Ggrimpston 2025 Review: Everything You Need to Know

Executive Summary

Ggrimpston is a forex broker that offers trading services across multiple financial instruments. These instruments include forex, commodities, indices, spot metals, stock CFDs, energy, and cryptocurrency CFDs. This ggrimpston review reveals that while the broker provides competitive trading conditions with leverage up to 1:400 and supports multiple trading platforms, there are concerning user complaints regarding margin withdrawal issues that potential traders should carefully consider.

The broker positions itself as a comprehensive trading solution for various types of traders. These traders seek to participate in forex and diversified asset trading. With support for PC, MAC, Linux, and mobile devices including iPhone, iPad, Android phones and tablets, and Windows phones, Ggrimpston attempts to cater to modern traders' technological needs. However, user feedback indicates mixed experiences, particularly concerning fund withdrawal processes. This raises questions about the broker's operational reliability and customer service quality.

Important Notice

Traders should be aware that Ggrimpston has not provided specific regulatory information in available materials. This means users in different regions may face varying legal and compliance requirements. The lack of clear regulatory oversight could pose additional risks for traders, particularly regarding fund protection and dispute resolution mechanisms.

This evaluation is based on user feedback and publicly available information. Given the limited regulatory transparency and user complaints about withdrawal issues, potential clients should exercise enhanced due diligence before engaging with this broker.

Rating Framework

Broker Overview

Ggrimpston operates as a multi-asset broker. It provides access to forex, commodities, indices, spot metals, stock CFDs, energy, and cryptocurrency CFDs. The broker's business model focuses on offering diverse trading opportunities across various financial markets, though specific information about the company's establishment date and corporate background is not detailed in available materials. The platform appears to target traders seeking comprehensive market access with competitive leverage ratios.

The broker supports trading across multiple device types. These include PC, MAC, Linux systems, and mobile devices such as iPhone, iPad, Android phones and tablets, and Windows phones. This technological diversity suggests an attempt to accommodate different trading preferences and lifestyles. However, the absence of specific regulatory information raises questions about the broker's compliance framework and the protection offered to client funds across different jurisdictions.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Ggrimpston's operations. This represents a significant concern for potential clients seeking regulated trading environments.

