ainvesting 2025 Review: Everything You Need to Know

Abstract

The ainvesting review gives a balanced look at the online CFD broker, ainvesting, which started in May 2017. Despite following MiFID rules and holding a valid FSC license from the Bulgarian Financial Regulatory Authority, users don't trust it much with only a 58 trust score. The platform has a user-friendly web-based trading setup and offers many types of assets like stocks, cryptocurrencies, and forex. This makes it good for small to mid-sized investors who want to trade different assets and use market analysis tools. However, customer service gets mixed reviews and the platform looks old, which makes people unsure about the service quality. While the broker follows rules and offers variety, potential clients should think about these good points against the problems with service and old technology.

Notice

ainvesting only has a license from the Bulgarian Financial Regulatory Authority, which might mean different service quality in different places. This review looks at user feedback, regulatory info, and broker details to give you the full picture. Readers should know that important details like how to deposit money and minimum deposits aren't clearly explained in the available information. The way we judge things here uses both expert views and user reviews to make sure the evaluation is fair.

Score Framework

Scoring basis: Ratings come from missing account details, okay market analysis tools, mixed customer service reviews, platform problems according to users, and low user trust overall.

Broker Overview

Ainvesting started in May 2017 and has its main office in Bulgaria. It works as an online CFD broker that offers different financial tools like forex, stocks, and cryptocurrencies. The broker built itself on rules that follow MiFID guidelines and has an FSC license from the Bulgarian Financial Regulatory Authority. In the beginning, ainvesting tried to get market share by giving access to many asset types, and it keeps trying to balance what it offers to meet different trading interests. Even with these efforts, the broker's reputation has problems because of mixed user reviews and worries about old platform design.

For trading technology, ainvesting gives you a web-based trading platform that's designed to be easy to use. The design helps you navigate easily and trade multiple assets—including stocks, cryptocurrencies, and forex—for clients who want good market analysis tools right away. Also, following regulations is a key part of what the broker offers, as it works according to MiFID regulations under the Bulgarian Financial Regulatory Authority's watch. But while it meets compliance rules, clients worry about service delivery and new technology. This ainvesting review clearly shows that while the platform follows regulations and offers different assets, users still aren't fully satisfied because of service quality and platform problems.

Regulatory Region

Ainvesting works under the strict watch of the Bulgarian Financial Regulatory Authority. This regulatory setup makes sure the broker follows MiFID standards and uses careful financial practices, though specific protective measures aren't explained well in available resources.

Deposit and Withdrawal Methods

The available summary doesn't give specific deposit and withdrawal methods. People who want to invest will need to look at other resources for details about banking and electronic transfer options.

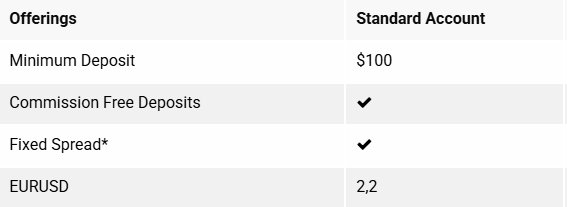

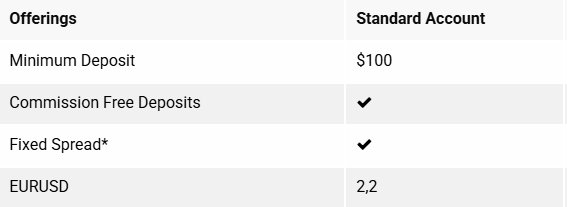

Minimum Deposit Requirements

Details about minimum deposit requirements aren't clearly given in the available documents. This missing information means that future clients need to contact the broker directly for accurate and current information about any thresholds.

Bonuses and Promotions

Information about bonuses or promotional offers isn't given in the current summary. Users who want promotions must look for additional materials or contact customer service for answers.

Tradable Assets

Ainvesting offers many different tradable assets that include stocks, cryptocurrencies, and forex. This multi-asset offering is made to appeal to investors who want varied investment options and the ability to spread their portfolios across different asset types. The platform works for both new and experienced traders by giving exposure to both traditional financial markets and new digital assets.

Cost Structure

The available information doesn't give clear details on cost structures like spreads or commission fees. Investors must note that while regulatory compliance is met, specifics about cost—whether spreads, commission, or other fees—stay unclear. This lack of transparency means you need to ask more questions either by contacting the broker directly or through more detailed documents.

Leverage Ratios

Specific leverage ratios offered by ainvesting aren't mentioned in the summary. Investors who need clarity on available leverage options should check with the broker directly to make sure these financial tools meet their trading strategies and risk management policies.

Platform Options

Ainvesting stands out by offering a user-friendly web-based trading platform. The platform's design is meant to be easy to use, allowing simple navigation and access to market analysis tools. However, some users have noted that the platform's interface looks somewhat old compared to modern alternatives available in the market.

Regional Restrictions

There is no detailed information available about any regional restrictions. It's unclear if certain geographical areas have limitations that could affect the availability of services.

Customer Service Languages

The summary doesn't give details on the languages supported by the customer service team. This information gap means that potential clients may need to confirm language support before committing to the platform.

