Is QC safe?

Pros

Cons

Is QC Finances A Scam?

Introduction

QC Finances is a relatively new player in the forex market, claiming to offer a wide range of trading instruments including forex, cryptocurrencies, stocks, commodities, and indices. As with any financial service provider, traders must exercise caution when selecting a broker, as the forex industry has a history of scams and unregulated entities. The importance of due diligence cannot be overstated; a brokers legitimacy can significantly impact a trader's financial safety and success. This article will provide a comprehensive analysis of QC Finances, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment.

To ensure a thorough evaluation, this investigation is based on a review of various online sources, customer feedback, and regulatory databases. The assessment framework will cover the broker's compliance with legal standards, the transparency of its operations, and the experiences of its clients. By the end of this article, readers will have a clearer understanding of whether QC Finances is a reputable broker or a potential scam.

Regulation and Legitimacy

One of the first aspects to consider when evaluating QC Finances is its regulatory status. A broker's regulation is crucial as it serves as a safeguard for traders, ensuring that the broker operates within a legal framework designed to protect clients' funds. Unfortunately, QC Finances has been flagged as an unregulated broker, operating without the necessary licenses from recognized financial authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities Commission of the Bahamas (SCB) | N/A | Bahamas | Not Listed |

The absence of a valid license from a reputable regulatory body raises significant concerns regarding the broker's legitimacy. QC Finances claims to be regulated by the SCB, but a search in the SCB's database reveals no record of such a registration. This lack of oversight indicates that QC Finances is operating illegally, and traders should be wary of engaging with this broker. The high leverage offered by QC Finances, reaching up to 1:500, is another red flag, as regulatory bodies typically impose lower leverage limits to protect retail traders from excessive risk.

Company Background Investigation

QC Finances presents itself as a global brokerage with purported headquarters in Sydney, Australia, and Switzerland. However, the legitimacy of these claims is questionable. The broker lacks transparency regarding its ownership structure and management team, which is often a warning sign in the forex industry.

The absence of detailed information about the company's history, development, and ownership raises concerns about its credibility. In a well-regulated environment, brokers are required to disclose information about their management and operational history. This lack of transparency is particularly alarming for potential investors, as it suggests that the broker may be attempting to obscure its true nature.

Furthermore, the company's website does not provide any legal documentation, such as terms and conditions or privacy policies, which are essential for understanding the broker's operations and client rights. This lack of information only adds to the suspicion that QC Finances may not be a legitimate entity.

Trading Conditions Analysis

When it comes to trading conditions, QC Finances offers a range of accounts with varying minimum deposit requirements and leverage options. However, the overall fee structure appears to be unfavorable compared to industry standards.

| Fee Type | QC Finances | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.4 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The spreads offered by QC Finances are significantly higher than the industry average, indicating that traders may incur higher trading costs. Additionally, the lack of a clear commission model raises questions about hidden fees that could affect profitability.

Moreover, the brokers policy on bonuses, which are often used as incentives, is concerning since bonuses are frequently associated with withdrawal restrictions. This practice is typically seen in unregulated environments and can lead to difficulties when attempting to access funds.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading environment. QC Finances does not provide clear information regarding its fund safety measures. There is no indication that client funds are held in segregated accounts, a practice that is standard among regulated brokers to protect clients investments in the event of bankruptcy.

Moreover, the absence of investor protection schemes raises further concerns. In regulated environments, brokers are often required to participate in compensation schemes that protect clients funds up to a certain amount. Without such protections, traders using QC Finances face a higher risk of losing their investments.

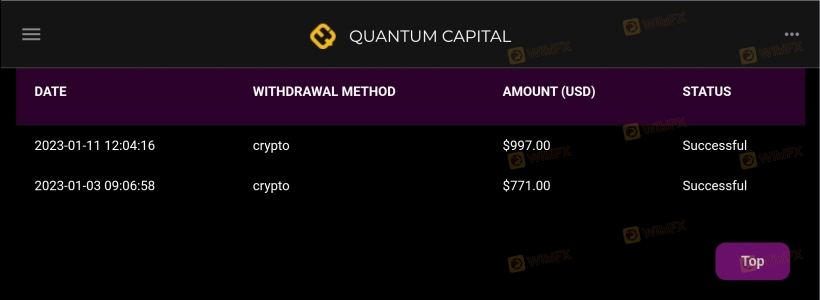

Historically, unregulated brokers like QC Finances have been involved in numerous disputes and complaints regarding fund withdrawals, further emphasizing the need for caution when considering this broker.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. In the case of QC Finances, numerous complaints have surfaced, indicating widespread dissatisfaction among users. Common issues include difficulties in withdrawing funds, lack of communication from customer service, and unexpected fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Hidden Fees | High | Poor |

One notable case involved a trader who reported that after investing a significant amount, they faced severe difficulties when attempting to withdraw their funds. The broker ceased communication, and the trader was left without access to their investment. Such experiences are indicative of a potentially fraudulent operation.

Platform and Trade Execution

QC Finances claims to offer an advanced trading platform; however, user experiences suggest otherwise. The platform is described as basic and lacking essential features found in industry-standard platforms like MetaTrader 4 or 5.

Issues related to order execution, such as slippage and high rejection rates, have been reported by users. These problems can significantly impact a trader's ability to execute profitable trades and raise concerns about the broker's integrity.

Furthermore, the absence of robust security measures on the platform raises alarms about potential manipulation or unauthorized access to user accounts.

Risk Assessment

Using QC Finances poses several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Fund Safety Risk | High | No segregation of client funds. |

| Execution Risk | Medium | Reports of slippage and rejections. |

| Transparency Risk | High | Lack of information about the company. |

To mitigate these risks, traders should conduct thorough research and consider trading with regulated brokers that offer transparency, security, and clear communication regarding fees and policies.

Conclusion and Recommendations

In conclusion, the evidence suggests that QC Finances operates as an unregulated broker with numerous red flags indicating potential scams. The lack of regulation, transparency, and poor customer reviews all point to significant risks for traders.

For those considering trading in the forex market, it is advisable to avoid QC Finances and instead seek out reputable, regulated brokers. Recommendations include brokers that are licensed by recognized authorities such as the FCA, ASIC, or CySEC, which provide a safer trading environment with robust investor protections.

In summary, QC Finances is not a safe choice for traders. The risks associated with this broker far outweigh any potential benefits, and traders should prioritize their financial safety by choosing a regulated and trustworthy broker.

Is QC a scam, or is it legit?

The latest exposure and evaluation content of QC brokers.

QC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

QC latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.