bcel 2025 Review: Everything You Need to Know

1. Summary

BCEL started in 1975. It has been one of Laos's main banks for many years, offering personal banking products and services to customers throughout the country. This bcel review shows its long market presence. The bank has moved into the digital age by working with top electronic wallet companies, such as Duangdee Thavychuk Co., Ltd, to connect with modern online payment systems like OnePay. BCEL focuses on individual customers and small to medium-sized businesses. The bank works to deliver secure and reliable electronic payment solutions along with traditional banking services that customers expect. Despite its long history and many different products, detailed information about specific trading conditions or user feedback in foreign exchange is hard to find. The data we have shows that BCEL does well in regular banking operations. However, its role in forex trading is not clearly defined in public information that we can access. Potential clients should think about these factors when looking at their needs. This short assessment of BCEL gives an important overview for future customers who want dependable financial services without the detailed complexities usually found in specialized forex broker reviews.

2. Disclaimers and Methodology

BCEL operates mainly as a Laotian bank. Its services and rules may be very different from international forex brokers that operate in multiple countries. This review uses publicly available information and market feedback. These sources may not show a complete picture of how the bank operates, especially regarding detailed trading conditions and customer service specifics that traders need to know. The information we provide here has limitations because our sources did not include detailed regulatory information or user experiences in the forex domain.

3. Rating Framework

4. Broker Overview

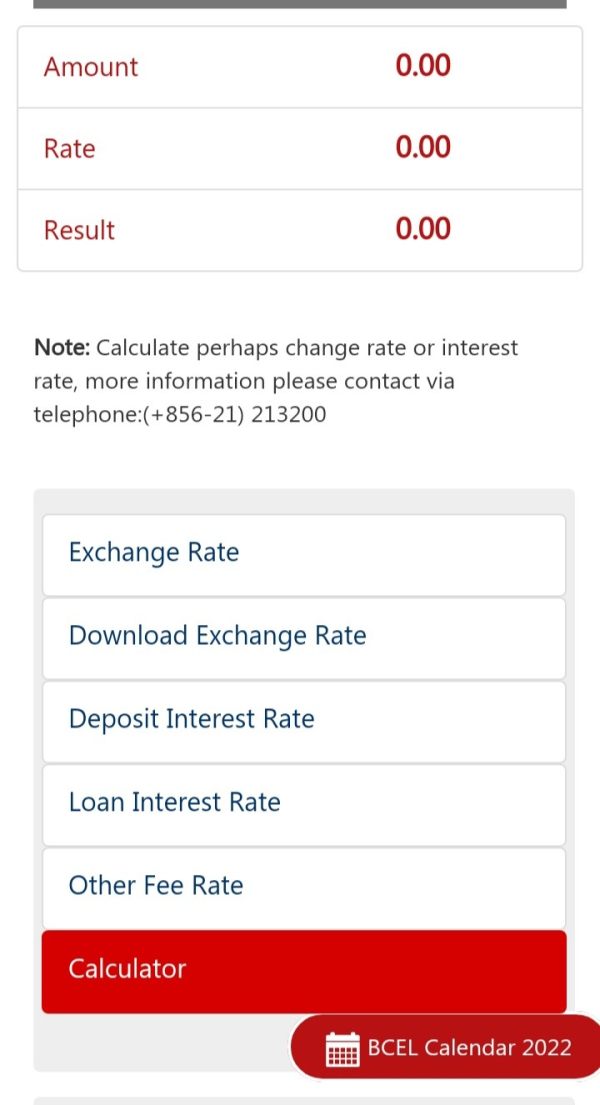

BCEL is formally known as Banque Pour Le Commerce Exterieur Lao Public. The bank was established in 1975 and has built a strong reputation as a cornerstone in the Laotian banking sector over nearly five decades. BCEL offers many different services including bank accounts, ATMs, deposit machines, debit and credit cards, mobile and internet banking services, and various loan products. The bank has positioned itself as a reliable provider of personal financial services that customers can trust. BCEL's business model now focuses on electronic payment solutions. These solutions serve the digital needs of both individual customers and small businesses in an increasingly connected world. The bank continues to modernize its operations. It has established partnerships with leading electronic wallet providers to enhance its digital payment infrastructure and stay competitive. This strategic move supports faster transactions. It also reinforces BCEL's relevance in an increasingly cashless economy where digital payments are becoming the norm. However, while BCEL's traditional banking services are strong and well-documented, information about its offerings and conditions specifically related to forex trading remains limited. This bcel review helps readers understand that while BCEL excels in personal banking, clients interested in foreign exchange trading should be aware of the limited publicly available trading-specific details.

