Is Winfxmarkets safe?

Business

License

Is Winfxmarkets Safe or Scam?

Introduction

Winfxmarkets positions itself as an online trading platform catering to forex and CFD traders. It claims to offer a user-friendly interface and a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the rapid growth of online trading has also led to an influx of unregulated brokers, making it essential for traders to exercise caution and perform thorough evaluations before committing their funds. In this article, we will investigate whether Winfxmarkets is a legitimate trading platform or a potential scam. Our assessment will be based on regulatory compliance, company background, trading conditions, customer feedback, and risk evaluation.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for ensuring the safety of traders' funds. Winfxmarkets claims to operate under a UK address, but it lacks authorization from the Financial Conduct Authority (FCA), the primary regulatory body in the UK. The FCA has issued warnings against Winfxmarkets, indicating that it operates without the necessary licenses. This lack of regulation raises significant concerns about the safety of funds deposited with this broker.

Regulatory Information Table:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Authorized |

The absence of a regulatory license means that traders using Winfxmarkets have no access to investor protection schemes, such as the Financial Services Compensation Scheme (FSCS). This situation is alarming, as it leaves traders vulnerable to potential fraud and financial loss. Thus, it is crucial to assess the quality of regulation and historical compliance when evaluating whether Winfxmarkets is safe.

Company Background Investigation

Winfxmarkets is operated by Winfxmarkets Ltd, which claims to be based in London. However, the companys history is relatively short, having been established only in 2022. There is limited information available regarding its ownership structure and management team, which raises questions about its transparency and credibility.

The lack of detailed information about the company's founders and their professional backgrounds further adds to the skepticism surrounding Winfxmarkets. A legitimate broker typically provides comprehensive information about its management team, including their qualifications and experience in the financial industry. In contrast, Winfxmarkets seems to lack this level of transparency, making it difficult to ascertain whether it is a trustworthy entity.

Trading Conditions Analysis

When evaluating a broker, understanding their trading conditions is essential. Winfxmarkets advertises various account types, each with different minimum deposit requirements and spreads. However, the overall fee structure lacks clarity, and there are reports of unusual fees that could catch traders off guard.

Trading Costs Comparison Table:

| Cost Type | Winfxmarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Winfxmarkets appear to be higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of a clear commission structure raises concerns about hidden fees that could affect the overall trading experience. Thus, it is vital for potential clients to question whether Winfxmarkets is safe given these unfavorable trading conditions.

Customer Funds Security

The safety of customer funds is paramount when trading online. Winfxmarkets claims to implement various security measures; however, it does not provide detailed information regarding segregated accounts or investor protection policies. The lack of clarity surrounding these critical aspects raises concerns about the safety of funds deposited with the broker.

Moreover, the FCA's warning about Winfxmarkets indicates that the broker does not adhere to the necessary regulations that protect client funds. This situation creates a significant risk for traders, as they may not have legal recourse in the event of financial mismanagement or fraud. Therefore, assessing whether Winfxmarkets is safe involves looking closely at its customer fund security measures.

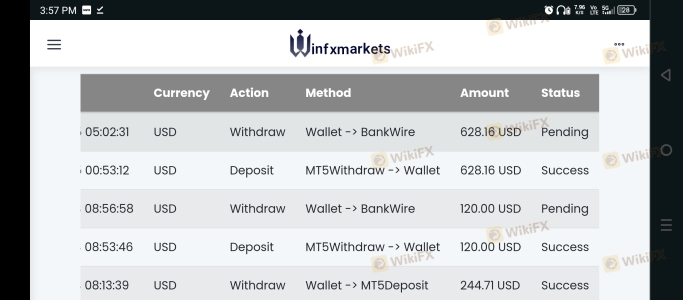

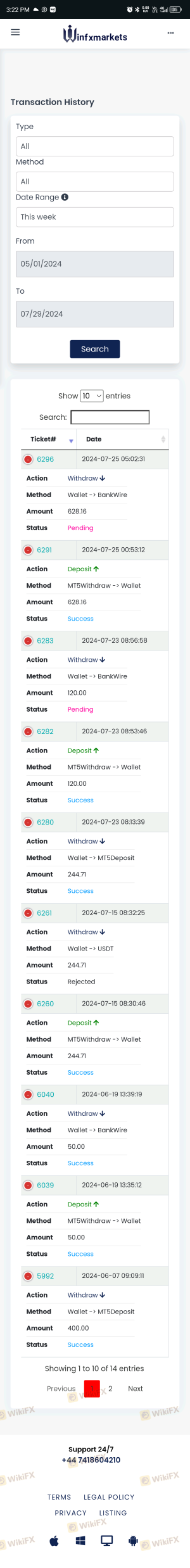

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. Numerous reports from traders indicate dissatisfaction with Winfxmarkets, particularly regarding withdrawal issues. Common complaints include delays in processing withdrawal requests, unresponsive customer service, and unexpected fees imposed during the withdrawal process.

Complaint Types and Severity Assessment Table:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Account Suspension | High | Unresponsive |

| Hidden Fees | Medium | Inconsistent |

Several traders have reported being unable to withdraw their funds after initial successful transactions, leading to suspicions of fraudulent activity. These patterns of complaints suggest that Winfxmarkets may not be a reliable broker. Therefore, it is crucial to consider whether Winfxmarkets is safe based on the experiences of other traders.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders seeking to execute trades efficiently. Winfxmarkets claims to offer a robust trading platform; however, user experiences indicate issues with stability and execution quality. Reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes.

Additionally, the absence of advanced trading tools and features typically found in reputable platforms raises concerns about the overall trading experience. If traders encounter frequent issues with execution, it could indicate deeper problems within the platform's operational framework, further questioning whether Winfxmarkets is safe for trading.

Risk Assessment

Using an unregulated broker like Winfxmarkets presents several risks that traders must consider. The lack of regulatory oversight, combined with numerous complaints and withdrawal issues, creates a high-risk environment for potential investors.

Risk Rating Summary Table:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Withdrawal Risk | High | Reports of denied or delayed withdrawals |

To mitigate these risks, potential traders should conduct thorough research, avoid depositing large sums of money, and consider using regulated alternatives.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Winfxmarkets is not a safe trading platform. The lack of regulation, high-risk trading conditions, and numerous customer complaints indicate that traders should exercise extreme caution. It is advisable to avoid investing with Winfxmarkets and instead consider regulated brokers that offer robust investor protections.

For traders seeking reliable alternatives, consider platforms regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers are more likely to provide a secure trading environment and better overall trading conditions. As the online trading landscape continues to evolve, prioritizing safety and regulation is essential for protecting your investments.

Is Winfxmarkets a scam, or is it legit?

The latest exposure and evaluation content of Winfxmarkets brokers.

Winfxmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Winfxmarkets latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.