GlobalFXExpert 2025 Review: Everything You Need to Know

Executive Summary

GlobalFXExpert has emerged as a highly controversial broker in the forex trading landscape. Multiple financial regulatory authorities have flagged it as a fraudulent platform. This globalfxexpert review reveals significant concerns about the broker's legitimacy and operational practices that every trader should know. The platform claims to offer CFD trading across various asset classes including forex, precious metals, energy, indices, stocks, and cryptocurrencies. However, it lacks proper regulatory oversight from major financial authorities.

According to available information, GlobalFXExpert is registered in the United States at 43617 Marguerite St, California, MD 20619, USA. The Seychelles FSA has issued warnings against this broker, identifying it as an unauthorized entity. User feedback has been overwhelmingly negative, with traders reporting poor service quality, lack of transparency, and questionable business practices that raise serious red flags. The broker primarily targets investors seeking CFD trading opportunities. Given the extensive negative reviews and regulatory warnings, potential clients should exercise extreme caution before considering this platform.

Important Notice

This review is based on comprehensive analysis of user feedback, regulatory warnings, and available public information about GlobalFXExpert. The Seychelles Financial Services Authority has specifically warned against this broker, categorizing it as an unauthorized entity operating without proper licensing that puts traders at risk. Different jurisdictions may have varying regulations regarding this broker's operations. Potential clients should verify the legal status of GlobalFXExpert in their respective regions before engaging with the platform.

Our evaluation methodology incorporates multiple data sources, including regulatory announcements, user testimonials, and industry reports. Given the limited transparency from the broker itself, this assessment relies heavily on third-party information and regulatory guidance to provide an accurate picture of GlobalFXExpert's operations and reliability that traders can trust.

Rating Framework

Broker Overview

GlobalFXExpert operates as a CFD trading platform. Specific details about its establishment date remain unclear from available sources. The company presents itself as a trading service provider registered in the United States, with its official address listed as 43617 Marguerite St, California, MD 20619, USA that appears legitimate on the surface. The broker's business model centers around providing Contract for Difference trading services across multiple asset categories. It targets retail investors seeking exposure to various financial markets.

The platform claims to facilitate trading in foreign exchange, precious metals, energy commodities, stock indices, individual equities, and cryptocurrency markets. However, the lack of specific information about trading platforms, account structures, and operational procedures raises significant concerns about the broker's transparency and legitimacy that cannot be ignored. According to regulatory warnings, particularly from the Seychelles FSA, GlobalFXExpert operates without proper authorization. This has led to its classification as a potentially fraudulent entity. This globalfxexpert review emphasizes the importance of thorough due diligence before engaging with this broker, given the substantial regulatory and user feedback concerns surrounding its operations that make it extremely risky.

Regulatory Status: The Seychelles Financial Services Authority has issued explicit warnings against GlobalFXExpert, identifying it as an unauthorized broker operating without legitimate licensing. This regulatory stance significantly undermines the platform's credibility and legal standing in the financial services industry in ways that cannot be overlooked.

