MTC5 2025 Review: Everything You Need to Know

MTC5, a relatively new entrant in the forex brokerage landscape, has garnered attention for its user-friendly interface and a range of trading options. However, its lack of regulatory oversight raises significant concerns. This review will delve into the strengths and weaknesses of MTC5, drawing insights from various user experiences and expert opinions.

Note: It is crucial to consider that MTC5 operates under different entities across regions, which may impact its regulatory status and service quality. This review aims to provide a fair and accurate assessment based on the available data.

Rating Overview

We rate brokers based on user feedback, expert analysis, and available data.

Broker Overview

Founded within the last 1-2 years, MTC5 is registered in the United States. However, it currently operates without valid regulation, having an unauthorized status under the National Futures Association (NFA). This situation poses a high risk for potential clients. MTC5 offers trading through the MT5 platform, supporting various asset classes, including forex and futures. While it provides a user-friendly interface and mobile app for convenient trading, the absence of regulatory oversight raises significant concerns regarding the safety of client funds.

Detailed Section

Regulatory Areas

MTC5 is primarily registered in the United States but lacks proper regulatory oversight. As noted in various sources, it has been flagged as unauthorized by the NFA, which should be a red flag for potential investors. Users are advised to exercise caution and conduct thorough research before engaging with this broker.