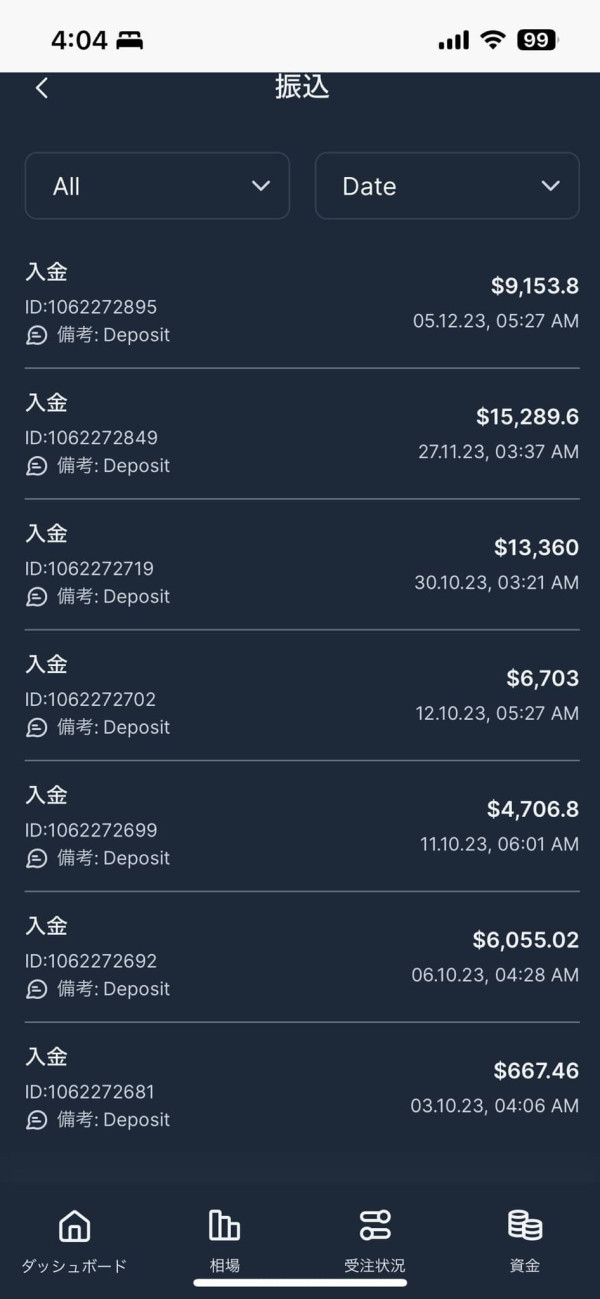

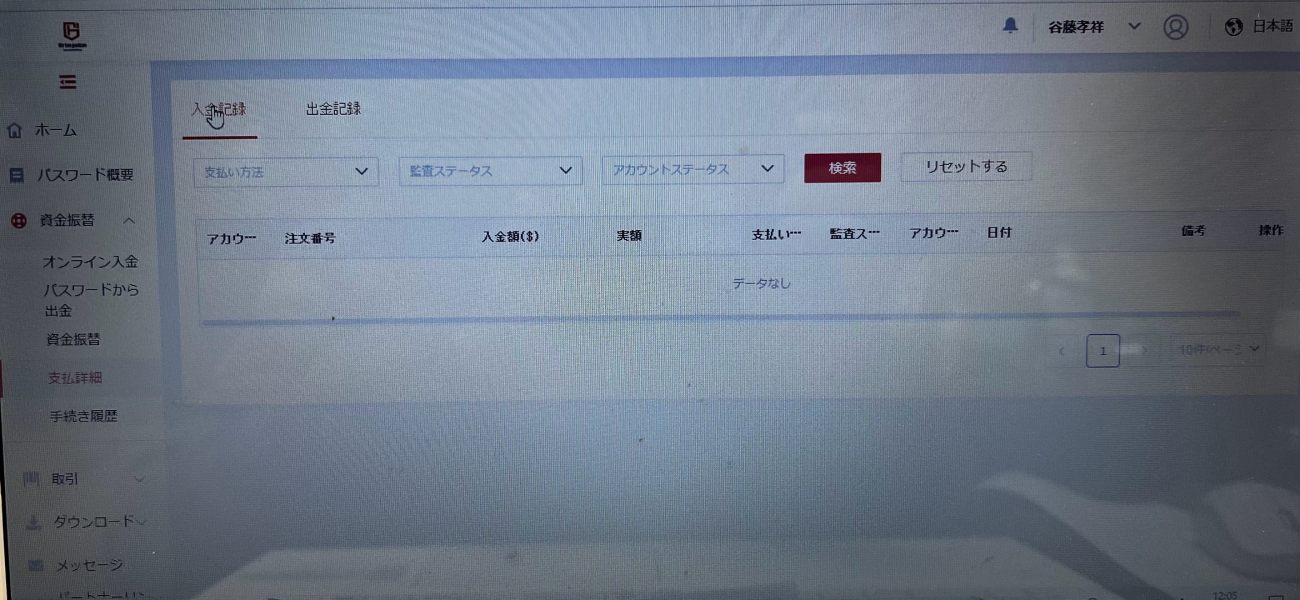

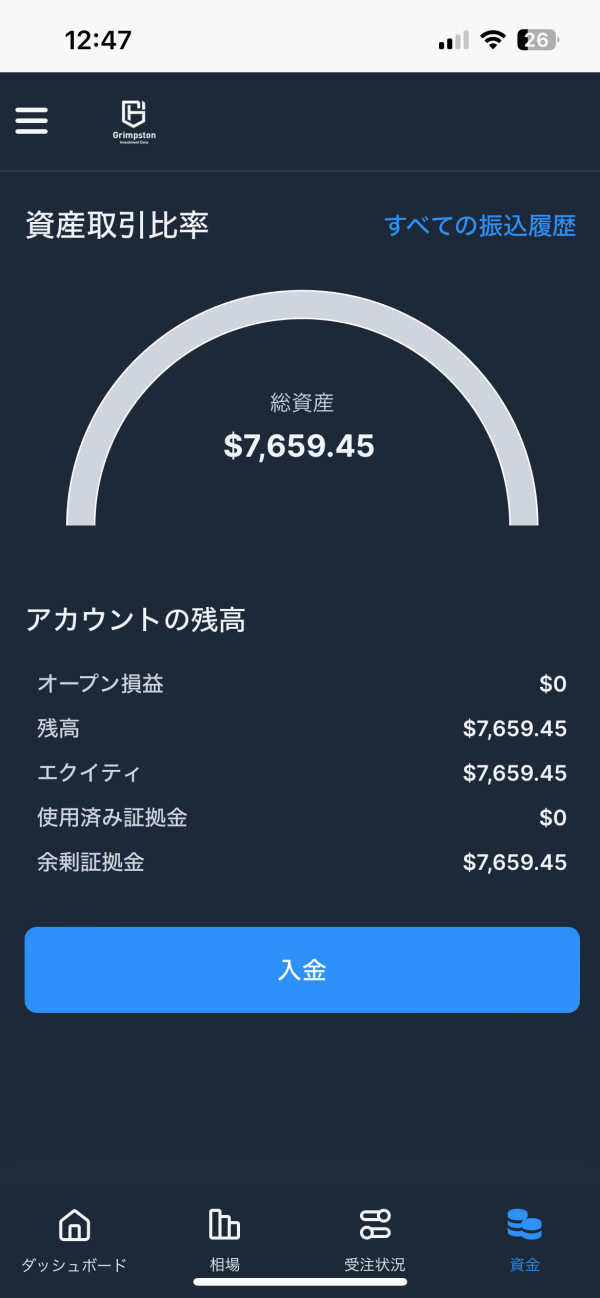

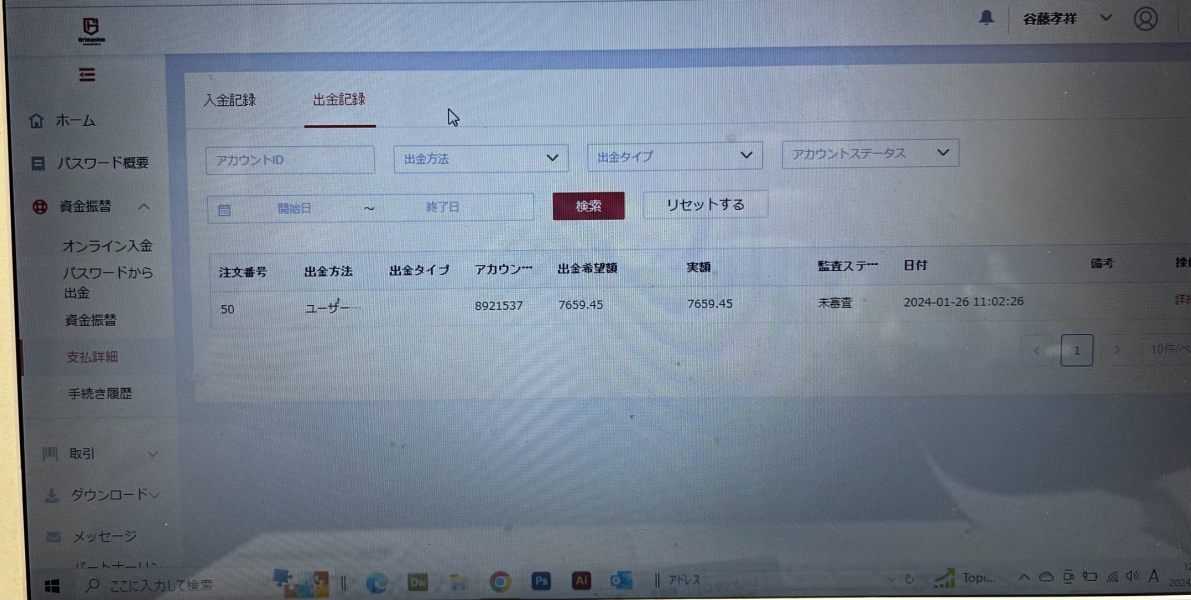

