Is Ggrimpston safe?

Business

License

Is Ggrimpston Safe or Scam?

Introduction

Ggrimpston is a forex broker that has emerged in the competitive landscape of online trading, aiming to attract both novice and experienced traders with its various offerings. Given the complexities and risks associated with forex trading, it is crucial for traders to carefully evaluate the brokers they choose to work with. This article aims to provide a comprehensive analysis of Ggrimpston's legitimacy by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, and potential risks. Our investigation is based on a thorough review of available online resources, including regulatory databases, user reviews, and expert analyses.

Regulatory Status and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and reliability. Ggrimpston's operations are under scrutiny due to its classification as a "suspicious clone" by various regulatory observers. This classification raises significant concerns regarding its legitimacy and adherence to regulatory standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Not Listed | United States | Suspicious Clone |

The lack of a valid license from recognized regulatory bodies such as the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC) suggests that Ggrimpston may not be operating within the bounds of legal compliance. The designation of a "suspicious clone" indicates that it may be impersonating a legitimate entity, which is a common tactic among fraudulent brokers. This lack of regulatory oversight can expose traders to various risks, including the potential loss of funds without any recourse for recovery. Overall, the absence of proper regulation raises serious questions about whether Ggrimpston is safe for traders.

Company Background Investigation

A thorough investigation into Ggrimpston's company background reveals limited information about its history, ownership structure, and management team. Established within the last few years, Ggrimpston has not built a substantial reputation in the forex market. The lack of transparency regarding its founders and management raises concerns about the broker's accountability and ethical practices.

Investors often benefit from knowing the expertise and backgrounds of a broker's management team, as this can indicate the broker's operational integrity. Unfortunately, Ggrimpston does not provide sufficient information about its leadership or their qualifications, which is a red flag for potential clients. The absence of detailed company disclosures makes it difficult for traders to assess the broker's commitment to transparency and ethical trading practices.

Trading Conditions Analysis

When evaluating whether Ggrimpston is safe, it is essential to analyze its trading conditions, including fee structures and commissions. While the broker advertises low spreads and no handling fees for deposits, the lack of clarity surrounding its overall cost structure is concerning.

| Fee Type | Ggrimpston | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0-2.0 pips |

| Commission Model | Not Disclosed | $5-10 per lot |

| Overnight Interest Range | Not Specified | Varies by broker |

The absence of clear information regarding commissions and overnight fees may indicate hidden costs that could affect traders' profitability. Such practices are often seen in less reputable brokers, where clients may face unexpected charges that diminish their trading capital. The overall lack of transparency in trading conditions raises further doubts about whether Ggrimpston is a scam or simply a broker with questionable practices.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Ggrimpston's policies regarding fund security are vague and lack the necessary assurances that traders typically seek. Effective fund protection measures include the segregation of client funds, investor compensation schemes, and negative balance protection policies.

Without clear information on these aspects, it is difficult to ascertain whether Ggrimpston provides adequate protection for its clients' funds. Historical issues related to fund safety, such as difficulties in withdrawals or reports of mismanagement, have not been disclosed. This lack of information could imply that Ggrimpston may not prioritize client security, further questioning its legitimacy in the market.

Customer Experience and Complaints

Customer feedback serves as a vital indicator of a broker's reliability and service quality. Reviews of Ggrimpston reveal a mixed bag of experiences, with numerous complaints centering on withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Unresponsive |

| Poor Customer Service | Medium | Inconsistent |

| Misleading Information | High | Lack of Transparency |

The high severity of withdrawal issues suggests that traders may face challenges when attempting to access their funds, a common red flag for potential scams. Furthermore, the inconsistent responses from customer service indicate a lack of commitment to resolving client concerns. Such patterns of complaints raise significant doubts about whether Ggrimpston is safe for traders looking for a reliable broker.

Platform and Trade Execution

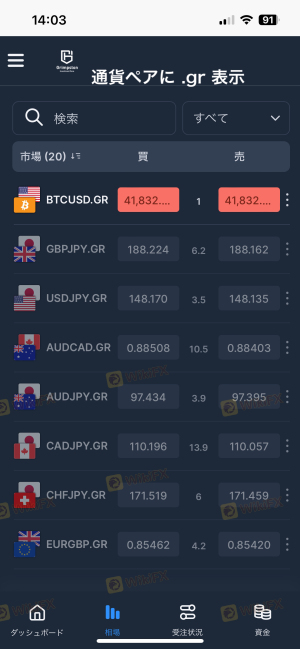

The performance and stability of a trading platform are crucial for a seamless trading experience. Ggrimpston uses the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and robust features. However, concerns have been raised regarding order execution quality, including instances of slippage and rejected orders.

Traders have reported experiencing delays in order execution, which can significantly impact trading outcomes, especially in volatile market conditions. The potential for platform manipulation is another issue that traders must consider when evaluating Ggrimpston. If the broker is found to engage in practices that disadvantage traders, it could further solidify suspicions that Ggrimpston is a scam.

Risk Assessment

Using Ggrimpston carries inherent risks that traders must carefully weigh. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases exposure. |

| Fund Safety Risk | High | Unclear policies regarding fund protection. |

| Customer Service Risk | Medium | Inconsistent responses to complaints. |

| Execution Risk | High | Potential for slippage and order rejections. |

To mitigate these risks, traders should conduct thorough due diligence before committing funds to Ggrimpston. It is advisable to start with a small investment and monitor the broker's performance closely. Additionally, seeking alternative brokers with robust regulatory oversight and positive customer feedback could provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the legitimacy of Ggrimpston. The lack of regulatory oversight, transparency regarding company operations, and numerous complaints regarding customer service and fund withdrawals suggest that Ggrimpston may not be a safe option for traders.

For individuals seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers such as IG, OANDA, or Forex.com offer robust regulatory protections and a commitment to transparency, making them more trustworthy options in the forex market. Ultimately, traders should prioritize their safety and conduct thorough research before engaging with any broker, especially one with questionable practices like Ggrimpston.

Is Ggrimpston a scam, or is it legit?

The latest exposure and evaluation content of Ggrimpston brokers.

Ggrimpston Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ggrimpston latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.