Vistova 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive vistova review reveals significant concerns about this forex trading platform that traders must carefully consider. Established on June 13, 2023, Vistova operates from Saint Lucia without proper regulatory oversight, raising immediate red flags for potential investors. The platform markets itself as offering forex, CFDs, futures, commodities, and indices trading services, but multiple independent sources have flagged it as high-risk with suspected fraudulent activities.

The broker's extremely short operational history combined with numerous user complaints about fund withdrawals and customer service failures creates a troubling picture. According to WikiFX monitoring data, Vistova has received 22 exposure reviews highlighting various issues, compared to only 1 positive and 1 neutral review. The minimum deposit requirement of $500, while not excessive by industry standards, becomes concerning when considered alongside the platform's lack of regulatory protection and transparency issues.

Multiple financial watchdog websites have categorized Vistova as a suspected scam operation, with users reporting difficulties in fund recovery and poor trading experiences. The absence of clear regulatory compliance, combined with the platform's Saint Lucia registration—a jurisdiction known for limited financial oversight—makes this broker unsuitable for serious traders seeking reliable trading conditions and fund security.

Important Notice

This vistova review is based on comprehensive analysis of user feedback, regulatory database searches, and third-party monitoring services available as of 2025. Traders should note that Vistova operates from Saint Lucia without mention of specific regulatory authorization from major financial authorities. The platform's regulatory status appears unclear, with no verified licenses from recognized bodies such as FCA, ASIC, CySEC, or other tier-1 regulators.

Our evaluation methodology incorporates user testimonials, industry monitoring reports, and publicly available information about the broker's operations. Given the rapidly evolving nature of online trading platforms and regulatory environments, traders are strongly advised to conduct independent verification of any claims made by the broker and to consider the regulatory protection available in their jurisdiction before engaging with this platform.

Rating Framework

Based on our comprehensive analysis, here are Vistova's scores across six critical dimensions:

These scores reflect the platform's significant deficiencies across all evaluated areas, with particular concerns about trustworthiness and customer support capabilities.

Broker Overview

Vistova emerged in the forex trading landscape on June 13, 2023, positioning itself as a multi-asset trading platform headquartered in Saint Lucia. Despite its recent establishment, the company claims to offer comprehensive trading services across various financial instruments including forex pairs, contracts for difference (CFDs), futures contracts, commodities, and stock indices. The platform targets retail traders seeking exposure to global financial markets through online trading technology.

However, the broker's extremely short operational history raises immediate concerns about its experience in handling client funds and providing reliable trading infrastructure. The choice of Saint Lucia as a registration jurisdiction, while not inherently problematic, often indicates a preference for less stringent regulatory environments compared to major financial centers. This vistova review finds that the company's business model lacks the transparency and regulatory backing typically expected from reputable forex brokers.

The platform's marketing materials suggest a focus on providing competitive trading conditions, but the absence of detailed information about spreads, commissions, and execution quality makes it difficult for potential clients to assess the true cost of trading. Furthermore, multiple industry monitoring services have flagged concerning patterns in user feedback, with complaints significantly outweighing positive testimonials. The broker's rapid emergence and subsequent negative reviews suggest potential issues with business practices that warrant careful consideration by prospective traders.

Regulatory Status: According to available information, Vistova operates without clear regulatory oversight from major financial authorities. The Saint Lucia registration does not appear to include specific licensing from recognized regulatory bodies, creating uncertainty about client fund protection and operational standards.

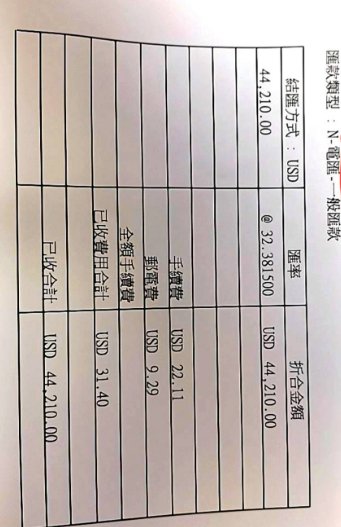

Minimum Deposit Requirements: The platform requires a minimum initial deposit of $500, which positions it in the mid-range category compared to industry standards. However, this requirement becomes concerning when considered alongside the lack of regulatory protection and negative user feedback regarding fund recovery.

