AAX 2025 Review: Everything You Need to Know

Executive Summary

AAX is a digital asset trading platform that serves both new and experienced cryptocurrency traders. This aax review shows a platform that offers good trading conditions with low fees and leverage up to 1:100 across multiple cryptocurrency assets. The exchange provides a user-friendly interface designed to help traders at different skill levels, making it easy for people new to digital asset trading while offering advanced features for seasoned professionals.

Key highlights include the platform's focus on security through multi-signature measures and its full support for major cryptocurrencies including Bitcoin and Ethereum. However, our analysis shows that AAX faces challenges in certain areas, especially regarding customer service quality and regulatory transparency. The platform mainly targets crypto enthusiasts and traders seeking a reliable place for both spot and futures trading activities.

While AAX shows potential as a growing digital asset exchange, users should know about certain limits in customer support response and the need for more complete regulatory disclosure. The platform's competitive fee structure and high leverage options make it attractive for active traders, though newcomers may need extra guidance to fully use all available features.

Important Notice

Due to the changing nature of cryptocurrency rules worldwide, AAX may face different legal and compliance requirements across various regions. Traders should check the platform's availability and regulatory status in their specific area before starting trading activities. The regulatory landscape for digital asset exchanges continues to develop, and users should stay informed about local laws governing cryptocurrency trading.

This review is based on available user feedback, market research, and publicly accessible information about AAX's services and features. Our analysis includes user experiences and platform data available at the time of writing. Given the dynamic nature of the cryptocurrency exchange industry, some features and conditions may change over time. Users should verify current terms and conditions directly with AAX before making trading decisions.

Rating Framework

Broker Overview

AAX operates as a digital asset trading platform based in the Asia-Pacific region, focusing on providing cryptocurrency trading services to a diverse user base. The exchange has positioned itself as a complete solution for both spot and futures trading, targeting individuals ranging from cryptocurrency newcomers to experienced digital asset traders. The platform's business model centers on making efficient cryptocurrency transactions possible while maintaining competitive fee structures and providing access to popular digital assets.

The exchange offers trading services across multiple cryptocurrency pairs and has built its reputation on providing high leverage options and user-friendly trading interfaces. AAX's approach emphasizes accessibility for retail traders while adding advanced features that appeal to more sophisticated market participants. The platform supports various trading strategies through its spot and futures offerings, allowing users to engage in both simple buy-and-hold strategies and more complex trading approaches.

Regarding platform infrastructure, AAX operates as a dedicated cryptocurrency exchange rather than using traditional forex trading platforms like MetaTrader 4 or MetaTrader 5. The exchange supports trading in major cryptocurrencies including Bitcoin and Ethereum, along with various altcoins and trading pairs. However, specific information about regulatory oversight and licensing remains limited in available public documentation, which represents a significant consideration for potential users evaluating the platform's credibility and compliance status.

Regulatory Status: Available information does not specify particular regulatory bodies overseeing AAX operations, which raises questions about compliance frameworks and user protection measures. This lack of regulatory transparency is a significant factor that potential users should consider when evaluating the platform.

Deposit and Withdrawal Methods: Specific details about supported deposit and withdrawal methods are not fully detailed in available sources, though as a cryptocurrency exchange, it likely supports various digital asset transfers and potentially fiat currency options.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation, requiring potential users to verify current requirements directly with the platform.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in available information, suggesting users should check the platform directly for any ongoing incentives.

Tradeable Assets: AAX supports trading in multiple cryptocurrency assets, with confirmed support for major digital currencies including Bitcoin and Ethereum. The platform likely offers additional altcoin trading pairs and cryptocurrency derivatives through its futures trading services.

Cost Structure: The platform emphasizes low trading fees as a key competitive advantage, though specific fee schedules and structures require verification through current platform documentation. This aax review notes that competitive pricing appears to be a central element of AAX's value proposition.

Leverage Options: AAX offers leverage up to 1:100 for qualifying trades, providing significant capital efficiency for experienced traders while requiring careful risk management.

