Is VFM BROKERS safe?

Business

License

Is VFM Brokers Safe or a Scam?

Introduction

VFM Brokers, a forex and CFD trading platform, has been making waves in the online trading community since its establishment in 2020. Operating under the umbrella of Venture Financial Markets Ltd, VFM Brokers claims to provide a range of trading instruments, including forex, commodities, and cryptocurrencies. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it essential for traders to carefully assess the credibility and safety of their chosen brokers. This article aims to evaluate whether VFM Brokers is a trustworthy trading platform or a potential scam. Our investigation is based on a thorough review of available sources, including regulatory information, customer feedback, and the company's operational history.

Regulation and Legitimacy

The regulation of a trading platform is a crucial factor that determines its legitimacy and safety for traders. VFM Brokers operates from Saint Vincent and the Grenadines, a location often associated with unregulated brokers due to its lax regulatory environment. Upon investigation, it becomes evident that VFM Brokers does not hold any licenses from recognized financial authorities.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that traders using VFM Brokers do not have the protections typically afforded by licensed brokers, such as segregated accounts and investor compensation schemes. Without these safeguards, traders are at a higher risk of losing their funds without any recourse. Moreover, the lack of regulatory oversight raises significant red flags regarding the brokers operational practices and financial stability. Therefore, it is essential for potential clients to approach VFM Brokers with caution, as the absence of regulation is a strong indicator of potential risk.

Company Background Investigation

VFM Brokers was established in 2020, and its parent company, Venture Financial Markets Ltd, is registered in Saint Vincent and the Grenadines. However, there is limited information available regarding the company's ownership structure and management team. Transparency is a key element when assessing the credibility of a broker, and VFM Brokers falls short in this regard.

Many reputable brokers provide detailed information about their management teams, including their qualifications and industry experience. In contrast, VFM Brokers does not disclose such information, raising concerns about the expertise of the individuals behind the platform. Furthermore, the companys website has faced accessibility issues, further complicating efforts to gather reliable information. The lack of transparency and information disclosure is a significant drawback for VFM Brokers, leading to questions about its legitimacy and overall safety.

Trading Conditions Analysis

When considering whether VFM Brokers is safe, evaluating its trading conditions is essential. The broker claims to offer competitive trading fees, with various account types designed to cater to different trading styles. However, the specifics of these fees are not always clear.

| Fee Type | VFM Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 1.5 pips |

| Commission Structure | Variable (Not Clearly Specified) | 0 - 5 USD per lot |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of transparency regarding spreads and commissions can be a cause for concern. Traders may find themselves subject to hidden fees, which can significantly impact their profitability. Furthermore, the broker's promise of zero commissions is not sufficiently substantiated, as many traders have reported issues with unexpected charges. This ambiguity in the fee structure raises questions about the brokers commitment to fair trading practices and could potentially indicate a lack of integrity in its operations.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's reliability. VFM Brokers does not provide clear information regarding its policies on fund security, such as whether client funds are held in segregated accounts or if there are any investor protection measures in place.

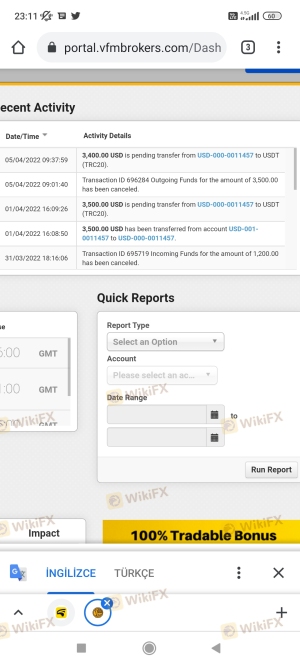

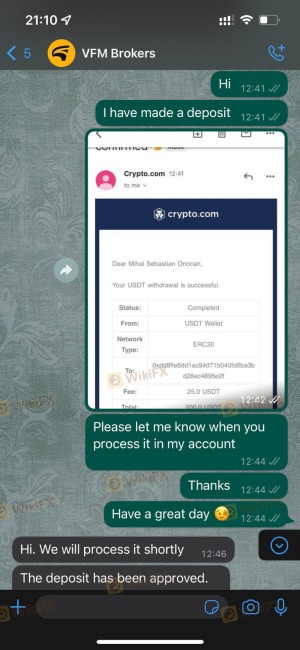

Without proper safeguards, clients risk losing their deposits if the broker encounters financial difficulties or engages in fraudulent activities. Additionally, there have been reports from users regarding withdrawal issues, which further complicate the assessment of fund safety. Without a robust framework for protecting client funds, VFM Brokers presents a considerable risk to traders, further questioning its legitimacy and safety.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the reliability of any brokerage. VFM Brokers has received numerous complaints from users, primarily concerning withdrawal issues and lack of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency | High | Lacking |

Many users have reported that their withdrawal requests were either delayed or rejected entirely, leading to frustration and distrust. Additionally, the company's response to these complaints has been inadequate, with many traders reporting long wait times for support. These patterns of customer dissatisfaction underscore the potential risks associated with trading with VFM Brokers, reinforcing the need for caution.

Platform and Trade Execution

The trading platform offered by VFM Brokers is MetaTrader 4 (MT4), a widely recognized and reliable trading platform. However, the performance and stability of the platform are crucial in assessing whether VFM Brokers is safe. Traders have reported mixed experiences regarding order execution, with some experiencing slippage and rejections during high volatility periods.

The potential for manipulation or unfair trading practices is a significant concern, especially for an unregulated broker. If traders face issues such as frequent slippage or order rejections, it raises questions about the broker's integrity and operational practices. Therefore, potential clients must consider these factors before engaging with VFM Brokers.

Risk Assessment

Overall, the risk associated with trading through VFM Brokers is substantial, given the lack of regulation, transparency, and customer support.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Financial Risk | High | Lack of transparency regarding fund security measures. |

| Operational Risk | Medium | Issues with withdrawal and customer support may hinder trading experience. |

To mitigate these risks, traders should consider engaging with regulated brokers that provide clear information on their operations and customer protections. Additionally, conducting thorough research and due diligence before committing funds to any broker is essential.

Conclusion and Recommendations

In conclusion, the evidence suggests that VFM Brokers poses significant risks for potential traders. The absence of regulatory oversight, coupled with numerous complaints regarding customer service and withdrawal issues, raises serious concerns about the broker's legitimacy. Traders are advised to exercise extreme caution and consider alternative, regulated options that prioritize transparency and client protection.

For those seeking reliable trading platforms, brokers with established regulatory frameworks, such as those licensed in jurisdictions like the UK or Australia, are recommended. Ultimately, the question remains: Is VFM Brokers safe? The overwhelming evidence points to a high level of risk, suggesting that traders should be wary of engaging with this broker.

Is VFM BROKERS a scam, or is it legit?

The latest exposure and evaluation content of VFM BROKERS brokers.

VFM BROKERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VFM BROKERS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.