Trading Assets: Vistova claims to offer access to multiple asset classes including foreign exchange pairs, contracts for difference, futures contracts, commodity markets, and stock indices. However, the specific range and depth of available instruments remain unclear from publicly available information.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available in public sources, making it difficult for traders to assess the platform's competitiveness. This lack of transparency regarding pricing is itself a concerning factor for potential clients.

Leverage Ratios: Specific leverage offerings have not been clearly disclosed in available materials, representing another area where the platform lacks the transparency expected from professional forex brokers.

Platform Technology: The trading platform technology utilized by Vistova has not been specifically identified in available sources, raising questions about whether they use established platforms like MetaTrader or proprietary solutions.

Geographic Restrictions: Information about geographic restrictions and service availability in different jurisdictions has not been clearly communicated, potentially creating compliance issues for international traders.

This vistova review highlights significant information gaps that make it difficult for traders to make informed decisions about the platform's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Vistova's account conditions present several areas of concern that contribute to its poor rating in this category. The minimum deposit requirement of $500, while not excessive compared to some premium brokers, becomes problematic when considered alongside the platform's lack of regulatory oversight and transparency issues. Unlike established brokers that offer multiple account tiers with varying features and deposit requirements, Vistova appears to provide limited information about account structure and benefits.

The absence of detailed information about account types, special features, or tiered services suggests a lack of sophistication in client offerings. Professional forex brokers typically provide clear documentation about Islamic accounts, VIP services, demo account availability, and account-specific benefits. This vistova review found no evidence of such comprehensive account structuring, which limits the platform's appeal to diverse trader segments.

Furthermore, the account opening process and verification requirements remain unclear from available sources. Reputable brokers provide transparent information about KYC procedures, document requirements, and account activation timelines. The lack of such clarity, combined with user complaints about customer service responsiveness, suggests potential difficulties in account management and support.

The platform's short operational history also means that account holders lack the assurance that comes with proven track records of client fund management and account security protocols that established brokers can demonstrate.

The trading tools and resources offered by Vistova represent a significant weakness in their service proposition. Available information suggests a notable absence of comprehensive analytical tools, educational resources, and trading aids that modern forex traders expect from their brokers. Professional platforms typically offer economic calendars, market analysis, technical indicators, and automated trading capabilities, but such features are not clearly documented for Vistova.

Educational resources, which serve as crucial differentiators for forex brokers, appear to be either absent or inadequately promoted. Successful brokers invest heavily in trader education through webinars, tutorials, market analysis, and trading guides. The lack of visible educational infrastructure suggests that Vistova may not prioritize client development and long-term trading success.

Research and analysis capabilities, including fundamental and technical analysis tools, are essential for informed trading decisions. The absence of detailed information about such resources indicates potential limitations in the platform's analytical capabilities. Additionally, modern traders expect integration with third-party tools, social trading features, and mobile accessibility—areas where Vistova's offerings remain unclear.

The platform's failure to clearly communicate its technological capabilities and trading tools creates uncertainty about execution quality, order management features, and overall trading environment sophistication.

Customer Service and Support Analysis (Score: 2/10)

Customer service represents one of Vistova's most significant weaknesses, with user feedback consistently highlighting poor support experiences. The platform's customer service infrastructure appears inadequate for handling client inquiries, technical issues, and account-related concerns effectively. Multiple user reports indicate extended response times, unhelpful support interactions, and difficulties in reaching qualified assistance when needed.

