Is Daily FX Markets safe?

Business

License

Is Daily FX Markets Safe or Scam?

Introduction

Daily FX Markets is a relatively new player in the forex trading arena, having been established in the United Kingdom. The broker markets itself as a user-friendly platform for both novice and experienced traders, claiming to offer competitive trading conditions and a range of financial instruments. However, the importance of conducting thorough due diligence when selecting a forex broker cannot be overstated. Traders need to be cautious, as the forex market is rife with unregulated entities that may not prioritize client safety or transparency. This article aims to provide a comprehensive evaluation of Daily FX Markets, assessing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile. The insights presented are derived from a thorough analysis of available data, including customer reviews and expert assessments.

Regulation and Legitimacy

One of the most critical aspects to consider when evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and maintain transparency in their operations. In the case of Daily FX Markets, it has been identified as an unregulated broker, which raises serious questions about its legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a valid regulatory license is alarming, as it implies that Daily FX Markets operates without oversight from any recognized financial authority. This lack of regulation can expose traders to significant risks, including the potential for fraud and mismanagement of funds. Furthermore, the broker has received a low score from various review platforms, indicating widespread skepticism about its operations. The absence of a regulatory framework means that there are no mechanisms in place to protect traders in the event of disputes or financial issues, making it essential for potential clients to proceed with caution.

Company Background Investigation

Daily FX Markets was established in 2023 and claims to focus primarily on forex trading. The companys history is relatively short, which can be a red flag for potential investors. A brief exploration of its ownership structure reveals limited information, further contributing to concerns regarding its transparency. The management team behind Daily FX Markets has not been prominently featured in available resources, making it difficult to assess their qualifications and experience in the financial industry.

Transparency is crucial for any financial institution, and the lack of detailed information about the company's operations and management raises questions about its credibility. A trustworthy broker typically offers insights into its leadership team and operational history, allowing traders to gauge their expertise and reliability. In the case of Daily FX Markets, the absence of such information is concerning and warrants further scrutiny.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer are a key factor in determining their overall value proposition. Daily FX Markets claims to provide competitive spreads and a commission-free trading environment, which can be appealing to traders looking to minimize their costs. However, it is essential to delve deeper into the actual trading conditions offered by the broker.

| Fee Type | Daily FX Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.1 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While the broker advertises spreads starting from 0.1 pips, the lack of transparency regarding other potential costs, such as overnight fees, raises concerns. Additionally, the absence of a clear commission structure could be indicative of hidden fees that may not be immediately apparent to traders. Such ambiguities in the fee structure can lead to unexpected costs, making it crucial for traders to read the fine print before committing their funds.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. Daily FX Markets has made claims regarding the security of client funds, stating that they implement measures to safeguard traders investments. However, the lack of regulation raises significant concerns about the effectiveness of these measures.

Traders should inquire about the broker's policies on fund segregation, investor protection, and negative balance protection. Unfortunately, Daily FX Markets has not provided sufficient information on these critical aspects, leaving potential clients in the dark about the safety of their investments. The absence of any historical incidents related to fund security further complicates the assessment, as it is difficult to ascertain the broker's reliability in this area.

Customer Experience and Complaints

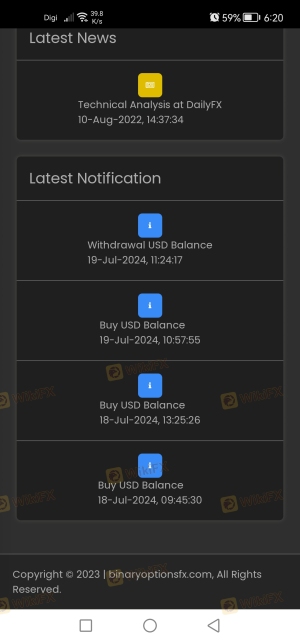

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of Daily FX Markets reveal a mixed bag of experiences, with some users reporting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Issues | Medium | Unresolved |

Several traders have expressed frustration over delayed withdrawals, a common complaint among unregulated brokers. This can be a significant red flag, as it often indicates underlying operational issues. In one notable case, a trader reported being unable to withdraw their funds after being added to an investment group by the broker, highlighting the potential risks of engaging with an unregulated entity.

Platform and Trade Execution

The trading platform offered by Daily FX Markets is another critical factor in determining its overall reliability. The broker claims to utilize the MetaTrader 5 platform, which is known for its user-friendly interface and robust features. However, the actual performance of the platform in terms of stability, order execution quality, and slippage rates remains to be seen.

Users have reported varying experiences with trade execution, with some noting instances of slippage and delayed order processing. Such issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. The absence of transparent performance metrics further complicates the evaluation of Daily FX Markets' platform reliability.

Risk Assessment

Engaging with Daily FX Markets presents a range of risks that traders should carefully consider. The absence of regulation, coupled with reports of withdrawal issues and limited transparency, contributes to a heightened risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Service Risk | Medium | Reports of slow response times and unresolved complaints. |

To mitigate these risks, potential clients are advised to conduct thorough research, avoid investing more than they can afford to lose, and consider engaging with more reputable, regulated brokers.

Conclusion and Recommendations

In conclusion, Daily FX Markets presents several red flags that caution against engaging with the broker. The lack of regulation, transparency issues, and reports of withdrawal complications suggest that it may not be a safe choice for traders. While the broker offers competitive trading conditions on the surface, the underlying risks associated with its operations cannot be ignored.

For traders seeking a reliable and secure trading environment, it is advisable to consider well-regulated alternatives with a proven track record of client protection and transparency. Brokers such as IG, OANDA, and Forex.com are examples of reputable firms that prioritize customer safety and regulatory compliance. Ultimately, the decision to engage with Daily FX Markets should be approached with caution, and potential clients are encouraged to weigh the risks carefully before proceeding.

In summary, is Daily FX Markets safe? The evidence suggests that traders should be wary and consider other options to ensure the safety of their investments.

Is Daily FX Markets a scam, or is it legit?

The latest exposure and evaluation content of Daily FX Markets brokers.

Daily FX Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Daily FX Markets latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.