VFM Brokers 2025 Review: Everything You Need to Know

Executive Summary

VFM Brokers presents itself as an online forex trading platform serving retail and institutional clients across more than 50 countries globally. However, this vfm brokers review reveals significant concerns about the platform's transparency and reliability that traders should carefully consider. The broker lacks clear regulatory information and detailed trading conditions. This raises red flags for potential traders who need reliable information to make informed decisions. Multiple review platforms have discussed the legitimacy and reliability of VFM Brokers, with several comments warning users about potential scam risks that could result in financial losses. While the company claims to offer global services, traders should exercise extreme caution and thoroughly investigate the platform before committing any funds to their accounts. The absence of concrete information about licensing, trading conditions, and customer protection measures makes it difficult to provide a positive assessment of this broker.

Important Notice

This review is based on user feedback and discussions from multiple review websites, as information about VFM Brokers remains limited and fragmented. Traders should be aware that regulatory status and operational details may vary significantly across different jurisdictions where the company claims to operate. Our assessment methodology relies on available public information, user testimonials, and industry standard evaluation criteria. Due to the limited transparency from VFM Brokers itself, potential clients are strongly advised to conduct independent research and verify all claims before opening any trading accounts.

Rating Framework

Broker Overview

VFM Brokers operates as an online forex trading platform that claims to serve both retail and institutional clients across more than 50 countries worldwide. The company presents itself as part of Venture Financial Markets Limited, though specific founding dates and detailed company background information remain unclear from available sources that we could verify. According to various review platforms, the broker has been subject to scrutiny regarding its operational legitimacy and business practices.

The platform's business model appears to focus on forex trading services, though comprehensive details about their operational structure, execution methods, and business approach are not readily available to the public. This lack of transparency has contributed to concerns raised by various review sites and user discussions across multiple platforms. The broker's global reach claims suggest an ambitious scope, but verification of actual operational presence in claimed jurisdictions remains questionable for traders seeking reliable services. This vfm brokers review finds that the company's reluctance to provide clear operational details creates uncertainty for potential clients seeking reliable trading services.

Regulatory Status: Available information does not specify any clear regulatory oversight from recognized financial authorities, which represents a significant concern for trader protection and fund security.

