Is SMARTFXEXPERTS safe?

Business

License

Is SmartFXExperts A Scam?

Introduction

SmartFXExperts positions itself as an online trading platform that offers access to a variety of financial instruments, including forex, commodities, and cryptocurrencies. Established in a competitive market, it aims to attract traders with its promises of high leverage and diverse trading options. However, the importance of thoroughly assessing forex brokers cannot be overstated. Traders must be cautious, as the forex market is rife with unregulated and potentially fraudulent platforms that can jeopardize their investments. In this article, we will investigate the legitimacy of SmartFXExperts through a comprehensive analysis of its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory framework surrounding a broker is critical for ensuring the safety of traders' funds and maintaining market integrity. SmartFXExperts claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the quality of regulation in Vanuatu is often viewed as inadequate compared to more stringent jurisdictions like the FCA in the UK or ASIC in Australia. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 40491 | Vanuatu | Registered but lacks strict oversight |

While the VFSC does provide a level of oversight, it is important to note that the requirements to obtain a license are relatively lenient. This raises concerns about the overall reliability of SmartFXExperts. The absence of a compensation fund or robust investor protection measures further exacerbates these concerns. Traders should be aware that in the event of a dispute, their recourse options may be limited, making it crucial to consider whether they want to engage with a broker operating under such regulatory conditions. Therefore, the question remains: Is SmartFXExperts safe? The answer is not straightforward, as the regulatory landscape suggests potential risks.

Company Background Investigation

SmartFXExperts is owned by a company that claims to operate in Vanuatu, but the lack of transparency regarding its ownership structure and management team is troubling. The broker does not provide detailed information about its founders or key personnel, which is a red flag for many traders. A reputable broker typically offers insights into its management team, showcasing their industry experience and qualifications.

The company's history is relatively short, having been established in 2023, which raises questions about its track record and reliability. The absence of verifiable information regarding the company's operational history and its supposed location in the United States—an assertion that appears dubious—contributes to a perception of opacity.

In summary, the lack of transparency and detailed information about SmartFXExperts' background raises significant concerns regarding its legitimacy. Traders should be cautious and consider whether they want to entrust their funds to a broker that does not provide clear and accessible information. This leads us back to our initial inquiry: Is SmartFXExperts safe? The evidence suggests that potential traders should proceed with caution.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential for determining whether it provides a fair trading environment. SmartFXExperts offers a single account type with high leverage options, which can be appealing to traders seeking to maximize their potential returns. However, it is crucial to analyze the overall fee structure and any hidden costs that may arise during trading. Below is a comparison of SmartFXExperts' core trading costs against industry averages:

| Fee Type | SmartFXExperts | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.2 pips | 1.0 - 1.5 pips |

| Commission Structure | None stated | Variable |

| Overnight Interest Range | Not disclosed | 2% - 5% |

While the spreads offered by SmartFXExperts can be competitive, the lack of transparency regarding commissions and overnight interest rates is concerning. Traders may encounter unexpected fees that are not clearly outlined in the broker's terms and conditions. This lack of clarity could lead to dissatisfaction and potential disputes over charges that traders were not made aware of prior to opening an account.

In conclusion, while SmartFXExperts may present attractive trading conditions at first glance, the lack of clarity regarding fees and potential hidden costs poses a significant risk to traders. This raises further questions about whether SmartFXExperts is safe for trading, as unexpected fees could undermine the trading experience.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. SmartFXExperts claims to implement various measures to safeguard client funds, including segregated accounts. However, the effectiveness of these measures remains uncertain due to the broker's regulatory status. The lack of a compensation scheme means that traders may not have recourse in the event of broker insolvency or misconduct.

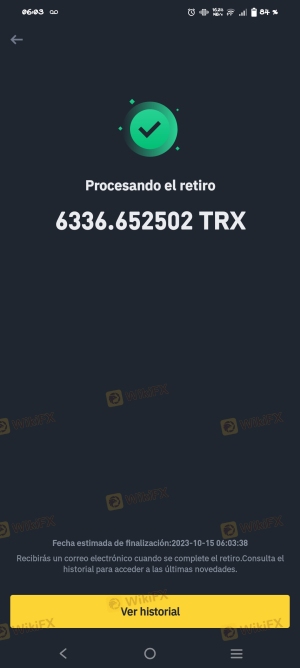

The absence of negative balance protection is another critical concern. Traders could potentially find themselves in a situation where they owe money to the broker, leading to significant financial losses. Additionally, any historical issues related to fund security or complaints regarding the handling of withdrawals have not been adequately addressed or disclosed by SmartFXExperts.

Overall, the broker's approach to fund safety raises serious questions about whether SmartFXExperts is safe for traders. The lack of robust investor protection measures and transparency regarding fund security protocols casts doubt on the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Analyzing user experiences with SmartFXExperts reveals a mixed bag of reviews, with several complaints highlighting issues related to withdrawal delays and poor customer support. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | No adequate reply |

Typical cases include traders reporting significant delays in processing withdrawals, often leading to frustration and distrust towards the broker. Furthermore, the company's lack of transparency in addressing these complaints has resulted in negative perceptions among users.

In light of these complaints, it is crucial for potential clients to consider whether SmartFXExperts is safe based on the experiences of existing clients. The reported issues suggest that traders may encounter challenges that could affect their overall trading experience.

Platform and Trade Execution

The performance of a trading platform is essential for a trader's success. SmartFXExperts utilizes the MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, there have been reports of execution issues, including slippage and order rejections, which could hinder trading performance.

Traders have noted that while the platform offers a range of tools and resources, the quality of order execution is inconsistent. Instances of slippage during volatile market conditions have raised concerns about the broker's ability to manage trades effectively. Moreover, any signs of platform manipulation could further undermine trader confidence.

In conclusion, while SmartFXExperts provides a well-known trading platform, the execution quality and potential issues related to slippage raise questions about whether SmartFXExperts is safe for traders who rely on timely and accurate trade execution.

Risk Assessment

Engaging with SmartFXExperts involves several risks that potential traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a weak regulatory framework |

| Financial Risk | Medium | High leverage increases potential losses |

| Operational Risk | High | Reports of execution issues and complaints |

The cumulative risks associated with trading through SmartFXExperts suggest that traders should exercise extreme caution. It is advisable to implement risk management strategies, such as using lower leverage and setting strict stop-loss orders, to mitigate potential losses.

Conclusion and Recommendations

In light of the comprehensive analysis presented, it is evident that SmartFXExperts raises several red flags that warrant concern. The broker's regulatory status, lack of transparency, and mixed customer feedback suggest that traders should approach this platform with caution.

While SmartFXExperts may offer attractive trading conditions, the potential risks associated with using this broker cannot be ignored. Therefore, it is advisable for traders, especially those new to the market, to consider more reputable and well-regulated alternatives.

In conclusion, is SmartFXExperts safe? Based on the evidence presented, it is prudent for traders to seek other options that provide stronger regulatory oversight, transparent fee structures, and a proven track record of client satisfaction.

Is SMARTFXEXPERTS a scam, or is it legit?

The latest exposure and evaluation content of SMARTFXEXPERTS brokers.

SMARTFXEXPERTS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SMARTFXEXPERTS latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.