AlfaTrade Review 1

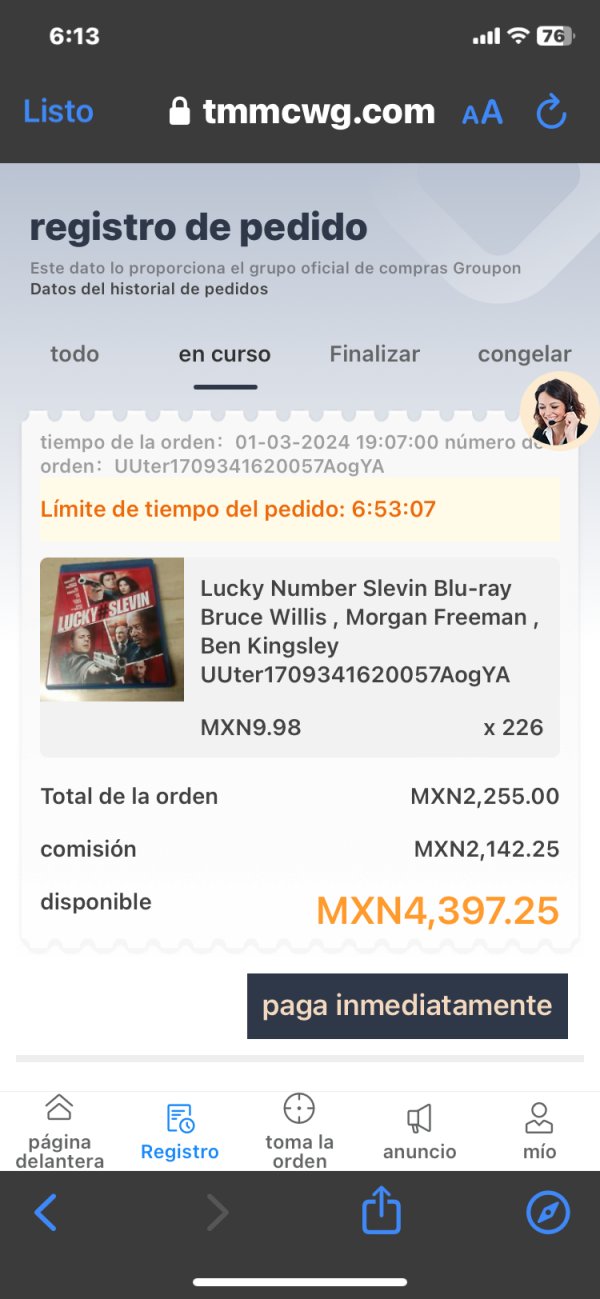

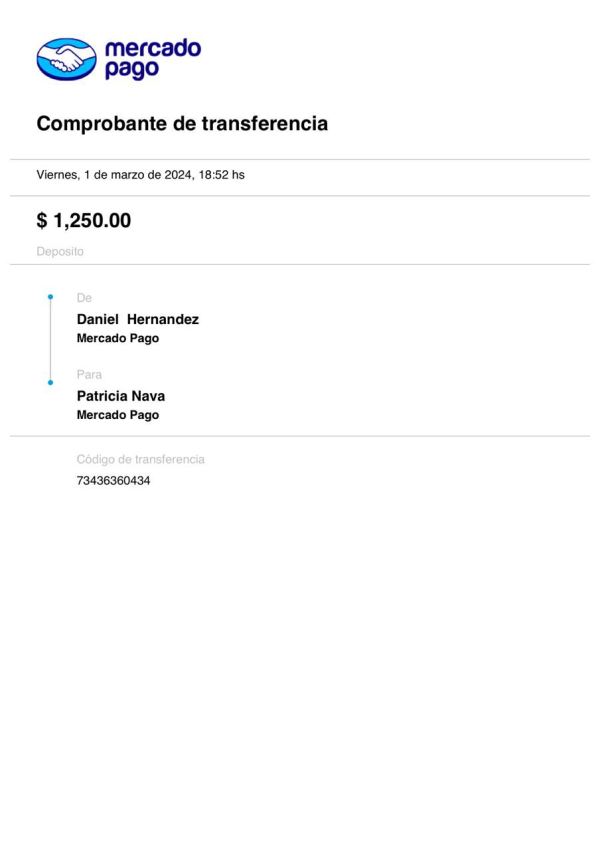

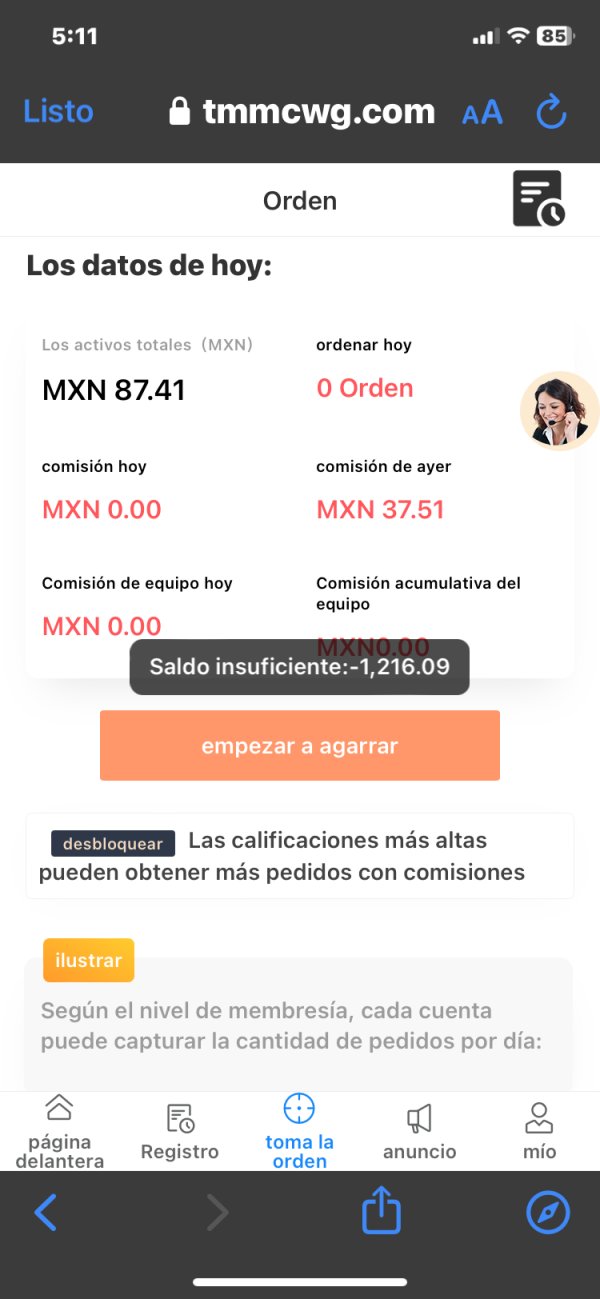