Platform Technology: The exchange operates on its own trading platform rather than third-party solutions, designed specifically for cryptocurrency trading activities.

Geographic Restrictions: Specific regional limitations and availability are not detailed in available sources, requiring verification based on user location.

Customer Support Languages: Available language support for customer service is not specified in current documentation.

Account Conditions Analysis

AAX's account structure appears designed to accommodate various trader types, though specific account tier details are not fully outlined in available information. The platform's approach to account conditions emphasizes accessibility through competitive fee structures and high leverage availability, making it potentially attractive for both small and large traders. However, the lack of detailed information about specific account types and their respective features represents a limitation for users seeking to understand exactly what services align with their trading needs.

The minimum deposit requirements are not clearly specified in available documentation, which creates uncertainty for potential users planning their initial investment. This lack of transparency regarding entry requirements may complicate decision-making for newcomers to the platform. Additionally, without clear information about account opening procedures and verification requirements, users cannot fully assess the accessibility and convenience of getting started with AAX.

The absence of information about specialized account features, such as Islamic-compliant accounts or institutional trading arrangements, suggests that AAX may primarily focus on standard retail trading accounts. This aax review indicates that while the platform offers competitive basic conditions, the limited transparency about account structures and requirements may affect user confidence.

User feedback regarding account conditions has not provided specific insights into the practical experience of account management, funding, or the overall account lifecycle. This information gap makes it challenging to provide complete guidance about what users can expect when establishing and maintaining accounts with AAX.

AAX emphasizes providing a user-friendly interface combined with multi-signature security measures, which represents a solid foundation for trading tools and platform security. The platform's focus on interface design suggests attention to user experience, though specific details about trading tools, charting capabilities, and analytical resources are not fully documented in available sources. This limits our ability to fully assess the depth and quality of tools available to traders.

The multi-signature security implementation indicates that AAX has invested in protecting user assets and transaction integrity, which is crucial for cryptocurrency trading platforms. However, without detailed information about additional security features, research tools, or educational resources, it's difficult to determine how fully the platform supports trader development and decision-making processes.

Available information does not specify the range of analytical tools, market research resources, or educational materials that AAX provides to its users. For a complete trading platform, these resources are typically essential for helping users make informed trading decisions and develop their skills over time. The absence of detailed information about these features represents a significant gap in understanding the platform's full value proposition.

Automated trading support, API access, and integration capabilities are not detailed in available documentation, which may be important considerations for more advanced users seeking to implement sophisticated trading strategies or connect third-party tools to their AAX accounts.

