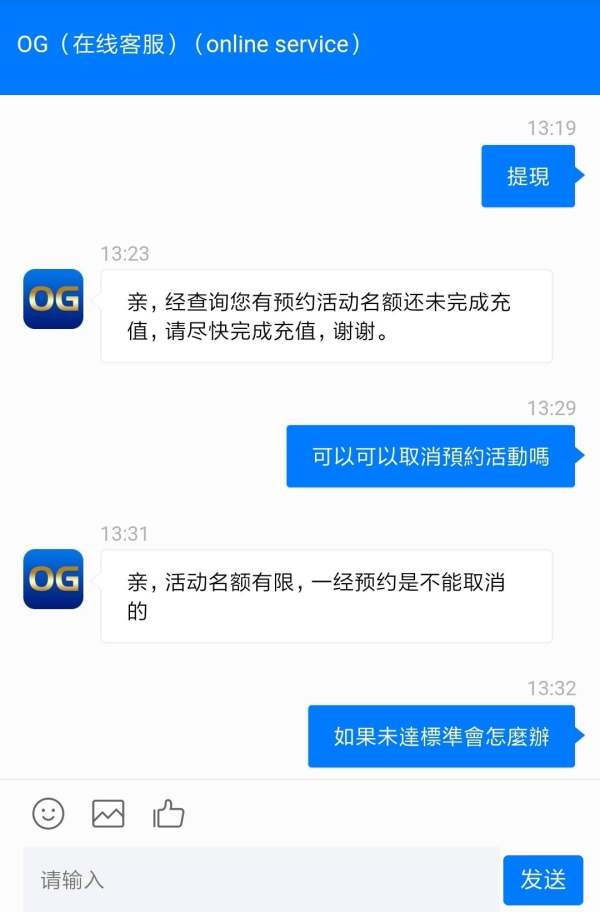

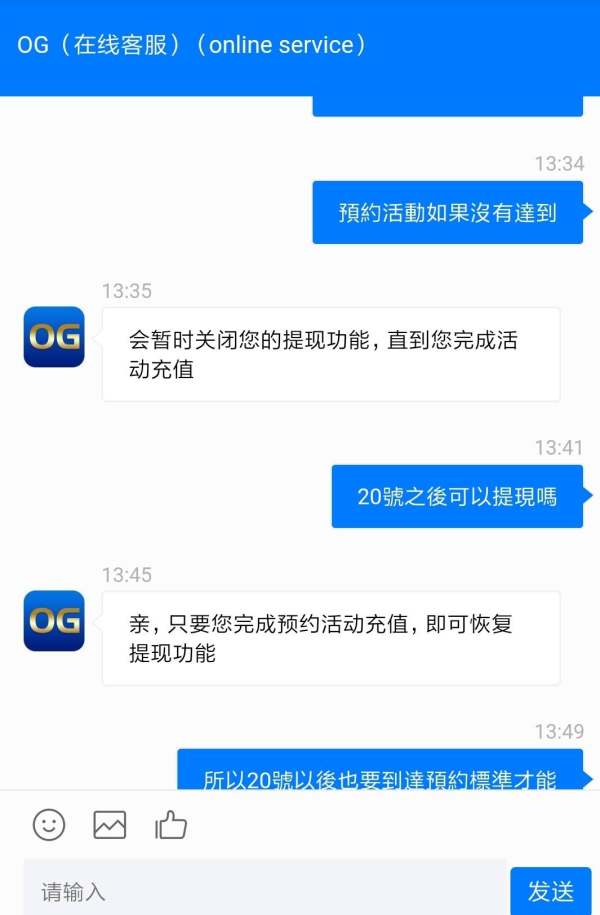

Customer Service and Support Analysis (3/10)