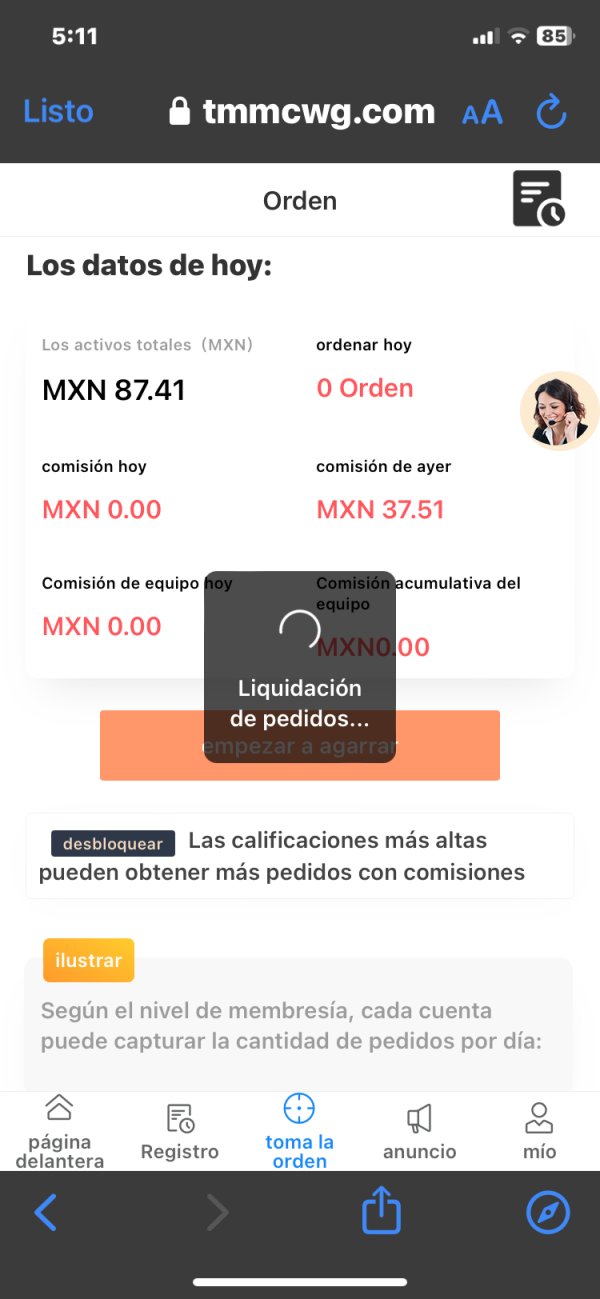

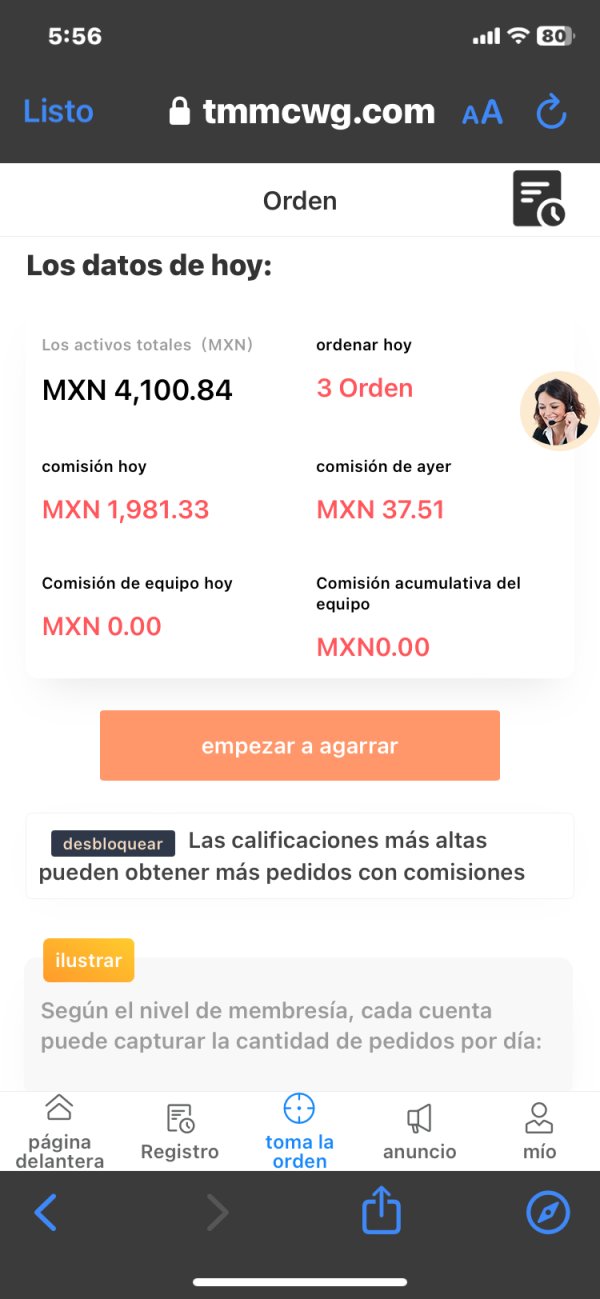

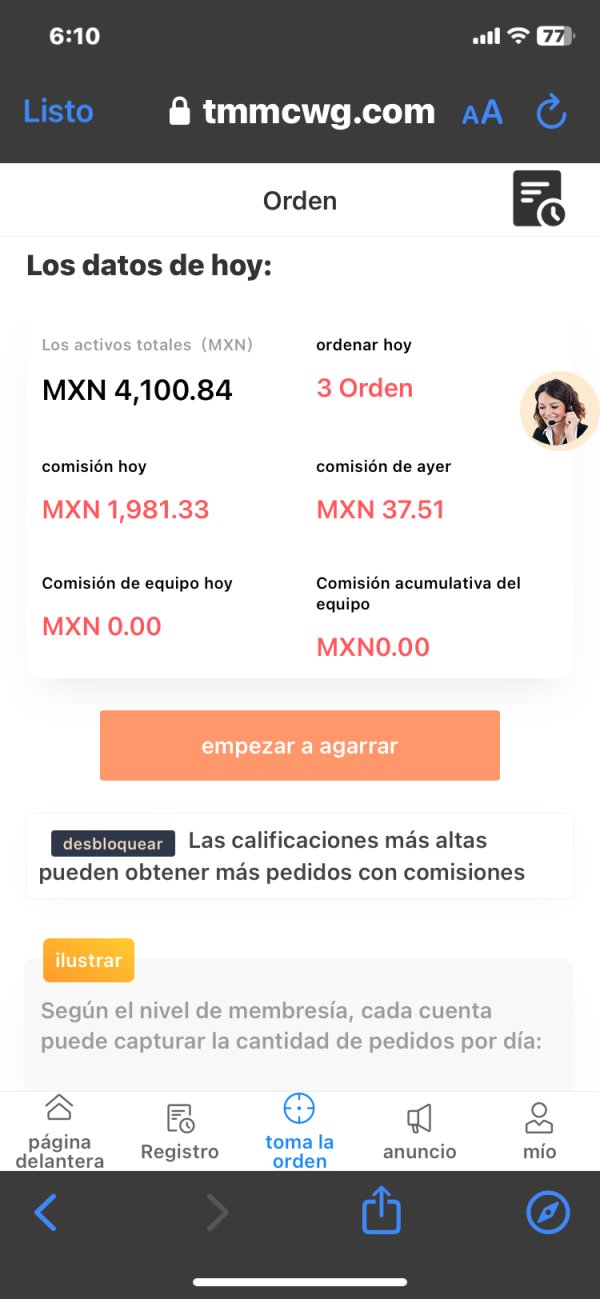

