Is VIX Trade safe?

Pros

Cons

Is Vix Trade Safe or Scam?

Introduction

Vix Trade is an online forex broker that positions itself within the competitive landscape of the foreign exchange market. With the promise of providing traders access to various financial instruments, including forex pairs, commodities, and indices, Vix Trade aims to attract both novice and experienced traders. However, the world of forex trading is rife with potential pitfalls, making it imperative for traders to carefully evaluate the credibility and safety of their chosen brokers. Given the prevalence of scams and unregulated entities in this sector, a thorough assessment of Vix Trade's legitimacy is warranted. This article employs a comprehensive investigative approach, analyzing regulatory status, company background, trading conditions, customer experiences, and overall risk factors associated with Vix Trade.

Regulation and Legitimacy

The regulatory status of a forex broker serves as a cornerstone of its credibility. Regulation ensures that brokers adhere to specific standards of conduct, which protect investors from fraud and malpractice. In the case of Vix Trade, the broker operates without any recognized regulatory oversight, which raises significant concerns about its legitimacy. The absence of a regulatory license means that Vix Trade is not subject to the stringent compliance checks and customer protection protocols that regulated brokers must follow.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The lack of regulatory oversight is particularly concerning, as it leaves traders vulnerable to potential fraud and mismanagement. Unregulated brokers often operate with minimal accountability, which can lead to issues such as sudden withdrawal restrictions, manipulation of trading conditions, or even outright scams. Furthermore, Vix Trade's association with offshore jurisdictions, which are often exploited by unscrupulous brokers, compounds the risks involved. The historical compliance record of Vix Trade is non-existent, as there are no regulatory bodies overseeing its operations. This lack of transparency raises alarms for potential investors.

Company Background Investigation

Vix Trade's corporate history and ownership structure are crucial elements in assessing its reliability. The broker claims to have been in operation for several years, yet there is scant information available regarding its founding, ownership, or management team. This opacity is a red flag, as reputable brokers typically provide detailed information about their corporate structure and key personnel.

The management team behind Vix Trade appears to lack verifiable experience in the financial services industry, which raises concerns about their capability to manage client funds responsibly. Transparency in ownership and management is vital for building trust with clients, and Vix Trade's failure to disclose this information further diminishes its credibility.

Additionally, the company's information disclosure level is alarmingly low. Potential clients are often left in the dark regarding critical operational details, such as the location of their headquarters, contact information, and customer service channels. This lack of transparency is a common tactic used by scam brokers to avoid accountability and makes it difficult for traders to seek recourse in case of disputes.

Trading Conditions Analysis

A thorough examination of Vix Trade's trading conditions reveals a mixed picture. The broker advertises competitive spreads and a variety of account types to attract traders. However, the absence of clear information regarding fees and commissions raises concerns about hidden costs that could erode trading profits.

| Fee Type | Vix Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Unclear | 0.5% - 1% |

The spread for major currency pairs at Vix Trade is reported to be around 2 pips, which is higher than the industry average of 1.5 pips. This discrepancy may suggest that traders could incur higher trading costs than expected. Furthermore, the lack of clarity surrounding the commission model is troubling. Many reputable brokers provide clear and transparent fee structures, allowing traders to understand their potential costs upfront.

Moreover, Vix Trade's vague policies regarding overnight interest rates could lead to unexpected charges for traders holding positions overnight. Such hidden fees can significantly impact overall trading performance, especially for those employing strategies that involve holding positions for extended periods.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Vix Trade's lack of regulatory oversight raises serious questions about its fund protection measures. Typically, regulated brokers are required to maintain client funds in segregated accounts, ensuring that trader deposits are protected in the event of financial difficulties. However, Vix Trade does not provide any information regarding its fund safety protocols.

The absence of investor protection schemes is another significant risk factor. Reputable brokers often participate in compensation schemes that provide a safety net for clients in case of broker insolvency. Vix Trade's failure to offer such assurances leaves traders exposed to the risk of losing their entire investment without any recourse.

Additionally, there have been reports of withdrawal issues and complaints from clients regarding the difficulty in accessing their funds. These issues are often indicative of a broker's operational integrity and can be a strong warning sign for potential investors.

Customer Experience and Complaints

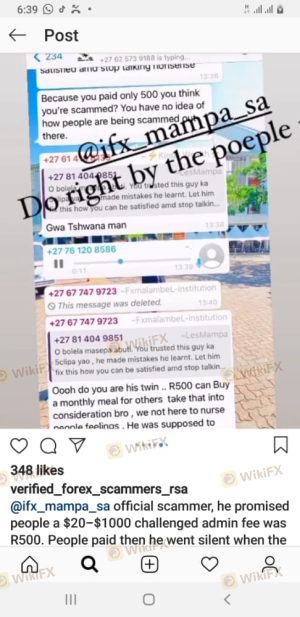

Customer feedback is an invaluable resource for assessing a broker's credibility. In the case of Vix Trade, numerous complaints have surfaced regarding poor customer service and withdrawal difficulties. Many users report challenges in retrieving their funds, with some claiming that the broker imposes excessive withdrawal fees or delays processing requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Transparency of Fees | High | Unresponsive |

The common patterns among complaints suggest a troubling trend of dissatisfaction among clients. The severity of withdrawal issues is particularly concerning, as it indicates potential operational problems within the broker. Furthermore, the lack of responsive customer service exacerbates the situation, leaving traders feeling unsupported and frustrated.

Several case studies illustrate these issues. For instance, one trader reported being unable to withdraw their funds after multiple attempts, leading to significant financial distress. This case highlights the potential risks associated with trading with Vix Trade and serves as a cautionary tale for prospective clients.

Platform and Trade Execution

The trading platform offered by Vix Trade is another critical aspect of its overall service. While the broker claims to provide a user-friendly trading environment, many users have reported issues with platform stability and execution quality. Problems such as slippage and order rejections can significantly impact trading outcomes, especially in volatile market conditions.

User experiences indicate that the platform may not be as reliable as advertised. Instances of delayed order execution and technical glitches have been reported, which can lead to missed trading opportunities and financial losses. Moreover, any signs of platform manipulation, such as artificially widening spreads during high volatility, can raise further concerns about the broker's integrity.

Risk Assessment

When considering the overall risk associated with trading with Vix Trade, several factors come into play. The absence of regulation, combined with poor customer feedback and operational transparency, paints a concerning picture for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund safety measures |

| Operational Risk | Medium | Complaints about withdrawal issues |

| Customer Service Risk | High | Poor response to client queries |

To mitigate these risks, potential traders should exercise extreme caution. It is advisable to conduct thorough research, avoid depositing large sums, and consider using regulated brokers with proven track records.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the legitimacy of Vix Trade. The broker operates without regulatory oversight, has a troubling history of customer complaints, and lacks transparency in its operations. These factors collectively suggest that Vix Trade may not be a safe option for traders.

For those considering engaging with Vix Trade, it is crucial to weigh the potential risks against the promised rewards. It is advisable to explore alternative brokers that are well-regulated and have demonstrated reliability in their operations. Trusted options include brokers like IC Markets, Pepperstone, and Avatrade, which offer robust regulatory frameworks and positive user experiences.

Ultimately, the question remains: Is Vix Trade Safe? The overwhelming evidence suggests that traders should approach this broker with caution, if not outright avoidance.

Is VIX Trade a scam, or is it legit?

The latest exposure and evaluation content of VIX Trade brokers.

VIX Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VIX Trade latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.