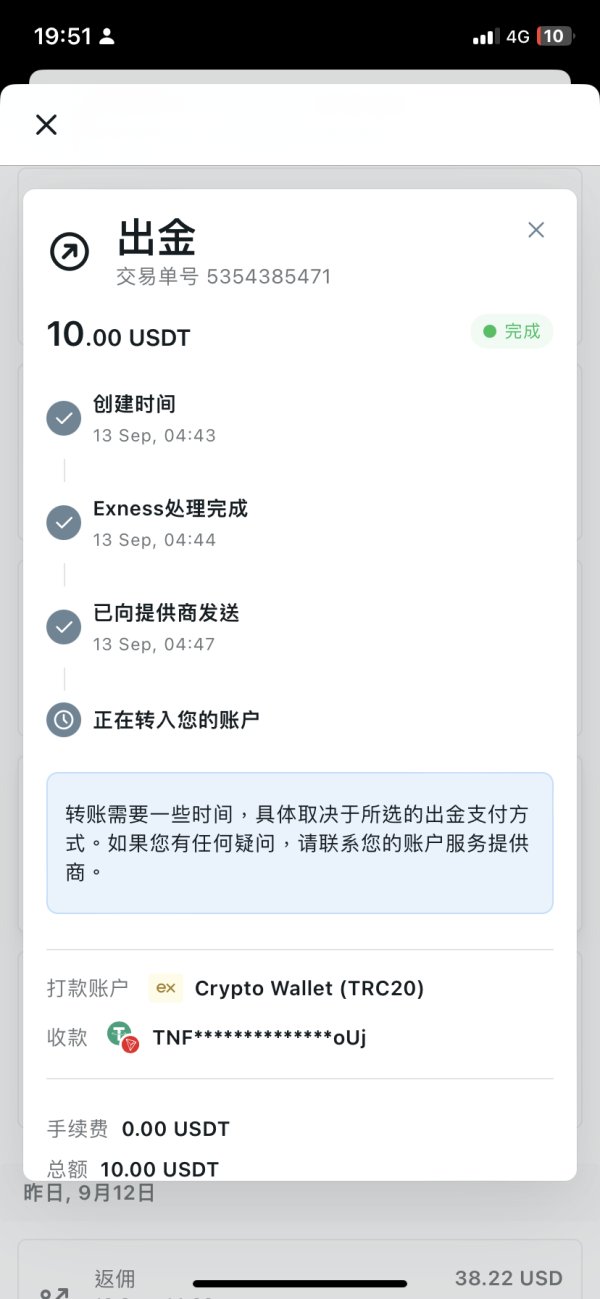

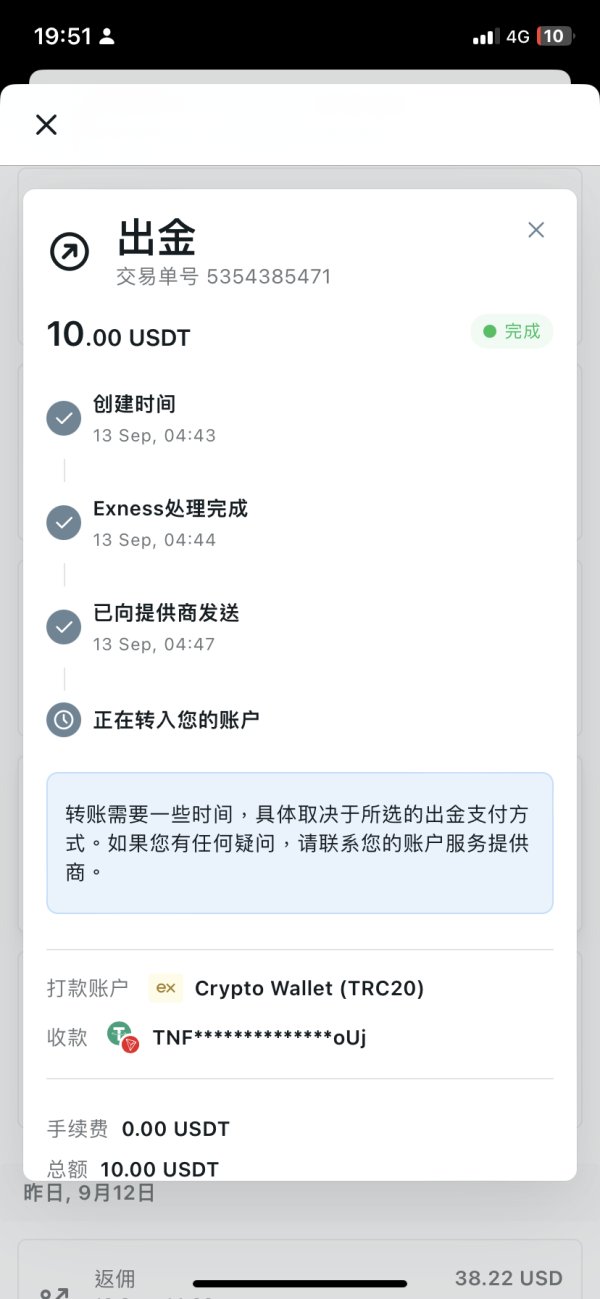

Payment Methods: Specific information regarding deposit and withdrawal methods is not detailed in available sources. This raises transparency concerns for potential clients seeking clarity about funding procedures.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit thresholds in publicly available information. This makes it difficult for traders to assess entry-level investment requirements.

Promotional Offers: Details about bonus structures, promotional campaigns, or special offers are not mentioned in available documentation. This suggests either absence of such programs or lack of transparency in marketing practices.

Tradeable Assets: GlobalFXExpert claims to provide CFD trading opportunities across six major asset categories. These include foreign exchange pairs, precious metals, energy commodities, stock market indices, individual company stocks, and cryptocurrency instruments.

Cost Structure: Comprehensive information about spreads, commissions, overnight financing charges, and other trading costs remains undisclosed in available sources. This prevents accurate cost analysis for potential clients.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in accessible information. This is concerning given the importance of leverage specifications in CFD trading.

Platform Options: The specific trading platforms offered by GlobalFXExpert, such as MetaTrader 4, MetaTrader 5, or proprietary solutions, are not mentioned in available documentation. This lack of information makes it impossible to evaluate platform quality.

Geographic Restrictions: Information about territorial limitations or restricted jurisdictions is not provided in accessible sources. This creates uncertainty about service availability.

Customer Service Languages: Available languages for customer support services are not specified in the information summary. This globalfxexpert review highlights the significant information gaps that potential clients should consider before proceeding with any investment decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by GlobalFXExpert receive an extremely poor rating due to the complete lack of transparency regarding essential trading parameters. Available sources provide no specific information about account types, tier structures, or differentiated service levels that traders might expect from a legitimate broker that operates with proper oversight. The absence of clearly defined minimum deposit requirements makes it impossible for potential clients to understand the financial commitment required to begin trading.