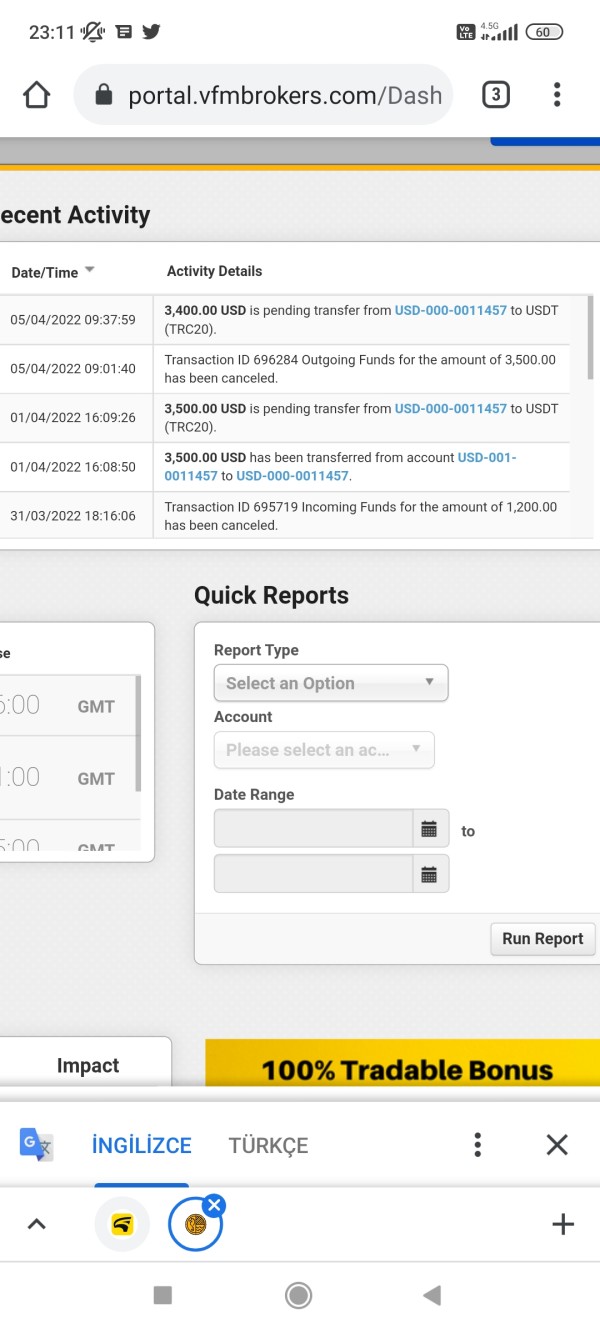

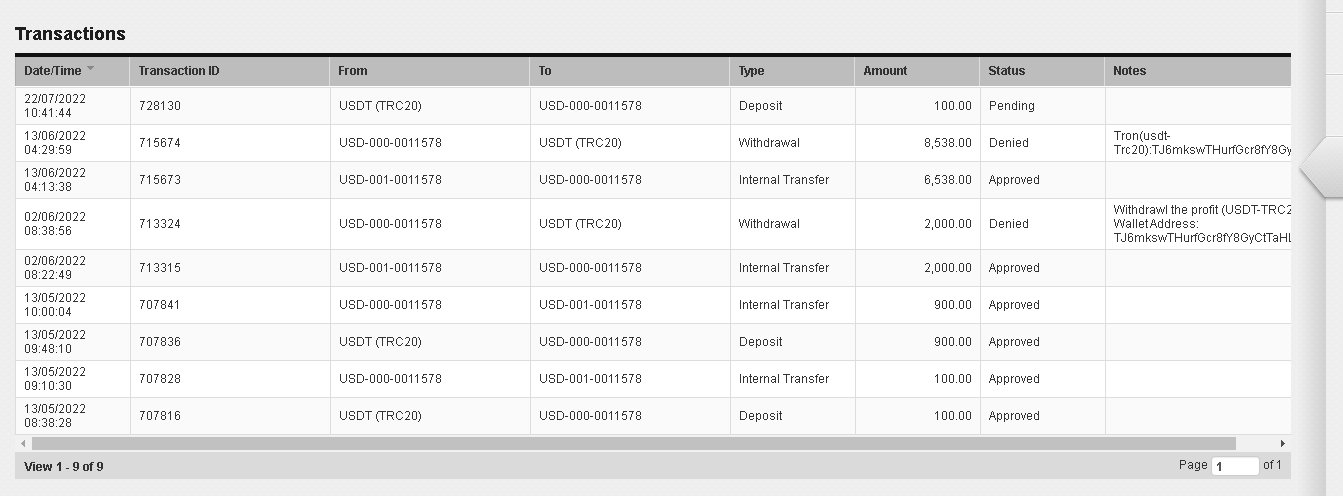

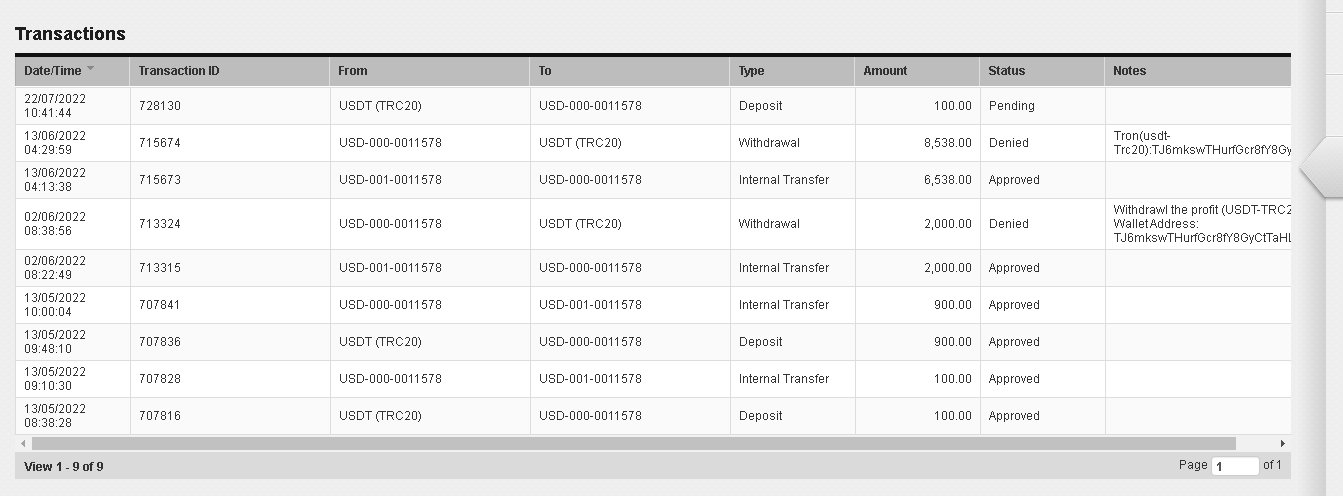

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees has not been disclosed in available sources.

Minimum Deposit Requirements: No clear minimum deposit amounts have been specified, making it difficult for traders to plan their initial investment.

Bonus and Promotions: Details about promotional offers, welcome bonuses, or ongoing incentives are not mentioned in available information.

Trading Assets: While the platform is described as a forex broker, the complete range of available currency pairs, commodities, indices, or other CFD instruments remains unspecified.

Cost Structure: Critical information about spreads, commission rates, overnight fees, and other trading costs is notably absent from public materials.

Leverage Ratios: Maximum leverage offerings and risk management parameters have not been clearly communicated.

Platform Options: Specific trading platform software, mobile applications, or web-based interfaces are not detailed in available sources.

Geographic Restrictions: Despite claims of global service, specific country restrictions or regulatory limitations are not clearly outlined.

Customer Support Languages: Multi-language support capabilities remain unspecified in this vfm brokers review.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of VFM Brokers' account conditions proves challenging due to the absence of specific information about account types, features, and requirements. Traditional brokers typically offer multiple account tiers such as standard, premium, or VIP accounts with varying benefits and minimum deposit requirements that help traders choose suitable options. However, VFM Brokers has not provided clear details about their account structure, making it impossible to assess the competitiveness or suitability of their offerings.

The lack of information about account opening procedures, verification requirements, and documentation needed raises concerns about operational transparency that professional brokers should maintain. Most reputable brokers provide detailed account specifications including minimum deposits, maximum leverage, available instruments, and special features like Islamic accounts for Muslim traders. The absence of such fundamental information in this vfm brokers review suggests either poor communication practices or potential operational deficiencies that could impact trader experience and satisfaction.

Assessment of VFM Brokers' trading tools and educational resources is severely limited by the lack of available information. Professional forex brokers typically provide comprehensive trading platforms with advanced charting capabilities, technical indicators, economic calendars, market analysis, and automated trading support that help traders make informed decisions. However, no specific details about VFM Brokers' technological offerings have been identified in available sources.

Educational resources represent a crucial component of broker services, particularly for retail traders seeking to improve their market knowledge and trading skills. Quality brokers usually offer webinars, tutorials, market analysis, trading guides, and research materials that support trader development. The absence of information about such resources suggests either minimal investment in trader education or poor marketing communication of available services. This gap significantly impacts the overall value proposition for traders seeking comprehensive support beyond basic trade execution.