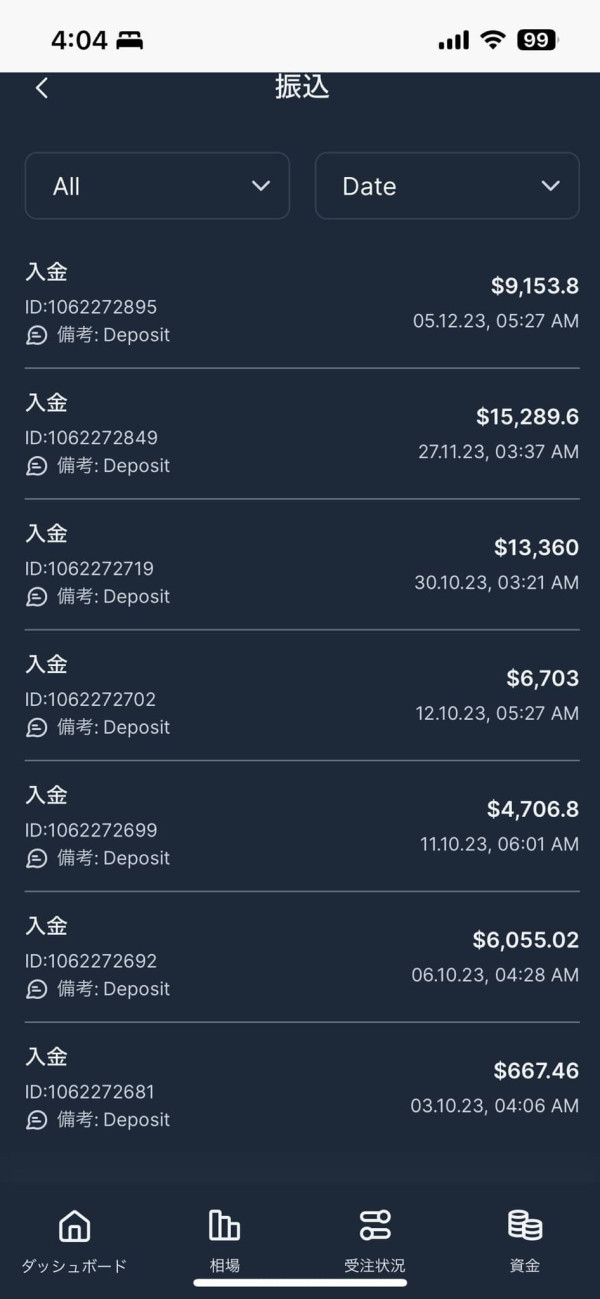

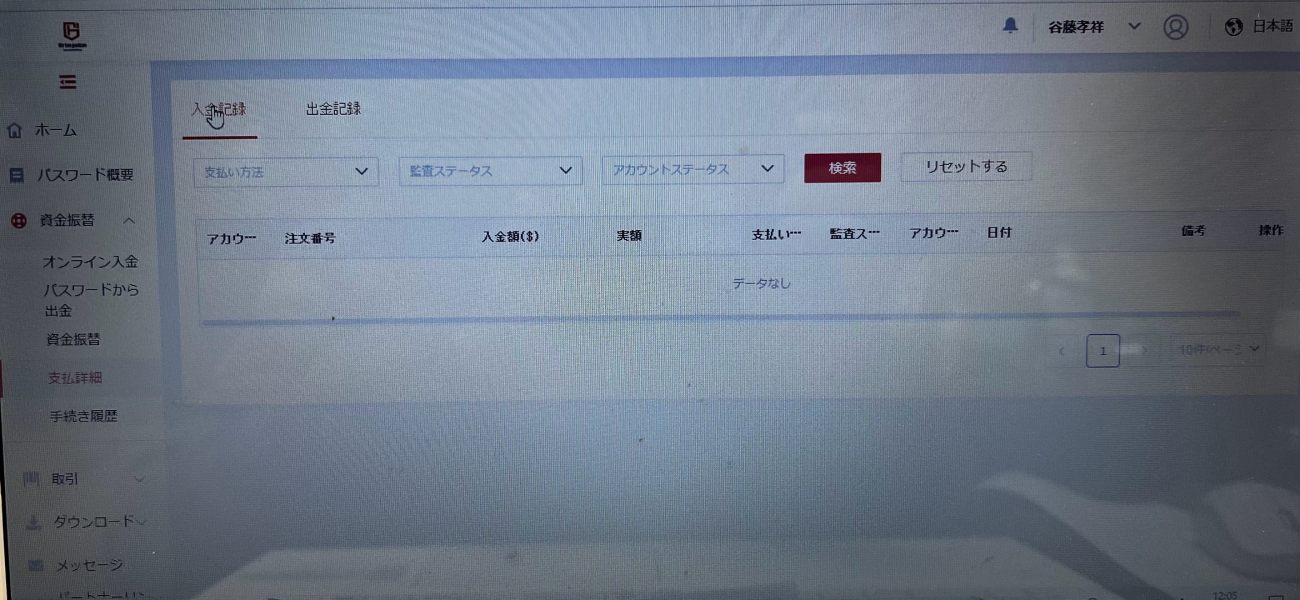

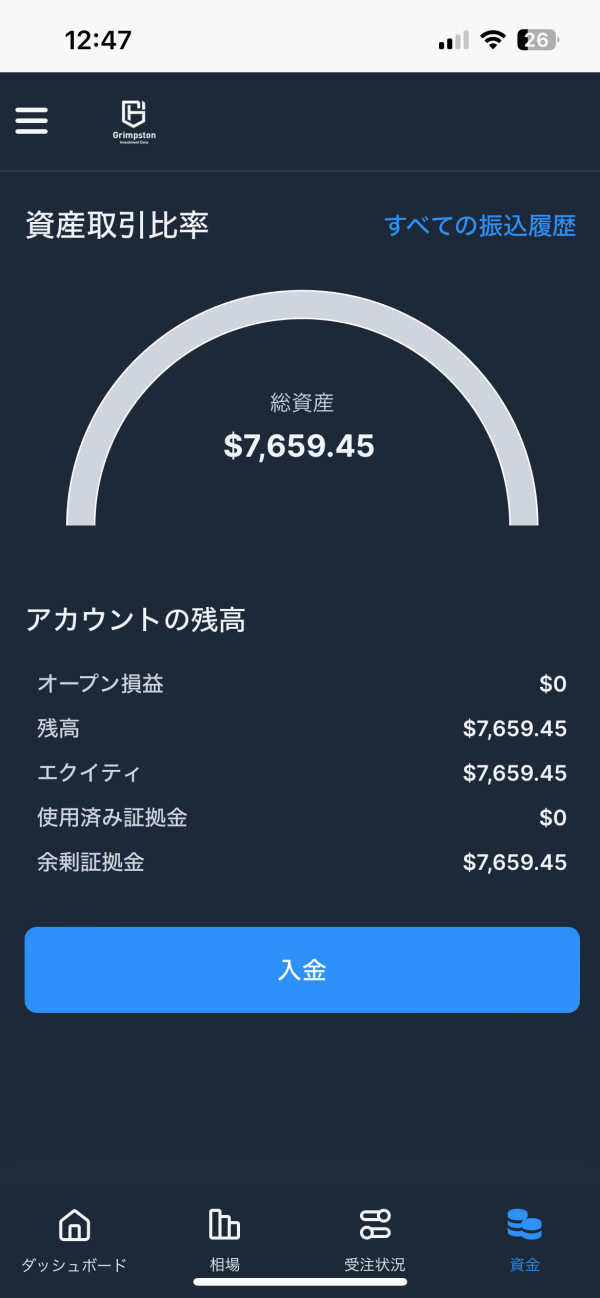

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available materials. User complaints suggest issues with margin withdrawal processes.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account is not specified in available information.

Bonus and Promotions: No specific bonus or promotional information is mentioned in available materials.