Furthermore, the account opening process remains undisclosed, with no information about required documentation, verification procedures, or timelines for account activation. This lack of transparency extends to special account features that many brokers offer, such as Islamic accounts for clients requiring Sharia-compliant trading conditions that are standard in the industry. User feedback consistently highlights concerns about unclear account terms and conditions. Many traders report unexpected restrictions or changes to their account parameters.

The regulatory warnings from the Seychelles FSA compound these concerns, as they suggest that any account conditions offered by GlobalFXExpert may not be backed by legitimate regulatory oversight. Compared to established brokers in the industry, GlobalFXExpert's approach to account conditions demonstrates a significant lack of professionalism and transparency that should concern potential clients who value their investments. This globalfxexpert review strongly advises traders to seek alternative brokers with clearly defined and regulated account structures.

GlobalFXExpert's tools and resources receive a below-average rating, primarily due to the limited information available about the platform's analytical and educational offerings. While the broker claims to provide CFD trading across multiple asset classes including forex, precious metals, energy, indices, stocks, and cryptocurrencies, specific details about trading tools, charting capabilities, and analytical resources remain undisclosed in a way that raises serious questions.

The absence of information about research and analysis resources is particularly concerning for traders who rely on market insights and professional commentary to inform their trading decisions. Educational resources, which are crucial for trader development, are not mentioned in available documentation. This suggests either their absence or the broker's failure to properly communicate these offerings to potential clients.

Automated trading support, including Expert Advisors, trading robots, or copy trading services, is not detailed in accessible information. This gap in information makes it difficult for traders to assess whether the platform can accommodate their preferred trading strategies and methodologies that are essential for success. User feedback regarding tools and resources has been generally negative. Traders express dissatisfaction with the limited functionality and poor quality of available trading instruments.

