Vix Trade 2025 Review: Everything You Need to Know

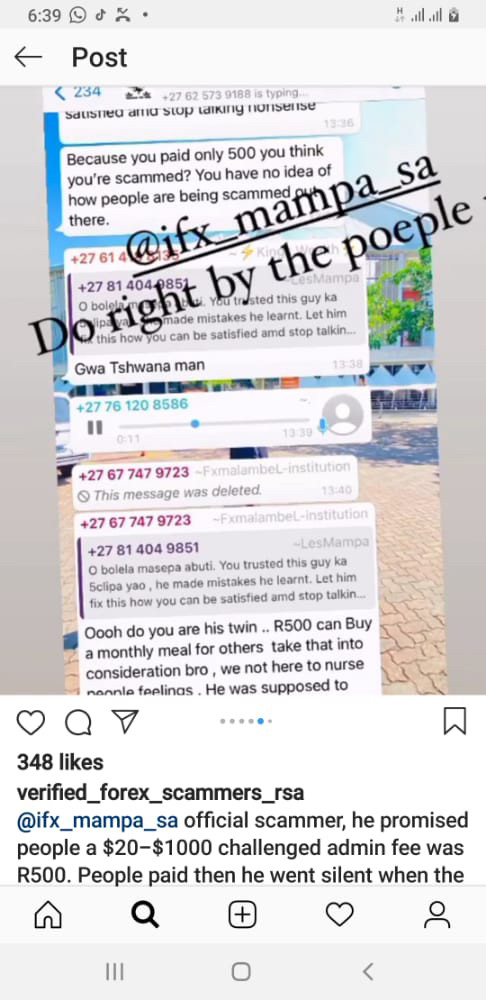

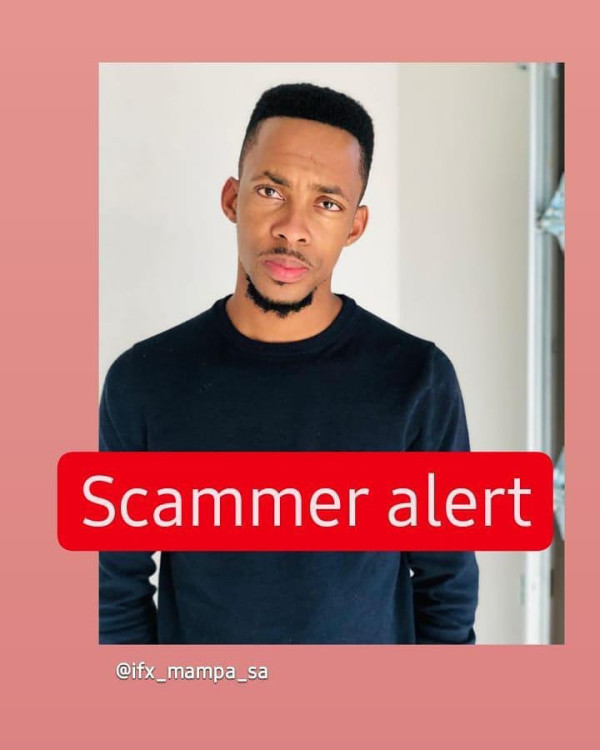

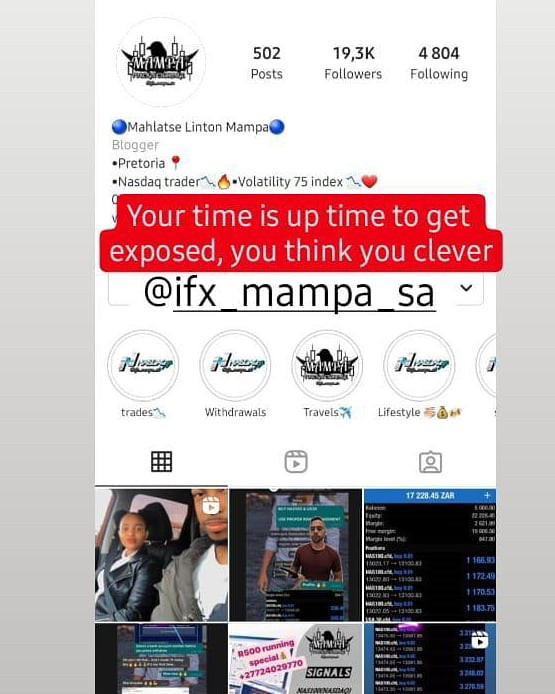

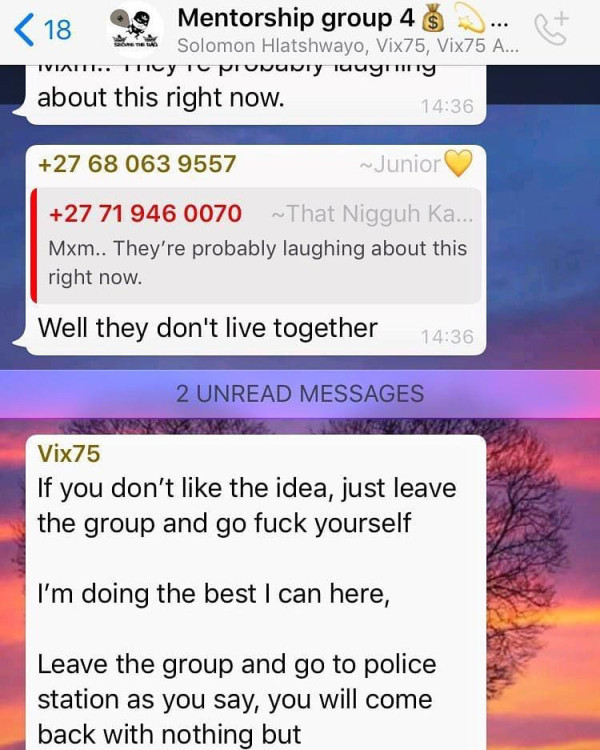

Vix Trade has garnered a mixed reputation in the forex trading community, with significant concerns regarding its regulatory status and user experiences. Many reviews highlight a lack of transparency and potential risks associated with trading through this broker, particularly due to its unregulated nature. Notably, Vix Trade operates under different entities in various regions, which adds to the complexity and potential risk for traders.

Note: Be aware that the differences in regional entities can significantly impact your trading experience and the level of protection you receive. Our evaluation is based on a comprehensive analysis of multiple sources to ensure fairness and accuracy.

Rating Overview

How We Rate Brokers: Our ratings are derived from a combination of user reviews, expert opinions, and factual data regarding broker operations.

Broker Overview

Vix Trade is a relatively new entrant in the forex market, with reports indicating it has been operational for 2 to 5 years. The broker operates primarily on the MetaTrader 4 (MT4) platform, which is widely recognized among traders for its user-friendly interface and advanced trading capabilities. Vix Trade offers a range of trading instruments, including forex, commodities, and indices, but lacks transparency regarding its regulatory status, which has raised significant concerns among potential users.

Detailed Breakdown

Regulatory Status

Vix Trade does not hold any major regulatory licenses, operating primarily in offshore jurisdictions such as Vanuatu and Estonia. This lack of regulation is a significant red flag, as it means that traders have little to no protection for their funds. According to WikiFX, the absence of regulation poses a high potential risk for traders, making it imperative to exercise caution when considering this broker.

Deposit/Withdrawal Currencies

While specific information about supported currencies is limited, it is common for brokers like Vix Trade to allow deposits in major currencies such as USD and EUR. However, users have reported difficulties with withdrawals, which is a common complaint with unregulated brokers.

Minimum Deposit

The minimum deposit requirement for Vix Trade is reported to be around $200, which is relatively low compared to other brokers. However, this low barrier to entry can attract inexperienced traders who may not fully understand the risks involved.

Vix Trade does not prominently feature any bonuses or promotions on its website, which is often a strategy employed by regulated brokers to attract clients. The lack of such incentives may indicate a focus on providing a straightforward trading experience rather than engaging in promotional tactics.

Tradable Asset Classes