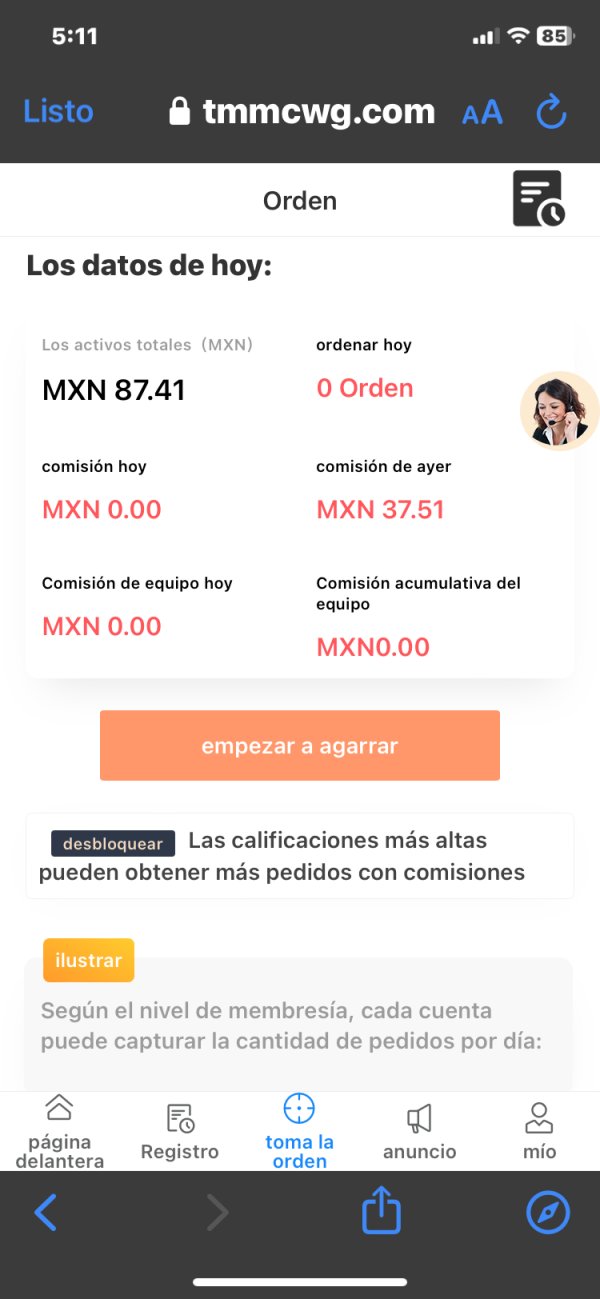

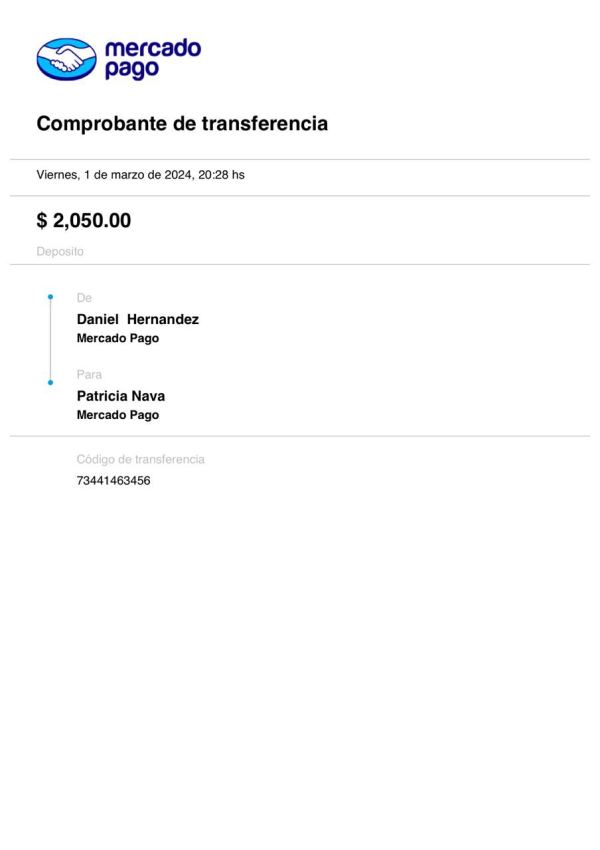

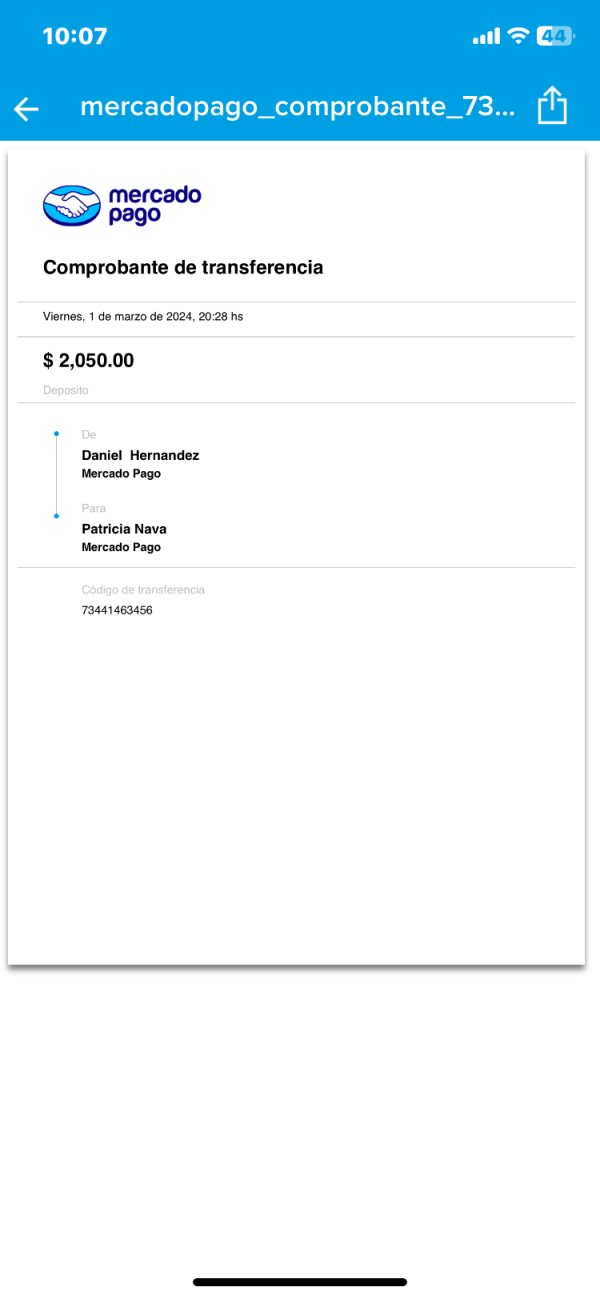

