Is Winpips safe?

Business

License

Is Winpips Safe or Scam?

Introduction

Winpips is a relatively new entrant in the forex trading market, positioning itself as a broker that claims to offer a variety of trading options, including forex, commodities, and cryptocurrencies. With the allure of competitive trading conditions and advanced trading platforms, it has attracted the attention of both novice and experienced traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to provide an objective analysis of Winpips, examining its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation is based on a review of multiple sources, including user reviews, regulatory information, and expert analyses, to assess whether Winpips is safe or if it poses potential risks to traders.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for determining its legitimacy and the safety of client funds. Winpips operates under a license purportedly issued by the local financial regulatory authority in Cambodia. However, the broker's regulatory information has raised concerns among industry experts and traders alike. Below is a summary of the core regulatory details:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Exchange Regulator of Cambodia | Not specified | Cambodia | Not verified |

The lack of a valid and recognized regulatory license is a significant red flag. Reputable forex brokers are typically regulated by established authorities such as the FCA in the UK, ASIC in Australia, or CySEC in Cyprus. The absence of such oversight suggests that Winpips may not adhere to the stringent requirements that protect traders from fraud and malpractice. Furthermore, the historical compliance of Winpips remains questionable, with reports indicating that the broker has faced issues related to fund withdrawal and customer service responsiveness.

Company Background Investigation

Winpips is reported to have been established in the last few years, but detailed information about its ownership structure and corporate history is limited. The company's website lacks transparency, as it does not provide information about its founders, management team, or corporate governance. This anonymity raises concerns regarding the broker's accountability and operational integrity.

The management team is critical in establishing a broker's credibility. Unfortunately, there is little to no publicly available information on the qualifications and experience of Winpips' management. This lack of transparency is concerning, as a competent and experienced management team is essential for the effective operation of a trading platform. The overall opacity surrounding Winpips and its corporate structure further fuels skepticism about whether Winpips is safe for traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. Winpips claims to offer competitive spreads and various account types; however, the specifics regarding fees and trading costs are not clearly outlined. Below is a comparison of core trading costs:

| Fee Type | Winpips | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1.0 - 2.0 pips |

| Commission Model | Not specified | $0 - $10 per lot |

| Overnight Interest Range | Not specified | Varies by broker |

The lack of transparency in Winpips' fee structure is alarming. Traders often face unexpected costs when brokers do not clearly disclose their fees, which can lead to frustration and financial loss. Additionally, the absence of specified spreads and commission models raises questions about the broker's overall trading environment. This uncertainty contributes to the growing concern among traders about whether Winpips is safe for their investments.

Customer Funds Security

The safety of customer funds is a critical factor when evaluating any forex broker. Winpips claims to maintain client funds in segregated accounts, which is a standard practice among reputable brokers. However, there is insufficient evidence to verify these claims. The lack of a clear policy on fund protection, negative balance protection, and investor compensation schemes raises serious concerns about the safety of traders' investments.

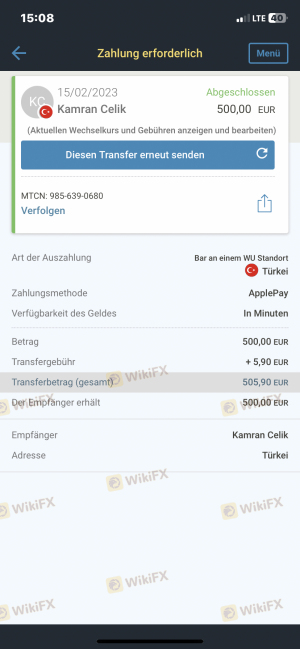

Historically, there have been reports of customers facing difficulties in withdrawing their funds from Winpips. Such issues can indicate deeper problems within the broker's operational framework, potentially putting clients' investments at risk. The absence of a robust regulatory framework further exacerbates these concerns. As traders weigh their options, it is essential to consider whether Winpips is safe to trade with, given the potential risks associated with fund security.

Customer Experience and Complaints

User feedback is an invaluable resource for assessing a broker's reliability. Reviews of Winpips reveal a pattern of dissatisfaction among customers, particularly regarding withdrawal processes and customer service responsiveness. Below is a summary of the most common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Inconsistent |

| Account Management Problems | High | Poor |

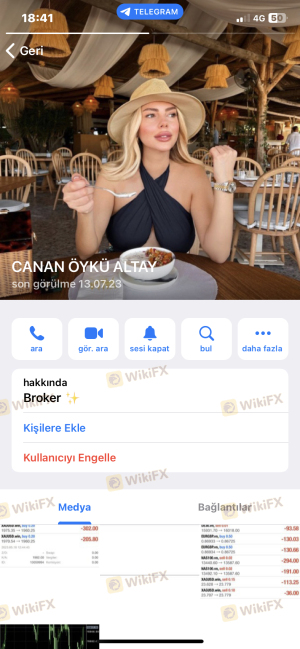

Several users have reported being unable to withdraw their funds, with claims of additional fees being imposed unexpectedly. Such experiences are alarming and suggest that the broker may not prioritize customer satisfaction. For instance, one user reported that despite a significant balance in their account, they faced challenges when attempting to withdraw funds, leading to frustration and financial distress. These complaints raise significant concerns about whether Winpips is safe for traders looking to invest their hard-earned money.

Platform and Trade Execution

The trading platform offered by Winpips is another crucial aspect to evaluate. While the broker claims to provide a user-friendly interface and access to popular trading tools, there have been reports of technical issues affecting trade execution. Traders have experienced slippage, order rejections, and delays when placing trades, which can severely impact trading performance.

The quality of order execution is vital for traders, as delays and inaccuracies can lead to financial losses. Additionally, any signs of platform manipulation should raise red flags. The combination of technical difficulties and user complaints further complicates the question of whether Winpips is safe for trading.

Risk Assessment

Using Winpips carries inherent risks that potential traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation and oversight. |

| Fund Security Risk | High | Unclear policies on fund protection and withdrawal. |

| Customer Service Risk | Medium | Poor responsiveness and unresolved complaints. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Winpips. Seeking out regulated brokers with established reputations can provide a safer trading environment. Additionally, maintaining a cautious approach when investing with unregulated brokers is crucial for long-term success in the forex market.

Conclusion and Recommendations

In conclusion, the evidence suggests that Winpips is not a safe option for traders. The lack of transparency regarding its regulatory status, combined with numerous complaints about withdrawal issues and customer service, raises significant concerns about the broker's legitimacy. For traders seeking to invest their funds, it is essential to prioritize safety and reliability.

Given the potential risks associated with Winpips, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Such brokers typically offer better protection for client funds and more transparent trading conditions. Ultimately, traders should remain vigilant and conduct thorough due diligence before committing to any forex broker, especially one like Winpips that exhibits several warning signs.

Is Winpips a scam, or is it legit?

The latest exposure and evaluation content of Winpips brokers.

Winpips Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Winpips latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.