Is Samrridh Fx safe?

Business

License

Is Samrridh FX Safe or Scam?

Introduction

In the ever-evolving world of forex trading, brokers play a pivotal role in determining the trading experience and outcomes for investors. Samrridh FX, an online trading platform claiming to offer a range of financial instruments, positions itself as a global player in this competitive market. However, the necessity for traders to exercise caution cannot be overstated, as the landscape is rife with unregulated and potentially fraudulent entities. This article aims to provide a comprehensive analysis of Samrridh FX, evaluating its legitimacy, regulatory status, trading conditions, and customer experiences to ascertain whether Samrridh FX is safe or a scam.

Our investigation is grounded in a thorough examination of available online resources, including regulatory information, user reviews, and expert analyses. The assessment framework encompasses several critical aspects: regulatory compliance, company background, trading conditions, customer fund safety, user experiences, platform performance, and an overall risk evaluation. By synthesizing these elements, we aim to present a balanced view of Samrridh FX and its operations.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its credibility and the safety of client funds. Unfortunately, Samrridh FX is not regulated by any major financial authority, raising significant concerns about its legitimacy. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Unregulated, Offshore | Not Verified |

The absence of regulation from reputable bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) is alarming. Regulatory oversight is crucial as it ensures that brokers adhere to strict operational standards, including the segregation of client funds and the provision of investor protection measures. The lack of a valid forex license implies that Samrridh FX operates in a virtually anonymous capacity, making it difficult for traders to seek redress in case of disputes or financial mismanagement.

Moreover, the offshore registration in St. Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment, does little to enhance the credibility of Samrridh FX. As such, traders should be wary and consider the inherent risks associated with engaging with an unregulated broker. In this context, it is reasonable to conclude that Samrridh FX is not safe due to its lack of regulatory oversight.

Company Background Investigation

Understanding the company behind a trading platform is essential for evaluating its trustworthiness. Samrridh FX is operated by Samrridh FX Limited, which claims to be based in St. Vincent and the Grenadines. However, the details surrounding its history, ownership structure, and management team remain opaque. The lack of transparency raises questions about the company's operational integrity and accountability.

While the website provides basic contact information, such as an email address and a phone number, there is no comprehensive disclosure regarding the management team or their professional backgrounds. A credible broker typically showcases its leadership's experience and qualifications, which are vital indicators of its operational capabilities. In the case of Samrridh FX, the absence of such information contributes to the perception that it may not be a legitimate broker.

Furthermore, the company's development history is not well-documented, making it challenging for potential clients to assess its track record. Without a clear understanding of its operational history, traders are left in the dark regarding the company's reliability and commitment to ethical practices. This lack of clarity further underscores the concerns regarding whether Samrridh FX is safe or a scam.

Trading Conditions Analysis

A broker's trading conditions significantly influence a trader's experience and profitability. Samrridh FX claims to offer competitive trading conditions, including high leverage and various account types. However, the overall fee structure and potential hidden costs warrant careful examination.

The following table compares the core trading costs associated with Samrridh FX against industry averages:

| Fee Type | Samrridh FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $7 per lot | $5 per lot |

| Overnight Interest Range | Not specified | Varies widely |

While the advertised spreads may appear attractive, they are higher than many industry competitors, which could adversely affect trading profitability. Additionally, the commission structure, particularly the $7 per lot fee, is on the higher end of the spectrum. Such costs can significantly erode trading profits, especially for high-frequency traders.

Moreover, the lack of transparency regarding overnight interest rates raises concerns about potential hidden fees that could be levied on traders. Brokers with unclear or ambiguous fee structures often raise red flags, as they may engage in practices that could disadvantage traders financially.

In conclusion, while Samrridh FX presents itself as a competitive broker, the actual trading conditions may not be as favorable as claimed. Therefore, the question of whether Samrridh FX is safe becomes increasingly pertinent, as traders must weigh the potential costs against the benefits.

Customer Fund Safety

The safety of customer funds is a critical consideration when evaluating any forex broker. Samrridh FX's lack of regulatory oversight raises significant concerns regarding its fund safety measures. Legitimate brokers typically implement robust security protocols, including the segregation of client funds and negative balance protection.