BCEL does not provide concrete details about trading services in the public domain. Information such as the types of platforms available, asset classes covered, and regulatory oversight specific to forex trading are not clearly stated in available sources. The absence of this information makes it hard for potential traders to assess whether BCEL is suitable for forex activities beyond its traditional banking framework. Trading fees, execution speeds, and other investment-specific aspects have also not been detailed in the sources we reviewed. While BCEL's core operations as a banking institution are well established, those looking for complete forex solutions might need to do more research on their own. This overview serves as an important guide for weighing the strengths of a traditional banking powerhouse against the specific demands of modern forex trading.

Regulatory Jurisdiction

The available information does not specify any particular regulatory authority overseeing BCEL's forex trading operations. BCEL operates under national banking regulations as a traditional Laotian bank. However, details about its regulatory oversight concerning electronic trading remain unclear and hard to find in public sources. This uncertainty means that specific compliance measures or additional licensing in the forex domain are not detailed in the public records.

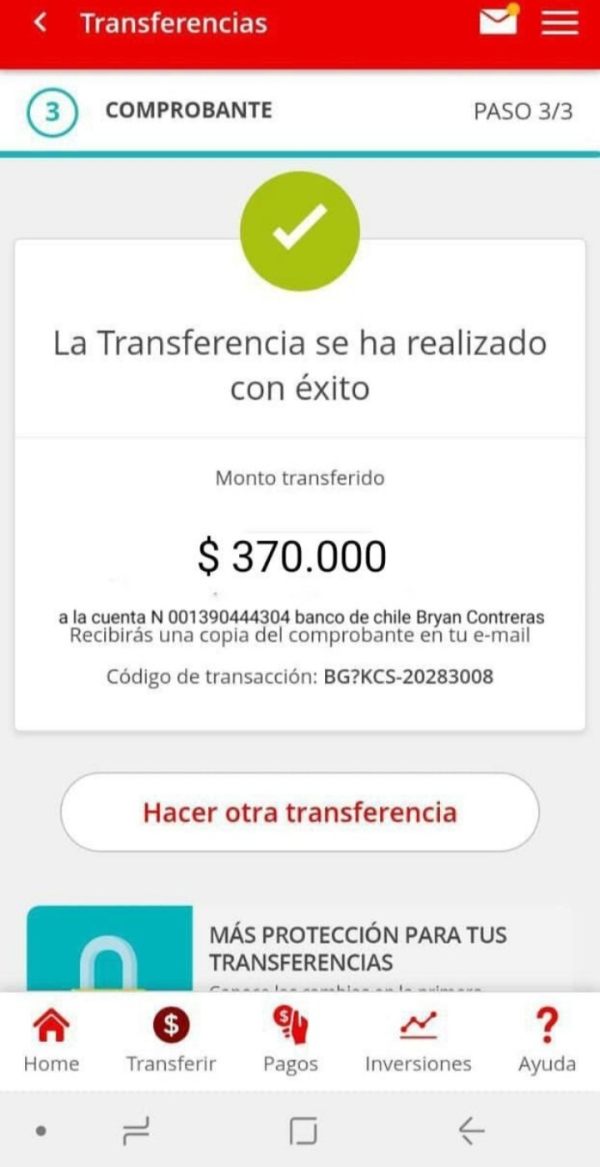

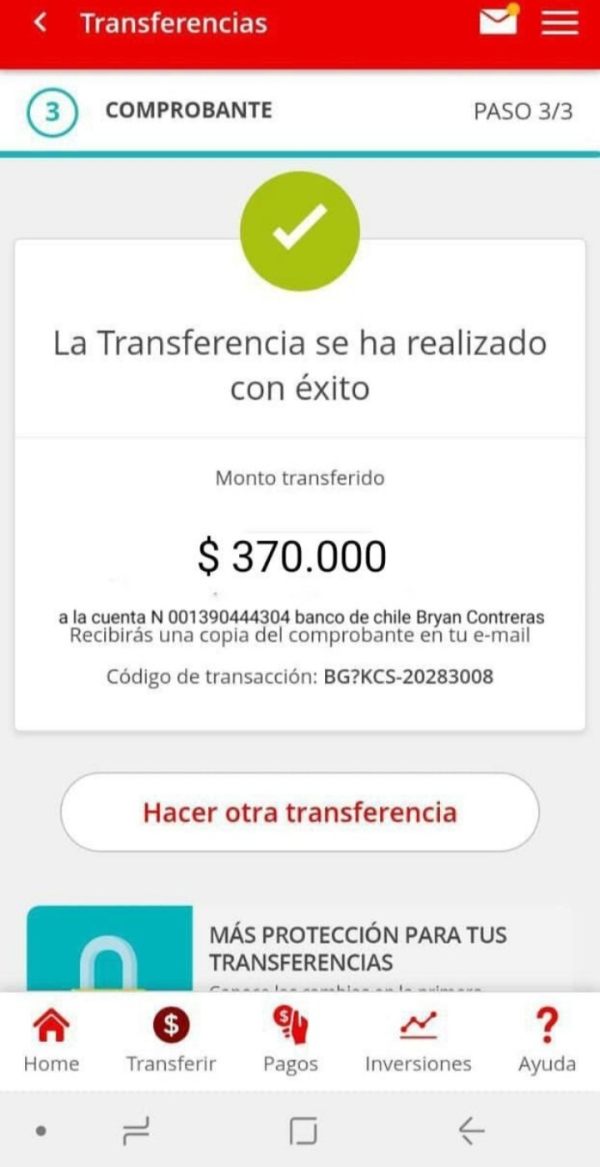

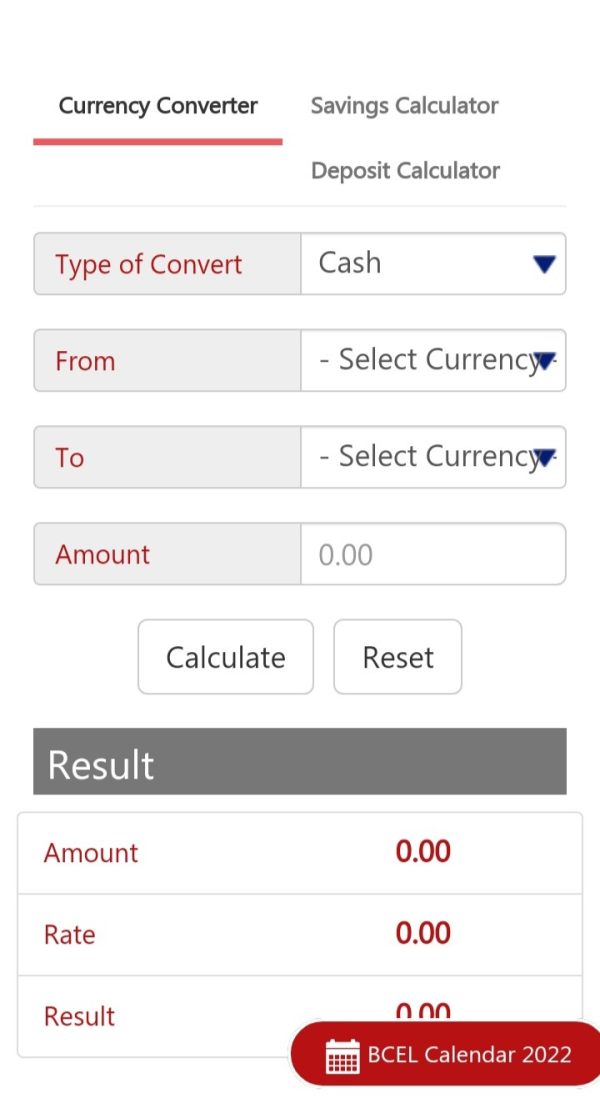

Deposit and Withdrawal Methods

Specific methods for deposits and withdrawals in a forex trading context are not mentioned in existing sources. BCEL is known for its comprehensive banking solutions that serve many customer needs. However, the detailed procedures for handling trading-related funds via online platforms or traditional banking channels are not provided in available documentation.

