Is EnticeCapital safe?

Business

License

Is Entice Capital A Scam?

Introduction

Entice Capital is an online trading platform that positions itself as a forex broker, catering to traders looking for various investment opportunities. With the increasing number of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and safety of these brokers to protect their investments. This article aims to provide an objective analysis of Entice Capital, focusing on its regulatory compliance, company background, trading conditions, client fund safety, customer experiences, platform performance, and risk assessment. The evaluation is based on a thorough review of various sources, including regulatory warnings, user feedback, and financial analyses.

Regulation and Legitimacy

The regulatory status of a trading platform is a key indicator of its legitimacy. Entice Capital claims to be registered in Saint Lucia, promoting this registration as a sign of its credibility. However, it is important to note that forex trading activities are not licensed in Saint Lucia, leaving Entice Capital unregulated. This lack of oversight raises significant concerns about the safety of client funds and the potential for fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Lucia | Unverified |

The absence of a valid regulatory license means that Entice Capital does not adhere to the stringent standards imposed by reputable financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This lack of regulation exposes traders to heightened risks, including the potential loss of funds without any recourse for recovery. The importance of regulatory oversight cannot be overstated, as it ensures transparency, accountability, and legal protection for investors. Given these factors, it is prudent for traders to approach Entice Capital with caution.

Company Background Investigation

Entice Capital is operated by Entice Capital Limited, which is based in Saint Lucia. However, there is limited publicly available information regarding the company's history, ownership structure, and management team. The lack of transparency surrounding the company's operations is a red flag for potential investors. A reputable broker typically provides detailed information about its founders and executives, including their professional backgrounds and experience in the financial industry.

The absence of such information about Entice Capital raises concerns about its credibility and trustworthiness. Without a clear understanding of the company's leadership and operational history, traders may find it challenging to assess the platform's reliability. Furthermore, the company's claims of providing a secure trading environment become less credible in the absence of verifiable background information. Therefore, it is essential for traders to conduct thorough research before engaging with Entice Capital and consider the implications of its opaque corporate structure.

Trading Conditions Analysis

When evaluating a trading platform, understanding its fee structure and trading conditions is vital. Entice Capital offers various account types, each with different minimum deposit requirements and trading conditions. However, the overall fee structure and potential hidden costs remain a concern. Traders should be aware of any unusual or problematic fee policies that could affect their trading experience.

| Fee Type | Entice Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.8 pips | 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low |

The spreads offered by Entice Capital appear to be higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of a clear commission structure raises questions about potential hidden fees. Traders should exercise caution and carefully review the terms and conditions before committing to any investments with Entice Capital. Understanding the trading costs is essential for making informed decisions and maximizing returns.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Entice Capital's lack of regulation raises significant questions about its client fund safety measures. Regulated brokers are typically required to implement stringent security protocols, including segregating client funds and participating in investor protection schemes. However, Entice Capital does not appear to offer these safeguards, leaving clients vulnerable to potential financial loss.

The absence of information regarding fund segregation and negative balance protection policies further exacerbates concerns about the safety of client investments. Traders should be wary of platforms that do not provide clear assurances regarding the protection of their funds. The lack of historical data on any past fund security issues or disputes involving Entice Capital further complicates the assessment of its trustworthiness. As such, it is crucial for traders to prioritize platforms with established reputations for client fund safety.

Customer Experience and Complaints

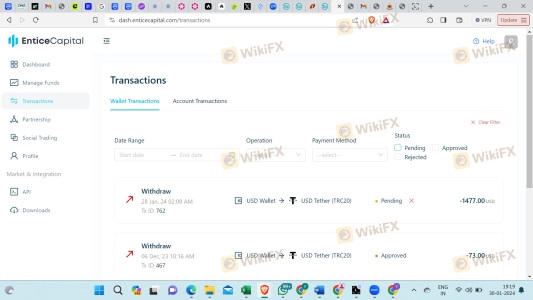

Customer feedback is an essential aspect of evaluating any trading platform. Reviews and testimonials can provide valuable insights into the experiences of real users. However, numerous complaints have been reported against Entice Capital, indicating potential issues with customer support and fund withdrawals. Common complaints include delays in processing withdrawal requests, unexpected fees, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Unexpected Fees | Medium | Slow response |

| Poor Customer Support | High | Unresolved |

For instance, users have reported difficulties in withdrawing their funds after making deposits, with some experiencing unexplained delays and excessive fees. Such issues are significant red flags, as they suggest potential fraudulent practices. Traders should be cautious when considering Entice Capital, as the pattern of complaints indicates a concerning level of customer dissatisfaction. It is essential to weigh these experiences against the potential benefits of trading with this broker.

Platform and Trade Execution

The performance and reliability of a trading platform are critical components of a trader's experience. Entice Capital claims to provide a seamless trading environment with fast execution and low latency. However, the lack of independent reviews and performance metrics makes it challenging to assess the platform's actual performance.

Traders should be aware of any signs of manipulation, such as excessive slippage or frequent order rejections, as these can significantly impact trading outcomes. The absence of verifiable data on order execution quality raises concerns about the platform's integrity. Traders are encouraged to conduct thorough research and seek feedback from other users to gauge the reliability of Entice Capital's trading platform.

Risk Assessment

Engaging with an unregulated trading platform like Entice Capital introduces several risks for traders. The lack of regulatory oversight, combined with the potential for hidden fees and poor customer service, creates an environment where traders may face significant financial losses without any recourse for recovery.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds without protection |

| Customer Service Risk | Medium | Poor support and unresolved complaints |

To mitigate these risks, traders should consider diversifying their investments and only engaging with regulated brokers that provide clear assurances regarding client fund safety and transparent trading conditions. It is advisable to conduct thorough research and seek out reputable alternatives to Entice Capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that Entice Capital raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, combined with a troubling history of customer complaints and opaque trading conditions, indicates that traders should exercise extreme caution. The potential for financial loss is high, and the absence of legal protections further complicates the situation.

For traders seeking a reliable and secure trading environment, it is recommended to consider regulated brokers with established reputations and transparent operations. Platforms like FCA-regulated brokers or those under ASIC supervision may offer a safer alternative for forex trading. Ultimately, conducting thorough research and prioritizing platforms that prioritize client safety is essential for protecting investments in the volatile forex market.

In summary, the question of whether Is Entice Capital Safe is answered with caution: potential traders should be wary and consider more reputable options to safeguard their investments.

Is EnticeCapital a scam, or is it legit?

The latest exposure and evaluation content of EnticeCapital brokers.

EnticeCapital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EnticeCapital latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.