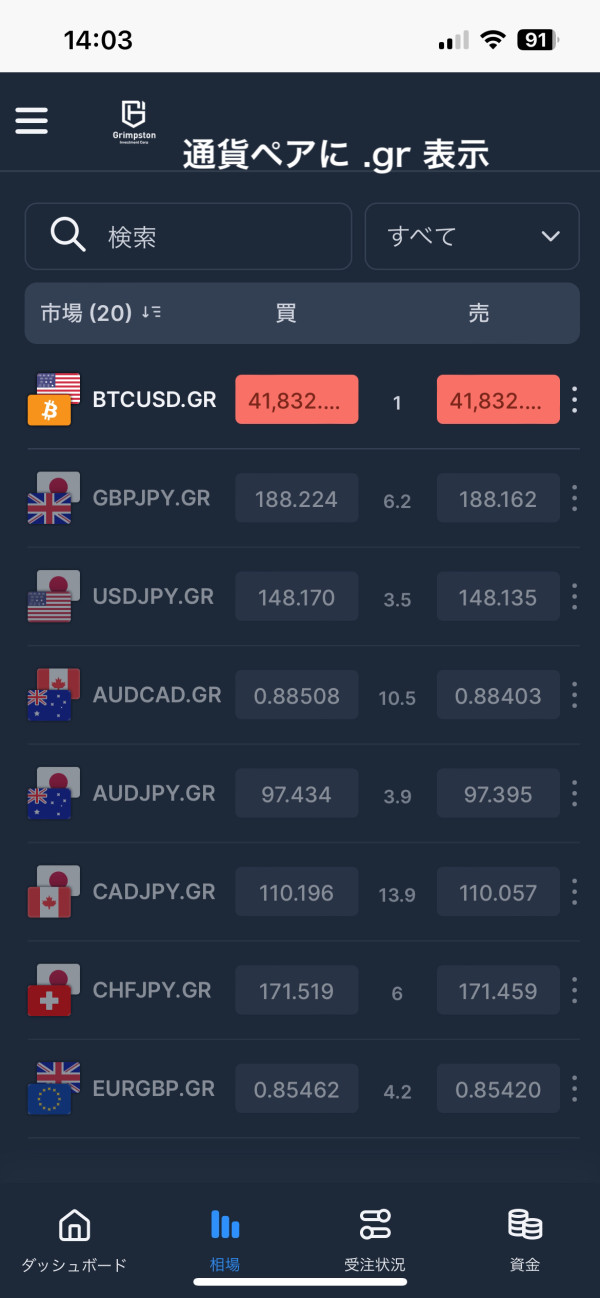

Tradeable Assets: The broker offers forex, commodities, indices, spot metals, stock CFDs, energy, and cryptocurrency CFDs. This provides a comprehensive range of financial instruments for diversified trading strategies.

Cost Structure: Specific information about spreads and commission structures is not detailed in available materials. This makes it difficult to assess the true cost of trading with this ggrimpston review subject.

Leverage Options: Maximum leverage of 1:400 is available. This is competitive within the industry standard range.

Platform Choices: Supports PC, MAC, Linux, and various mobile devices. These include iPhone, iPad, Android devices, and Windows phones.

Regional Restrictions: Specific geographical limitations are not mentioned in available information.

Customer Support Languages: Available customer service language options are not specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis

Ggrimpston's account conditions show both strengths and areas of concern. The broker offers leverage up to 1:400, which is competitive compared to industry standards and provides traders with significant trading power. This high leverage ratio can be particularly attractive to experienced traders seeking to maximize their position sizes, though it also increases potential risks for inexperienced users.

However, the lack of detailed information about specific account types, minimum deposit requirements, and account opening procedures makes it difficult to fully assess the broker's offerings. User feedback indicates problems with margin withdrawal, which directly impacts the practical utility of account conditions regardless of leverage offerings. The absence of information about special account features such as Islamic accounts or professional trading accounts limits our ability to evaluate the broker's accommodation of diverse trading needs.

According to available user feedback, the withdrawal issues represent a significant concern that overshadows the competitive leverage offerings. This ggrimpston review finding suggests that while the basic trading conditions may appear attractive, the practical implementation may not meet user expectations.

Ggrimpston demonstrates strength in platform diversity. It supports multiple operating systems including PC, MAC, Linux, and various mobile devices. This comprehensive platform support indicates a commitment to accessibility across different technological preferences and suggests that traders can maintain their activities regardless of their preferred device ecosystem.

The broker covers multiple asset classes including forex, commodities, indices, spot metals, stock CFDs, energy, and cryptocurrency CFDs. This diversification provides traders with opportunities to implement various trading strategies and portfolio approaches within a single brokerage relationship. However, specific information about research and analysis resources, educational materials, or automated trading support is not detailed in available materials.