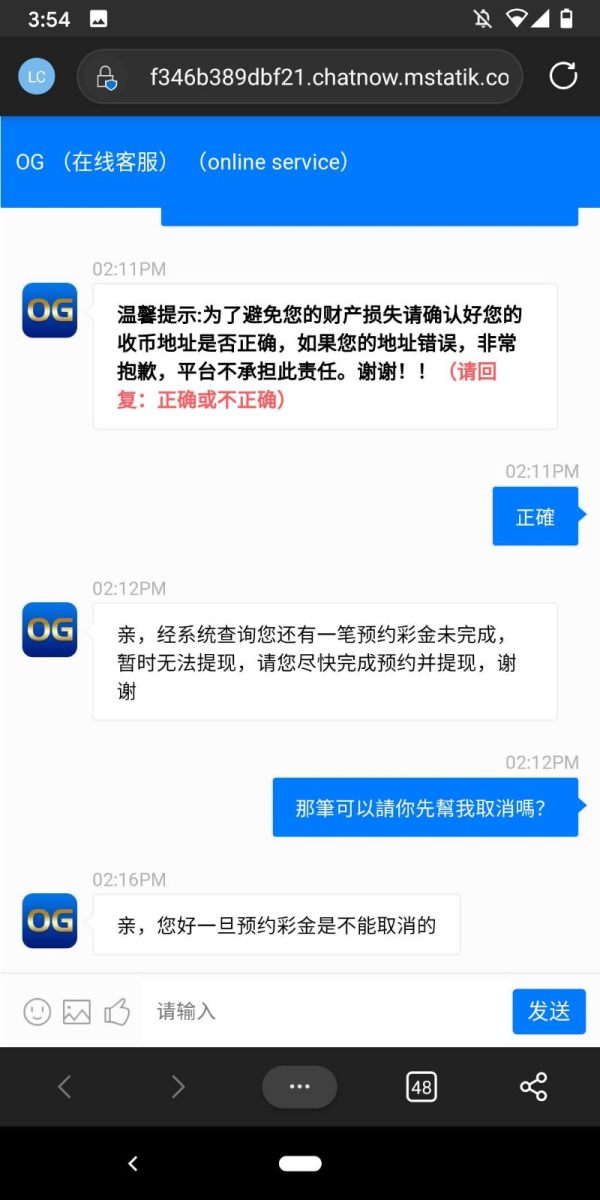

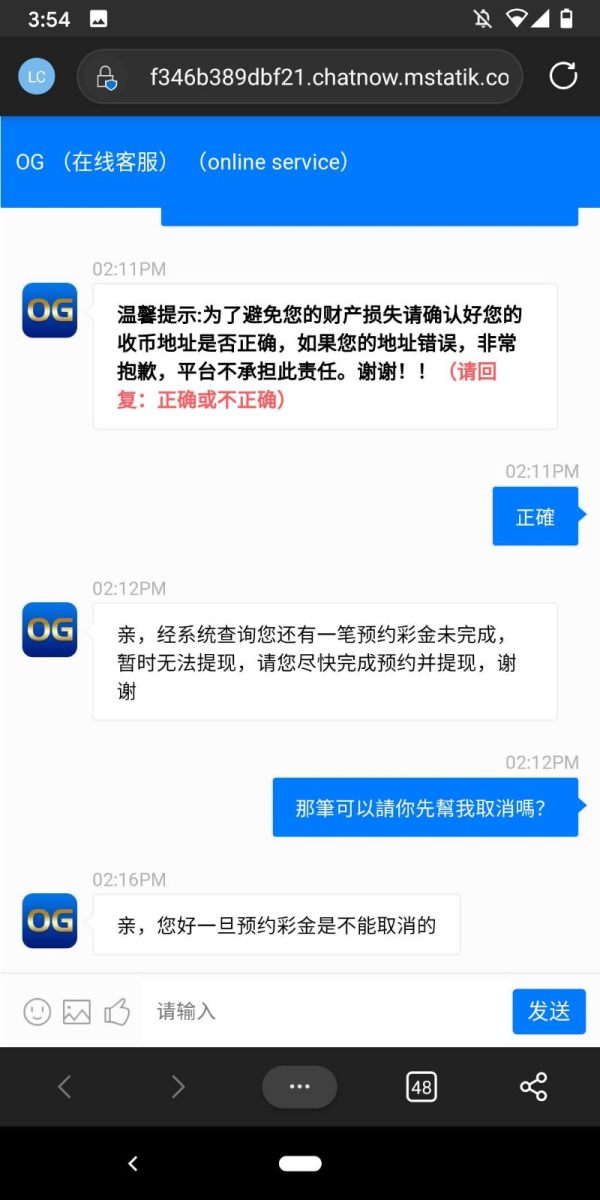

Customer service and support receive a poor rating based on available user feedback and significant information gaps. User evaluations consistently warn against trading with this broker, and these warnings suggest widespread dissatisfaction with customer service quality and responsiveness.

