Is MTC5 safe?

Pros

Cons

Is MTC5 A Scam?

Introduction

MTC5 is a forex broker that has recently emerged in the trading landscape, aiming to provide various trading services to clients interested in foreign exchange and other financial instruments. As the forex market becomes increasingly popular, the necessity for traders to meticulously evaluate the reliability and legitimacy of brokers cannot be overstated. With countless brokers available, distinguishing between trustworthy firms and potential scams is crucial for safeguarding one's investments. This article employs a comprehensive evaluation framework, analyzing MTC5's regulatory status, company background, trading conditions, customer experience, and overall risk profile to determine whether it is a legitimate trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical aspect that can significantly impact its credibility. MTC5 claims to operate under the oversight of the National Futures Association (NFA) in the United States; however, it currently holds an “unauthorized” status. This means that, while it may have a registration number, it lacks the necessary regulatory approval to operate legally in the forex market. The absence of proper regulation raises significant concerns about the safety of client funds and the broker's adherence to industry standards.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| NFA | 0559399 | United States | Unauthorized |

The lack of a valid regulatory license is a red flag, indicating that MTC5 may not be operating in compliance with established financial regulations. Regulatory bodies like the NFA enforce strict guidelines to protect traders, including ensuring that client funds are kept in segregated accounts and that brokers maintain transparency in their operations. MTC5's unauthorized status suggests a higher risk for potential clients, as they may not have recourse in the event of disputes or financial issues.

Company Background Investigation

MTC5 is a relatively new entrant in the forex market, having been operational for approximately 1-2 years. It is based in the United States, but detailed information regarding its ownership structure and management team is scarce. This lack of transparency is concerning, as potential clients typically seek brokers with well-established histories and experienced management teams. A thorough investigation of the company's background reveals minimal information, leaving potential clients in the dark regarding who is behind the platform and their qualifications.

The absence of detailed disclosures about the management team raises questions about the broker's commitment to transparency. A reputable broker will usually provide information about its founders, management team, and any relevant expertise they possess in the financial sector. This information is vital for traders to assess the broker's reliability and experience in managing client accounts and navigating the complexities of the forex market.

Trading Conditions Analysis

MTC5's trading conditions, including fees and spreads, are essential factors to consider when evaluating its legitimacy. The broker claims to offer a commission-free trading environment, which may initially seem appealing. However, it is crucial to delve deeper into the overall cost structure to identify any hidden fees or unfavorable conditions that could affect trading profitability.

| Fee Type | MTC5 | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable | 1.0 pips |

| Commission Model | None | $3 per lot |

| Overnight Interest Range | Variable | Variable |

While MTC5 advertises low or nonexistent commissions, the variability of spreads can lead to increased trading costs, especially during volatile market conditions. Traders should be cautious of any broker that lacks transparency in its fee structure, as hidden costs can erode profits over time.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. MTC5 claims to utilize advanced encryption technology to protect personal information and transaction data. However, the lack of regulatory oversight raises concerns about the effectiveness of these security measures.

A reliable broker should implement stringent fund protection policies, including segregated accounts to separate client funds from the broker's operational funds. Additionally, negative balance protection policies are essential to ensure that traders do not lose more than their invested capital. MTC5's unauthorized status suggests that it may not have adequate safeguards in place to protect client funds, making it a potential risk for traders.

Customer Experience and Complaints

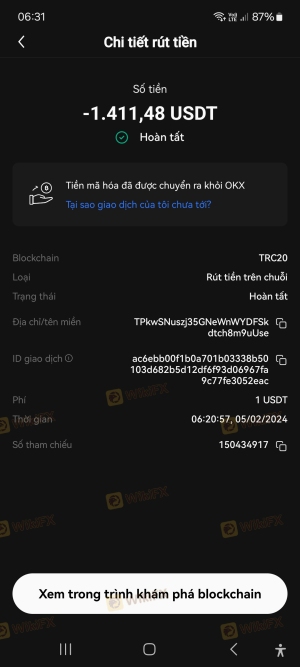

Customer feedback provides valuable insights into a broker's reliability and service quality. MTC5 has received mixed reviews from users, with several complaints regarding slow customer support and difficulty in withdrawing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Quality | Medium | Limited Support |

The prevalence of complaints regarding withdrawal issues is particularly alarming, as it indicates potential problems with fund accessibility. A reliable broker should ensure that clients can access their funds promptly and without undue restrictions. The quality of customer support is also crucial, as traders often require assistance with technical issues or account-related queries.

Platform and Trade Execution

MTC5 offers a trading platform that is accessible via web and mobile applications. However, the performance and stability of the platform are critical factors in ensuring a smooth trading experience. Users have reported issues with order execution quality, including slippage and instances of rejected orders during high volatility.

The presence of these issues may indicate potential platform manipulation or inefficiencies in trade execution, which could adversely affect traders' ability to capitalize on market opportunities. A reputable broker should provide a stable trading environment with minimal disruptions and reliable order execution.

Risk Assessment

The overall risk associated with trading through MTC5 is elevated due to its unauthorized regulatory status and the complaints regarding customer service and fund accessibility.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulatory oversight raises concerns. |

| Fund Security Risk | High | Insufficient protections for client funds. |

| Customer Service Risk | Medium | Complaints about slow responses and withdrawal issues. |

To mitigate these risks, potential traders should conduct thorough due diligence before engaging with MTC5. This includes seeking alternative brokers with better regulatory standing and proven track records of customer satisfaction.

Conclusion and Recommendations

In summary, MTC5 raises several red flags that warrant caution. The broker's unauthorized status under the NFA, coupled with complaints regarding customer service and fund accessibility, suggests that it may not be a safe option for traders. While the platform offers various trading features, the potential risks associated with trading through MTC5 outweigh the benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Options such as IC Markets, FP Markets, and Pepperstone are recommended for their reputable standing and comprehensive trading conditions. Ultimately, traders should prioritize safety and reliability when selecting a broker to ensure a secure trading experience.

Is MTC5 a scam, or is it legit?

The latest exposure and evaluation content of MTC5 brokers.

MTC5 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MTC5 latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.