Customer Service and Support Analysis (Score: 3/10)

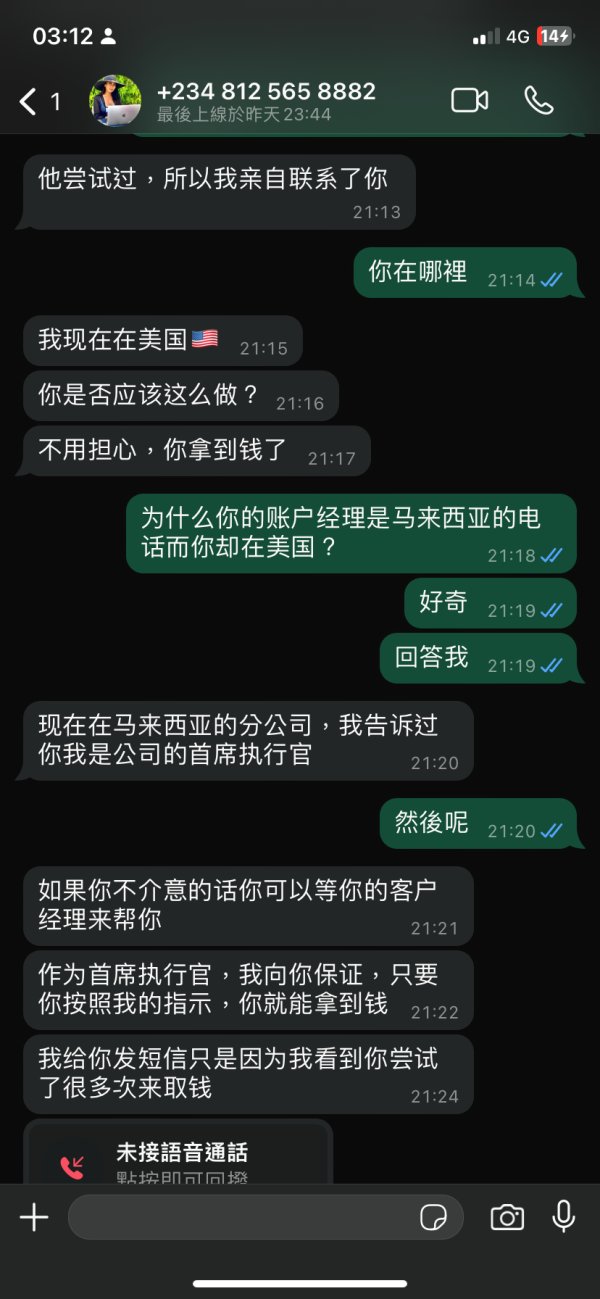

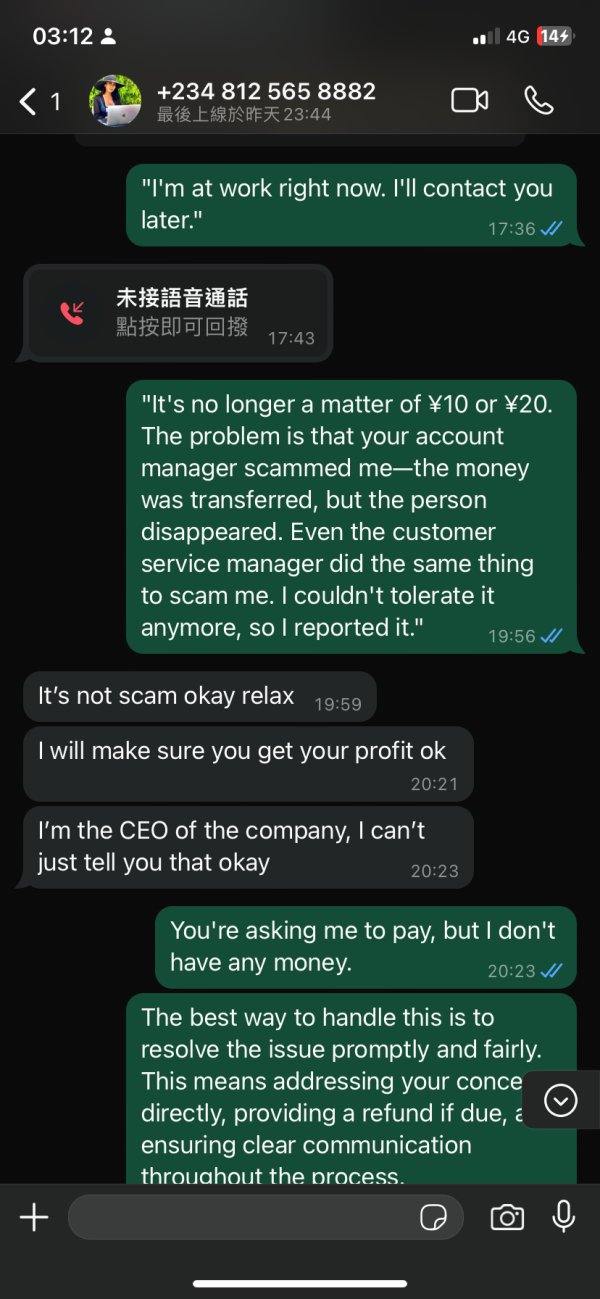

The customer service and support infrastructure at GlobalFXExpert receives a poor rating based on consistently negative user feedback and lack of transparent communication channels. Available information does not specify the customer service channels offered by the broker, such as live chat, telephone support, email assistance, or help desk systems. This raises immediate concerns about accessibility and support availability.

User testimonials consistently report poor response times from customer service representatives, with many traders experiencing significant delays in receiving assistance for account-related issues, technical problems, or general inquiries. The quality of service provided has been criticized by multiple users. They describe unhelpful responses, lack of expertise among support staff, and failure to resolve issues effectively.

Multilingual support capabilities are not detailed in available sources, which could present significant barriers for international clients seeking assistance in their native languages. Operating hours for customer service are also not specified. This makes it unclear whether the broker provides round-the-clock support that forex traders typically require given the 24-hour nature of currency markets. The overall customer service experience appears to fall significantly short of industry standards. This contributes to the broker's poor reputation among users.

Trading Experience Analysis (Score: 4/10)

The trading experience provided by GlobalFXExpert receives a below-average rating due to widespread user dissatisfaction and lack of detailed information about platform performance characteristics. User feedback consistently indicates poor platform stability and performance issues. Traders report frequent technical difficulties that interfere with their trading activities.