The specific customer service channels, availability hours, and response times are not detailed in available information. Modern traders expect multiple contact methods including live chat, email support, and telephone assistance with reasonable response times that help resolve issues quickly.

The lack of transparency about these basic service elements raises concerns about the broker's commitment to client support. Multi-language support capabilities are not specified, which could be problematic for international clients who need assistance in their native language.

Quality customer service should include support in major trading languages and cultural understanding of different market regions. Most concerning is the absence of information about problem resolution processes, complaint handling procedures, and escalation mechanisms.

Given the regulatory issues surrounding the broker, clients may face additional challenges in resolving disputes or accessing support when needed. The combination of negative user warnings and lack of transparent customer service information contributes to the poor rating in this critical area.

Without proper customer support, traders may find themselves unable to get help when they need it most. This situation becomes even more problematic when regulatory protections are absent.

Trading Experience Analysis (5/10)

The trading experience at OG Forex Broker receives an average rating. This assessment is limited by the lack of detailed user feedback and technical specifications that would provide a clearer picture of actual trading conditions.

While the broker claims to offer multiple trading services, the actual quality of order execution, platform stability, and trading environment remains unclear from available information. Platform stability and execution speed are critical factors for successful trading, particularly in the fast-moving forex market where delays can cost money.

However, available documentation does not provide specific data about server uptime, execution speeds, or slippage rates. This information would allow for a comprehensive assessment of the actual trading experience that clients can expect.

The high leverage offering up to 1:400 could enhance trading flexibility for experienced traders who understand how to manage risk properly. However, this feature alone does not compensate for other potential shortcomings in the trading environment.

Mobile trading capabilities, which are essential in today's market, are not specifically addressed in available information. Modern traders require seamless access across desktop and mobile platforms with full functionality to manage their positions effectively.

This og review notes that while basic trading services appear to be available, the lack of detailed performance data, user experience feedback, and technical specifications prevents a more positive assessment. Without proper regulatory oversight, even basic trading services become questionable in terms of reliability and fairness.