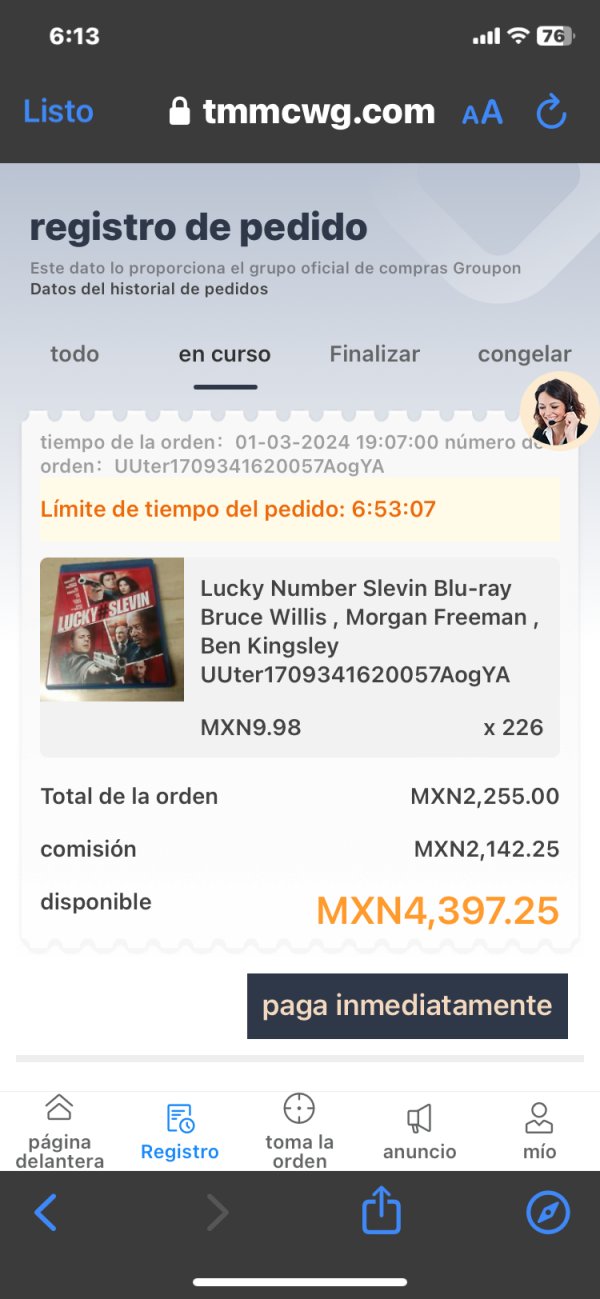

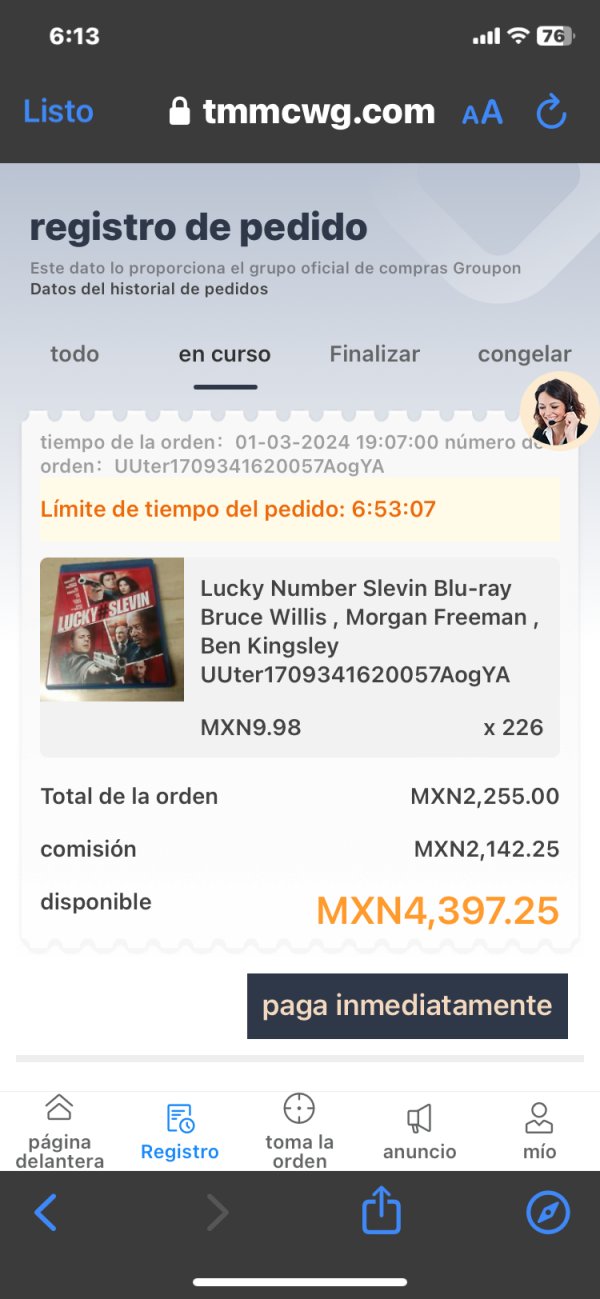

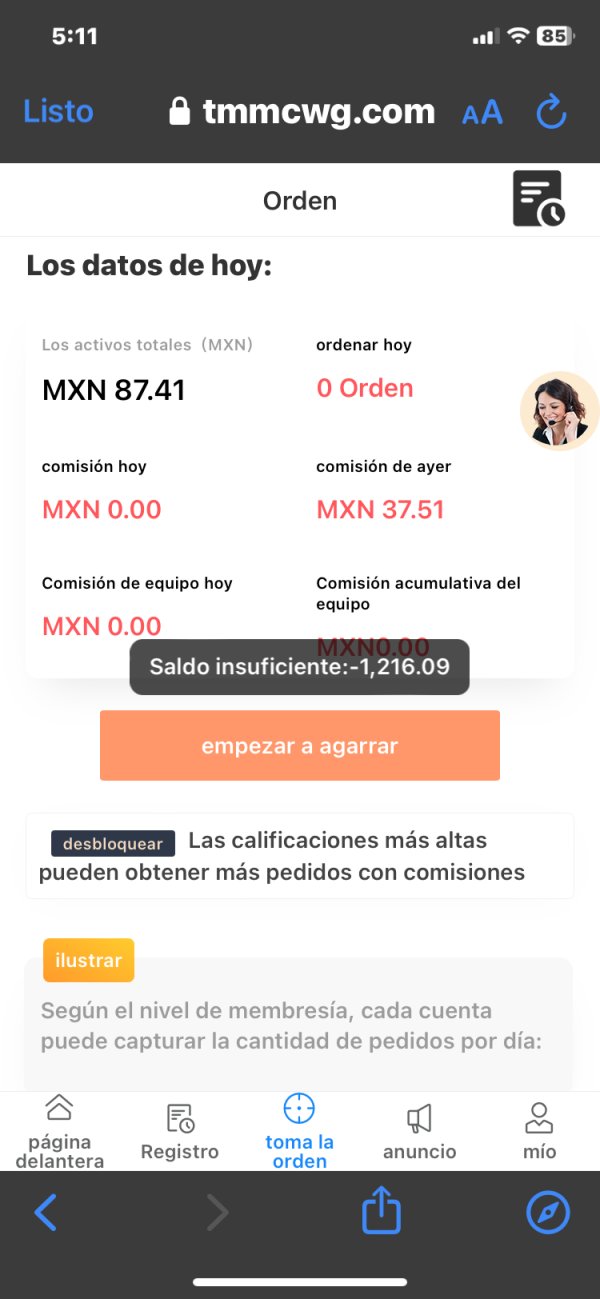

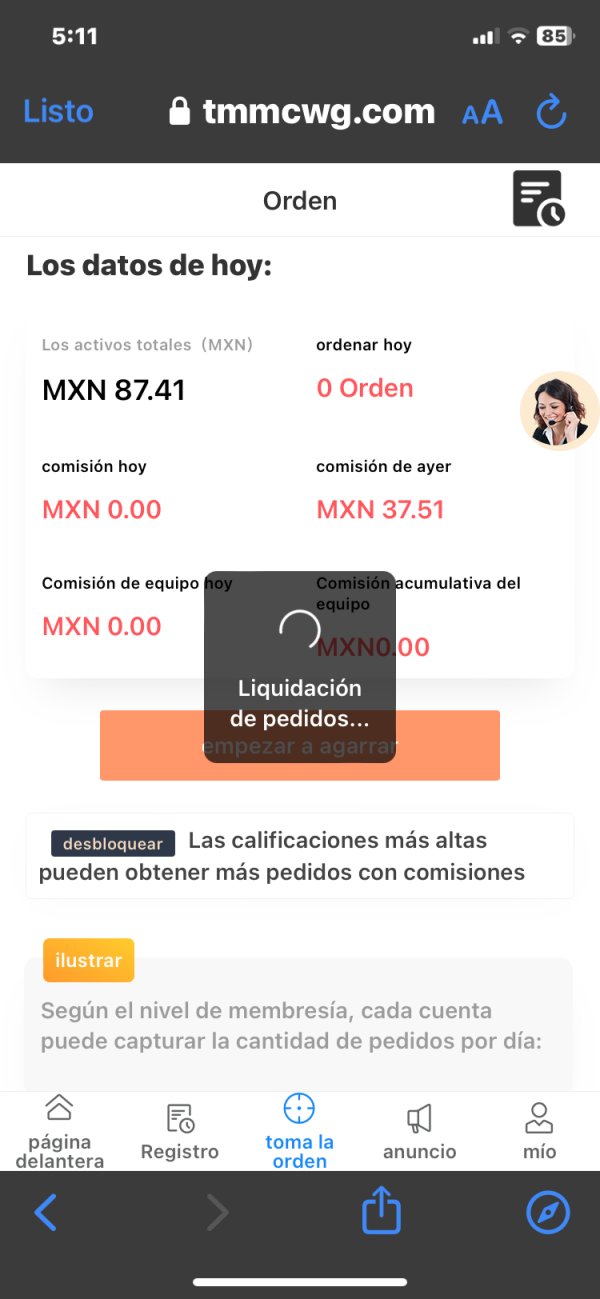