Order execution quality remains a significant concern, though specific data about slippage rates, execution speeds, and requote frequencies are not available in accessible sources. The absence of this critical information prevents traders from making informed decisions about the platform's suitability for their trading strategies. This is particularly problematic for scalping or high-frequency trading approaches that require precise execution.

Platform functionality completeness has been questioned by users, who report limited features and poor user interface design compared to established trading platforms in the industry. Mobile trading capabilities are not detailed in available information. This is increasingly important as traders seek flexibility to manage positions while away from desktop computers. The overall trading environment appears to lack the sophistication and reliability that professional traders require. This contributes to negative user experiences and poor platform reputation. This globalfxexpert review emphasizes that the trading experience falls well below industry standards.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent GlobalFXExpert's most significant weakness, earning the lowest possible rating due to explicit regulatory warnings and classification as a fraudulent platform. The Seychelles Financial Services Authority has specifically identified GlobalFXExpert as an unauthorized broker. This fundamentally undermines any claims to legitimacy or regulatory compliance.

The absence of proper licensing from recognized financial regulatory authorities creates substantial risks for client fund protection and legal recourse in case of disputes. Information about fund safety measures, such as segregated client accounts, deposit insurance, or compensation schemes, is not available in accessible sources. This suggests these protections may not exist.

