TF Global 2025 Review: Everything You Need to Know

Executive Summary

This tf global review shows concerning findings about TF Global's operations and reliability as a forex broker. TF Global has been assessed as an unregulated broker with significant potential fraud risks, making it a highly questionable choice for retail traders who want safe trading environments. The broker primarily targets corporate and financial sector clients. It has received overwhelmingly negative user feedback and maintains an extremely low credibility rating that should alarm potential investors.

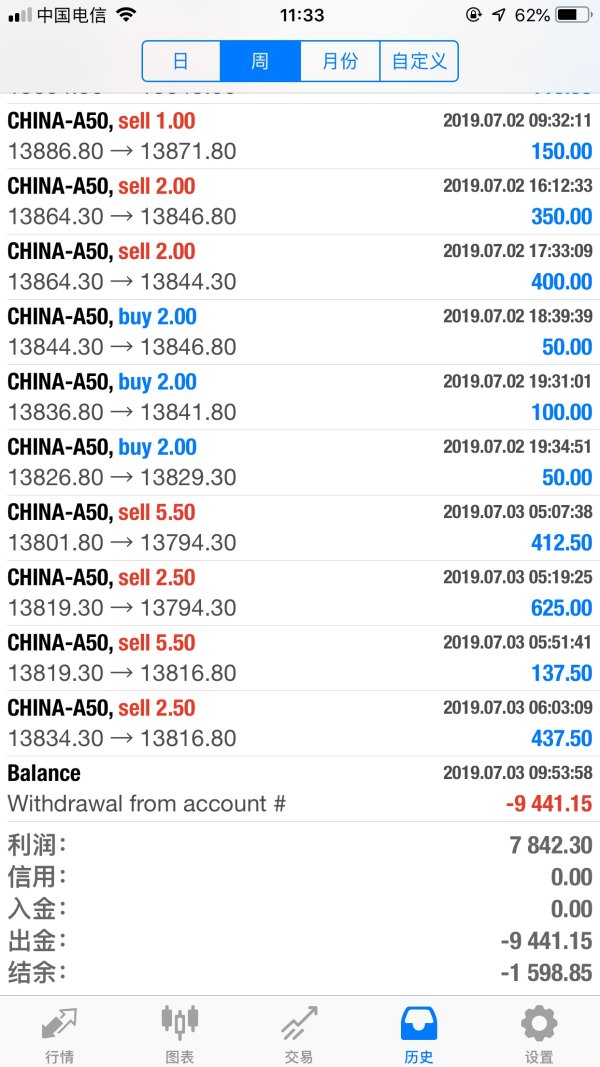

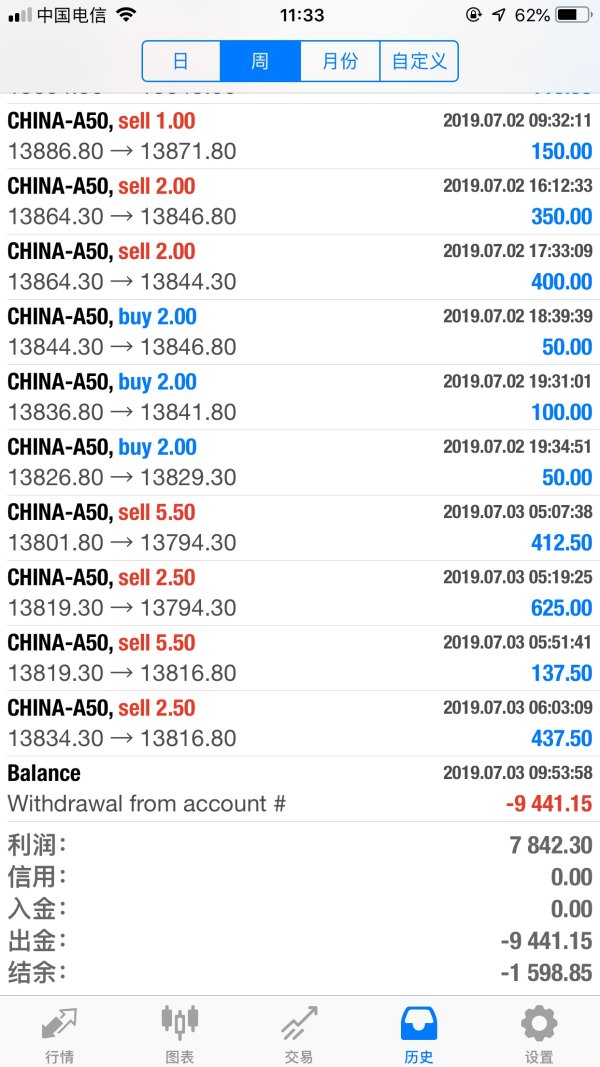

According to WikiFX monitoring data, TF Global holds a concerning score of just 1.55 out of 10. This reflects severe trust and operational issues that affect daily trading activities. Over the past three months, the platform has received 4 user complaints, with traders expressing extreme disappointment with their trading experience and overall service quality. The broker's unregulated status compounds these concerns significantly. Users lack the protection typically afforded by recognized financial authorities, leaving them vulnerable to potential losses.

The available evidence suggests that TF Global operates without proper regulatory oversight. This poses substantial risks to client funds and trading security that cannot be ignored. Users have consistently reported negative experiences, with particular emphasis on poor trading conditions and unsatisfactory service delivery that fails to meet basic industry standards. This tf global review strongly advises potential clients to exercise extreme caution and consider regulated alternatives before engaging with this broker.

Important Notice

TF Global has been classified as an unregulated broker. This means it operates without oversight from recognized financial regulatory authorities that protect traders. This status creates significant legal and financial risks for traders across different jurisdictions, as the absence of regulatory protection leaves clients vulnerable to potential fraud and fund misappropriation that could result in total loss of invested capital.

This review is based on comprehensive analysis of user feedback, third-party ratings, and available public information about TF Global's operations. The assessment aims to provide traders with accurate, unbiased information to make informed decisions about their choice of forex broker without external influence or bias. Given the broker's unregulated status and negative user feedback, this evaluation emphasizes risk awareness and trader protection as primary concerns. The findings presented here should guide potential clients toward safer trading alternatives.

Rating Framework

Broker Overview

TF Global was established in 2019 and operates from the United States. It positions itself primarily as a service provider for corporate and financial sector clients who require specialized trading services. The company presents itself as offering various financial services, though the specific nature and scope of these services remain unclear from available documentation that should be transparent for potential clients. The broker's business model appears to focus on institutional rather than retail clients. This may explain the limited transparency in its retail trading offerings that individual traders would typically expect.

