Blackwell Global 2025 Review: Everything You Need to Know

Summary

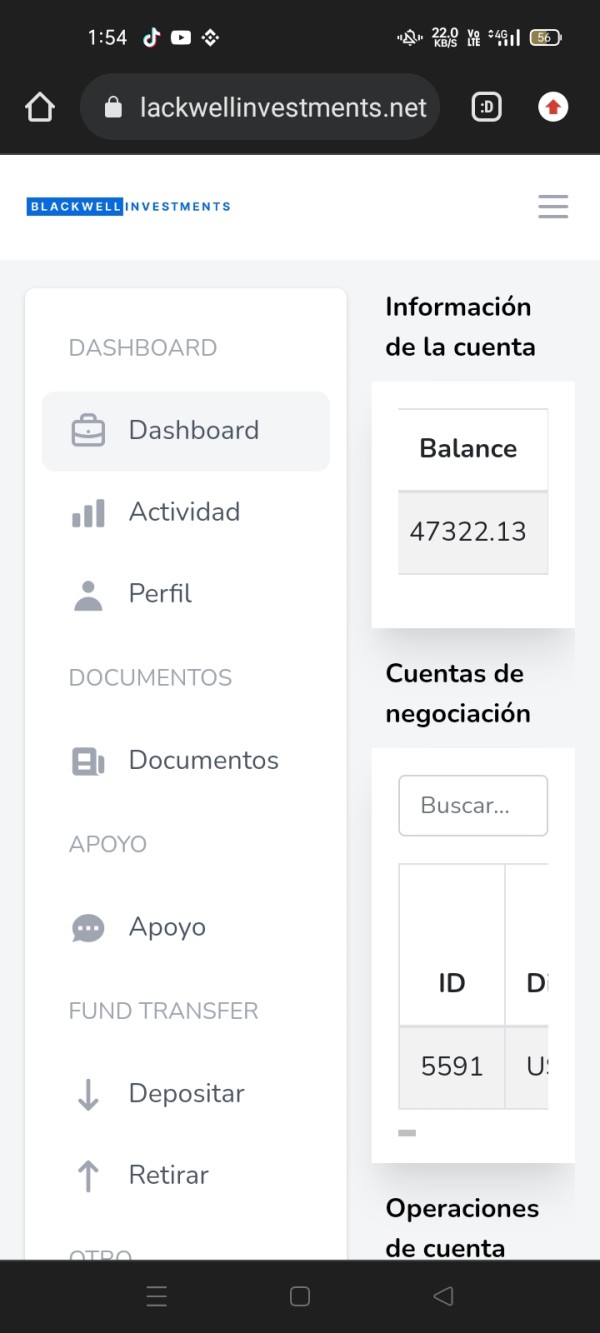

Blackwell Global is a regulated forex broker that has gotten mixed reviews from traders. The trading community has different opinions about this company. According to various industry reports, this blackwell global review shows a broker with a user rating of 3 out of 5 stars, which means moderate satisfaction among its clients. The company offers competitive trading fees and works in multiple countries. It serves traders and investors in over 30 countries around the world.

The broker has several key strengths. These include a diverse range of trading platforms and comprehensive asset classes covering forex, CFDs, indices, and commodities. Blackwell Global provides both mobile apps and desktop trading clients. This setup caters to different trading preferences and styles. The company also offers detailed research tools and analytical resources to help traders make decisions.

However, users have shared concerns about company culture and bonus plans. Several reviews show dissatisfaction with how the company runs internally and how it handles compensation. Despite these challenges, the broker keeps its regulatory status and continues serving clients worldwide with competitive fees that appeal to cost-conscious traders.

The main target audience includes forex traders and investors who want access to international markets through a regulated platform. The broker works in multiple countries, making it accessible to traders in different regions. However, specific regulatory details change depending on location.

Important Notice

Blackwell Global operates under different rules in various countries. The specific regulatory bodies and license numbers may change depending on where you live and which entity you trade with. Traders should check the regulatory status that applies to their region before opening an account.

This review uses publicly available information, user feedback, and company materials. Market conditions, regulatory requirements, and broker offerings may change over time. The assessments here reflect information available when this was written and may include subjective elements based on user experiences and industry analysis.

Rating Framework

Broker Overview

Blackwell Global started in 2010 and positions itself as an international financial services provider based in London. The company offers a complete suite of trading services covering foreign exchange, contracts for difference (CFDs), indices, and commodities trading. Their business model focuses on serving retail clients, fund managers, and industry professionals across more than 30 countries globally.

The broker built its reputation on providing access to diverse financial markets through multiple trading platforms. Their service portfolio includes both traditional forex trading and expanded asset classes such as precious metals, oil, and major global indices. The company's international reach shows its goal to serve traders across different time zones and regulatory environments.

