Is Yum safe?

Pros

Cons

Is Yum Safe or Scam?

Introduction

Yum Group Global Limited, operating under the brand name "Yum Forex," positions itself as an online forex broker offering access to a wide array of financial markets, including foreign exchange, commodities, and indices. Given the volatile nature of the forex market, it is crucial for traders to conduct thorough due diligence when selecting a broker. The potential for scams in this industry is high, making it essential for investors to scrutinize the legitimacy and reliability of the trading platforms they choose. This article investigates whether Yum Forex is a safe trading option or a scam, utilizing various sources and evaluations to assess its regulatory status, company background, trading conditions, customer experiences, and overall risks.

Regulation and Legitimacy

Regulation in the forex trading industry serves as a critical safeguard for investors, ensuring that brokers adhere to specific standards that protect traders funds and promote fair trading practices. Unfortunately, Yum Forex currently lacks valid regulatory oversight. The following table summarizes the core regulatory information regarding Yum Forex:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns about the safety of funds deposited with Yum Forex. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the National Futures Association (NFA) in the US impose strict guidelines on brokers to ensure transparency and protect investors. Yum Forex claims to be regulated by the NFA, but investigations reveal that it is not a member and does not hold any valid licenses. This lack of oversight indicates a high potential risk for traders, as there are no legal frameworks in place to address grievances or ensure the security of client funds. Overall, the regulatory landscape for Yum Forex suggests that Yum is not safe, and traders should approach with caution.

Company Background Investigation

Yum Group Global Limited claims to have been founded in the United Kingdom, but discrepancies exist regarding its establishment date and ownership structure. The companys website suggests a foundation year of 2019, yet domain registration records indicate it was created in February 2022. This inconsistency raises questions about the transparency of the company's claims and its operational history.

The management team behind Yum Forex is not clearly disclosed, which further complicates the assessment of its credibility. Effective management is crucial in the financial services industry, as experienced leaders can significantly influence a company's ethical practices and operational integrity. The lack of information regarding the team behind Yum Forex suggests a lack of transparency, which is often a red flag for potential scams.

In terms of information disclosure, Yum Forex provides minimal details about its operations, which can lead to distrust among potential clients. Overall, the company's opaque background and questionable claims contribute to the perception that Yum is not safe for traders looking to invest their funds.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Yum Forex advertises a variety of trading instruments and claims to provide competitive spreads and leverage options. However, the specifics of their fee structure remain vague. The following table outlines the core trading costs associated with Yum Forex:

| Fee Type | Yum Forex | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.2 pips | 1.0-1.5 pips |

| Commission Structure | N/A | $5-$10 per lot |

| Overnight Interest Range | N/A | 2%-5% |

The spreads offered by Yum Forex are relatively high compared to industry standards, which could significantly impact traders' profitability. Additionally, the lack of clarity regarding commissions and overnight interest rates raises concerns about hidden fees that could further erode traders capital. High trading costs can deter potential clients and suggest that the broker may not prioritize transparency in its operations. Therefore, the trading conditions at Yum Forex do not inspire confidence, leading to the conclusion that Yum is not safe for traders seeking fair and transparent trading environments.

Client Funds Security

The safety of client funds is a paramount concern for any forex trader. A reliable broker should implement robust security measures, including segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, Yum Forex does not provide sufficient information regarding its fund security measures.

Without regulatory oversight, there are no guarantees that client funds are held in segregated accounts, which is a standard practice among reputable brokers. This lack of transparency can lead to significant risks, as traders may not have access to their funds in the event of financial difficulties faced by the broker. Historical complaints about difficulties in fund withdrawals further highlight the potential risks associated with trading with Yum Forex.

Given the absence of clear fund safety protocols and the potential for financial loss, it is reasonable to conclude that Yum is not safe for traders concerned about the security of their investments.

Customer Experience and Complaints

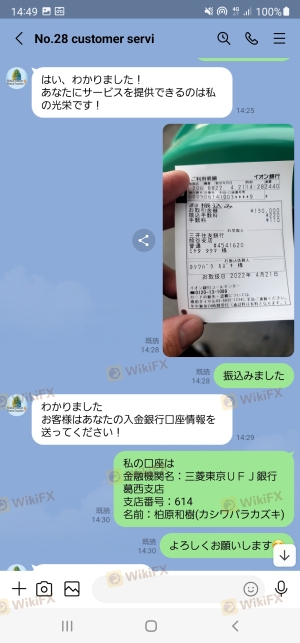

Analyzing customer feedback is crucial for understanding a broker's reputation. Reviews and complaints regarding Yum Forex indicate a pattern of negative experiences from clients. Common complaints include difficulties in withdrawing funds, misleading trading practices, and high-pressure sales tactics. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Misleading Promotions | Medium | Poor |

| Account Management Problems | High | Poor |

Typical cases involve clients who have reported being unable to access their funds, often being asked to pay additional fees before withdrawals can be processed. Such practices are indicative of potential scams, as they create barriers for clients attempting to retrieve their investments. The overall customer experience at Yum Forex suggests a lack of accountability and responsiveness to client concerns, further reinforcing the notion that Yum is not safe for traders.

Platform and Trade Execution

The quality of the trading platform is another critical factor for traders. Yum Forex claims to offer the widely recognized MetaTrader 4 platform, which is known for its user-friendly interface and comprehensive trading tools. However, user experiences indicate that the platform may suffer from performance issues, including slippage and order rejections.

Traders have reported instances of significant slippage during volatile market conditions, which can adversely affect trade outcomes. Additionally, the lack of transparency regarding the platform's operational stability raises concerns about potential manipulation or technical failures. Given these issues, the trading environment provided by Yum Forex does not instill confidence in its clients, leading to the conclusion that Yum is not safe for traders seeking reliable execution and platform performance.

Risk Assessment

Engaging with Yum Forex presents several risks that potential traders should consider. The following table summarizes the key risk areas associated with trading with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Financial Risk | High | Lack of transparency in fund security |

| Operational Risk | Medium | Potential performance issues on platform |

| Customer Service Risk | High | Poor response to client complaints |

The combined risks associated with trading at Yum Forex suggest a precarious situation for traders. Without proper regulation and accountability, clients face the potential for financial loss and inadequate support. To mitigate these risks, it is advisable for traders to seek regulated brokers with established reputations and positive client feedback.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that Yum is not safe for forex trading. The lack of regulation, transparency, and customer support, coupled with numerous complaints and operational issues, indicate that Yum Forex operates in a high-risk environment. Traders should exercise extreme caution and consider alternative brokers with stronger regulatory oversight and positive customer experiences.

For those seeking reliable trading options, it is advisable to explore well-regulated brokers known for their transparency, competitive trading conditions, and robust customer support. By prioritizing safety and reliability, traders can better protect their investments and enhance their trading experiences.

Is Yum a scam, or is it legit?

The latest exposure and evaluation content of Yum brokers.

Yum Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Yum latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.