M Online 2025 Review: Everything You Need to Know

Executive Summary

This M Online review shows a troubling picture for traders who might consider this brokerage platform. Our detailed analysis of user feedback and market standards reveals that M Online has major problems that future clients should think about carefully. The platform has a disappointing rating of 1.7 out of 5 stars on Trustpilot, which puts it in the "Poor" category.

Even with these bad ratings, M Online does offer some good features. The platform includes a user-friendly trading system called meinTrade.ch and gives direct access to Interbank exchange rates without hidden spreads or markups. The broker targets high-risk investors, especially those who want to trade cryptocurrency and digital assets along with traditional forex markets.

The platform's clear commission structure and direct market access could help experienced traders who care more about cost transparency than full support services. But the mostly negative user feedback shows major operational problems that have hurt client satisfaction and the overall trading experience.

Important Notice

This review is based on available user feedback, market standards, and public information about M Online's services. Since there is limited regulatory information in available materials, traders should do extra research about licensing and compliance status before using this platform. Our review method includes user reviews, platform features, and industry standards to give a complete evaluation.

Rating Framework

Broker Overview

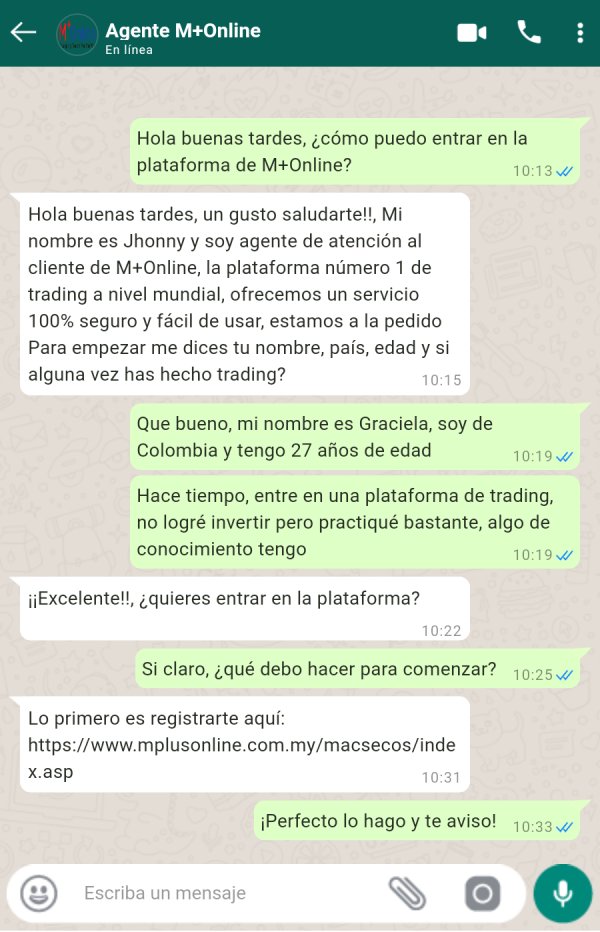

M Online works as an online trading platform that focuses on forex markets and high-risk investment opportunities, especially in the cryptocurrency sector. While we don't have much information about when it was established or its corporate background, the platform has built a presence in online trading through its own meinTrade.ch platform.

The broker's business model centers on giving direct access to interbank forex rates with clear commission structures. This avoids hidden spreads or markups that many retail forex brokers use. This approach appeals to traders who care more about cost transparency and direct market access than educational resources or extensive customer support services.

The platform focuses on high-risk investments, including cryptoassets and cryptocurrencies, which puts it in a specialized market segment. According to available information, M Online stresses the importance of understanding high-risk investment features, which suggests their target customers are experienced traders who are comfortable with volatile market conditions and significant potential losses.

Regulatory Status: Available documentation doesn't include specific regulatory information, which is a major concern for potential clients who want regulated trading environments.