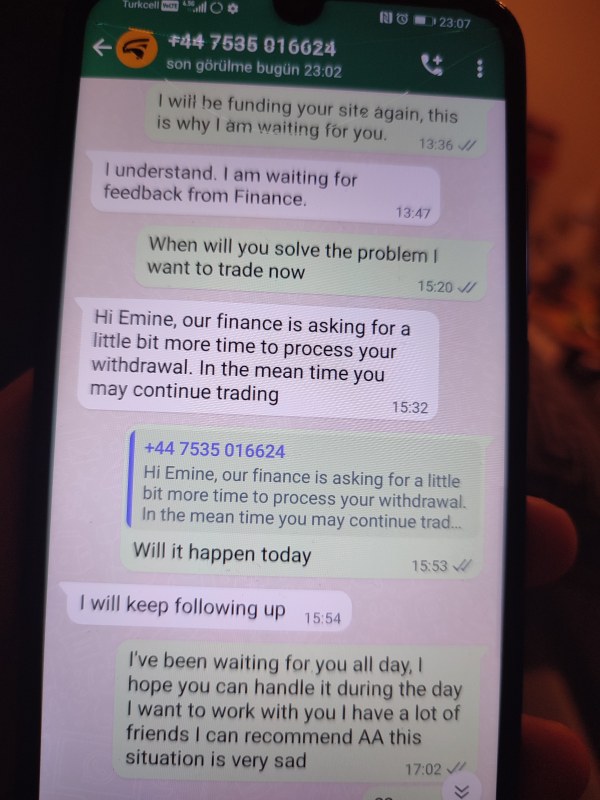

Customer Service and Support Analysis

Customer service evaluation for VFM Brokers faces significant limitations due to unavailable information about support channels, response times, and service quality. Professional brokers typically offer multiple contact methods including phone support, live chat, email assistance, and comprehensive FAQ sections that address common trader concerns. The availability of 24/5 or 24/7 support during market hours represents a standard expectation for global forex brokers.

Multi-language support capabilities are particularly important for brokers claiming international operations across 50+ countries. However, no specific information about language support, local phone numbers, or regional customer service teams has been identified. The absence of customer service details raises concerns about trader support quality and accessibility. Without clear communication channels and responsive support systems, traders may face difficulties resolving issues, obtaining assistance, or receiving timely responses to important account-related queries.

Trading Experience Analysis

The trading experience evaluation for VFM Brokers remains incomplete due to insufficient information about platform functionality, execution quality, and user interface design. Critical factors such as platform stability, order execution speed, slippage rates, and system uptime directly impact trader success and satisfaction. However, no specific performance data or user experience testimonials have been identified in available sources.

Mobile trading capabilities represent essential features for modern forex traders who require flexibility and accessibility. Most competitive brokers offer dedicated mobile applications with full functionality, real-time quotes, and seamless order management. The lack of information about mobile trading options, platform compatibility, and user interface quality makes it difficult to assess VFM Brokers' technological competitiveness. This vfm brokers review cannot provide meaningful insights into actual trading experience without concrete user feedback or platform demonstrations.