Minimum Deposit Requirements

No clear details about minimum deposit requirements for trading accounts have been disclosed. BCEL's public profile focuses on its personal banking products and services. Any thresholds for opening forex-related accounts remain unspecified in current documentation that we could access.

BCEL's promotional offers and bonus structures in relation to forex trading activities are not mentioned. The bank's historical focus remains on conventional financial services that have served customers well for decades. Available resources do not elaborate on marketing incentives tailored specifically for forex traders.

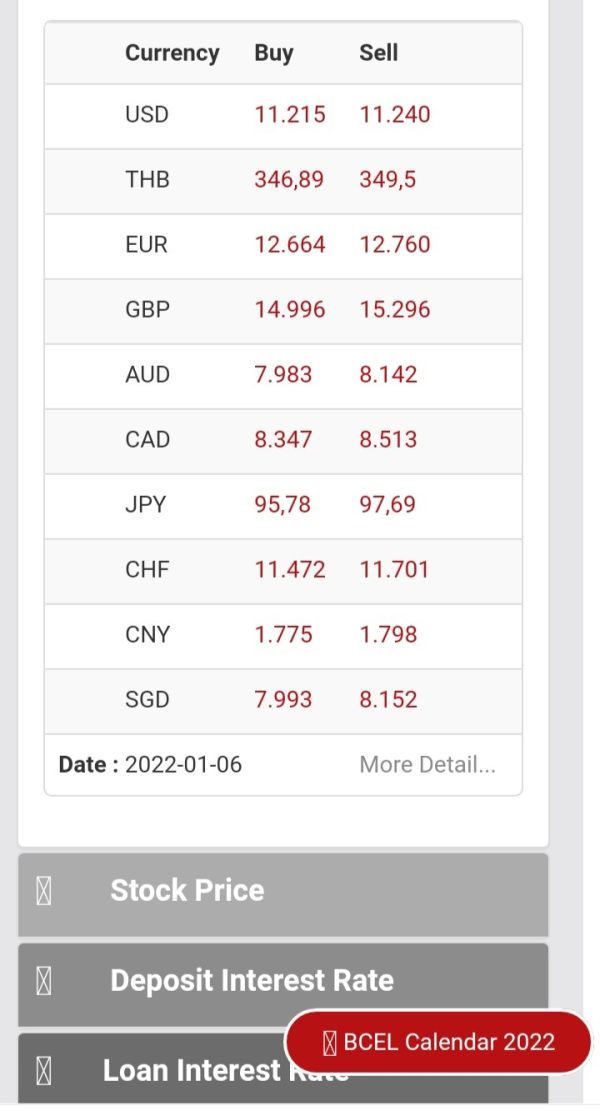

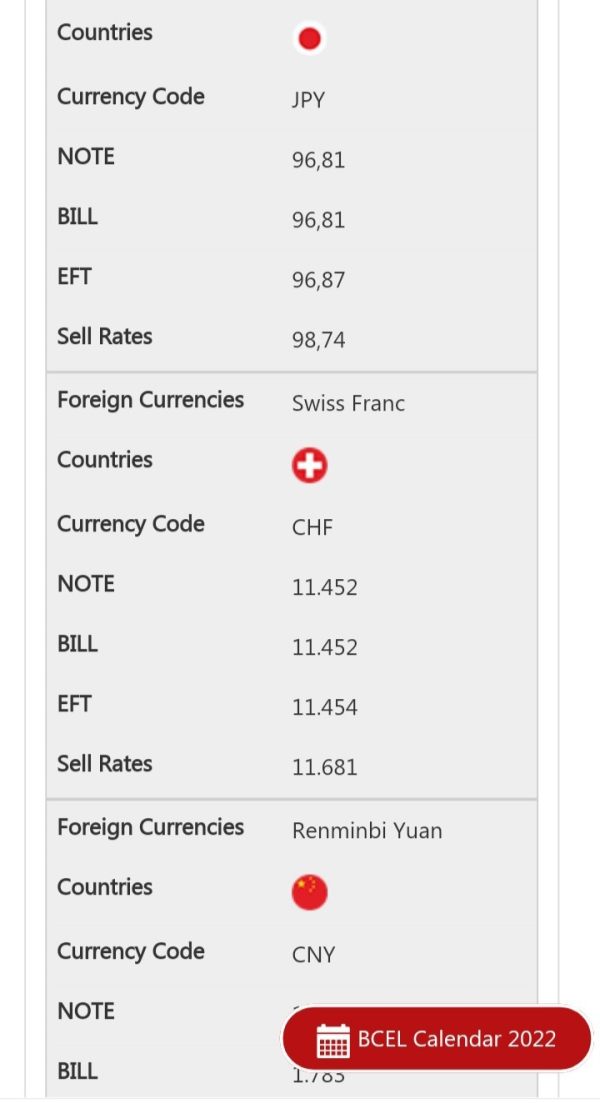

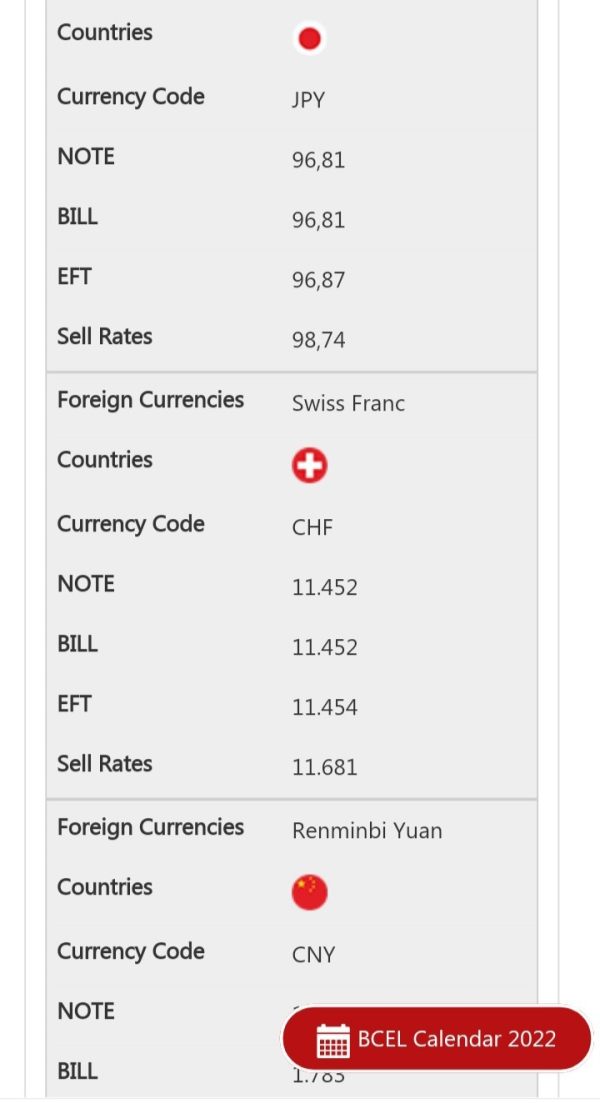

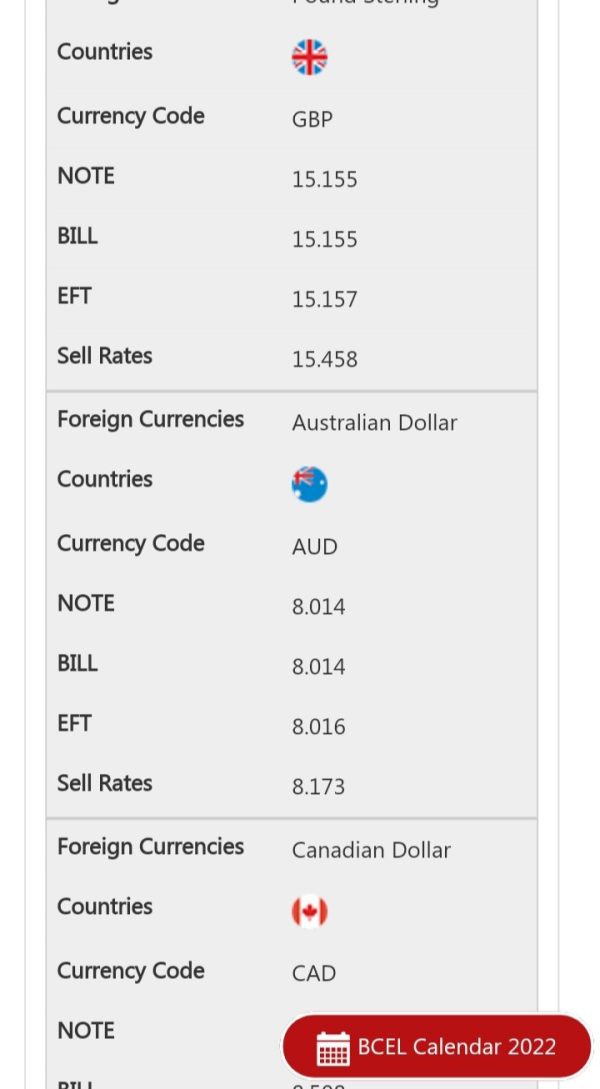

Tradable Assets

Information about the range of tradable assets, including forex pairs or other financial instruments, is notably absent. BCEL's expertise primarily lies in delivering traditional personal banking services to individual and business customers. There is no comprehensive list of assets available for online trading in the reviewed sources.

Cost Structure

The cost structure, including commissions, spreads, or any service fees related to trading, is not documented. Users can expect standard banking fees for personal financial services that are typical in the industry. However, there is a lack of clarity about the specific costs involved in forex trading activities.

Leverage Ratios

There is no available detail on the leverage ratios offered by BCEL for forex trading. The bank's primary focus remains on conventional banking services that have been its strength for many years. Any information on leverage typically provided by dedicated forex brokers is not present in the available public data.