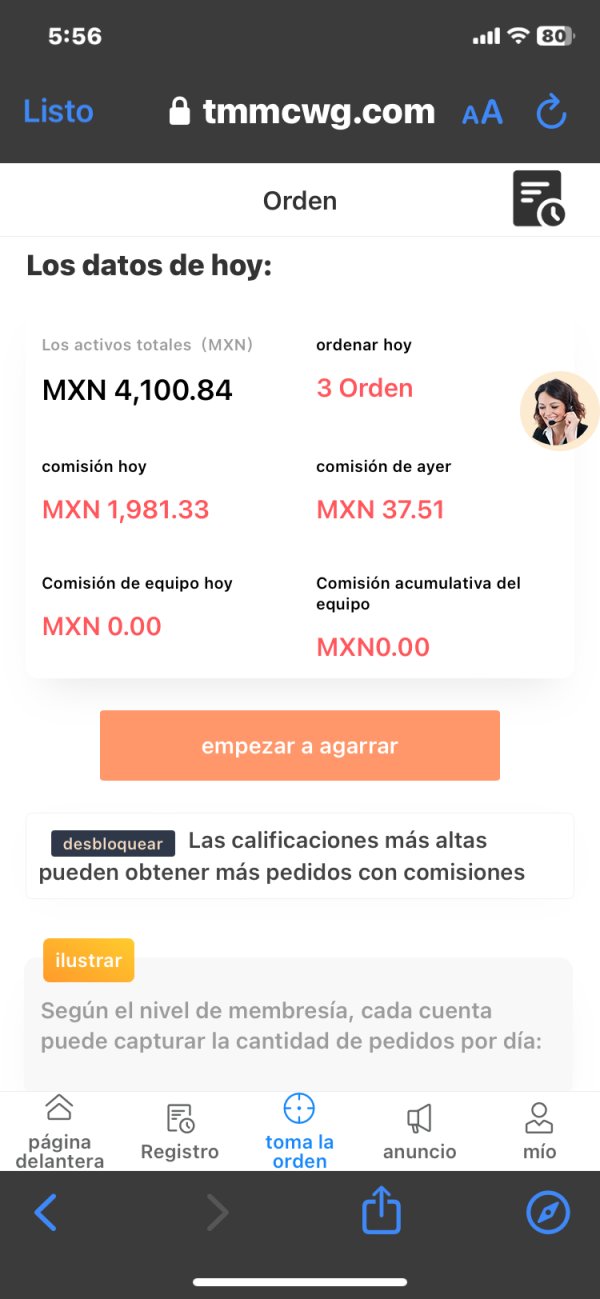

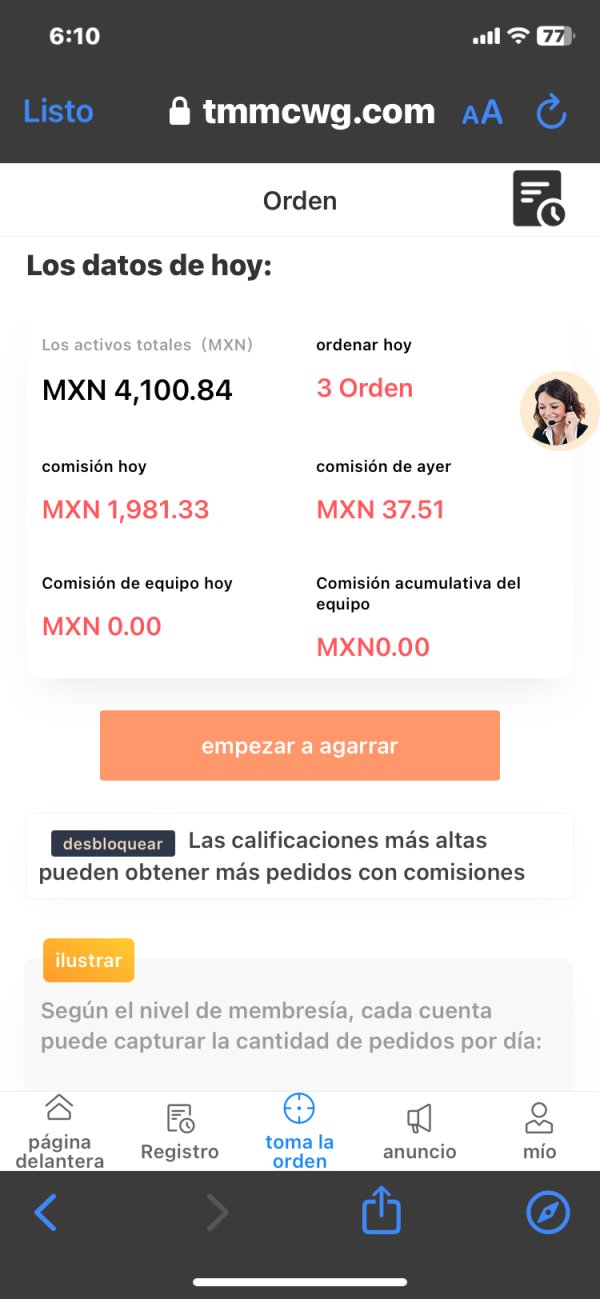

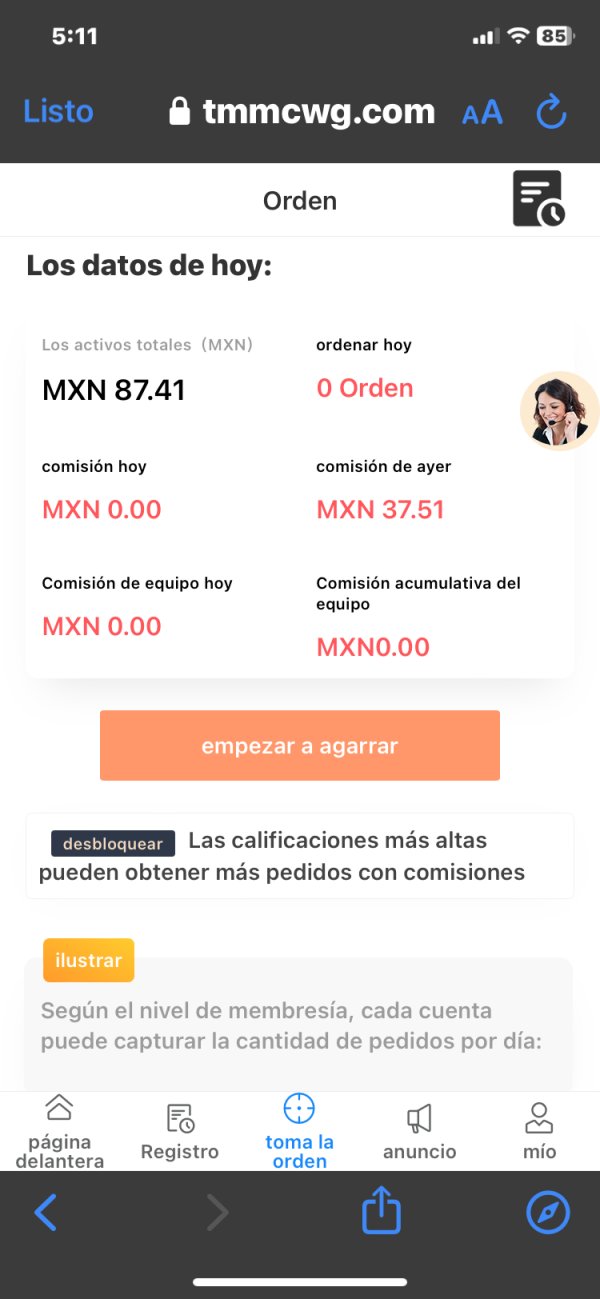