Company transparency is severely lacking, with minimal information available about corporate structure, ownership, financial statements, or operational procedures. The broker's industry reputation has been severely damaged by regulatory warnings and negative user experiences. Multiple sources identify it as a platform to avoid. The handling of negative events and user complaints appears inadequate. There is no evidence of meaningful efforts to address concerns or improve operations. The overwhelming consensus from regulatory authorities and user feedback indicates that GlobalFXExpert cannot be considered a trustworthy or reliable trading partner.

User Experience Analysis (Score: 2/10)

The overall user experience with GlobalFXExpert receives a poor rating based on consistently negative feedback across multiple aspects of the platform's operations. User satisfaction levels are extremely low. The majority of traders report unsatisfactory experiences that have led to warnings about the broker's legitimacy and operational practices.

While specific information about interface design and usability is not detailed in available sources, user feedback suggests significant deficiencies in platform design and functionality. The registration and verification processes are not clearly documented. This creates uncertainty for potential clients about account opening procedures and requirements.

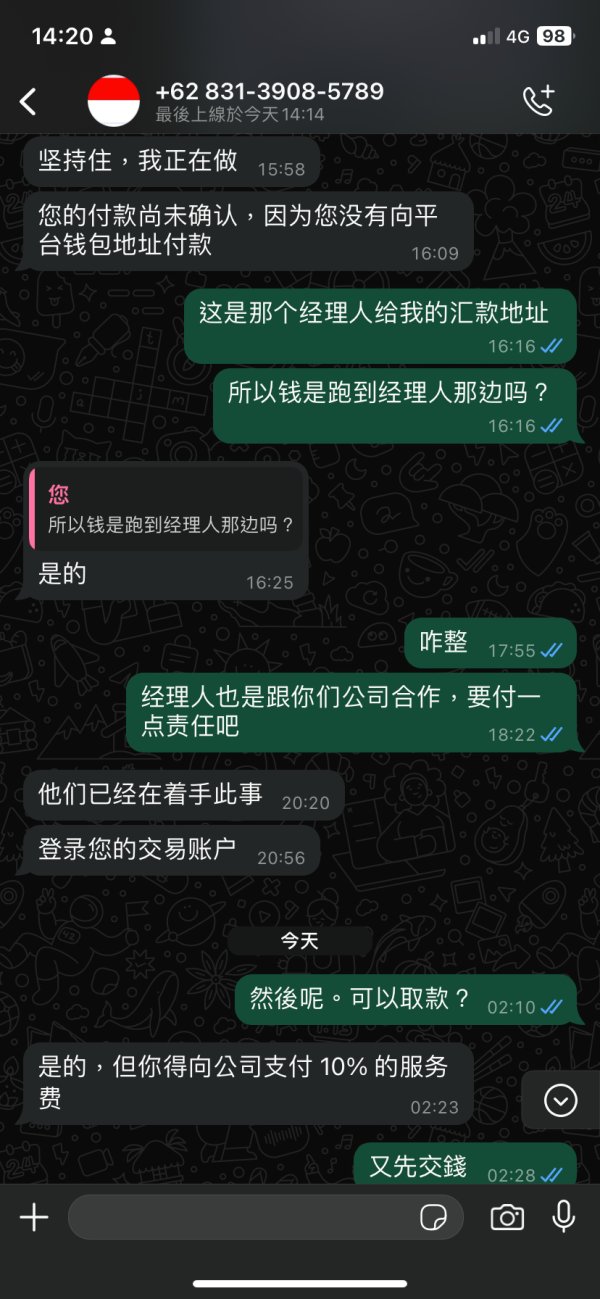

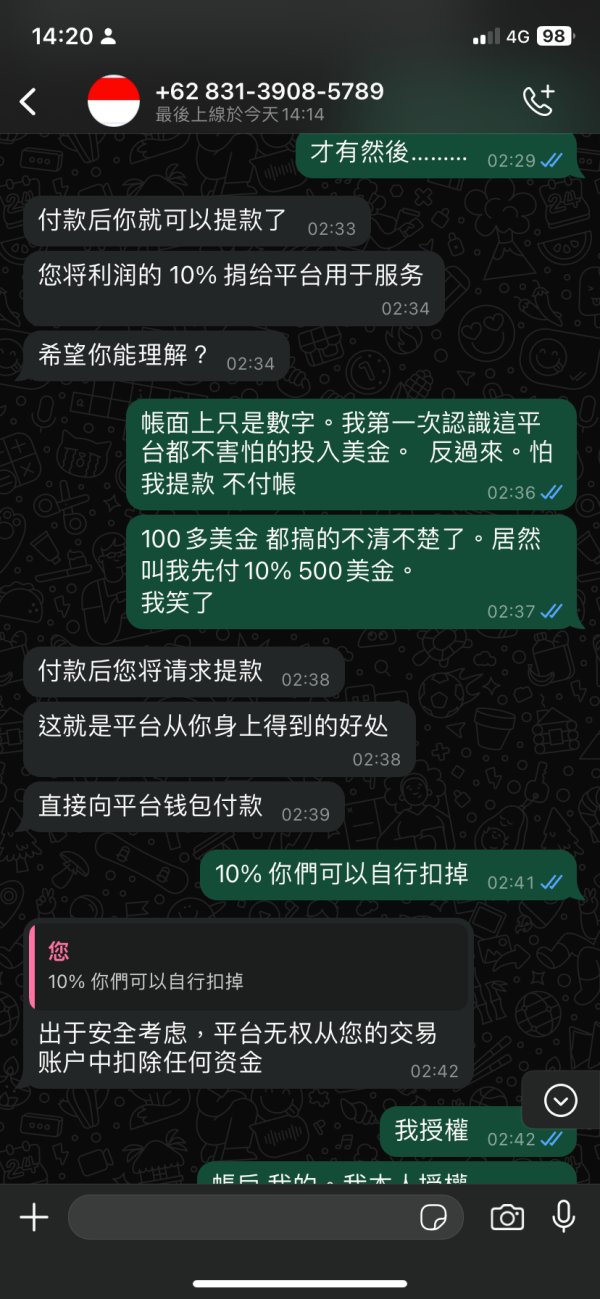

Fund operation experiences have been particularly problematic according to user reports, though specific details about deposit and withdrawal procedures are not available in accessible sources. Common user complaints center around lack of transparency, poor service quality, unresponsive customer support, and concerns about fund safety. The user demographic analysis suggests that GlobalFXExpert is unsuitable for any category of trader. This is particularly true for beginners who require reliable platforms and educational support.