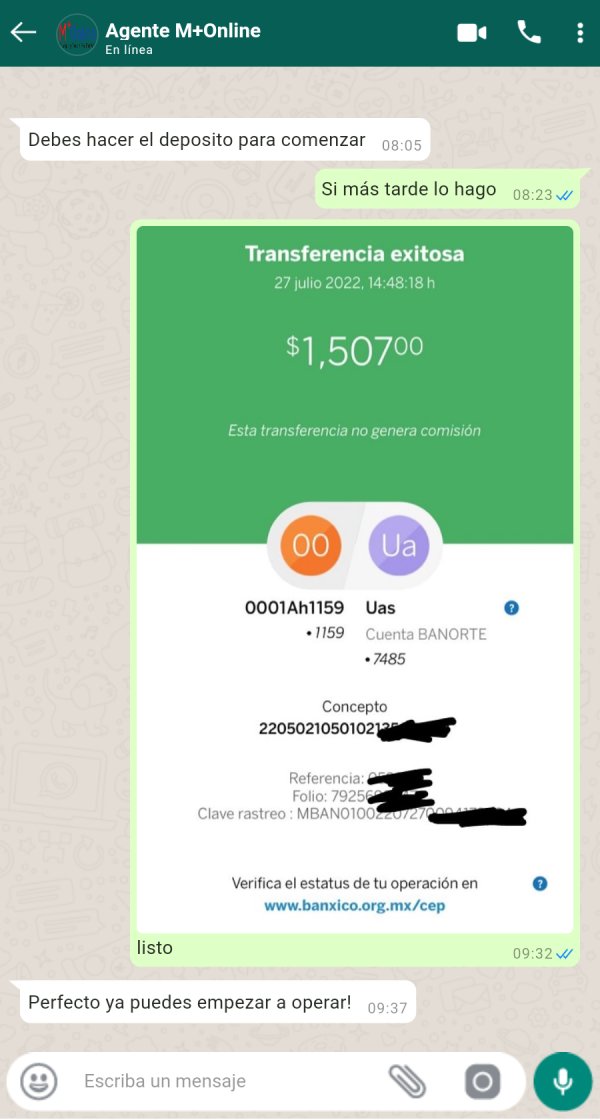

Deposit and Withdrawal Methods: Available materials don't give full details about funding options or withdrawal procedures. This could impact user experience and accessibility.

Minimum Deposit Requirements: Specific minimum deposit amounts aren't disclosed in accessible information, making it hard for potential clients to assess entry requirements.

Promotions and Bonuses: Current promotional offerings aren't detailed in available materials. This suggests limited incentive programs for new or existing clients.

Trading Assets: The platform focuses on forex trading and high-risk investments, particularly cryptocurrency assets, though specific asset counts and categories lack detailed documentation.

Cost Structure: While the platform emphasizes transparent commission structures without hidden spreads, specific pricing details aren't fully outlined in available materials.