According to industry sources, Blackwell Global maintains regulatory compliance across its operating areas. However, specific regulatory details are not extensively documented in available materials. This blackwell global review shows that while the company operates as a regulated entity, traders should verify the specific regulatory framework that applies to their region. The broker's longevity in the market, having operated for over a decade, suggests some stability and market acceptance despite mixed user reviews.

Regulatory Regions: Blackwell Global operates across multiple areas with regulatory compliance varying by region. Specific regulatory bodies and license numbers are not detailed in available documentation. Traders need to verify applicable regulations for their location.

Deposit and Withdrawal Methods: Available documentation does not specify the exact payment methods supported by Blackwell Global. Traders should contact the broker directly for current deposit and withdrawal options available in their region.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in the available information. Account opening requirements may vary based on account type and regulatory area.

Bonus and Promotions: Current promotional offerings are not extensively detailed in available materials. User feedback suggests some dissatisfaction with bonus plan implementations. This indicates potential issues with promotional structures.

Tradeable Assets: The broker offers trading in foreign exchange pairs, contracts for difference (CFDs), major global indices, and commodities including precious metals and oil. This diverse asset selection provides traders with multiple market exposure opportunities.

Cost Structure: User feedback indicates that Blackwell Global offers competitive trading fees. However, specific spread ranges, commission structures, and overnight financing rates are not detailed in available documentation.

Leverage Ratios: Specific leverage offerings are not mentioned in current documentation. Leverage availability typically varies based on regulatory requirements in different areas.

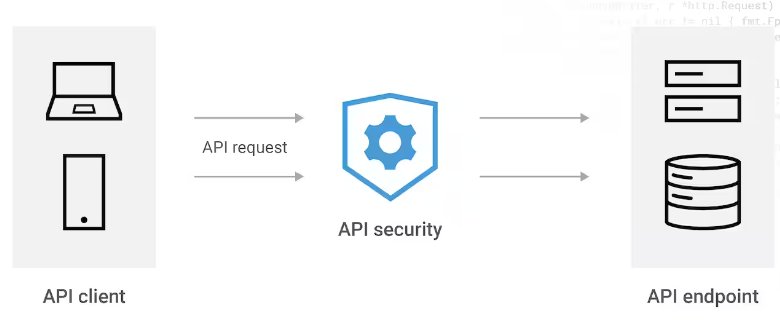

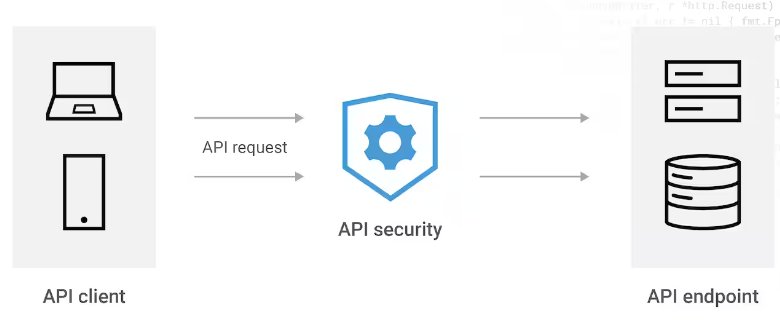

Platform Options: The broker provides multiple trading platforms including mobile applications and desktop trading clients. This blackwell global review confirms platform diversity but lacks specific details about platform features and capabilities.

Regional Restrictions: Specific geographic limitations are not detailed in available information. Service availability depends on local regulatory requirements and company policies.

Customer Service Languages: Available customer support languages are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Blackwell Global's account conditions receive a moderate rating based on available user feedback and limited documentation. The 3 out of 5 star user rating suggests that while the broker meets basic requirements, there are areas for improvement in account structure and client onboarding processes.

The lack of detailed information about account types, minimum deposit requirements, and specific account features creates challenges for potential clients. These clients seek comprehensive account comparisons. Industry standards typically include multiple account tiers with varying features, but specific details about Blackwell Global's account hierarchy are not extensively documented.

User feedback indicates moderate satisfaction with account conditions. This suggests that while the broker provides functional trading accounts, the overall experience may not exceed industry standards. The absence of detailed information about special account features, such as Islamic accounts or professional trading conditions, limits the assessment of the broker's accommodation for diverse trading needs.

Account opening procedures and verification processes are not specifically detailed in available materials. This blackwell global review suggests that prospective clients should directly contact the broker for comprehensive account information. They should also ask about requirements specific to their area and trading objectives.

Blackwell Global shows strong performance in trading tools and resources. The broker earns a high rating in this category. The broker provides multiple trading platforms and offers detailed research tools that support trader analysis and decision-making processes.

The platform diversity includes both mobile applications and desktop trading clients. This accommodates different trading styles and preferences. This multi-platform approach allows traders to access markets and manage positions across various devices, enhancing trading flexibility and accessibility.

Research capabilities appear to be a significant strength. The broker offers analytical tools that support market analysis. While specific details about research depth and frequency are not extensively documented, user feedback suggests satisfaction with the quality of analytical resources provided.