Customer Service and Support Analysis

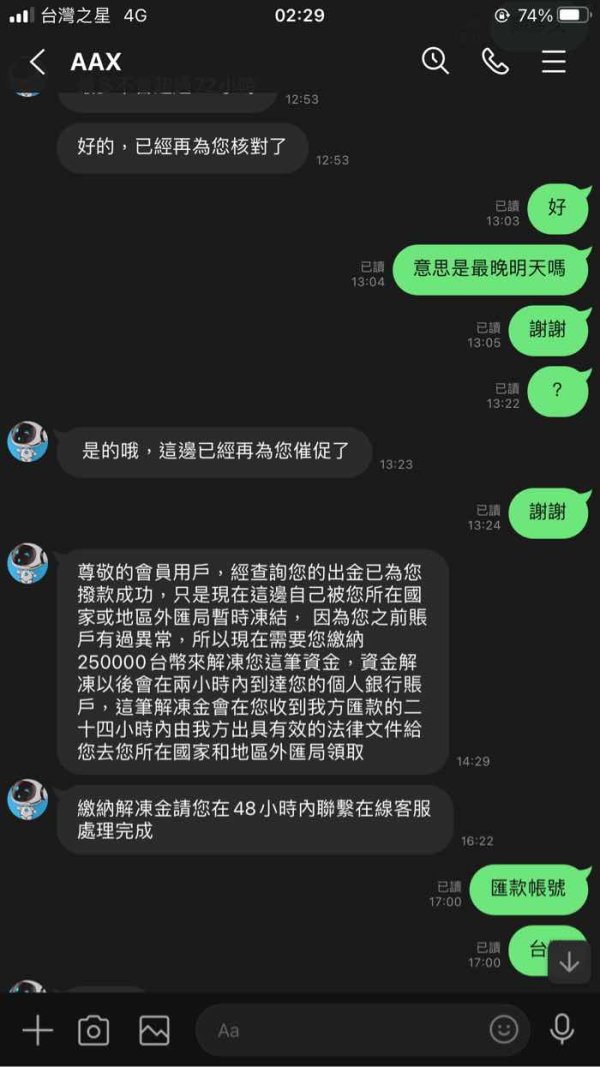

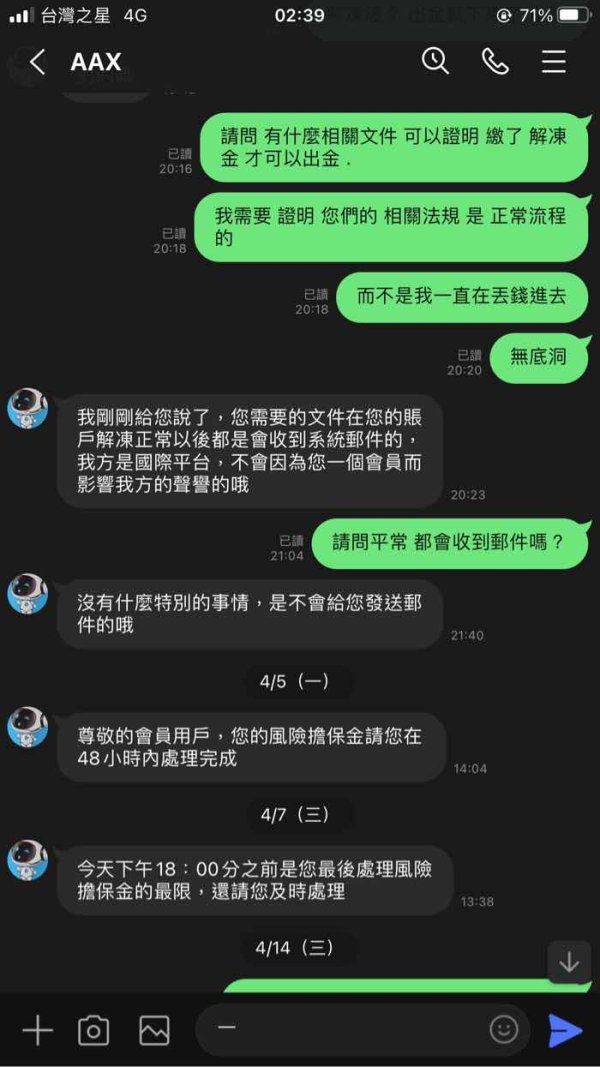

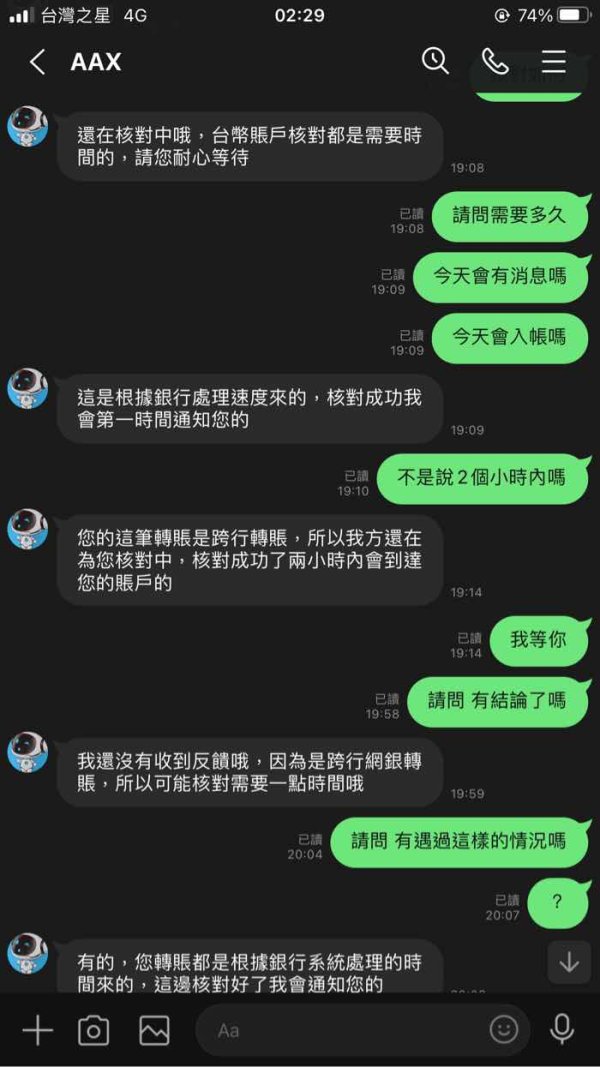

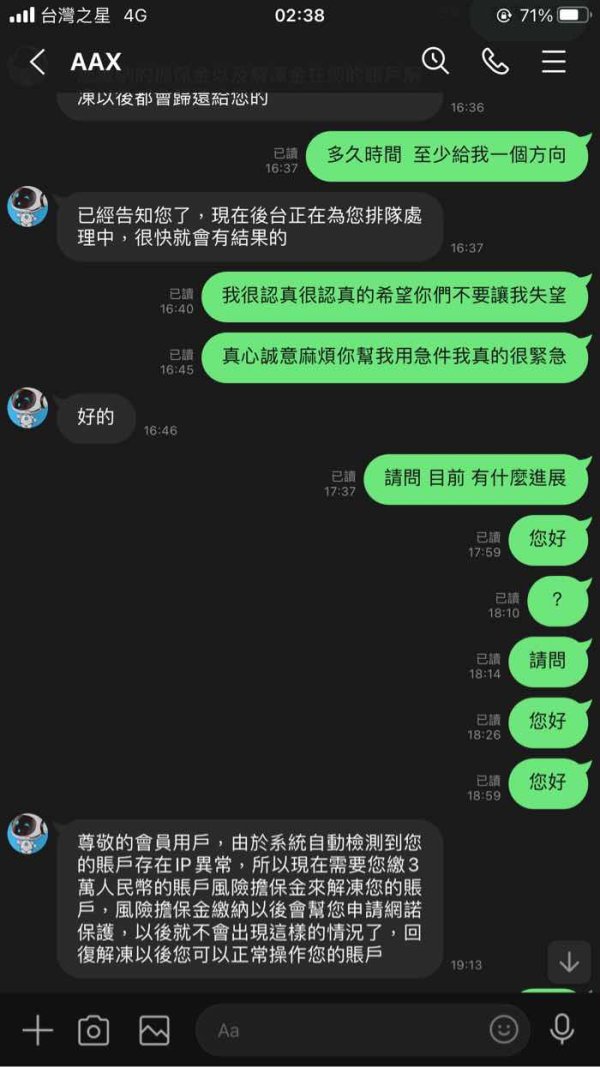

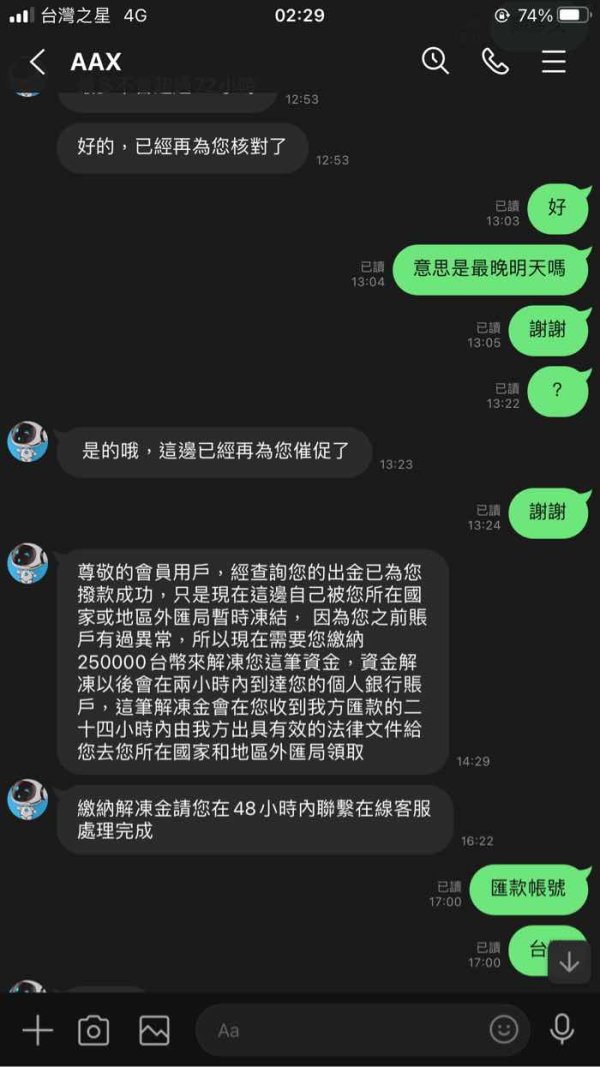

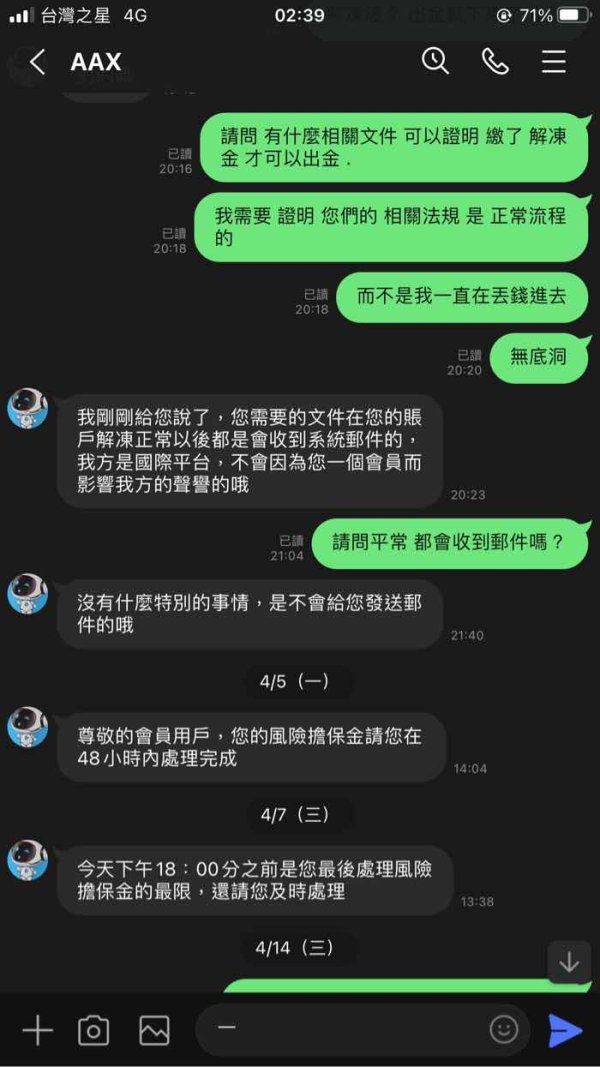

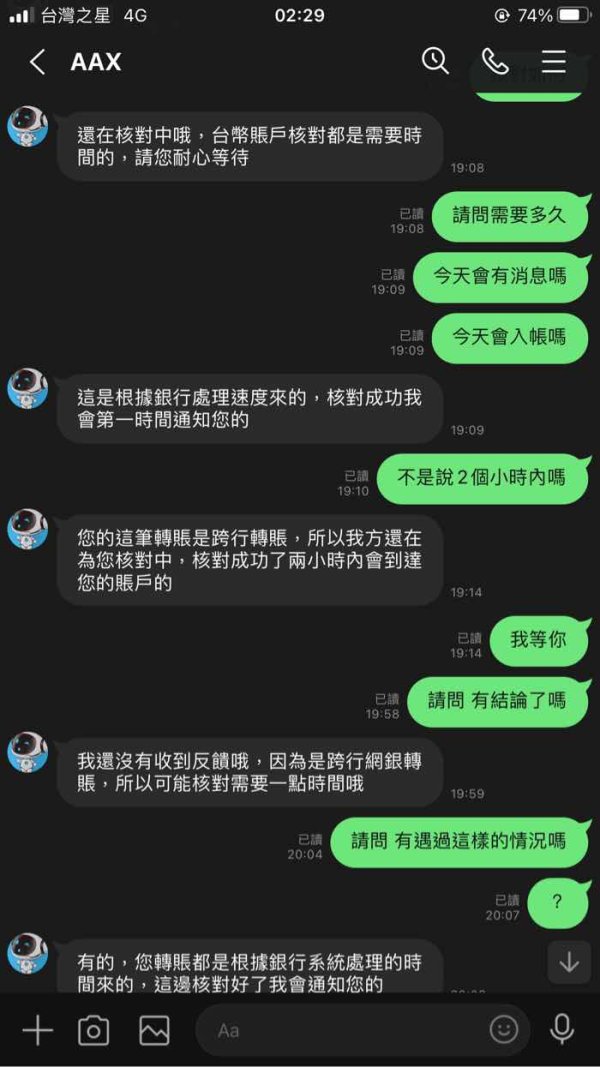

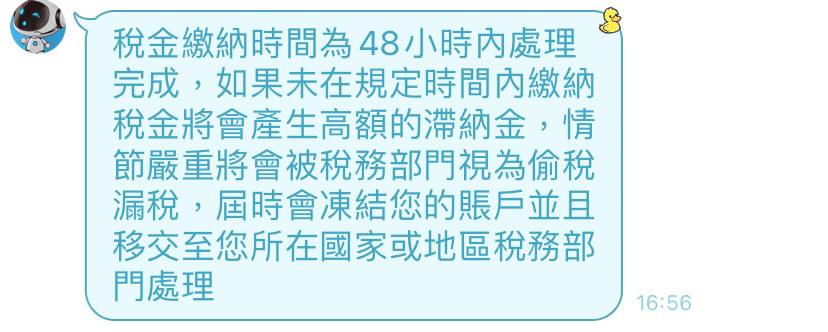

User feedback indicates that AAX's customer service quality requires improvement, representing a significant area of concern for potential users. The specific nature of service issues and response time problems are not detailed in available information, but the indication that customer support needs enhancement suggests that users may experience frustration when seeking assistance with platform-related issues or account problems.

The lack of detailed information about available customer service channels, operating hours, and support languages creates uncertainty about how users can access help when needed. For cryptocurrency trading platforms where technical issues or account problems can have immediate financial implications, reliable and responsive customer support is crucial for user confidence and satisfaction.

Without specific information about response times, resolution procedures, or the quality of support interactions, it's challenging to provide guidance about what users can expect when they need assistance. The general indication that service quality needs improvement suggests that AAX may be working to address these issues, but current users should be prepared for potential delays or complications when seeking support.

The absence of information about multilingual support, 24/7 availability, or specialized support for different types of issues further complicates the assessment of AAX's customer service capabilities. This aax review highlights customer service as an area where the platform may need significant improvement to meet user expectations.

Trading Experience Analysis

User feedback regarding AAX's trading experience has been generally positive, though specific details about platform performance, execution quality, and technical capabilities are not fully documented. The positive user sentiment suggests that the basic trading functionality meets user expectations, but without detailed performance metrics or specific user experiences, it's difficult to assess the platform's reliability under various market conditions.