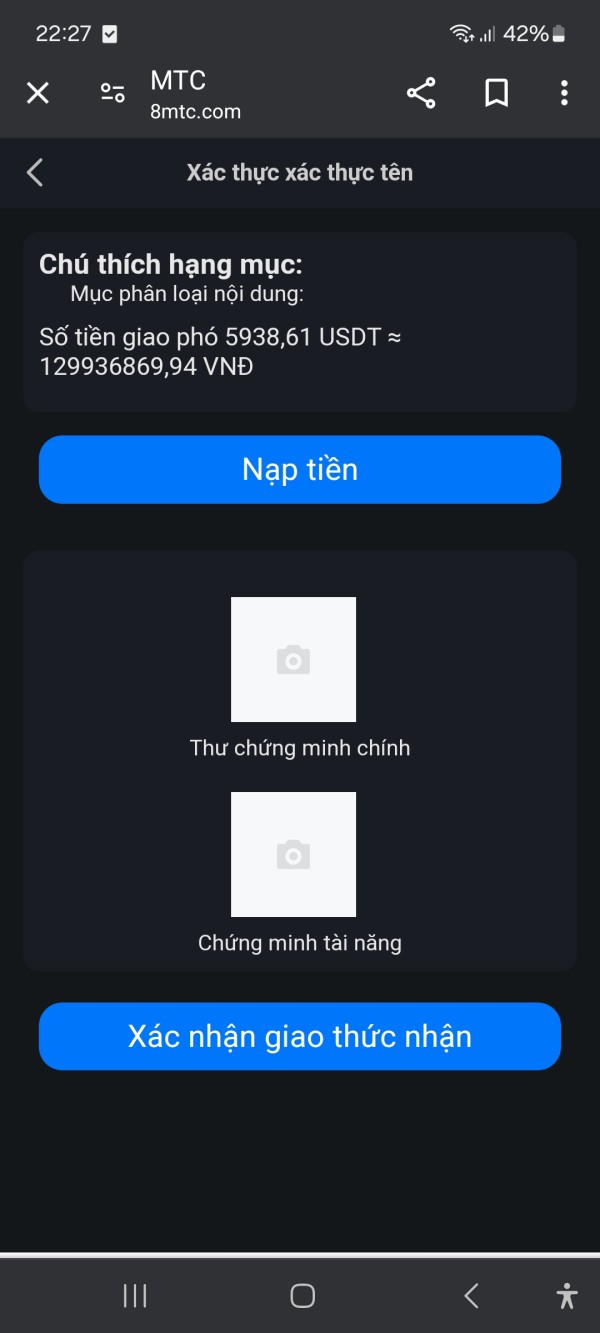

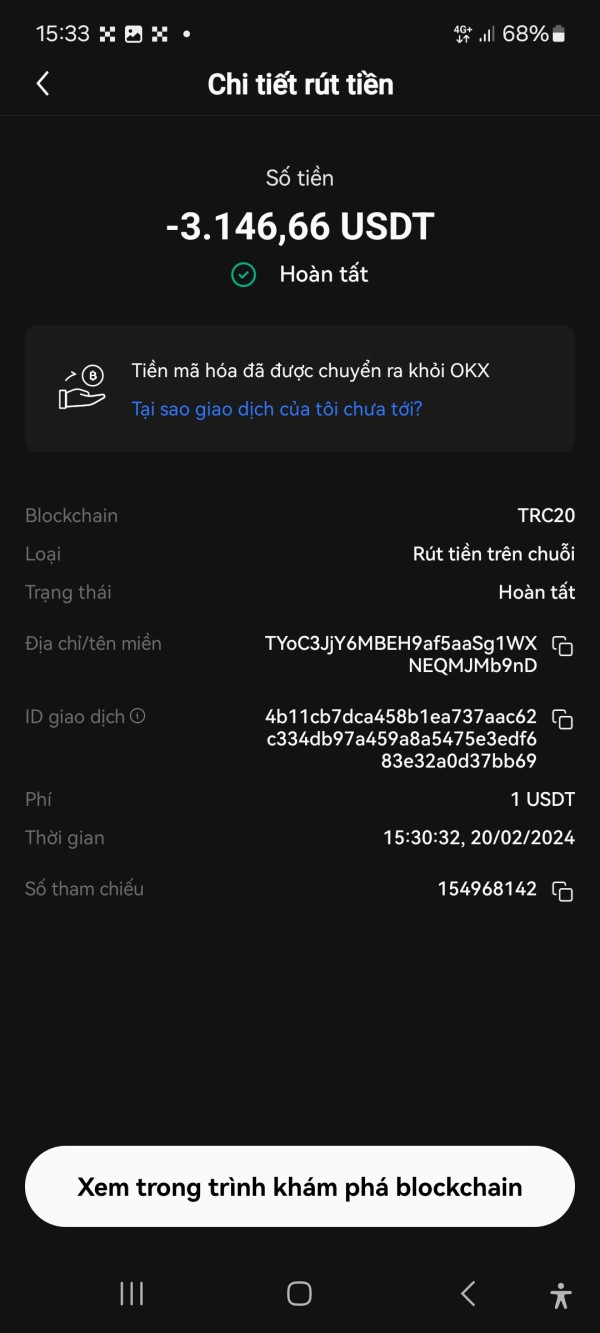

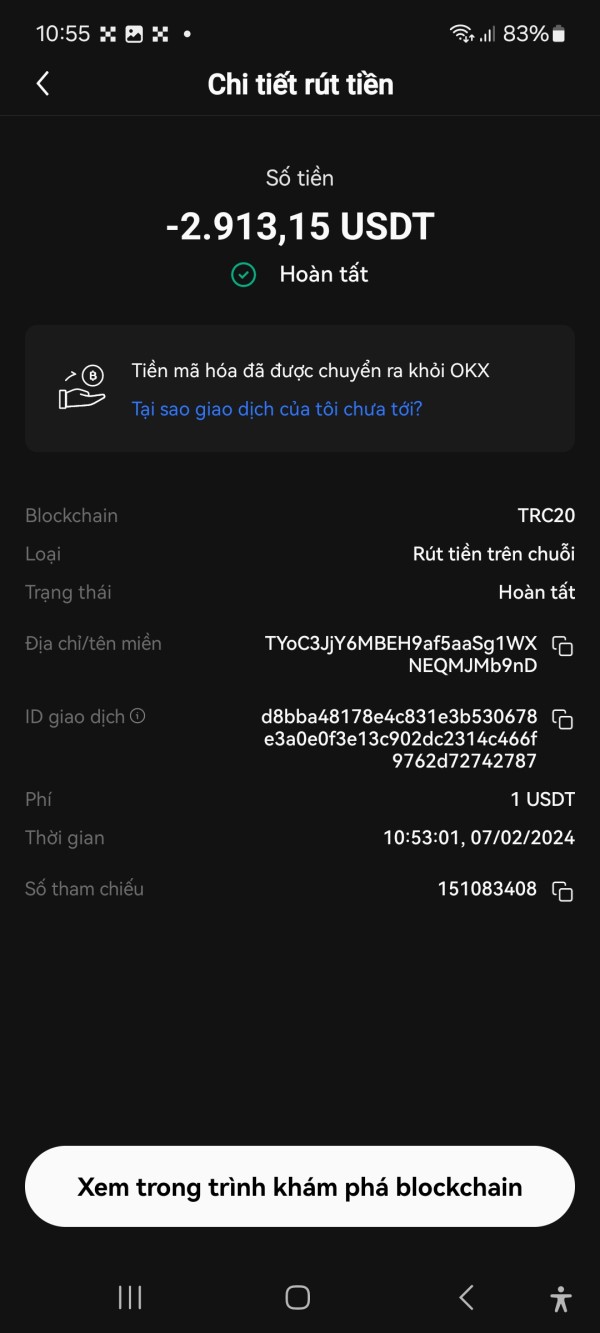

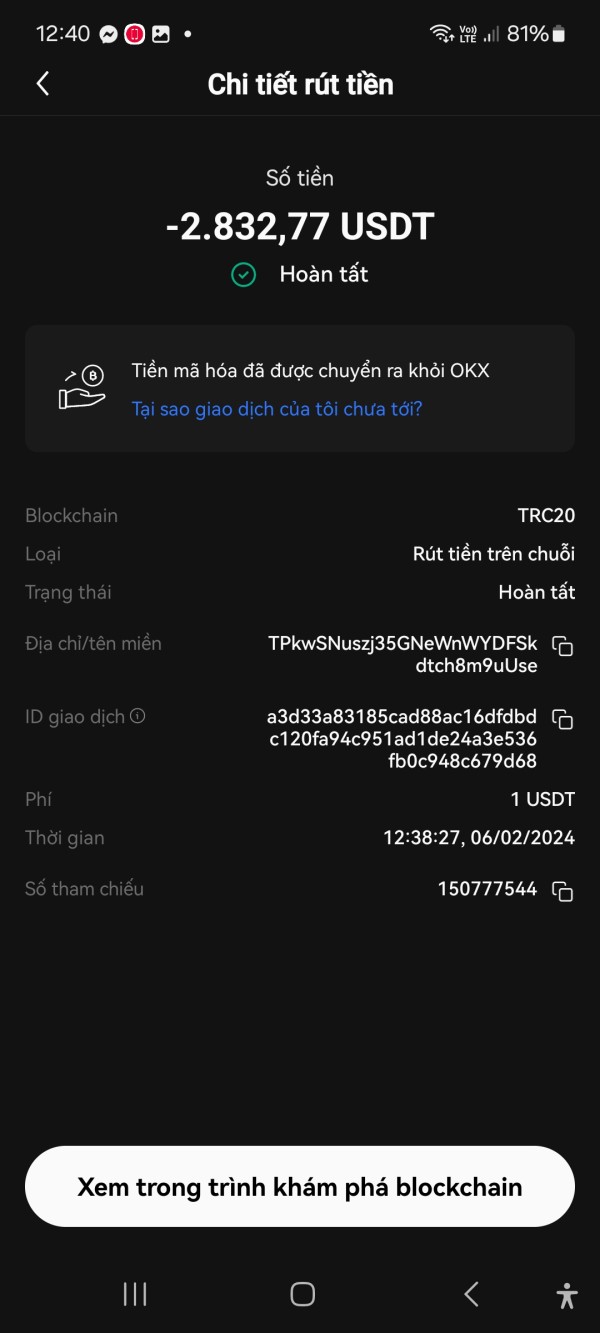

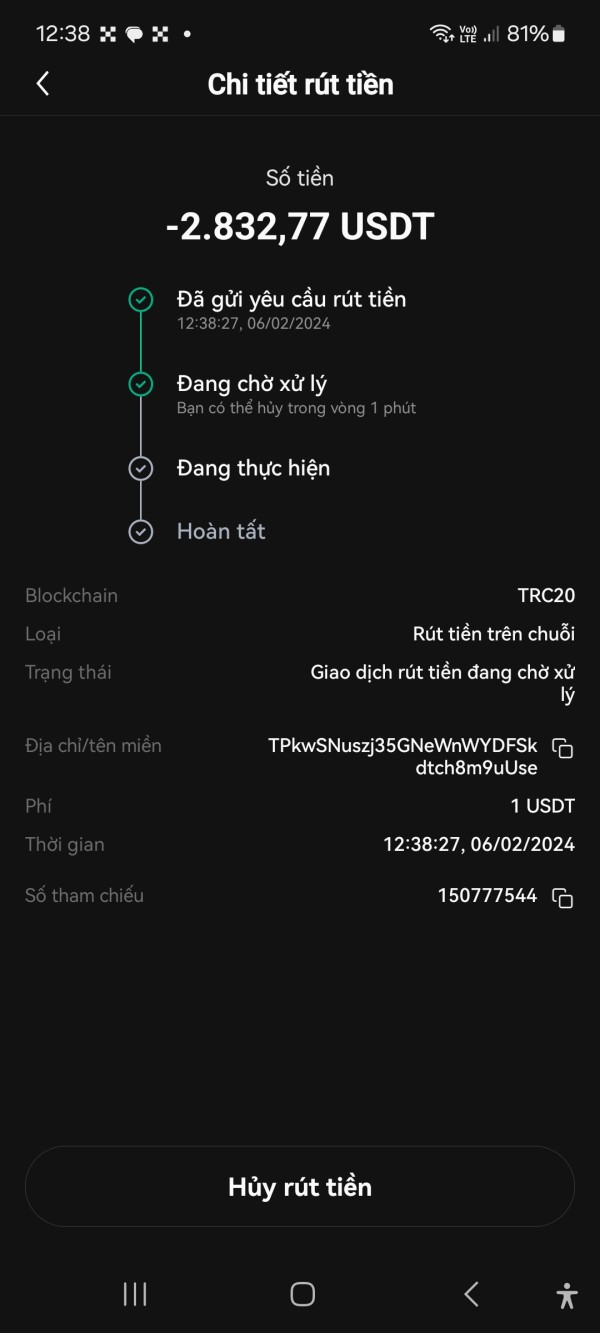

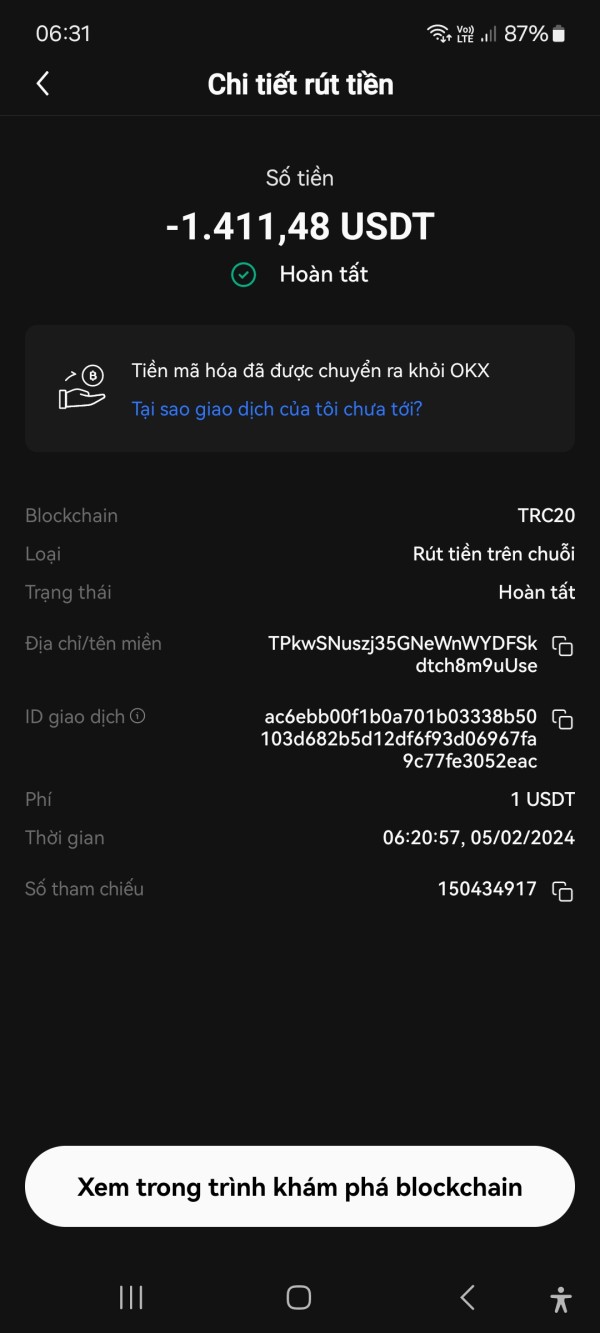

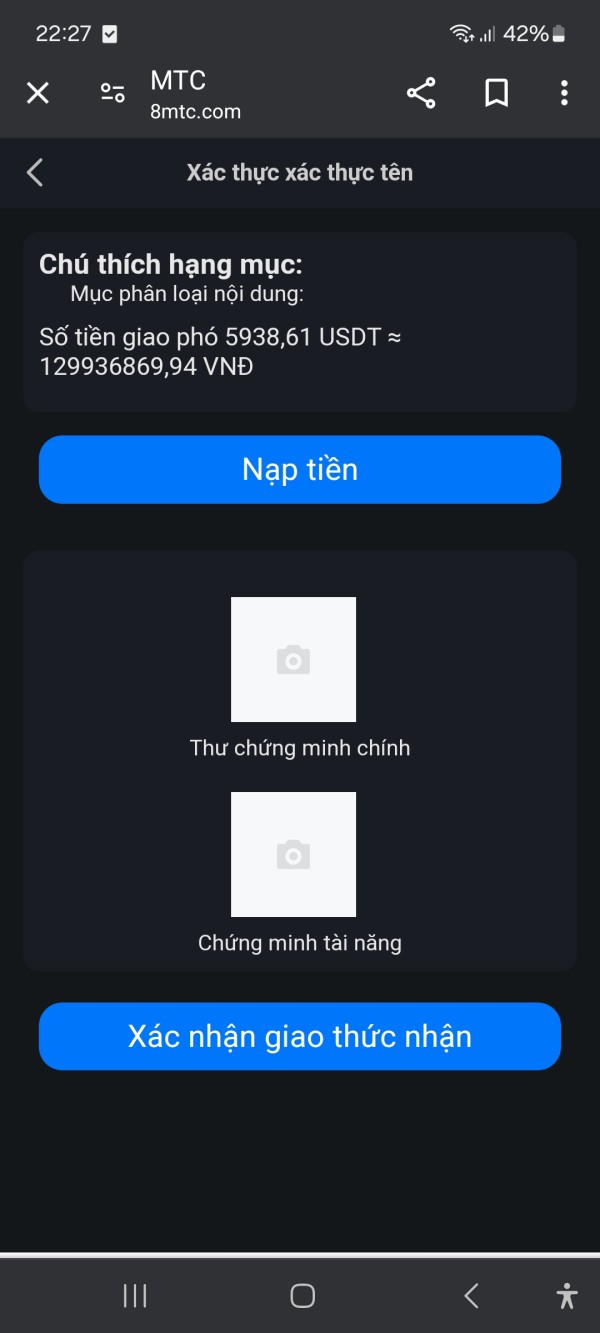

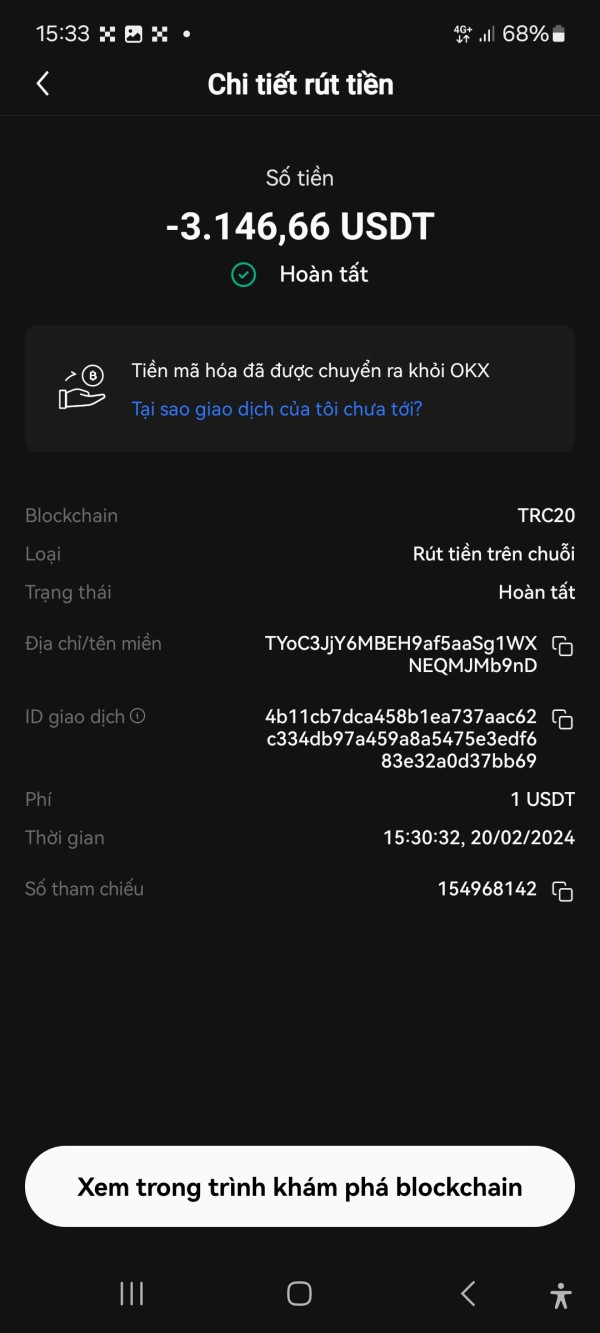

Deposit/Withdrawal Currencies/Cryptocurrencies