The absence of clearly documented support channels, operating hours, and multilingual capabilities further compounds these service quality issues. Professional forex brokers typically offer 24/5 support through multiple channels including live chat, phone, email, and sometimes social media. The lack of transparent communication about support availability creates additional uncertainty for potential clients.

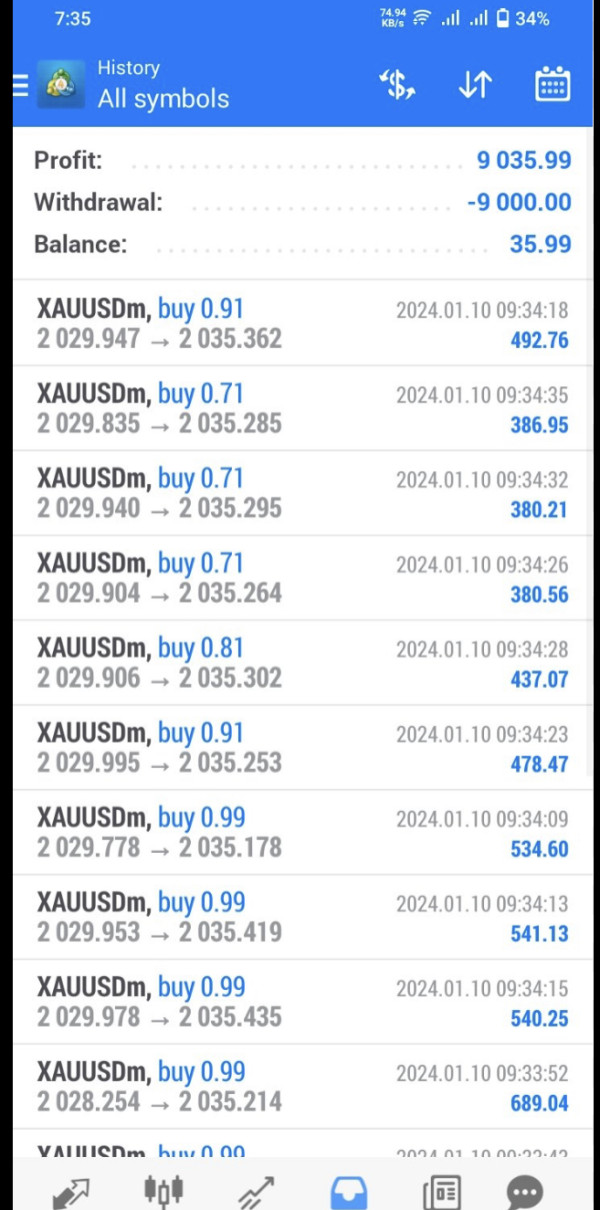

User complaints frequently mention difficulties in resolving withdrawal requests and account-related issues, suggesting systematic problems in customer service protocols. The platform's inability to effectively address client concerns has contributed to negative reviews and exposure reports on industry monitoring websites.

The combination of limited support infrastructure, poor response quality, and unresolved client issues creates a customer service environment that falls well below industry standards and expectations.

Trading Experience Analysis (Score: 3/10)