Based on the overwhelmingly negative feedback, recommendations for improvement would include obtaining proper regulatory authorization, implementing transparent operational procedures, and fundamentally restructuring customer service operations. However, given the extent of regulatory warnings and negative feedback, potential users are advised to consider alternative brokers with established reputations and proper regulatory oversight that can protect their investments.

Conclusion

This comprehensive globalfxexpert review reveals that GlobalFXExpert is widely regarded as an unreliable and potentially fraudulent broker that poses significant risks to traders. The platform has received explicit warnings from the Seychelles Financial Services Authority. It has been classified as an unauthorized entity operating without proper regulatory oversight.

GlobalFXExpert is not suitable for any category of trader, particularly beginners who require stable, regulated platforms with transparent operations and reliable customer support. The broker's complete lack of transparency regarding essential trading conditions, combined with consistently negative user feedback and regulatory warnings, creates an unacceptable risk environment for retail investors who deserve better protection.

The primary weaknesses include absence of legitimate regulatory authorization, overwhelmingly negative user reviews, lack of transparency in operational procedures, poor customer service quality, and questionable fund safety measures. No significant advantages have been identified that would justify the substantial risks associated with this platform that could harm your financial future. Traders are strongly advised to seek alternative brokers with proper regulatory credentials and established reputations in the financial services industry.