UnitedPips is an offshore broker that commenced operations in 2017 and is based in St. Lucia. With its establishment drawing attention due to low entry points for investors, the brokerage has accumulated a user base attracted by the promise of high leverage—up to 1:1000—and low minimum deposits starting at just $1. It claims regulation under the IFSA, a point leveraged to instill perceived trust among potential clients. However, this jurisdiction is frequently scrutinized for minimal oversight, thus raising red flags about the level of investor protection.

UnitedPips primarily focuses on forex and cryptocurrency trading, providing access to diverse asset classes that include major currency pairs and a selection of metals. The broker employs a proprietary trading platform called Unitrader, available in various versions: Classic, Pro, and Mobile, which are designed to cater to different trading styles and preferences. Despite these offerings, the brokerage faces criticism regarding the limited range of tradable instruments, particularly the lack of access to equities or commodities, which further highlights the risks associated with its offshore nature.

UnitedPips operates under the regulation of the International Financial Services Authority (IFSA), which raises questions regarding the level of oversight necessary for safeguarding client funds. Unlike brokers regulated by established authorities like the FCA or ASIC, the IFSA lacks stringent requirements, making it challenging for traders to objectively assess the level of security their investments are afforded. As stated in user reviews:

"The broker claims to maintain segregated accounts, but without proof of regulatory enforcement, such claims remain suspect."

- Visit the official NFA website.

- Use the BASIC lookup tool.

- Enter the broker's name or registration number for verification.

- Cross-verify with third-party review sites to gather traders' experiences.

- Review the terms and conditions for transparency regarding funds and account security.