Despite its corporate positioning, TF Global's operational framework raises significant concerns about its legitimacy and safety. The company lacks proper regulatory authorization, which is particularly troubling given its target market of financial institutions that typically require stringent compliance standards and regulatory oversight. The broker's establishment in 2019 means it has had sufficient time to obtain proper licensing from relevant authorities. Its continued unregulated status represents a red flag for potential clients who value security and regulatory protection.

The broker's regulatory status represents perhaps the most critical concern in this tf global review. Operating without regulatory oversight means TF Global is not subject to the capital adequacy requirements, client fund segregation rules, or operational standards that legitimate brokers must maintain to protect client interests. This regulatory gap creates substantial risks for any clients considering engagement with the platform. Potential users should carefully consider these risks before making any financial commitments.

Regulatory Status: TF Global operates as an unregulated broker. This means it lacks authorization from recognized financial regulatory authorities that oversee broker operations. This status requires extreme caution from potential clients, as unregulated brokers offer no investor protection or recourse mechanisms when problems arise.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available source materials. This itself raises transparency concerns for potential clients evaluating the broker's operational capabilities and fund management procedures.

Minimum Deposit Requirements: The minimum deposit threshold for opening accounts with TF Global is not specified in available documentation. This makes it difficult for potential clients to assess accessibility and account requirements before committing to the platform.

Bonuses and Promotions: Information regarding bonus structures, promotional offers, or incentive programs is not mentioned in source materials. This suggests either limited promotional activity or poor transparency in marketing communications that could benefit traders.

Tradeable Assets: Specific details about the range of tradeable instruments are not provided in available source materials. This includes information about forex pairs, commodities, indices, or other financial products that traders might want to access.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not detailed in available documentation. This lack of transparency makes it impossible to assess the broker's competitiveness or total cost of trading for potential clients.

Leverage Ratios: Information about maximum leverage offerings and margin requirements is not specified in source materials. This represents a significant information gap for potential clients who need to understand risk exposure.

Platform Options: Details about trading platform availability are not mentioned in available documentation. This includes information about MetaTrader support or proprietary platform features that traders typically require.