Unfortunately, Samrridh FX does not provide clear information on its fund safety policies. There is no indication of whether client funds are held in segregated accounts, which is a fundamental requirement for protecting traders' money in the event of insolvency. Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial deposits, further heightening the risk associated with trading on this platform.

Moreover, the historical record of Samrridh FX regarding fund security is unclear. There have been no publicly available reports of successful withdrawals or any incidents of fund mismanagement, but this lack of information does not necessarily imply a clean record. The potential for future issues remains a significant risk factor for traders considering whether Samrridh FX is safe.

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for assessing the overall reliability of a broker. Reviews of Samrridh FX reveal a mixed bag of user experiences, with several complaints highlighting significant concerns.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Non-responsive |

| Hidden Fees | Medium | Lack of Transparency |

| Poor Customer Support | High | Inconsistent Responses |

Common complaints revolve around withdrawal difficulties, with many users reporting delays or outright failures to process their requests. Such issues are alarming, as they directly impact traders' ability to access their funds. Furthermore, the lack of transparency regarding fees has led to frustration among users who feel misled about the true costs of trading.

For instance, one user reported attempting to withdraw funds only to face numerous delays and a lack of communication from the support team. This experience reflects poorly on the company's customer service capabilities and raises further questions about its operational integrity.

Given these concerns, it is evident that Samrridh FX is not safe for traders who prioritize reliable access to their funds and responsive customer support.

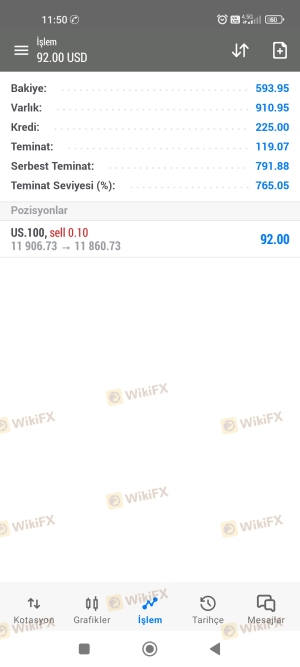

Platform and Trade Execution

The performance of a trading platform is pivotal in determining a trader's experience. Samrridh FX claims to offer the widely used MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, user experiences suggest that the platform may not be as reliable as advertised.

Traders have reported issues with order execution, including slippage and rejection of orders during volatile market conditions. Such occurrences can significantly impact trading outcomes, leading to frustration and financial losses. Moreover, any signs of potential platform manipulation should be taken seriously, as they indicate a lack of integrity in the broker's operations.

In summary, while Samrridh FX promotes its platform as robust and efficient, user experiences suggest that it may not meet the standards expected by traders. Therefore, the question of whether Samrridh FX is safe remains unresolved, as potential users must consider the risks associated with its platform performance.

Risk Assessment

Evaluating the overall risk of using Samrridh FX is essential for informed decision-making. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Mixed reviews indicate potential issues with support. |

| Platform Reliability Risk | Medium | Reports of execution issues and slippage. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative options. Engaging with regulated brokers that provide clear information on fund safety, customer support, and platform reliability can significantly reduce the likelihood of negative experiences.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Samrridh FX raises several red flags that warrant caution. The absence of regulatory oversight, combined with unclear fund safety measures and mixed customer experiences, paints a concerning picture of this broker's operations. Therefore, traders should approach Samrridh FX with skepticism and consider alternative brokers that prioritize transparency and regulatory compliance.

For those seeking reliable trading options, we recommend exploring well-regulated brokers such as FP Markets, OctaFX, or IG, which have established reputations for safety and reliability. By choosing a reputable broker, traders can better protect their investments and enhance their trading experience.

In conclusion, the analysis suggests that Samrridh FX is not safe for traders, and potential clients should proceed with caution or seek alternatives that offer greater security and trustworthiness in their trading endeavors.

Is Samrridh Fx a scam, or is it legit?

The latest exposure and evaluation content of Samrridh Fx brokers.

Samrridh Fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Samrridh Fx latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.