Details about the trading platforms available to forex clients are not provided. The review sources do not include information on whether BCEL offers proprietary or third-party trading platforms. This leaves a gap for those interested in the technical aspects of trade execution and platform functionality.

Geographic Restrictions

No clear information about any regional restrictions or countries where BCEL's forex services are unavailable has been disclosed. The focus remains on serving the domestic market and individual requirements within Laos. Extended details on global accessibility are not provided in current sources.

Customer Service Languages

There is no detailed information on the language options provided by BCEL's customer service teams for forex trading inquiries. The bank likely supports the primary Laotian and possibly other regional languages for its personal banking services. However, specifics for trading-related support remain undisclosed in available documentation.

This comprehensive section provides an overall view of the available data. Readers are encouraged to consider that many specific details on trading functionalities have not been detailed in public sources that we could access. As such, this bcel review relies on the broader business context of BCEL rather than a full analysis of forex functionalities.

6. Detailed Rating Analysis

6.1 Accounts Conditions Analysis

The available information does not offer any detailed information about the variety of accounts or the specific features that might appeal to forex traders. Deposit minimums and account opening procedures are not clearly explained in public sources. Potential specialized accounts—such as Islamic accounts—also lack comprehensive data that traders typically need to make informed decisions. For those assessing BCEL based solely on traditional personal banking, these account attributes remain unclear. Compared to other established trading platforms where account features are clearly outlined, BCEL's public documentation focuses mainly on conventional banking products. This gap makes it challenging for prospective forex participants to gauge if the account structures align with their trading expectations and financial goals. Users are advised to conduct further inquiry directly with BCEL to get more details. Overall, based on the information provided, this bcel review highlights that while traditional banking services are strong, specific forex trading account conditions have not been sufficiently detailed, limiting its immediate attractiveness for dedicated traders.

The evaluation of BCEL in terms of trading tools and resources reveals a significant information gap. Available sources do not provide details about the range or quality of trading platforms, analytical tools, or educational materials that are often essential for active forex trading. Tools that provide market analysis, automated trading capabilities, or deep research resources are standard in many leading brokers. However, such details are not mentioned in the discussions about BCEL that we could find. This absence raises questions about whether BCEL has invested in technology to support advanced trading activities. Potential users who rely on comprehensive tools for executing trades or staying updated with market trends will find the lack of clear, detailed information concerning. In contrast to specialized forex platforms, BCEL appears to focus on conventional banking methods and digital payment solutions rather than dedicated trading resources. This bcel review underscores this gap. It emphasizes the need for direct inquiry from the institution if these functionalities are of primary interest to potential customers.