MTC5 supports a range of deposit and withdrawal methods, but specific details regarding accepted currencies and cryptocurrencies are not clearly documented. Users should verify with the broker directly for the most accurate information.

Minimum Deposit

The minimum deposit requirement for MTC5 is not explicitly stated in the available resources, which may lead to confusion among potential clients. This lack of transparency could deter new traders looking for clear entry points.

Details regarding bonuses or promotional offers from MTC5 are scarce. Users are encouraged to inquire directly with the broker for any current promotions that may be available.

Tradable Asset Classes

MTC5 allows trading in various asset classes, primarily focusing on forex and futures. The broker's diverse offering enables traders to adopt various strategies based on their knowledge and preferences.

Costs (Spreads, Fees, Commissions)

MTC5 does not charge commissions, which could be appealing to some traders looking to minimize costs. However, the absence of detailed information on spreads and fees raises concerns about the overall cost-effectiveness of trading with this broker.

Leverage

Information regarding leverage options offered by MTC5 is not readily available, which can be a significant factor for traders looking to leverage their positions.

MTC5 operates on the MT5 platform, which is known for its advanced functionalities and user-friendly interface. This platform supports various trading strategies and offers features such as automated trading through Expert Advisors (EAs).

Restricted Regions

While MTC5 is based in the United States, it does not provide clear information on restricted regions for trading. Potential clients should verify whether their location is eligible for trading with MTC5.