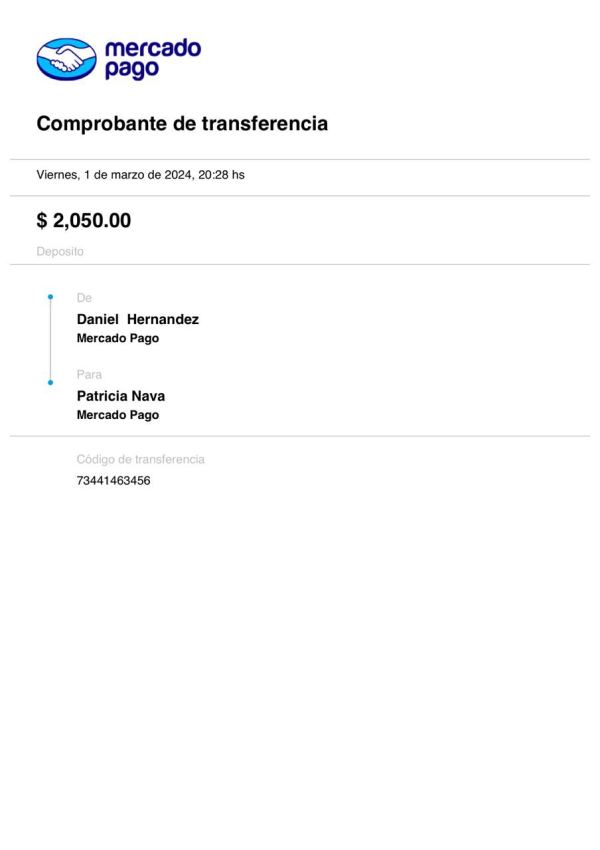

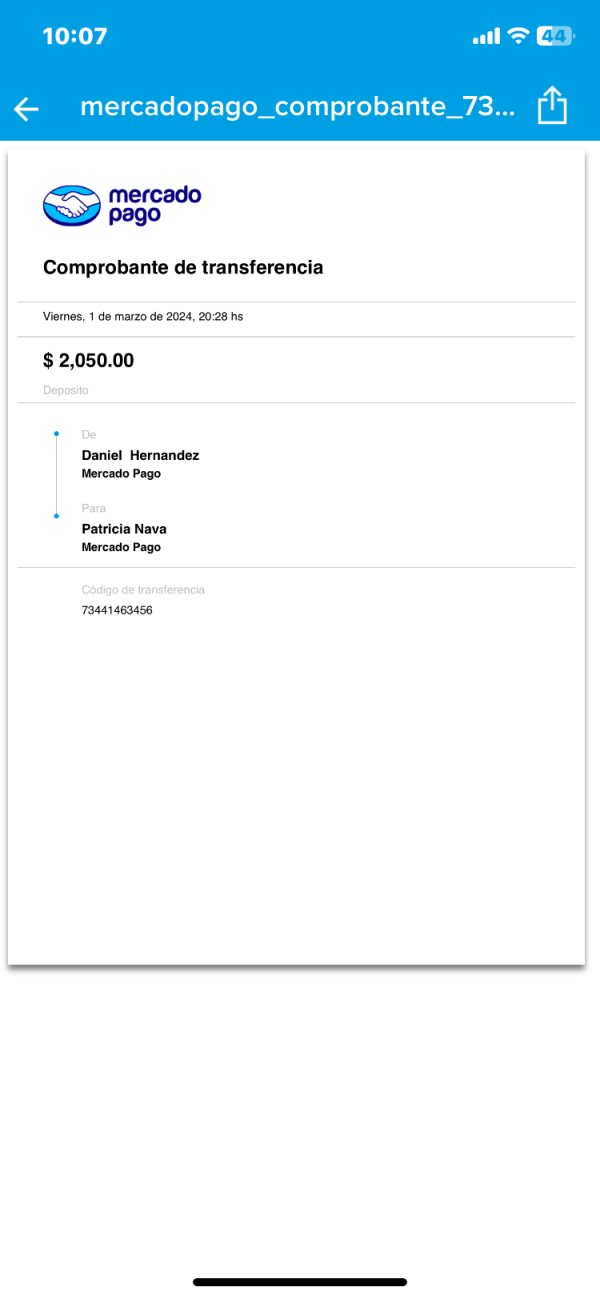

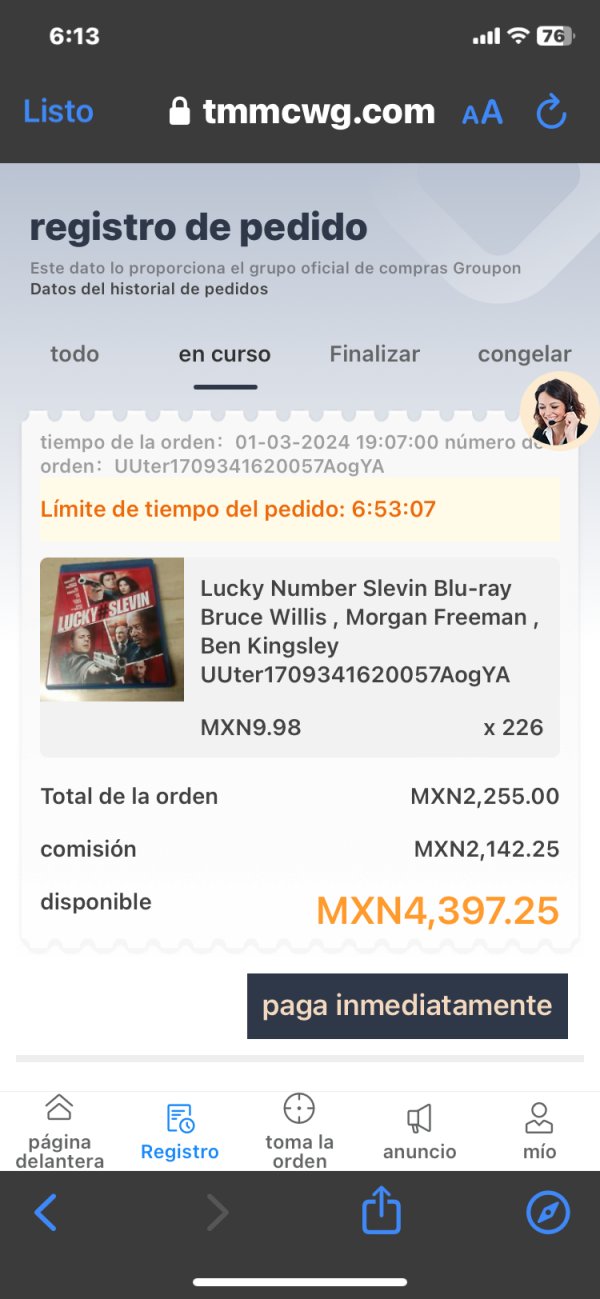

They scammed me on falabella, I had to complete tasks to earn a commission and they ended up freezing my earnings so I can't withdraw my money.