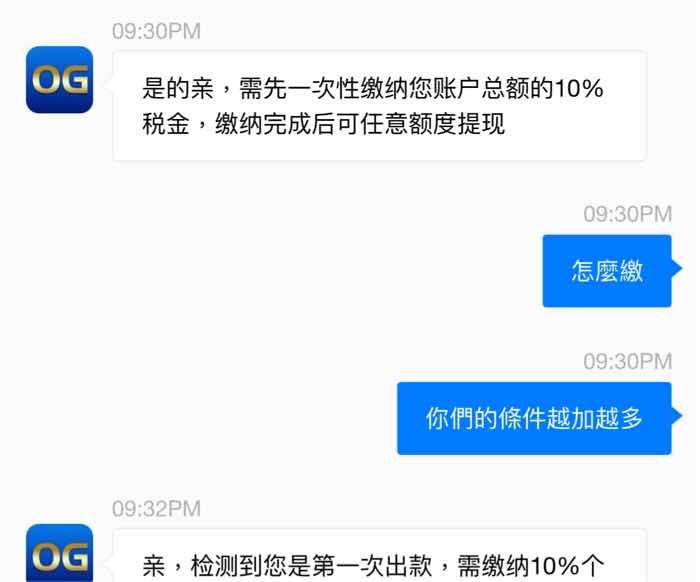

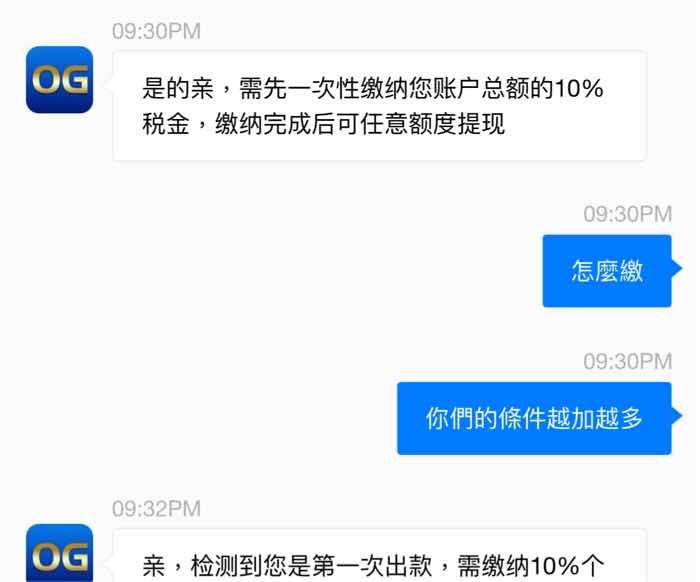

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most concerning aspects of OG Forex Broker. These factors earn the lowest rating in this evaluation due to fundamental issues that cannot be overlooked.

The revocation of the broker's regulatory license fundamentally undermines client confidence. This action raises serious questions about the safety of funds and the legitimacy of operations.

Regulatory oversight is the cornerstone of broker trustworthiness. It provides essential client protections including segregated fund requirements, compensation schemes, and operational standards that protect traders from fraud and mismanagement.

The loss of regulatory status means these protections may no longer apply to clients. This situation exposes clients to significant risks that they would not face with properly regulated brokers.

Client fund safety measures, which should include segregated accounts and third-party fund management, are not detailed in available information. Without proper regulatory oversight, verification of these critical safety measures becomes impossible for potential clients.

The broker's transparency regarding company ownership, financial statements, and operational details is also lacking. Reputable brokers typically provide comprehensive information about their corporate structure, regulatory compliance, and financial standing to build trust with clients.

Negative user feedback warning against trading with this broker further erodes trust. When combined with regulatory issues, these warnings suggest systemic problems that potential clients should take seriously.

The combination of regulatory revocation and user warnings creates a perfect storm of trust issues. No trader should risk their capital with a broker that has such fundamental reliability problems.

User Experience Analysis (3/10)

User experience at OG Forex Broker receives a poor rating. This rating is based on available feedback and significant information gaps that suggest problems with the overall client experience.

The consistent user warnings against trading with this broker indicate widespread dissatisfaction with the overall client experience. These warnings come from multiple sources and suggest systemic issues rather than isolated problems.

The user interface design and platform usability details are not comprehensively covered in available documentation. This lack of information makes it difficult to assess the quality of the trading environment from a user perspective.

Modern traders expect intuitive, responsive platforms with comprehensive functionality that makes trading efficient and effective. Account registration and verification processes are not clearly outlined, which could indicate either streamlined procedures or concerning gaps in client due diligence.

Proper brokers maintain clear, compliant onboarding processes that balance efficiency with regulatory requirements. Fund management experiences, including deposit and withdrawal processes, are not detailed in available information.

User feedback suggests problems in this area, though specific issues are not clearly documented. The high minimum deposit requirement of $1,000 also impacts user experience by creating a significant barrier to entry.

This requirement, combined with regulatory concerns and negative feedback, makes the broker unsuitable for most retail traders seeking a positive trading experience. The lack of transparency about basic user processes suggests that the broker does not prioritize client experience.

Without proper attention to user experience, traders may find themselves frustrated with basic account management tasks. This frustration becomes even more problematic when combined with regulatory uncertainty and poor customer support.

Conclusion

This comprehensive og review reveals significant concerns that make OG Forex Broker unsuitable for traders seeking a reliable and safe trading environment. The revocation of the broker's regulatory license represents a fundamental disqualification that overshadows any potential benefits their services might offer to clients.

While the broker offers some features that might appeal to experienced traders, including high leverage up to 1:400 and demo account access, these benefits are completely undermined by regulatory non-compliance and consistently negative user feedback. The high minimum deposit requirement of $1,000 further limits accessibility without providing corresponding value or security for traders.

We strongly recommend that traders avoid OG Forex Broker and instead seek properly regulated alternatives with positive user feedback and transparent operations. The forex market offers numerous reputable brokers that provide similar or superior services while maintaining proper regulatory compliance and client protections.

For those seeking high leverage trading opportunities, many well-regulated brokers offer competitive leverage ratios. These brokers maintain proper oversight and client fund safety measures that protect traders from unnecessary risks.

The risks associated with trading with an unlicensed broker far outweigh any potential benefits. This makes avoiding OG Forex Broker an easy decision for prudent traders who value their capital and want to trade in a safe environment.