Is Unitedpips safe?

Pros

Cons

Is UnitedPips Safe or a Scam?

Introduction

UnitedPips is an online forex brokerage that has positioned itself as a player in the global financial markets, offering a range of trading instruments including forex, cryptocurrencies, and precious metals. With the rise of online trading, the need for traders to carefully evaluate their brokers has never been more critical. Unscrupulous entities can exploit the lack of regulation in the industry, leading to significant financial losses. This article aims to provide a comprehensive analysis of UnitedPips, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. The information is gathered from various reliable sources, including broker reviews and user feedback, to ensure an objective evaluation of whether UnitedPips is a safe trading option.

Regulation and Legitimacy

The regulatory status of a broker is one of the most important factors to consider when assessing its safety. UnitedPips claims to be regulated by the International Financial Services Authority (IFSA) of Saint Lucia. Regulation by a recognized authority is crucial as it ensures that brokers adhere to strict operational standards, providing a level of protection for clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| International Financial Services Authority (IFSA) | N/A | Saint Lucia | Active |

While UnitedPips is regulated by IFSA, it is essential to note that this authority is not considered a top-tier regulator like the UKs Financial Conduct Authority (FCA) or the US Securities and Exchange Commission (SEC). The quality of regulation can directly impact the broker's accountability and transparency. Furthermore, there have been concerns regarding the historical compliance of brokers operating under similar jurisdictions, often leading to questions about the effectiveness of oversight. Therefore, while UnitedPips is technically regulated, the quality and reliability of that regulation should be carefully considered by potential traders.

Company Background Investigation

UnitedPips was established in 2017 and operates primarily out of Saint Lucia. The ownership structure of the company is somewhat opaque, which raises questions about transparency. The management teams backgrounds and professional experiences are not extensively detailed on their website, making it challenging to assess the qualifications of those running the brokerage.

The lack of transparency regarding company ownership and management can be a red flag for traders. A trustworthy broker typically provides detailed information about its team and their qualifications. Furthermore, the absence of a clear history or track record can make it difficult for potential clients to gauge the broker's reliability and commitment to ethical practices.

Trading Conditions Analysis

UnitedPips offers a competitive fee structure that includes fixed spreads and no commissions on trades. The absence of commissions is often seen as a positive, but traders should be aware of any hidden fees that may arise.

| Fee Type | UnitedPips | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.7 - 2 pips | 1 - 2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | None | Varies |

While the spreads offered by UnitedPips are competitive, they can vary significantly depending on the account type. The standard account starts with spreads of 2 pips, while the VIP account can have spreads as low as 0.7 pips. Traders should carefully review the fee structure to ensure it aligns with their trading strategies. Additionally, the lack of overnight interest (swap fees) may appeal to traders who prefer to hold positions over longer periods without incurring extra costs.

Client Fund Security

The safety of client funds is paramount when selecting a broker. UnitedPips claims to implement various security measures, including segregated accounts to keep client funds separate from the companys operational funds. This practice is essential for protecting clients in case of financial instability within the brokerage. However, it is crucial to verify whether these claims are substantiated.

Furthermore, UnitedPips does not provide clear information about investor protection schemes or negative balance protection policies. The absence of such measures can increase the risk for traders, particularly in volatile market conditions. Historical issues regarding fund security in similar offshore brokers also raise concerns about the reliability of UnitedPips in safeguarding client assets.

Customer Experience and Complaints

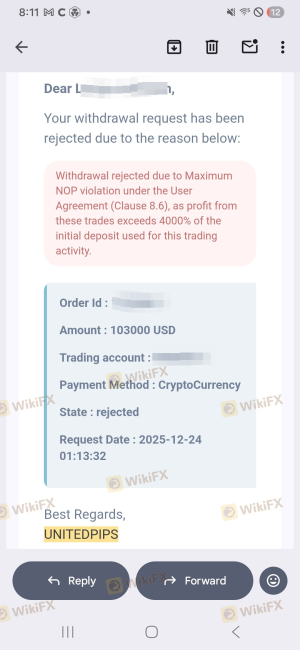

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of UnitedPips reveal a mixed bag of experiences. While some users praise the platforms functionality and customer support, others report issues with fund withdrawals and communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Often unresponsive |

| Account Blocking | High | Slow resolution |

| Customer Support Issues | Medium | Mixed reviews |

Common complaints include delays in processing withdrawals and difficulty in reaching customer support. Some users have reported their accounts being blocked without clear explanations, which is a significant concern for any trader. Such practices are often associated with untrustworthy brokers, making it imperative for potential clients to approach UnitedPips with caution.

Platform and Trade Execution

The trading platform offered by UnitedPips, known as Unitrader, is web-based and provides a user-friendly interface with advanced charting tools. However, the performance and stability of the platform are crucial for effective trading.

Many users have reported that the platform operates smoothly, but there are concerns about the execution quality. Instances of slippage and order rejections have been noted, which can significantly impact trading outcomes. If traders experience frequent execution issues, it can lead to frustration and financial losses.

Risk Assessment

When evaluating the overall risk of trading with UnitedPips, several factors come into play.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a lesser-known regulator. |

| Fund Security Risk | Medium | Claims of fund segregation but lacks investor protection details. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Service Risk | High | Frequent complaints regarding support responsiveness. |

The combination of regulatory risks and customer service issues raises significant concerns for potential traders. It is advisable for individuals to thoroughly assess their risk tolerance before engaging with UnitedPips.

Conclusion and Recommendations

In conclusion, while UnitedPips presents itself as a legitimate broker with various trading options, there are significant areas of concern that potential traders should consider. The lack of robust regulation, mixed customer reviews, and issues related to fund security and withdrawal processes suggest that caution is warranted.

For traders seeking a safer option, it may be beneficial to consider brokers with established regulatory oversight from reputable authorities, transparent practices, and positive user feedback. Options like brokers regulated by the FCA or ASIC could provide a more secure trading environment.

In summary, while is UnitedPips safe? The answer remains complex and layered with potential risks. It is essential for traders to conduct thorough research and consider their individual trading needs before proceeding.

Is Unitedpips a scam, or is it legit?

The latest exposure and evaluation content of Unitedpips brokers.

Unitedpips Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Unitedpips latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.