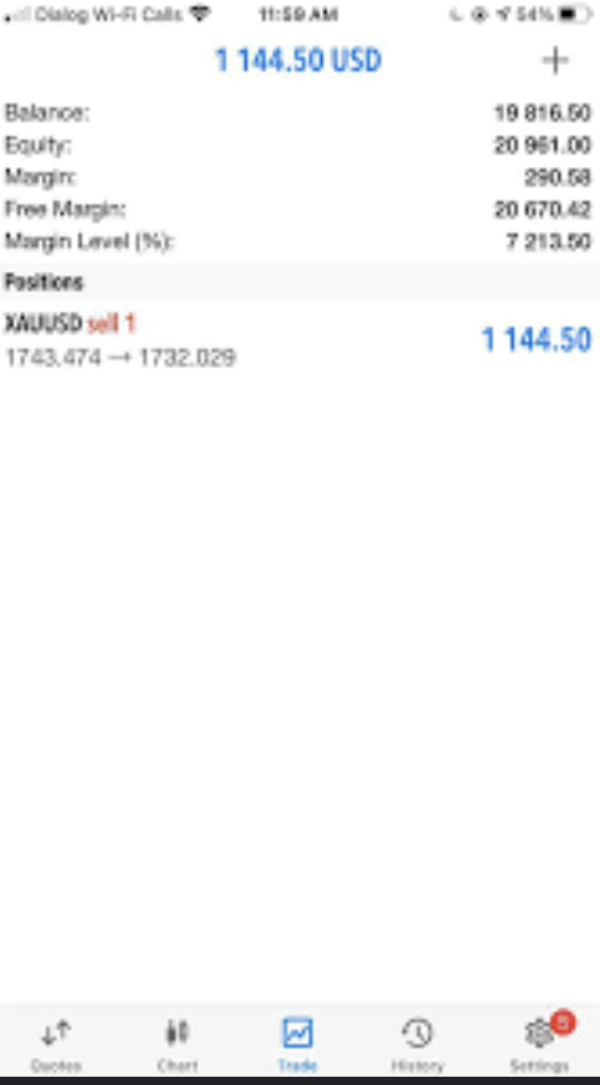

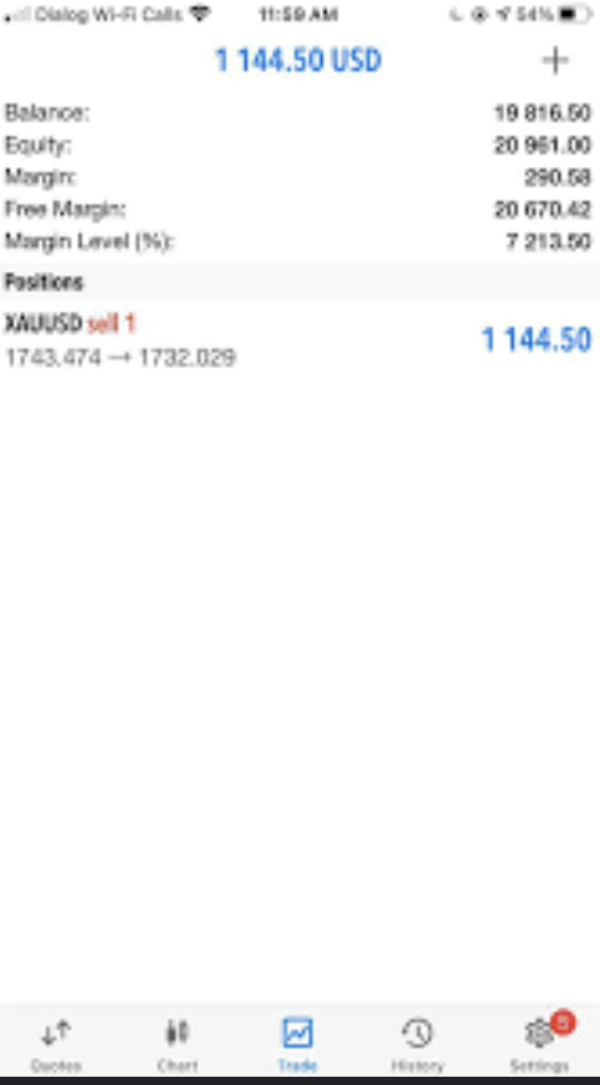

The trading experience offered by Vistova appears to suffer from multiple deficiencies that impact overall user satisfaction. User feedback suggests issues with platform stability, execution quality, and overall trading environment reliability. These concerns are particularly problematic for active traders who require consistent platform performance and reliable order execution.