Available Customer Support Languages

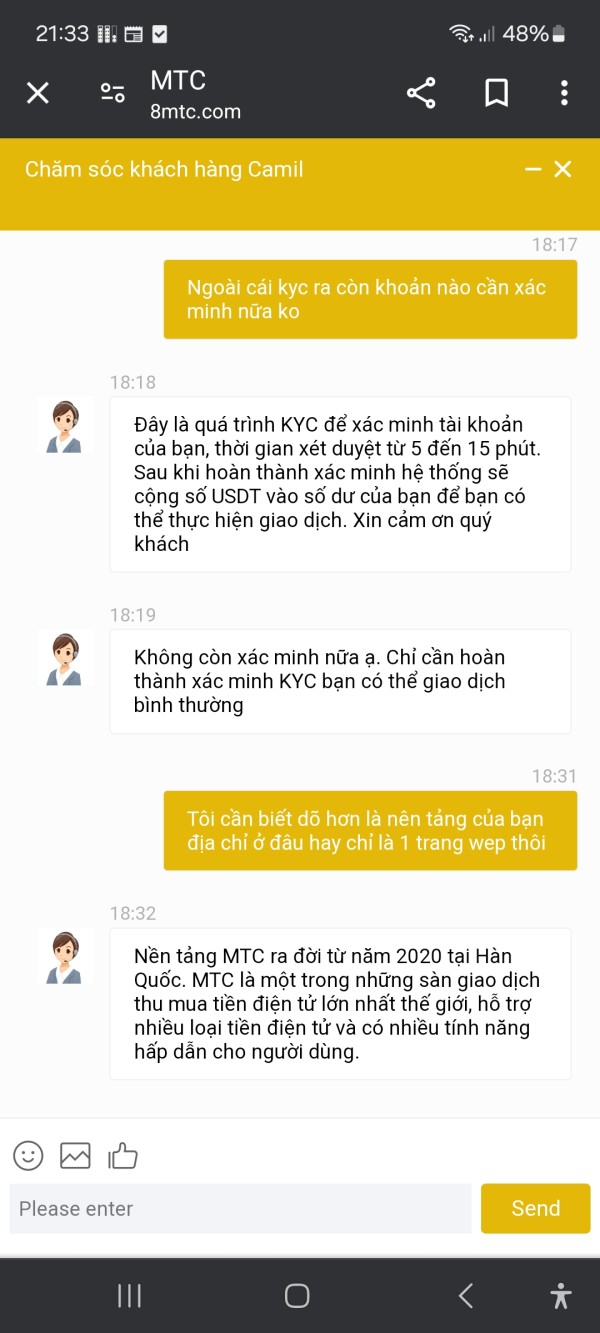

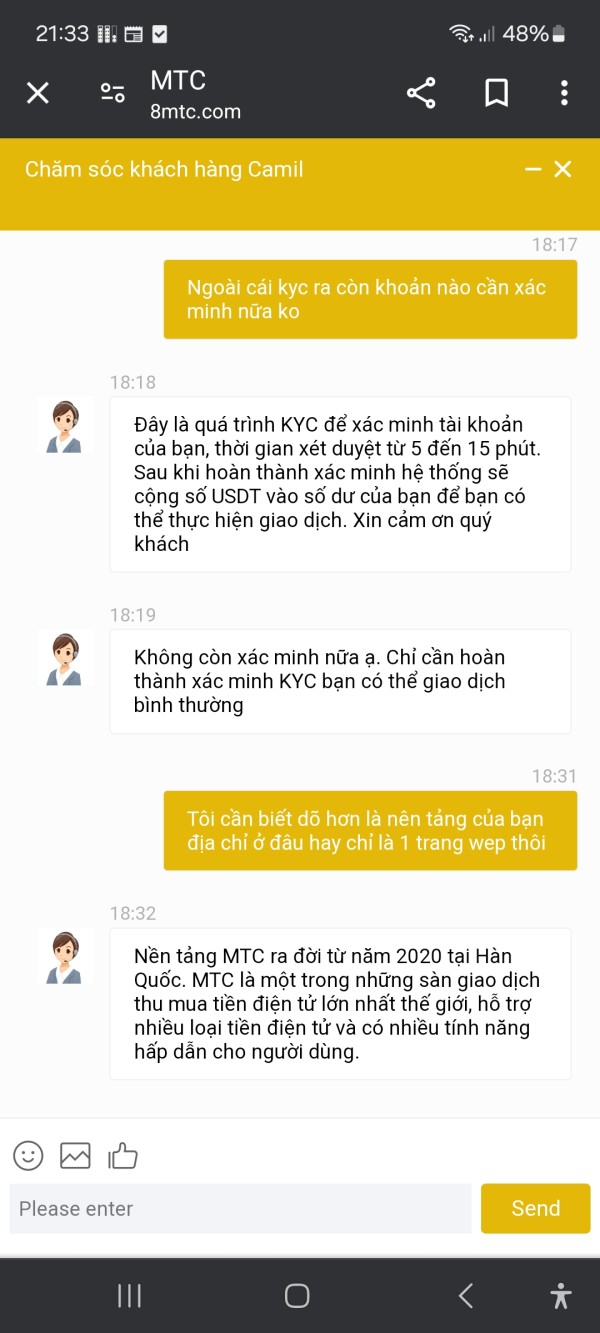

MTC5 offers limited customer service, with feedback indicating that support response times can be slow. This limitation may pose challenges for clients needing immediate assistance.

Rating Breakdown

Account Conditions

MTC5 scores a low 4.0 due to its unauthorized regulatory status, which raises concerns about the safety of client funds and overall trading conditions.

With a score of 5.5, MTC5 offers a decent range of tools and resources, including a mobile app for trading. However, the lack of comprehensive educational materials may hinder novice traders.

Customer Service & Support

Scoring only 3.0, MTC5's customer service has been criticized for being slow and limited. This aspect is critical, as responsive support is essential for traders navigating the complexities of the forex market.

Trading Experience

MTC5 achieves a score of 5.0, reflecting its user-friendly interface and mobile trading capabilities. However, the overall trading experience is marred by the lack of transparency regarding costs and regulatory status.

Trustworthiness

With a concerning score of 2.0, MTC5's lack of regulation poses significant risks for traders. Users are strongly advised to consider this factor before engaging with the broker.

User Experience

MTC5 scores a 6.0 for user experience, largely due to its intuitive interface and mobile app. However, the overall experience could be improved with better customer support and transparency regarding fees.

In conclusion, while MTC5 offers some appealing features, the lack of regulatory oversight and transparency raises significant concerns. Potential clients should proceed with caution, ensuring they conduct thorough research before committing their funds.