Geographic Restrictions: Specific information about regional limitations or restricted jurisdictions is not detailed in source materials. This could affect accessibility for international clients seeking trading services.

Customer Support Languages: Available customer service languages are not specified in the provided information. This could impact communication effectiveness for non-English speaking clients.

This tf global review highlights the concerning lack of detailed operational information. It compounds the risks associated with the broker's unregulated status and poor transparency standards.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of TF Global's account conditions is severely hampered by the lack of detailed information available in source materials. This absence of transparency regarding account types, features, and requirements represents a significant red flag for potential clients who need clear information to make informed decisions. Legitimate brokers typically provide comprehensive details about their account structures, minimum deposit requirements, and special features to help traders make informed decisions about their trading relationships.

The unavailability of specific account information makes it impossible to evaluate whether TF Global offers competitive conditions. It also prevents assessment of specialized account types such as Islamic accounts for Muslim traders who require Sharia-compliant trading options. This information gap is particularly concerning given that account conditions form the foundation of the trading relationship between broker and client.

Without detailed account information, potential clients cannot assess the accessibility, suitability, or competitiveness of TF Global's offerings. The lack of transparency in this fundamental area aligns with the broader pattern of limited disclosure that characterizes this tf global review, reinforcing concerns about the broker's operational standards and client communication practices that should be transparent and comprehensive.

The absence of clear account condition details creates additional risks. Combined with the broker's unregulated status, this creates a scenario where potential clients would be entering into trading relationships without adequate information about the terms and conditions that would govern their experience.

TF Global's trading tools and educational resources cannot be adequately assessed due to insufficient information in available source materials. This lack of detail about analytical tools, research resources, and educational materials represents another area where the broker fails to meet transparency standards expected by professional traders who require comprehensive support systems. Modern forex brokers typically offer comprehensive suites of trading tools including technical analysis software, economic calendars, market research, and educational resources to support trader development and success.

The absence of detailed information about such offerings suggests either limited tool availability or poor communication of available resources. Both scenarios represent significant concerns for potential clients who depend on quality tools for successful trading outcomes. Educational resources are particularly important for retail traders, and the lack of information about TF Global's educational offerings is concerning for those seeking to improve their trading skills.

Legitimate brokers invest significantly in trader education and typically highlight these resources prominently in their marketing and documentation. The unavailability of information about automated trading support, API access, or advanced trading tools further compounds concerns about TF Global's suitability for serious traders who require sophisticated technological capabilities. Professional traders require sophisticated tools and resources, and the lack of transparency in this area suggests potential limitations in the broker's technological capabilities that could impact trading performance.

Customer Service and Support Analysis

Customer service quality cannot be properly evaluated for TF Global due to the absence of detailed information about support channels, response times, and service quality metrics. This lack of transparency about customer support represents a significant concern, as reliable customer service is crucial for resolving trading issues and account management needs that arise during normal trading operations. Professional forex brokers typically provide multiple customer support channels including phone, email, live chat, and sometimes social media support to ensure comprehensive client assistance.

The availability of 24/7 support is particularly important in forex trading due to global market hours that span multiple time zones. Without information about TF Global's support structure, potential clients cannot assess whether adequate assistance would be available when needed during critical trading situations. Multilingual support capabilities are also not specified in available materials, which could indicate limitations in serving international clients who require assistance in their native languages.

Given TF Global's claimed focus on corporate clients, the absence of detailed customer service information is particularly concerning. Institutional clients typically require high-quality, responsive support that meets professional standards and provides timely resolution of complex issues. The lack of information about customer service quality aligns with the overall pattern of limited transparency that characterizes TF Global's operations, contributing to the low ratings in this comprehensive broker evaluation.

Trading Experience Analysis

User feedback regarding TF Global's trading experience is overwhelmingly negative. Traders have expressed extreme disappointment with their interactions with the platform, indicating fundamental problems with service delivery and platform performance. This negative sentiment is reflected in the broker's WikiFX rating of just 1.55, indicating severe operational and service quality issues that significantly impact trader satisfaction and overall trading outcomes.

The available user feedback suggests fundamental problems with the trading environment. Though specific details about platform stability, execution speed, and order processing quality are not detailed in source materials, the extreme disappointment expressed by users indicates that basic trading functionality may not meet acceptable standards required for professional trading activities. Platform reliability and execution quality are critical factors in forex trading, where milliseconds can impact trade outcomes and platform downtime can result in significant losses for active traders.