The lack of detailed information about execution speeds, slippage rates, and requote frequency makes it difficult to assess the platform's technical capabilities. Professional trading environments provide transparent data about execution statistics and platform performance metrics, which appear to be absent from Vistova's public communications.

Mobile trading capabilities, which are essential for modern forex trading, have not been clearly documented or demonstrated. The absence of proven mobile solutions limits trader flexibility and accessibility, particularly important for active traders who need to monitor and manage positions on the go.

User reports suggest inconsistent trading experiences, with some traders reporting technical difficulties and platform limitations. The combination of limited platform information, user complaints, and lack of performance transparency creates significant concerns about the overall trading environment quality.

This vistova review identifies trading experience as a critical weakness that potential clients should carefully consider before committing funds to the platform.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents Vistova's most critical weakness, with multiple factors contributing to serious concerns about the platform's reliability and integrity. The absence of regulatory oversight from recognized financial authorities creates fundamental questions about client fund protection and operational standards. Unlike brokers licensed by FCA, ASIC, CySEC, or other tier-1 regulators, Vistova operates without the safety nets and compliance requirements that protect trader interests.

The platform's Saint Lucia registration, while legal, provides limited regulatory protection compared to major financial jurisdictions. This regulatory gap becomes particularly concerning when combined with user reports of withdrawal difficulties and fund recovery issues. Multiple industry monitoring websites have flagged Vistova as high-risk, with some categorizing it as suspected fraudulent operation.

The broker's extremely short operational history compounds trustworthiness concerns, as there is insufficient track record to demonstrate reliable business practices and client fund management. Established brokers build trust through years of consistent operations, regulatory compliance, and positive client relationships—elements that Vistova cannot demonstrate.

User testimonials and exposure reports consistently highlight concerns about fund security, withdrawal processing, and overall business practices. The prevalence of negative feedback compared to positive reviews creates a pattern that suggests systematic issues with trustworthiness and reliability.

User Experience Analysis (Score: 2/10)

The overall user experience with Vistova appears to be significantly below industry standards, with multiple aspects contributing to user dissatisfaction. The platform's interface design, functionality, and overall usability have not been clearly demonstrated or documented, creating uncertainty about the trading environment quality that users can expect.

Registration and account verification processes appear to lack the streamlined efficiency that modern traders expect. User reports suggest complications in account setup, verification delays, and unclear communication about account status and requirements. These procedural inefficiencies create frustration and delay trading activity for new clients.

Fund management experiences, including deposits and withdrawals, represent a particularly problematic area based on user feedback. Multiple reports indicate difficulties with withdrawal processing, unclear fee structures, and poor communication about transaction status. These issues create significant stress for users and undermine confidence in the platform's operational capabilities.

The prevalence of user complaints compared to positive testimonials suggests systematic issues with user experience design and implementation. Professional trading platforms invest heavily in user experience optimization, interface design, and process efficiency—areas where Vistova appears to have significant deficiencies.

The combination of operational inefficiencies, poor communication, and fund management issues creates a user experience that discourages long-term client relationships and platform loyalty.

Conclusion

This comprehensive vistova review reveals a forex trading platform with significant deficiencies across all evaluated dimensions. Vistova's extremely poor performance in trustworthiness, customer service, and user experience, combined with its lack of regulatory oversight and short operational history, makes it unsuitable for serious forex traders seeking reliable trading conditions and fund security.

The platform's 1/10 trustworthiness rating reflects fundamental concerns about regulatory protection, business practices, and client fund safety that cannot be overlooked. While the minimum deposit requirement of $500 may appear reasonable, the absence of regulatory safeguards and prevalence of negative user feedback create unacceptable risk levels for retail traders.

Based on this analysis, Vistova cannot be recommended for forex trading activities. Traders would be better served by seeking established, properly regulated brokers with proven track records of client protection and service quality. The risks associated with this platform significantly outweigh any potential benefits, making it an unsuitable choice for both novice and experienced traders.