Vix Trade offers a limited range of tradable assets, primarily focusing on forex pairs and commodities. The absence of diverse asset classes can limit trading opportunities for users looking to explore different markets.

Costs (Spreads, Fees, Commissions)

The cost structure of Vix Trade is not clearly outlined, but many user reviews suggest that spreads can be relatively high. This lack of transparency regarding fees can significantly impact a trader's profitability, especially for those engaging in high-frequency trading.

Leverage

Leverage options at Vix Trade are not clearly stated, but many unregulated brokers offer high leverage to attract traders. While high leverage can amplify profits, it also increases the risk of significant losses.

Vix Trade primarily operates on the MT4 platform, which is well-regarded for its robust features and user-friendly interface. However, the lack of alternative platforms may deter traders who prefer other trading environments.

Restricted Regions

Vix Trade does not specify any restricted regions, but the absence of regulatory oversight suggests that it may not be compliant with the laws of many countries. Traders from jurisdictions with strict regulations should be cautious when considering this broker.

Available Customer Support Languages

Customer support at Vix Trade appears to be limited, with many users reporting poor communication and responsiveness. This is a significant drawback, especially for new traders who may require additional assistance.

Final Rating Overview

Detailed Analysis

-

Account Conditions: The low minimum deposit is appealing, but the lack of regulatory oversight raises concerns about fund safety. Users have reported difficulties with withdrawals, indicating a potential issue with account conditions.

Tools and Resources: While Vix Trade offers the MT4 platform, the lack of educational resources and market analysis tools limits trader development and decision-making capabilities.

Customer Service and Support: Many users have expressed dissatisfaction with Vix Trade's customer support, citing slow response times and unhelpful assistance as major issues.

Trading Setup (Experience): The trading experience on Vix Trade can be hampered by high spreads and a lack of transparency regarding fees, which can deter both new and experienced traders.

Trust Level: The absence of regulation and numerous negative reviews significantly impact the trust level associated with Vix Trade, making it a risky choice for traders.

User Experience: Overall user experiences have been mixed, with many expressing concerns about the broker's reliability and transparency.

Regulatory Compliance: The lack of regulatory oversight is a major drawback, as it leaves traders vulnerable to potential scams and poor practices.

In conclusion, while Vix Trade may offer a low barrier to entry for new traders, the significant risks associated with its unregulated status and poor user experiences make it a broker to approach with caution. It is advisable to consider more reputable and regulated alternatives for a safer trading experience.