The negative user feedback suggests potential issues in these fundamental areas. This makes TF Global unsuitable for serious trading activities that require consistent, reliable platform performance. The poor trading experience ratings, combined with the broker's unregulated status, create a compound risk scenario where traders face both operational difficulties and regulatory protection gaps that could result in significant financial losses.

This tf global review strongly emphasizes these concerns as primary reasons to avoid the platform. Mobile trading capabilities and platform functionality details are not specified in available materials, though the negative user feedback suggests that whatever platform features are available fail to meet user expectations and industry standards that traders have come to expect from legitimate brokers.

Trustworthiness Analysis

TF Global's trustworthiness rating of 1/10 reflects the most serious concerns identified in this review. The broker's unregulated status represents the primary trust issue, as operating without regulatory oversight means clients lack fundamental protections and recourse mechanisms available with licensed brokers who must comply with strict regulatory standards. Regulatory authorization serves as the foundation of trust in financial services, providing assurance that brokers meet capital adequacy requirements, maintain segregated client funds, and operate under established standards that protect client interests.

TF Global's failure to obtain such authorization raises immediate questions about its commitment to client protection and operational integrity. The WikiFX rating of 1.55 provides additional third-party validation of trust concerns, indicating that independent evaluation sources have identified significant reliability issues that affect the broker's credibility in the financial services industry. This low rating suggests that TF Global fails to meet basic standards expected of legitimate forex brokers who prioritize client safety and regulatory compliance.

Multiple sources have assessed TF Global as unreliable. This creates a consensus view that the broker poses significant risks to potential clients who value security and trustworthiness in their trading relationships. The combination of unregulated status, poor third-party ratings, and negative user feedback creates a clear pattern of trust-related concerns that potential clients should carefully consider before making any financial commitments.

Fund safety measures, operational transparency, and corporate governance standards are not detailed in available materials. This further compounds trust concerns and reinforces the recommendation for extreme caution when considering this broker for any trading activities.

User Experience Analysis

User experience with TF Global is characterized by extreme dissatisfaction. Available feedback indicates fundamental failures in service delivery and platform performance that affect daily trading operations. The 4 user complaints received over a three-month period, while seemingly limited in number, represent a concerning pattern given the broker's apparent limited client base and overall market presence.

The expression of extreme disappointment by users suggests that TF Global fails to meet basic expectations for trading platform functionality, customer service, and overall user experience. This negative feedback pattern is particularly concerning as it indicates systemic rather than isolated issues that could affect any potential client who chooses to trade with this broker. User interface design, platform usability, and account management processes are not detailed in available materials, though the negative feedback suggests significant shortcomings in these areas that impact user satisfaction.

Modern traders expect intuitive, responsive platforms with comprehensive functionality that supports their trading strategies and goals. TF Global appears to fall short of these standards based on available user feedback and performance indicators. The registration and verification process details are not specified, though the overall negative user experience suggests potential issues in onboarding and account setup procedures that could frustrate new clients.

Efficient, transparent account opening processes are essential for positive user experiences. Problems in this area can indicate broader operational issues that affect overall service quality. The target market of corporate and financial sector clients makes the negative user feedback particularly concerning, as institutional clients typically have higher service expectations and more sophisticated evaluation criteria than retail traders who may be more tolerant of service deficiencies.

Conclusion

This comprehensive tf global review reveals significant concerns about the broker's reliability, regulatory status, and operational standards. TF Global's classification as an unregulated broker, combined with extremely poor user feedback and low third-party ratings, creates a clear picture of a platform that poses substantial risks to potential clients who value safety and reliability in their trading relationships. The broker is not recommended for retail traders, and even corporate and financial sector clients should exercise extreme caution before engaging with TF Global for any trading activities.

The absence of regulatory protection, poor user satisfaction ratings, and lack of operational transparency represent fundamental barriers to safe, effective trading relationships. These factors combine to create an environment where clients face significant risks without adequate protections or recourse mechanisms when problems arise. The primary disadvantages include unregulated status, negative user feedback, poor WikiFX ratings, and limited operational transparency that fails to meet industry standards.

No significant advantages have been identified in available source materials. This reinforces the recommendation to seek regulated alternatives with established track records of client protection and service quality that can provide safer trading environments for both retail and institutional clients.