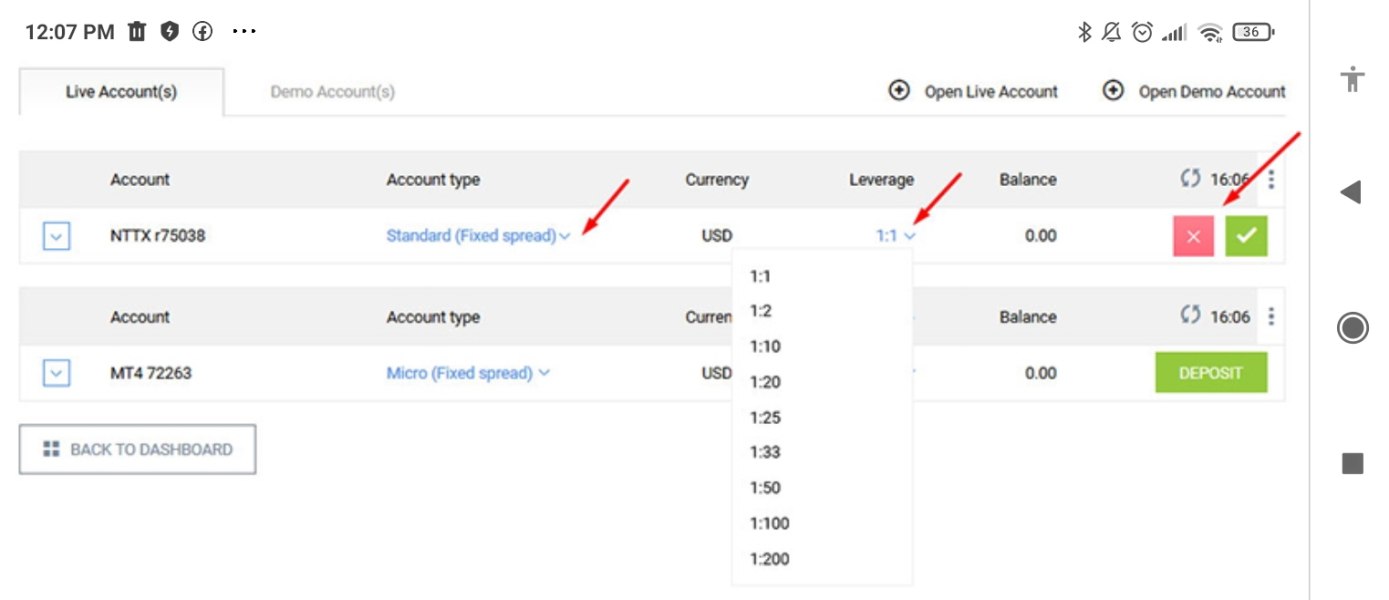

Leverage Options: Leverage ratios and margin requirements aren't specified in accessible documentation. This represents important missing information for risk assessment.

Platform Selection: The primary trading platform is meinTrade.ch, described as user-friendly, though detailed feature specifications are limited.

Geographic Restrictions: Regional limitations and availability aren't clearly outlined in available information.

Customer Support Languages: Supported languages for customer service aren't specified in accessible materials.

This M Online review highlights the significant information gaps that potential clients should consider when evaluating this platform.