6.3 Customer Service and Support Analysis

Customer service and support play a critical role in any financial institution. For BCEL, the available information does not provide specifics on the channels, response times, or multilingual support that forex traders typically expect from their brokers. There is no detailed account of whether customers have access to round-the-clock support or if help is available in multiple languages. This type of support is essential for an internationally diverse clientele that trades across different time zones. In specialized trading environments, robust customer service often includes live chat support, comprehensive FAQs, and dedicated account managers. However, these features are not clearly described for BCEL in the sources we reviewed. There is no documented evidence of customer feedback specifically related to the resolution of trading or account-related issues. This lack of detailed service-oriented information makes it difficult to fully assess BCEL's competitiveness in handling customer concerns. Overall, this section in the bcel review suggests that while standard personal banking customer service may be acceptable, the support infrastructure for trading activities remains unclear, requiring further investigation by interested parties.

6.4 Trading Experience Analysis

A seamless trading experience is crucial for successful market participation. The documentation about BCEL does not explain details related to platform stability, order execution quality, or other technical functionalities critical to modern trading environments. There is no available information about whether BCEL offers a dedicated trading interface or how its systems perform during periods of high volatility when markets move quickly. For traders accustomed to advanced analytical tools and rapid execution times, this omission represents a significant shortfall. Details about the accessibility of mobile trading, customizability of user interfaces, and backup measures in case of technical issues are not provided in the sources. This gap makes it challenging for potential clients to evaluate the true quality of the trading technology they would be engaging with if they choose BCEL. As this bcel review indicates, while the institution boasts a long history in the banking sector, its performance in delivering a competitive trading experience remains unclear, urging clients to seek further specifics before committing capital.

6.5 Trust Analysis

Trust is a foundational aspect of any financial service. BCEL's long-standing presence since 1975 does suggest a degree of reliability and industry reputation that comes from decades of operation. However, detailed insights into regulatory certifications, fund security measures, or corporate transparency specific to its forex trading operations are not documented in the available sources. There is no indication of any adverse events or risk management failures that might affect client perceptions. Nevertheless, the absence of clearly stated regulatory oversight or third-party audits leaves a void in a complete trust evaluation. In contrast, forex brokers typically emphasize these aspects to build greater confidence among their clientele. The legacy of BCEL in traditional banking provides a certain level of inherent trust that comes from its established history. However, when examined from a forex trading perspective, this bcel review identifies that more concrete information would be required to fully confirm its trustworthiness in this particular niche. Future improvements in disclosures could help bridge this gap and better align BCEL with modern market expectations regarding transparency and client safety.

6.6 User Experience Analysis

User experience for any trading platform is essential for customer satisfaction. In the case of BCEL, the information does not shed light on how intuitive or user-friendly its interfaces are for forex trading purposes. Important aspects such as the ease of registering, account verification processes, and overall interface design remain unspecified in available sources. In environments where competitors provide detailed walk-throughs, interactive tutorials, and customer-driven reviews, BCEL's lack of detailed user feedback poses a challenge. There is no documented evidence of common issues faced by users, nor detailed suggestions for improvement based on client testimonies. While the bank's traditional banking platforms are likely to be streamlined for everyday transactions, it is uncertain if these systems translate well into a dedicated trading scenario. Prospective traders may find the absence of robust user experience data a limiting factor in their evaluation. This final segment of our bcel review ultimately emphasizes that, although BCEL has a reputable background, its user-centric design specifically for forex trading has not been clearly described in the public domain.

7. Conclusion

BCEL remains a significant institution with a strong heritage in traditional banking services since 1975. The bank primarily serves individual and small business clients with reliable financial solutions that have been tested over decades. However, specific details about its forex trading operations, including account conditions, platform details, and customer service tailored for trading, are notably absent from public sources. While its longstanding legacy inspires confidence among traditional banking customers, prospective forex traders should be aware of the gaps in specific trading information. This bcel review serves as a starting point for those interested in exploring BCEL's capabilities. We recommend conducting additional inquiry for a comprehensive evaluation that meets your specific trading needs.