The broker's tool offerings seem to cater to different experience levels. However, specific educational resources and training materials are not detailed in available documentation. The strong rating in this category reflects the broker's commitment to providing traders with necessary tools for market analysis and trade execution.

Customer Service and Support Analysis (Score: 5/10)

Customer service receives a below-average rating. This is primarily influenced by user feedback regarding company culture and organizational practices. Reports indicate dissatisfaction with internal company culture, which may impact the quality of customer-facing services.

Specific customer service channels, response times, and availability hours are not detailed in available documentation. The lack of comprehensive customer support information makes it difficult to assess the broker's commitment to client service. It also makes it hard to evaluate problem resolution capabilities.

User feedback suggests concerns about company practices. These concerns particularly regard bonus plan implementations and organizational culture. These issues may translate into customer service challenges, as internal company problems often affect client-facing operations and support quality.

The absence of detailed information about multilingual support, customer service training, and escalation procedures further limits the assessment of Blackwell Global's customer service capabilities. Prospective clients should investigate customer support quality through direct contact before committing to the platform.

Trading Experience Analysis (Score: 7/10)

The trading experience with Blackwell Global receives a good rating. This is primarily supported by user satisfaction with trading fees and platform functionality. Competitive fee structures contribute positively to the overall trading experience, making the broker attractive to cost-conscious traders.

Platform stability and execution quality are not extensively documented. However, the availability of multiple trading platforms suggests a commitment to providing reliable trading infrastructure. The broker's support for both mobile and desktop trading accommodates different trading preferences and technical requirements.

Order execution details are not specifically mentioned in available documentation. This includes information about slippage, requotes, and execution speeds. These factors significantly impact trading experience, particularly for active traders and those employing time-sensitive strategies.

The diversity of tradeable assets enhances the trading experience by providing multiple market opportunities. Access to forex, CFDs, indices, and commodities allows traders to diversify their portfolios and explore different market sectors through a single platform. This blackwell global review indicates that while fee competitiveness is a strength, more detailed execution quality information would provide a clearer picture of the trading experience.

Trust and Reliability Analysis (Score: 6/10)

Blackwell Global's trust and reliability receive a moderate rating based on its regulatory status and market presence. The broker operates as a regulated entity, which provides a foundation for client trust. However, specific regulatory details and license numbers are not extensively documented.

The company started in 2010 and has continued operating for over a decade. This suggests market stability and regulatory compliance. However, the lack of detailed regulatory information, including specific oversight bodies and license numbers, limits the ability to fully assess the broker's regulatory standing.

Fund safety measures, segregation policies, and investor protection schemes are not detailed in available documentation. These factors are crucial for assessing broker trustworthiness and client fund security. The absence of clear information about financial reporting, auditing practices, and corporate governance structures further impacts the trust assessment.

User concerns about company culture and internal practices may affect overall trust levels. Organizational issues can impact business stability and client service quality. While regulatory status provides some assurance, the combination of limited transparency and user concerns results in a moderate trust rating.

User Experience Analysis (Score: 5/10)

User experience receives a below-average rating. This is primarily influenced by the 3 out of 5 star user rating and specific feedback about company culture and bonus plan issues. This moderate satisfaction level suggests that while the broker provides functional services, the overall user experience falls short of industry expectations.

Interface design and platform usability are not extensively detailed in available documentation. The availability of multiple platforms suggests attention to user accessibility. However, specific information about user interface quality, navigation ease, and feature organization is limited.

Registration and account verification processes are not specifically described. This makes it difficult to assess the convenience and efficiency of client onboarding. Smooth onboarding processes significantly impact initial user experience and overall satisfaction.

User complaints focus primarily on company culture and bonus plan implementations. This indicates potential issues with transparency and client relationship management. These concerns suggest that while trading functionality may be adequate, the broader client experience includes elements that detract from overall satisfaction. The broker would benefit from addressing these user concerns to improve overall experience ratings and client retention.

Conclusion

Blackwell Global presents itself as a regulated forex broker with competitive trading fees and diverse platform options. However, this comprehensive analysis reveals a mixed performance across key evaluation criteria. While the broker demonstrates strengths in trading tools and cost competitiveness, significant concerns about user experience and customer service impact its overall rating.

The broker appears most suitable for experienced traders who prioritize fee competitiveness and platform diversity over premium customer service and user experience. Traders seeking access to multiple asset classes through various trading platforms may find value in Blackwell Global's offerings. This is particularly true if they can navigate the reported organizational and service challenges.

Key advantages include competitive trading fees, multiple trading platforms, diverse asset selection, and regulatory compliance. Primary disadvantages include user dissatisfaction with company culture, limited transparency about specific services and conditions, and below-average customer service ratings. Prospective clients should carefully weigh these factors against their individual trading priorities and conduct thorough research before selecting this broker.