Detailed Rating Analysis

Account Conditions Analysis

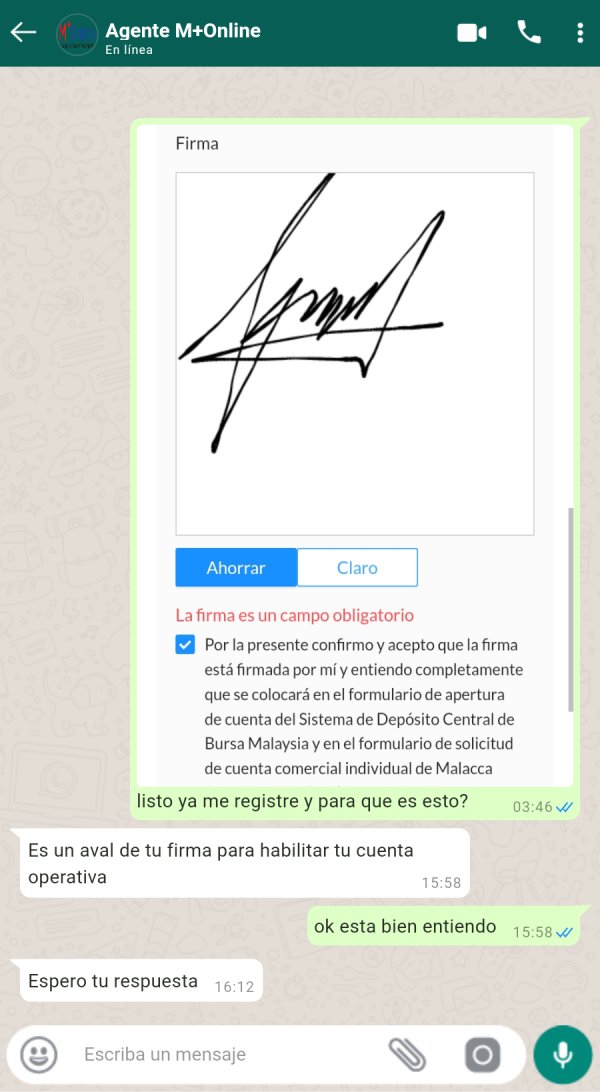

The account conditions evaluation for M Online shows major information gaps that greatly impact the overall assessment. Available documentation lacks full details about account types, minimum deposit requirements, and account opening procedures, making it very difficult for potential traders to make informed decisions about platform suitability.

Without clear information about different account tiers, fee structures, or special account features such as Islamic accounts for Muslim traders, M Online fails to meet basic transparency standards expected in the modern forex industry. The absence of detailed account specifications suggests either poor communication practices or limited account options compared to established competitors.

The platform's focus on high-risk investments may indicate specialized account structures, but the lack of clear documentation about risk management tools, account protection features, or educational resources for new traders represents a significant weakness. Professional traders typically need detailed information about account conditions to assess whether a platform meets their trading requirements and risk tolerance levels.

This M Online review emphasizes that the insufficient account condition transparency contributes greatly to the platform's poor overall rating and user satisfaction scores.

M Online's tools and resources receive a moderate rating mainly based on their meinTrade.ch platform, which is described as user-friendly and accessible for traders. The platform's emphasis on direct access to Interbank exchange rates represents a valuable feature for experienced traders who care more about market transparency and cost efficiency than comprehensive analytical tools.

The direct market access model eliminates hidden spreads and markups, giving traders transparent pricing structures that can help high-volume trading strategies. However, available information doesn't detail the extent of research resources, market analysis tools, or educational materials that modern traders typically expect from professional platforms.

The absence of full information about automated trading support, advanced charting capabilities, or third-party integration options suggests limited sophistication compared to industry-leading platforms. While the user-friendly interface may appeal to straightforward trading approaches, the lack of detailed tool specifications raises questions about platform capabilities for complex trading strategies.

Despite these limitations, the transparent pricing model and direct market access represent genuine advantages that partially offset the apparent lack of comprehensive trading resources and analytical tools.