AlfaTrade Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They scammed me on falabella, I had to complete tasks to earn a commission and they ended up freezing my earnings so I can't withdraw my money.

AlfaTrade is an unregulated offshore forex broker that may appeal to seasoned traders seeking high-leverage opportunities and low commissions. Founded in 2010, it operates primarily from St. Vincent and the Grenadines and advertises an array of trading platforms and diverse financial products, including forex, commodities, and indices. However, the risk profile associated with this broker raises significant concerns, particularly around fund security and the lack of regulatory oversight. Experienced traders willing to take risks may find potential rewards; however, the potential harms necessitate caution. In contrast, this broker is inadvisable for new or inexperienced traders who prioritize a secure investment environment and regulatory safeguards in their trading activities.

Attention Forex Traders:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Lack of regulatory oversight and poor user reviews raise significant safety concerns. |

| Trading Costs | 3 | While competitive on trading fees, hidden charges and high withdrawal costs are prominent issues. |

| Platforms & Tools | 4 | Offers popular platforms like MT4, but user experiences vary regarding reliability and support. |

| User Experience | 2 | Mixed experiences; complaints about customer support and fund withdrawals diminish user trust. |

| Customer Support | 1 | Limited availability and responsiveness negatively impact the overall trading experience. |

| Account Conditions | 2 | High minimum deposit requirements and hidden fees deter accessibility for many traders. |

AlfaTrade was founded in 2010 and claims to operate from multiple locations, including St. Vincent and the Grenadines. The broker is under the ownership of Nemesis Capital Limited, a company known for its lack of regulatory compliance and numerous complaints from clients regarding fund safety. Since its inception, AlfaTrade has aimed to cater to both retail and institutional investors, offering trading across distinct asset classes and adopting marketing strategies that appeal to high-risk traders. However, its offshore status and non-compliance with strict regulatory norms position it as a high-risk broker.

AlfaTrade primarily functions as a forex broker, providing access to various financial instruments, including currency pairs, commodities, stocks, and indices. The broker claims to facilitate trading via established platforms like MetaTrader 4, while alleged features include educational materials, market analytics, and market signals. Despite marketing efforts, many complaints emphasize the lack of transparency about fees, withdrawal processes, and conditions tied to trading.

| Detail | Description |

|---|---|

| Regulation | Not regulated |

| Min. Deposit | $500 |

| Max. Leverage | 1:200 |

| Major Fees | High withdrawal fees reported |

| Trading Platforms | MetaTrader 4 (MT4), WebTrader |

| Customer Support | Email only, limited documentation |

Managing uncertainty is crucial for traders when engaging with a platform like AlfaTrade.

The conflicting regulatory information surrounding AlfaTrade poses significant risks for potential investors. Although the broker claims to offer some regulatory credentials, credible sources demonstrate that it operates without proper oversight, which raises alarm bells about its legitimacy. Past affiliations with legitimate regulatory bodies such as the UKs FCA are now moot since the license was suspended in 2015.

To safeguard their interests, users are encouraged to verify the status of AlfaTrade via official regulatory channels. Heres a guide on how to conduct due diligence:

As one user bluntly stated:

"I invested significantly, but in the end, I couldnt withdraw my funds. They just stalled and ignored my requests."

This encapsulates the concerns about fund safety which dominate discussions about AlfaTrade.

The allure of low commissions at AlfaTrade reveals a complex array of costs associated with trading.

Users have reported an enticing commission structure with no direct trading fees; however, hidden, non-trading costs present a stark contrast and reveal unpleasant surprises. For instance, complaints surfaced regarding **$30** withdrawal fees and scenarios where clients faced unexpected charges after unsuccessful withdrawal attempts, highlighting issues in transparency related to the cost structure.

For many traders, the low initial commission could feel like a trap as the high withdrawal fees diminish net gains significantly. Thus, the cost structure appears to favor fewer trades while punishing withdrawal attempts.

Professional depth is juxtaposed with beginner-friendliness on the AlfaTrade trading platform.

AlfaTrade operates notable trading software, including MetaTrader 4 and a proprietary web trader. These platforms cater to a range of trader needs; MT4 is renowned for its extensive functionalities and ease of use. Yet, the quality of the tools and resources offered have drawn mixed feedback. While the platforms are generally well-regarded, many users reported difficulties.

One trader remarked:

"Initially, I enjoyed the MT4 features, but when I tried to access support, it took ages to get any useful assistance."

User experiences on usability reflect dissatisfaction, especially concerning customer support responses, which appear limited during crucial trading hours.

The user experience at AlfaTrade reflects a challenging engagement corridor for many traders.

Traders have expressed frustration about withdrawal delays, customer service issues, and overall usability, which has led to significant complaints ranging from unprofessional support staff to long waiting times. Accurate and timely customer support is paramount in online trading, particularly in volatile market conditions.

AlfaTrade's customer support channels underscore frustrations experienced by users.

The brokers support structure offers limited communication styles mostly via email. Many users report a lack of responsiveness during critical times, especially when needing assistance with withdrawals or general inquiries. Complaints emphasize a systemic challenge in accessibility, further impairing user confidence.

Exploring account conditions reveals how traders face barriers when seeking engagement levels with AlfaTrade.

With a minimum deposit set at $500, the requirement can deter many potential traders. These barriers, combined with hidden fees and unclear withdrawal rules, ultimately create a complex environment that appears unfriendly to the average trader.

In closing, AlfaTrade represents a potential opportunity for experienced and risk-tolerant traders, but the inherent risks and significant negative feedback warrant thorough investigation and caution. Regulatory negligence, mixed user experiences, and conflicting information impair their claims of providing a secure trading platform. New traders, in particular, are urged to steer clear, while seasoned investors should ensure they conduct all necessary due diligence before engaging with this platform. It is paramount to prioritize trading with regulated brokers to safeguard your investments and undervalue the same exciting features presented by offerings such as AlfaTrade.

FX Broker Capital Trading Markets Review