The lack of information about analytical tools, market research, educational resources, and trading automation capabilities represents a significant information gap. Modern traders typically expect comprehensive support tools beyond basic platform access, including market analysis, economic calendars, and educational materials to support their trading decisions.

Customer Service and Support Analysis

Customer service represents a significant weakness for Ggrimpston based on available user feedback. Complaints specifically mention issues with margin withdrawal, suggesting that customer support may not be effectively resolving critical user concerns. The inability to successfully process withdrawal requests represents a fundamental service failure that affects trader confidence and satisfaction.

The lack of specific information about customer service channels, response times, multilingual support, and service hours makes it difficult to assess the full scope of support offerings. However, the existence of unresolved withdrawal complaints suggests that whatever support infrastructure exists may not be adequate for addressing user needs effectively.

User feedback indicates that problem resolution capabilities may be insufficient, particularly regarding financial transactions. This represents a critical concern as effective customer service is essential for maintaining trader confidence and ensuring smooth operational experiences. The negative feedback regarding customer service directly impacts the broker's overall reliability assessment.

Trading Experience Analysis

The trading experience with Ggrimpston appears to be mixed based on available information. While the broker supports multiple platforms and offers competitive leverage, user feedback about withdrawal issues significantly impacts the overall trading experience. The ability to access funds is fundamental to trading operations, and problems in this area create uncertainty about the broker's operational reliability.

Platform stability and execution quality information is not specifically detailed in available materials, though the multi-platform support suggests some level of technological infrastructure. However, user complaints about financial operations raise questions about the overall operational quality and reliability of the trading environment.

The ggrimpston review evidence suggests that while basic trading functionality may be available across multiple platforms, the broader trading experience is compromised by operational issues. The lack of specific information about order execution quality, slippage, requotes, or platform performance makes it difficult to fully assess the trading environment quality.

Trust and Safety Analysis

Trust and safety represent the most significant concerns in this evaluation. The absence of specific regulatory information in available materials raises immediate questions about oversight and client protection. Regulatory supervision is crucial for ensuring broker compliance with industry standards and providing recourse mechanisms for client disputes.

User complaints about margin withdrawal issues compound these trust concerns. The inability to access funds represents a fundamental breach of trust between broker and client. Without clear regulatory oversight and with documented user complaints about financial operations, the safety of client funds becomes questionable.

The lack of information about fund security measures, company transparency, industry reputation, and negative event handling further undermines confidence. The combination of regulatory uncertainty and user complaints about financial operations creates a high-risk profile that potential clients should carefully consider before engagement.

User Experience Analysis

Overall user satisfaction appears to be compromised by operational issues despite potentially competitive trading conditions. The mixed feedback suggests that while some aspects of the service may meet expectations, critical failures in areas such as fund withdrawal create significant user dissatisfaction.

The lack of information about interface design, ease of use, registration processes, and verification procedures makes it difficult to assess the complete user journey. However, the documented complaints about fund withdrawal represent a critical failure point that affects the entire user experience regardless of other service aspects.

User feedback indicates that the broker may struggle with operational reliability, particularly in areas that directly affect client financial interests. The existence of withdrawal complaints suggests that users may face unexpected difficulties when attempting to access their funds, creating stress and uncertainty in the trading relationship.

Conclusion

This ggrimpston review reveals a broker with competitive trading conditions including high leverage ratios and multi-platform support. However, there are significant concerns regarding operational reliability and regulatory transparency. While the broker offers access to diverse asset classes and supports various trading platforms, user complaints about margin withdrawal issues and the absence of clear regulatory information create substantial risk factors.

The broker may be suitable for traders seeking diversified asset access and high leverage ratios, particularly in forex markets. However, the documented withdrawal issues and regulatory uncertainty make it difficult to recommend Ggrimpston without significant cautions about potential risks.

The main advantages include competitive leverage up to 1:400 and comprehensive asset class coverage. The primary disadvantages involve user complaints about fund access and the lack of regulatory transparency. Potential clients should carefully consider these risk factors and may wish to explore alternative brokers with clearer regulatory status and better user satisfaction records.