Customer Service and Support Analysis

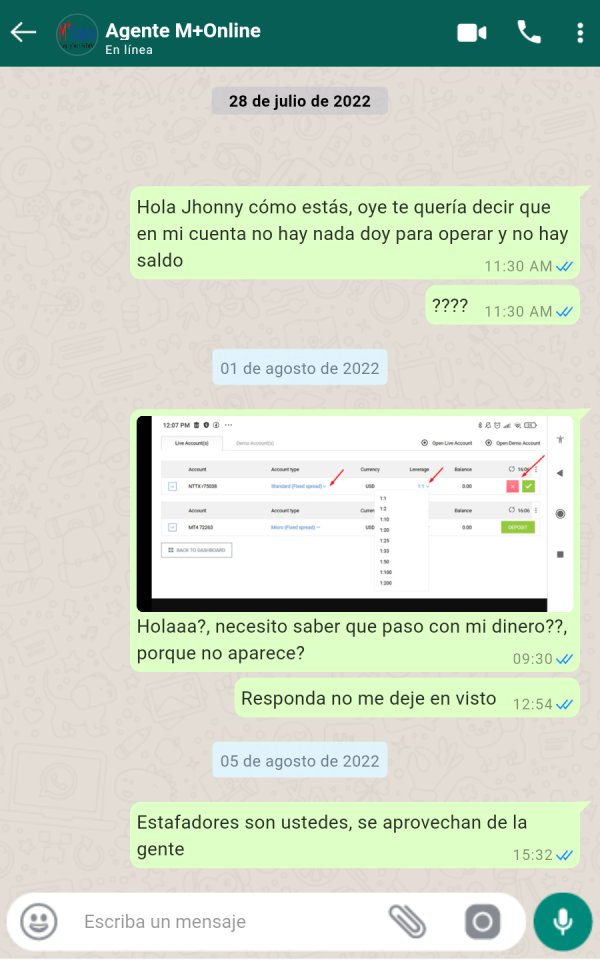

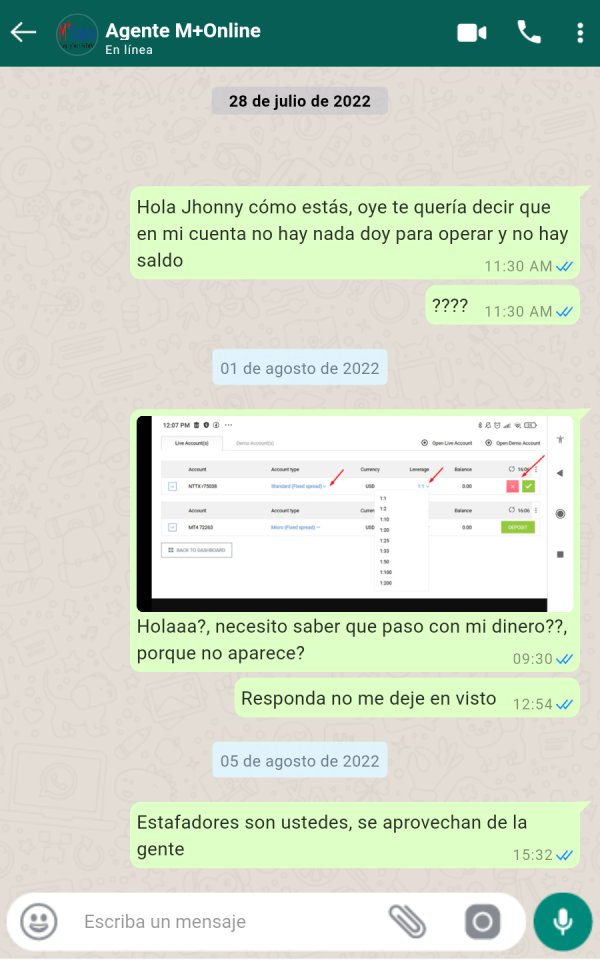

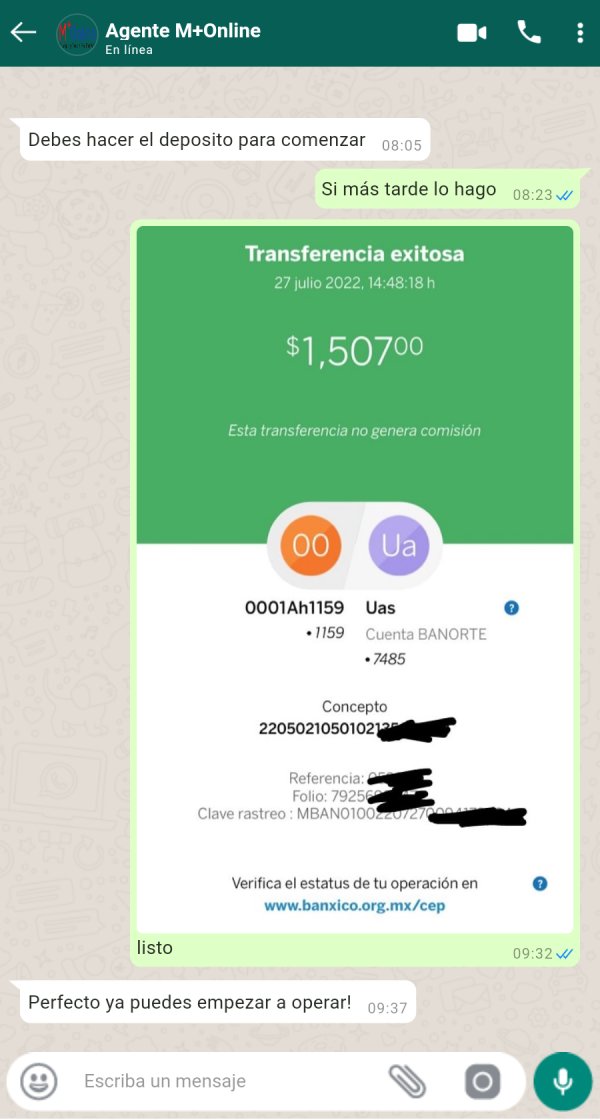

Customer service represents M Online's most significant weakness, as shown by the platform's devastating 1.7 out of 5 Trustpilot rating. User feedback consistently indicates poor service quality, inadequate response times, and unsatisfactory problem resolution, creating major concerns for potential clients who value reliable support services.

The "Poor" categorization on Trustpilot reflects systematic customer service failures that extend beyond isolated incidents to suggest fundamental operational problems. Without specific information about customer service channels, availability hours, or multilingual support options, the platform appears to lack the infrastructure necessary for professional client support.

Effective customer service is particularly crucial for forex trading platforms, where technical issues, account problems, or trading disputes require prompt and knowledgeable resolution. The consistently negative user feedback suggests that M Online fails to meet these basic requirements, potentially leaving traders without adequate support during critical trading situations.

The absence of detailed customer service information combined with overwhelmingly negative user experiences indicates that prospective clients should expect significant challenges when seeking assistance or problem resolution from this platform.

Trading Experience Analysis

The trading experience evaluation reveals mixed results, with some positive features offset by significant concerns and information gaps. M Online's direct access to Interbank rates provides genuine value for traders who care about transparent pricing and efficient market access, representing a notable advantage over brokers with hidden spreads or markup structures.

However, available information lacks crucial details about platform stability, order execution speed, or system reliability during high-volatility market conditions. The absence of specific performance metrics, uptime statistics, or user feedback about platform functionality makes it difficult to assess the actual trading environment quality.