This section of our ainvesting review gives a complete snapshot of the broker's operational parameters, even while several key details remain unspecified. Future investors should consider these uncertainties when deciding whether ainvesting fits their personal trading requirements.

Detailed Scoring Analysis

Account Conditions Analysis

In looking at account conditions, this ainvesting review shows certain critical gaps and limitations. The broker doesn't give detailed information about account opening processes, minimum deposit amounts, or any special account types, such as Islamic accounts. This lack of specific information makes the decision-making process harder for investors who want clear entry requirements and benefit from tailored account features. While the regulatory environment gives some safety, the unclear account conditions—ranging from fees to trading costs—is a big drawback. Also, user comments have suggested that there isn't enough detail and transparency about cost components such as spreads and commissions, which further lowers the trust level. In a market where complete account details are a key factor in decision-making, these missing pieces hurt the overall competitiveness of ainvesting. More detailed information and streamlined account setup procedures would greatly improve investor confidence.

About trading tools and resources, the ainvesting review shows that the platform does offer essential market analysis tools, which can help traders make informed decisions. The web-based interface includes basic charting options and real-time market data that give a baseline level of analytical support. However, the platform falls short when it comes to offering a complete set of research materials or advanced educational resources that could benefit both new and experienced traders. Also, there's no mention of automated trading functionality or support for third-party analytical tools, which many industry competitors provide as standard. Although the available tools meet the minimum requirements for trading, there's plenty of room for expansion and improvement to make sure that clients can access thorough market insights and sophisticated analytics. This shortfall may prove limiting for users who rely heavily on detailed research and robust educational resources in their trading strategies.

Customer Service and Support Analysis

Customer service and support represent a mixed bag for ainvesting. In this ainvesting review, user feedback shows that the quality of customer support is average, with some reports highlighting delays and inconsistent responses from the service team. The available information doesn't outline the specific channels available—whether it be live chat, email, or phone support—nor does it specify the operating hours. Such a lack of clarity about support availability can be a major concern for active traders seeking immediate resolution of technical or account-related issues. Also, the missing information on multi-language support further complicates the experience for international users. While regulatory compliance inspires some confidence in the broker's overall operations, the sporadic feedback on customer service suggests that improvements are necessary if the broker aims to elevate user satisfaction. Without clear and accessible support, particularly in fast-paced trading environments, the broker's appeal is diminished for those requiring robust and reliable assistance.

Trading Experience Analysis

The trading experience offered by ainvesting is central to this ainvesting review, with user feedback highlighting several points of concern. The platform is built on a web-based system that, while user-friendly in concept, suffers from an outdated interface that may hurt the fluidity and speed required for effective trade execution. Reports from users show that while the core functionality exists, elements such as order execution and real-time data updates could potentially be compromised by less modern software architecture. There is limited transparency about execution quality, such as slippage or latency issues. Also, the absence of details about mobile trading capabilities further restricts traders who require flexibility across devices. Despite the platform's regulatory compliance and its multi-asset capabilities, the technical performance remains a persistent issue. In an industry where trading efficiency is paramount, the platform's dated design and execution shortcomings highlight areas needing significant improvement to meet the expectations of a modern trading audience.

Trustworthiness Analysis

Trust remains a key factor in broker evaluations, and this ainvesting review reflects mixed feelings in this area. Although the broker fully complies with MiFID regulations and holds a valid license from the Bulgarian Financial Regulatory Authority, user trust metrics are relatively low, with a trust score of 58. This reduction in confidence is partly rooted in the reported inconsistencies in customer service and the old trading platform. Even though regulatory licenses can often boost a broker's reputation, they are insufficient to overcome the negative perceptions created by fragmented user experiences. Transparency in fee structures and more proactive communications about platform updates could help improve trust levels. Investors are advised to consider these factors carefully, as the current state of affairs suggests that while the broker operates within legal frameworks, it has yet to cement a stellar reputation in terms of client confidence and operational transparency.

User Experience Analysis

The overall user experience of ainvesting, as captured in this ainvesting review, is notably average. There are positive attributes such as a clear focus on multi-asset trading and regulatory compliance; however, these are undermined by a platform interface that many users consider outdated and clunky. The registration and verification process is not explained in detail, leaving potential gaps in understanding the true ease-of-use for new clients. Also, the feedback cited in user reviews shows dissatisfaction with both the aesthetic and functional aspects of the trading interface. This is reflected in the average score of 5/10 for user experience, suggesting that while the foundational elements exist, there is a clear need for modernization. Improvements in design, better navigation, and more robust implementation of customer support would collectively elevate the trading experience. For small and mid-sized investors who prioritize intuitive design and smooth operational flow, these areas of development are crucial in determining long-term user satisfaction.

Conclusion

In summary, ainvesting as a CFD broker holds good regulatory credentials and offers a multi-asset trading platform that appeals to small and mid-sized investors. However, as this ainvesting review demonstrates, significant improvements are needed in areas such as customer service, platform modernization, and overall transparency about cost structures and account features. While the broker's compliance with MiFID and its valid FSC license are notable strengths, the mixed user feedback and dated platform significantly lower investor confidence. Future traders should consider these factors alongside their individual trading needs before committing to ainvesting.