Trust Level Analysis

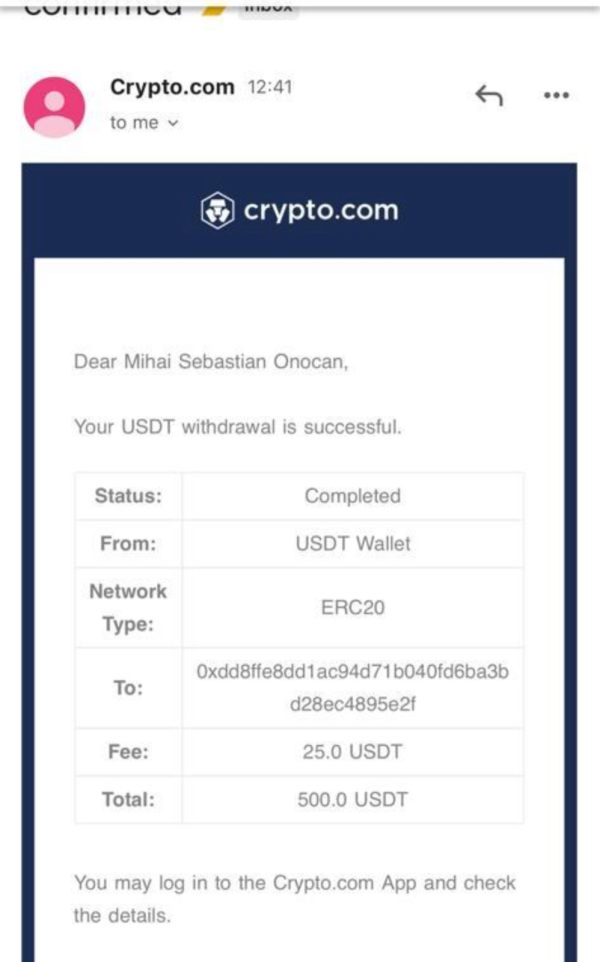

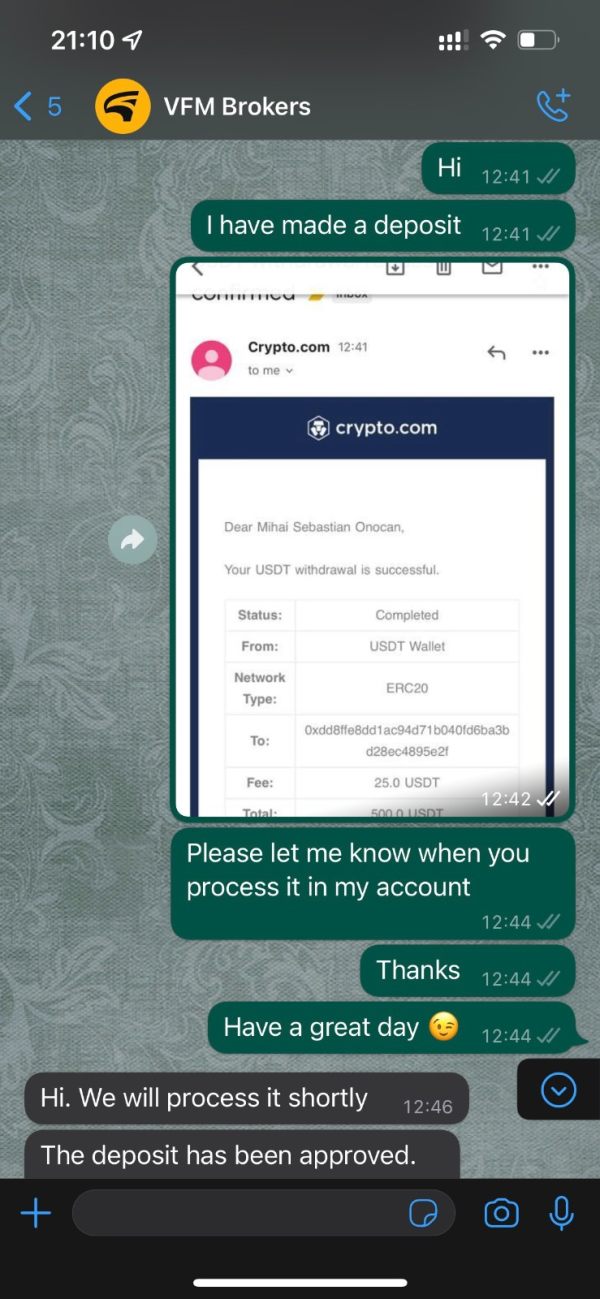