Platform stability and execution speed are critical factors for cryptocurrency trading, where market volatility can create opportunities and risks that require immediate response capabilities. The lack of specific information about order execution quality, slippage rates, or platform uptime statistics limits our ability to evaluate these crucial technical aspects of the trading experience.

Mobile trading capabilities and cross-device functionality are not detailed in available information, which is significant given the importance of mobile access for cryptocurrency traders who need to monitor and respond to market movements outside of regular business hours. The absence of information about mobile platform features and performance represents a gap in understanding the complete trading experience that AAX provides.

The overall positive user feedback suggests that AAX delivers a satisfactory trading environment, but without specific details about advanced trading features, order types, or platform customization options, it's challenging to determine how well the platform serves different trading styles and strategies.

Trust and Safety Analysis

The lack of specific regulatory information represents a significant concern for AAX's trust and safety profile. In the cryptocurrency exchange industry, regulatory oversight and compliance provide important protections for users and indicate a platform's commitment to operating within established legal frameworks. Without clear information about regulatory licenses, compliance procedures, or oversight relationships, users cannot fully assess the legal protections available to them.

While AAX implements multi-signature security measures, which demonstrates attention to technical security, the broader picture of user protection remains unclear without information about fund segregation, insurance coverage, or regulatory capital requirements. These factors are important for users seeking assurance that their assets are protected against various types of risks, including platform insolvency or security breaches.

Company transparency and public disclosure of key business information are not well-documented, which affects the ability to assess AAX's operational stability and long-term viability. Without information about company leadership, financial backing, or business partnerships, users must rely primarily on user feedback and basic platform functionality to evaluate trustworthiness.

The absence of information about how AAX handles security incidents, regulatory compliance, or user disputes further complicates the trust assessment. This aax review notes that enhanced transparency and regulatory clarity would significantly improve user confidence in the platform.

User Experience Analysis

AAX's user-friendly interface represents a positive aspect of the overall user experience, suggesting that the platform prioritizes accessibility and ease of use. However, the indication that customer service requires improvement creates a significant negative impact on the overall user experience, as support quality directly affects user satisfaction and confidence in the platform.

The platform appears designed to accommodate both novice and experienced cryptocurrency traders, which suggests thoughtful consideration of different user needs and skill levels. However, without specific information about onboarding processes, educational resources, or user guidance features, it's difficult to assess how effectively AAX supports users in developing their trading skills and platform familiarity.

Registration and verification procedures are not detailed in available information, which affects users' ability to anticipate the account setup process and any potential complications or delays. Similarly, the lack of specific information about fund management procedures and withdrawal processes creates uncertainty about day-to-day operational aspects of using the platform.

Common user complaints appear to center around customer service quality, which aligns with earlier feedback about support improvements needed. The balance between positive interface design and negative service experiences suggests that AAX has succeeded in creating a functional trading platform but struggles with the human elements of customer support and user assistance.

Conclusion

AAX presents itself as a digital asset trading platform with several attractive features, including competitive low trading fees, high leverage options up to 1:100, and a user-friendly interface designed for both novice and experienced traders. The platform's focus on major cryptocurrencies like Bitcoin and Ethereum, combined with multi-signature security measures, provides a solid foundation for cryptocurrency trading activities.

However, this aax review identifies significant areas of concern that potential users should carefully consider. The lack of clear regulatory information affects the platform's trustworthiness and user protection assurances. Additionally, user feedback indicating that customer service quality needs improvement represents a practical concern for users who may require support assistance.

AAX appears most suitable for experienced cryptocurrency traders who can navigate potential support challenges and are comfortable with platforms that may have limited regulatory transparency. New traders might benefit from platforms with more complete educational resources and proven customer support quality, though AAX's user-friendly interface could still serve beginners willing to accept the identified limitations.

The platform's competitive advantages in fees and leverage make it potentially attractive for active traders, but users should weigh these benefits against the concerns about customer service and regulatory clarity when making their decision.