Industry Reputation and Summary

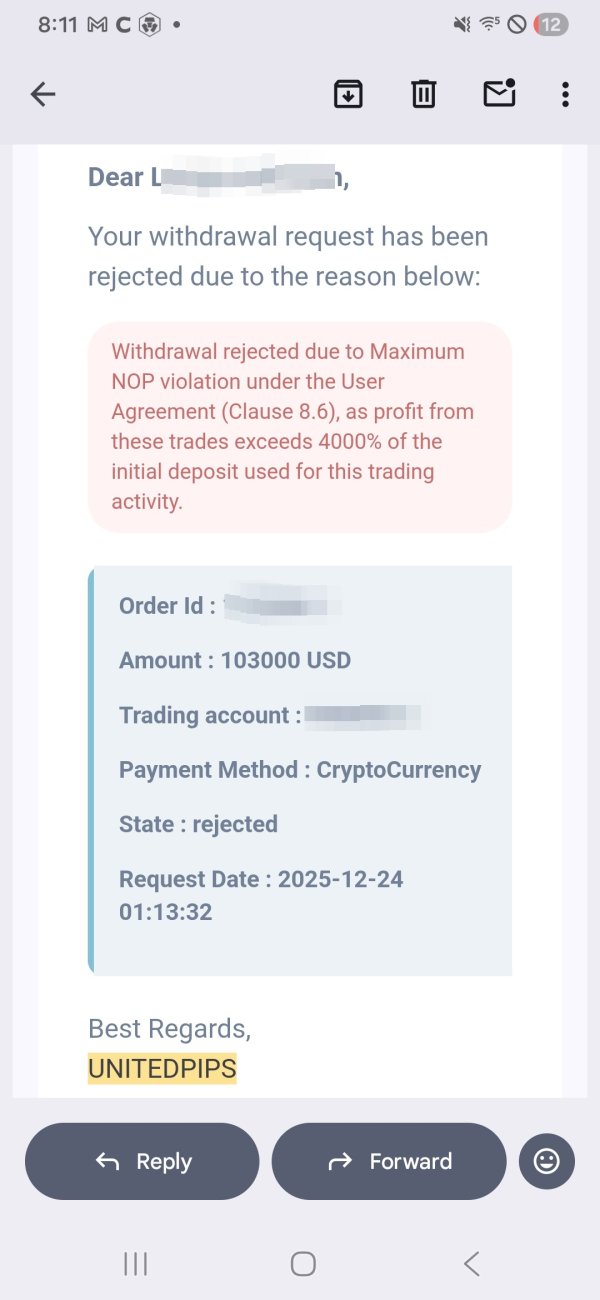

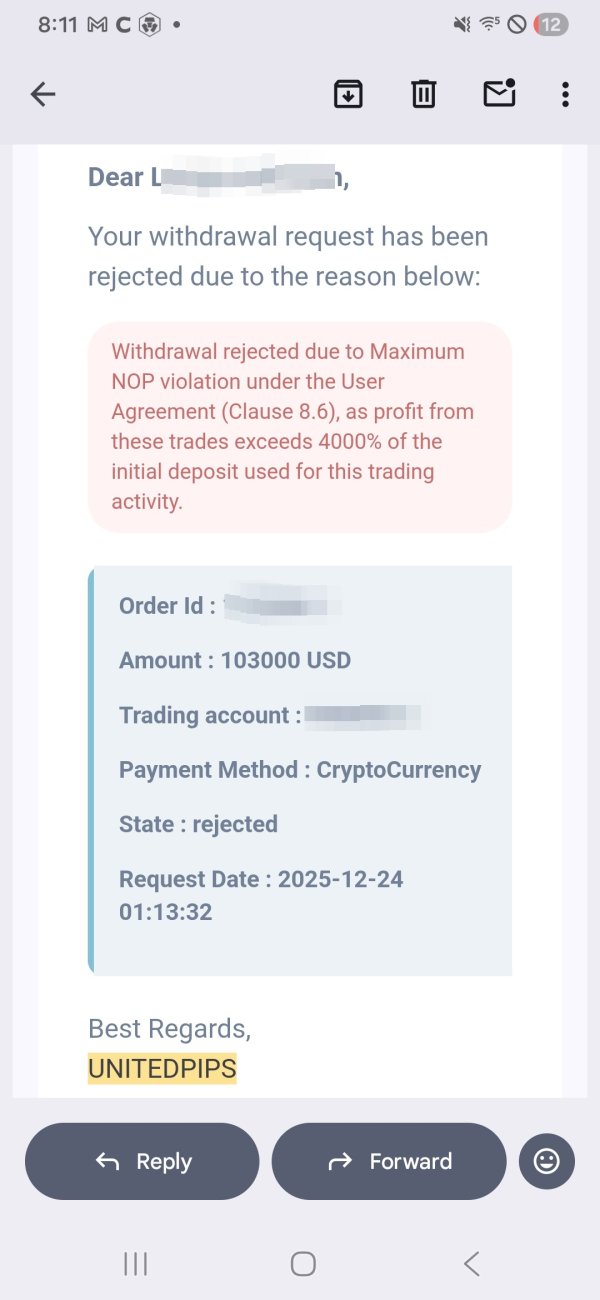

The brokerage has garnered mixed reviews, with several users vocalizing their apprehensions about withdrawal issues and fund safety. Notably, many traders emphasize the lack of responsive customer support and unresolved complaints related to account access and withdrawals. Such feedback reiterates the importance of conducting thorough research prior to engaging with the broker.

Trading Costs Analysis

Advantages in Commissions

UnitedPips has a competitive commission structure, notably a spread-only model with fixed spreads that can be as low as 0.7 pips depending on the account type. This allows traders to plan their strategies effectively without worrying about fluctuating costs, making it particularly appealing during times of heightened market volatility.

The "Traps" of Non-Trading Fees

However, the brokerage imposes considerable withdrawal fees, varying up to 5% when using PayPal. User complaints highlight dissatisfaction with these withdrawal fees, stating:

"$30 withdrawal fees on my account to access my funds without prior disclosure."

This inconsistency in fee structure creates hidden costs that can escalate trading expenses significantly.

Cost Structure Summary

For active traders who frequently enter the market, the comparatively low trading costs via spreads may seem enticing. Conversely, users with less frequent trading habits may find themselves disenchanted with withdrawal fees, which weren't communicated transparently prior to onboarding.

UnitedPips offers the proprietary Unitrader platform available as Classic, Pro, and Mobile options. Traders can access these tools via any internet-enabled device, enabling flexibility and convenience. However, without integration with industry-standard platforms like MT4 or MT5, new and experienced traders alike may feel limited in their trading capabilities.

While Unitrader boasts essential functionalities—including basic charting and analysis tools—the absence of advanced trading aids often found in established platforms may deter serious traders. Traders have expressed a desire for better integration of trading tools and more intricate analytical capabilities.

User feedback generally suggests that while Unitrader is functional, the absence of familiar industry standards (MT4/MT5) reduces user confidence. As stated by one trader:

"I had high expectations, but without MT4 features, it felt basic—definitely needs improvements."

User Experience Analysis

Onboarding Experience for New Users

The sign-up process with UnitedPips is relatively straightforward, requiring minimal information and deposits. However, issues arise with account verification, which some users have reported taking much longer than advertised.

Feedback from Experienced Traders

Many experienced traders have expressed their frustration with the limitations on account functionalities, particularly highlighting the absence of algorithmic trading support—a significant drawback for serious operators in todays trading environment.

Overall User Experience Summary

The general sentiment regarding user satisfaction is mixed; while many appreciate the platforms ease of access, the dissatisfaction around features and support permeates discussions among users. Individuals seeking a comprehensive trading tool may find their expectations unmet when engaging with UnitedPips.

Customer Support Analysis

Support Channels Offered

UnitedPips offers multiple support channels that include live chat, email, and phone support—ideal for users who may need immediate assistance. During peak usage hours, traders can expect relatively quick responses from the support team.

Response Times and Effectiveness

Feedback indicates that while initial queries often receive prompt replies, sustained issues may lead to significant delays in resolution. Some users have noted instances where their inquiries were not adequately addressed, leading to frustration.

Support Experience Summary

The effectiveness of UnitedPips customer support remains a focal point of disappointment for some users, with reports highlighting issues of unresponsive service, particularly during critical withdrawal periods.

Account Conditions Analysis

Overview of Account Types

UnitedPips offers three primary account types: Standard, Premium, and VIP. Each is designed to cater to traders varying experience levels and deposit preferences with associated minimum requirements ranging from $1 to $10,000.

Minimum Deposit Requirements

While the low initial deposit for the Standard account may appeal to new traders, higher-tier accounts demand substantial deposits, limiting options for those looking to progress to more advanced features without significant capital.

Summary of Account Conditions

Each account type presents its own benefits, but the restrictions that come with higher-tier accounts leave potential traders questioning the overall value.

Conclusion

UnitedPips positions itself as an appealing choice for beginner traders due to its low minimum deposit and high leverage offerings. However, the lack of robust regulatory oversight, ambiguous cost structures, and mixed customer support experiences considerably raise the risk profile associated with engaging this offshore brokerage. Given these factors, traders are advised to proceed with caution, conducting thorough due diligence and ensuring their investment strategy considers the inherent risks linked with UnitedPips. It ultimately serves as a stark reminder that attractive trading terms can sometimes mask a trap for the unwary.