The meinTrade.ch platform's user-friendly design may appeal to straightforward trading approaches, but the lack of detailed information about mobile trading capabilities, advanced order types, or platform customization options suggests potential limitations for sophisticated trading strategies.

While the transparent pricing model represents a genuine advantage, the overall trading experience assessment is hampered by insufficient documentation about critical performance factors and mixed user feedback that raises questions about platform reliability and functionality.

This M Online review indicates that the trading experience, while featuring some positive elements, lacks the comprehensive quality and reliability that professional traders typically require.

Trust and Reliability Analysis

Trust and reliability represent M Online's most critical weakness, earning the lowest possible rating due to multiple concerning factors. The devastating 1.7 out of 5 Trustpilot rating indicates systematic trust issues that extend far beyond normal customer service challenges to suggest fundamental reliability problems.

The absence of clear regulatory information in available documentation raises serious questions about licensing, compliance, and client fund protection. Professional forex brokers typically provide comprehensive regulatory disclosure, segregated account information, and clear dispute resolution procedures, none of which are adequately documented for M Online.

User feedback consistently indicates poor experiences that have damaged the platform's reputation and credibility within the trading community. The "Poor" rating classification on Trustpilot reflects widespread user dissatisfaction that suggests ongoing operational problems rather than isolated incidents.

Without proper regulatory oversight, transparent corporate information, or positive user experiences to establish credibility, M Online fails to meet basic trust requirements that professional traders demand. The combination of poor user feedback, limited regulatory disclosure, and inadequate transparency creates substantial risk for potential clients considering this platform.

User Experience Analysis

User experience evaluation reveals significant problems that align with the platform's poor Trustpilot ratings and negative user feedback. The overwhelming trend of dissatisfied users suggests systematic problems with platform usability, customer interaction, and overall service delivery that impact the fundamental user experience.

