CK Markets 2025 Review: Everything You Need to Know

In this comprehensive review of CK Markets, we delve into the broker's offerings, user experiences, and regulatory standing. Overall, CK Markets has garnered a largely negative reputation, primarily due to its lack of regulation and numerous complaints from users regarding withdrawal issues and misleading practices. Notably, the broker claims to provide a diverse range of trading instruments but operates under questionable regulatory frameworks.

Note: It is crucial to highlight that CK Markets operates under different entities across regions, which adds complexity to its regulatory status. This review aims to provide an accurate and fair assessment based on various sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on a combination of user feedback, expert analysis, and factual data regarding the broker's services and regulatory compliance.

Broker Overview

CK Markets was established in 2017 and claims to be registered in Saint Vincent and the Grenadines. The broker offers trading primarily through the widely used MetaTrader 4 platform and provides access to various asset classes, including forex, cryptocurrencies, commodities, and indices. However, it is important to note that CK Markets operates without any reputable regulatory oversight, which raises significant concerns regarding the safety of traders' funds.

Detailed Breakdown

-

Regulated Geographical Areas: CK Markets is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. The Financial Services Authority (FSA) of Saint Vincent does not regulate forex brokers, which means that CK Markets is not subject to any stringent oversight.

Deposit/Withdrawal Currencies/Cryptocurrencies: The broker accepts deposits in various currencies, including USD and cryptocurrencies like Tether (USDT). However, users have reported issues with withdrawals, often citing delays and complications when trying to access their funds.

Minimum Deposit: The minimum deposit required to open an account with CK Markets starts at $30 for a cent account and $100 for standard and ECN accounts. This relatively low entry point may attract new traders but comes with significant risks due to the broker's regulatory status.

Bonuses/Promotions: CK Markets offers a deposit bonus of 30% for new clients, particularly targeting users from Southeast Asia. However, such promotions often come with terms that can complicate the withdrawal of funds, leading to potential disputes.

Tradeable Asset Classes: CK Markets provides access to over 60 currency pairs, commodities like gold and oil, cryptocurrencies including Bitcoin and Ethereum, and various indices. This wide range of instruments is appealing; however, the execution and reliability of trading conditions have been questioned.

Costs (Spreads, Fees, Commissions): The broker advertises variable spreads starting from 0.0 pips on ECN accounts, but user reports indicate that actual spreads can be significantly higher. Additionally, a commission of $3 per round turn per lot applies on ECN accounts, which can add to trading costs.

Leverage: CK Markets offers high leverage options, up to 1:2000. While this can be enticing for traders looking to maximize their positions, it also increases the risk of significant losses, especially in volatile markets.

Allowed Trading Platforms: The primary trading platform offered by CK Markets is MetaTrader 4, which is well-regarded for its user-friendly interface and robust analytical tools. However, the platform has faced criticism regarding execution speed and reliability.

Restricted Regions: CK Markets does not accept clients from several jurisdictions, including the USA and various European countries. This restriction is likely due to regulatory compliance issues.

Available Customer Service Languages: CK Markets claims to offer customer support in multiple languages, but user experiences indicate that the quality of customer service is lacking, with many reports of slow response times and inadequate assistance.

Ratings Revisited

Detailed Evaluation

-

Account Conditions: CK Markets offers a variety of account types, including cent, standard, and ECN accounts. While the low minimum deposit is attractive, the lack of regulation poses a significant risk to traders' funds.

Tools and Resources: The broker provides access to the MetaTrader 4 platform, known for its extensive features. However, there is a notable absence of educational resources and market analysis tools that could benefit traders, especially beginners.

Customer Service: User feedback highlights a major drawback in CK Markets' customer support. Many clients report long wait times and unhelpful responses, which can be particularly frustrating when dealing with withdrawal issues.

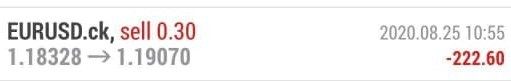

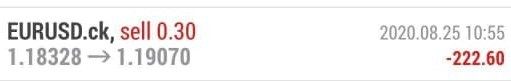

Trading Experience: While CK Markets offers high leverage and a wide range of trading instruments, users have reported problems with trade execution speed and slippage, which can negatively impact trading results.

Trustworthiness: The lack of regulation is a critical concern. CK Markets is not overseen by any reputable financial authority, which means that traders have little recourse if issues arise.

User Experience: Overall user experiences are mixed, with many clients expressing dissatisfaction with the broker's practices, particularly regarding withdrawal delays and misleading promotions.

Conclusion

In summary, CK Markets presents itself as a competitive broker with a wide range of trading options and high leverage, but significant red flags regarding its regulatory status and user experiences cannot be overlooked. The lack of credible oversight raises questions about the safety of funds, making it essential for potential clients to exercise caution. As always, we recommend considering regulated alternatives that offer greater security and peace of mind.

For those considering CK Markets, thorough research and careful evaluation of the risks involved are strongly advised.