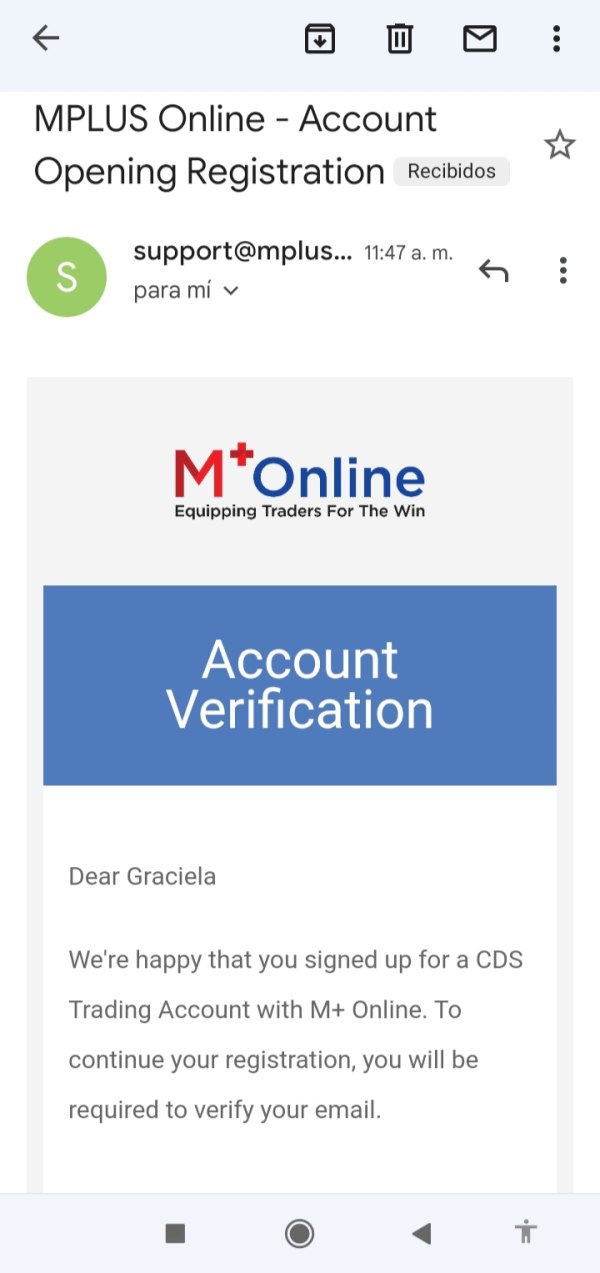

While the meinTrade.ch platform is described as user-friendly, this positive aspect appears insufficient to offset the broader user experience problems indicated by consistently negative feedback. The absence of detailed information about registration procedures, account verification processes, or funding operations suggests potential complications in basic platform interactions.

The platform's focus on high-risk investments may attract experienced traders comfortable with volatile markets, but the poor user satisfaction scores indicate that even risk-tolerant users encounter significant problems with platform operations and service quality. Common user complaints appear to center on customer service failures and operational difficulties that impact overall platform usability.

The combination of poor ratings, negative feedback trends, and limited transparency about user-facing processes suggests that M Online fails to provide the smooth, professional user experience that modern traders expect from legitimate forex platforms.

Conclusion

This comprehensive M Online review reveals a platform with significant operational challenges and trust issues that substantially outweigh any potential advantages. While the direct access to Interbank rates and transparent pricing model represent genuine features, the overwhelming negative user feedback and poor Trustpilot rating of 1.7 out of 5 indicate systematic problems that make this platform unsuitable for most traders.

The platform may appeal to highly risk-tolerant investors specifically interested in cryptocurrency trading and willing to accept poor customer service in exchange for transparent pricing. However, the lack of regulatory clarity, inadequate customer support, and consistently negative user experiences create substantial risks that most professional traders would find unacceptable.

Potential clients should carefully consider these significant limitations and explore more established, well-regulated alternatives that provide comprehensive support, transparent operations, and positive user experiences essential for successful forex trading.