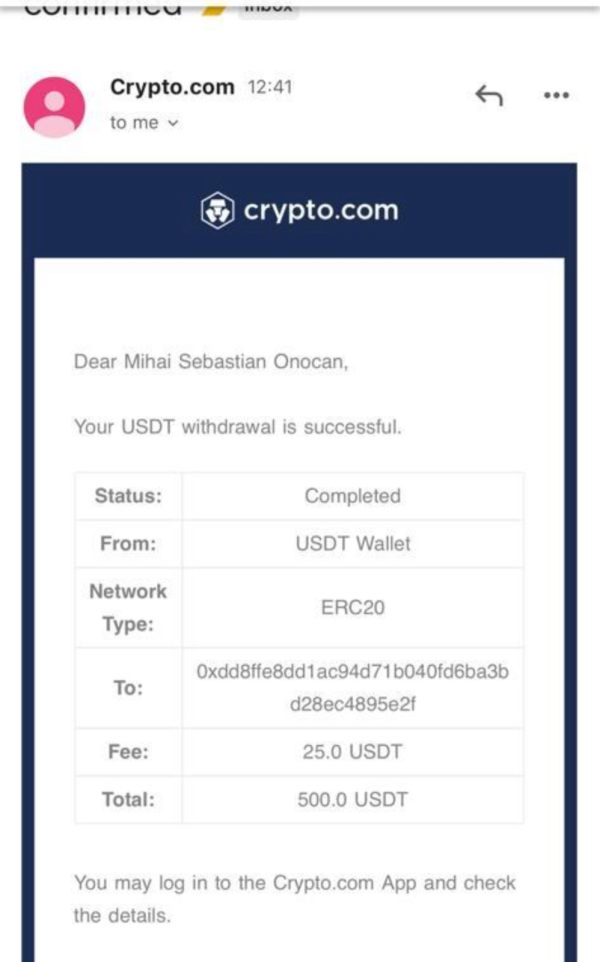

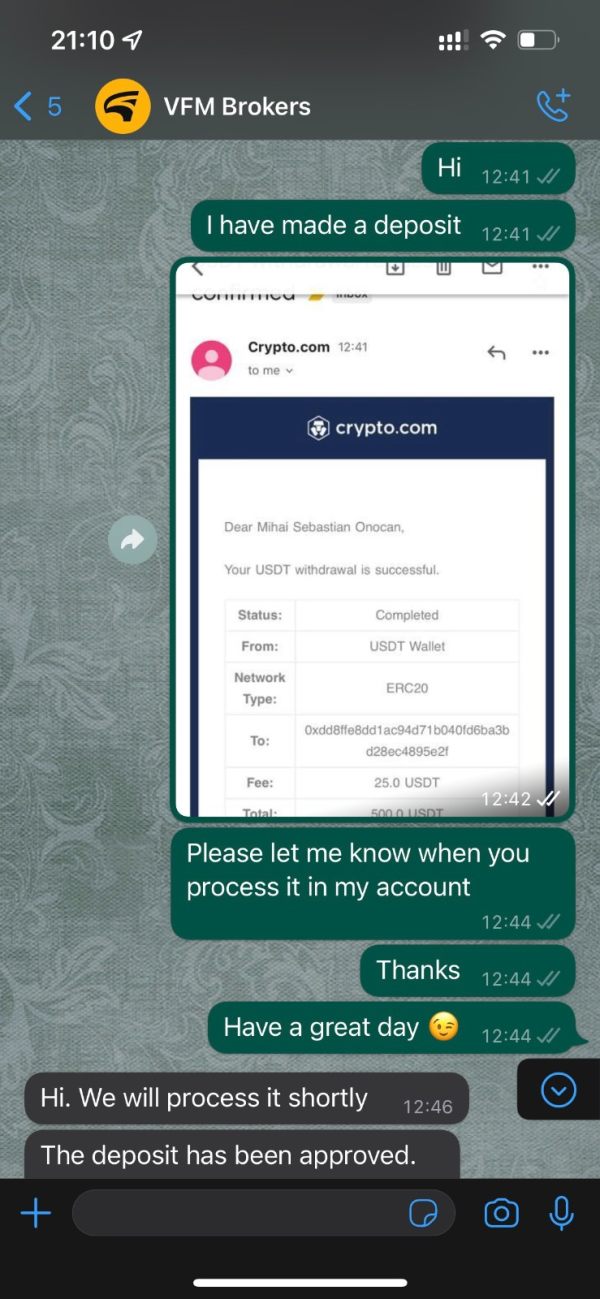

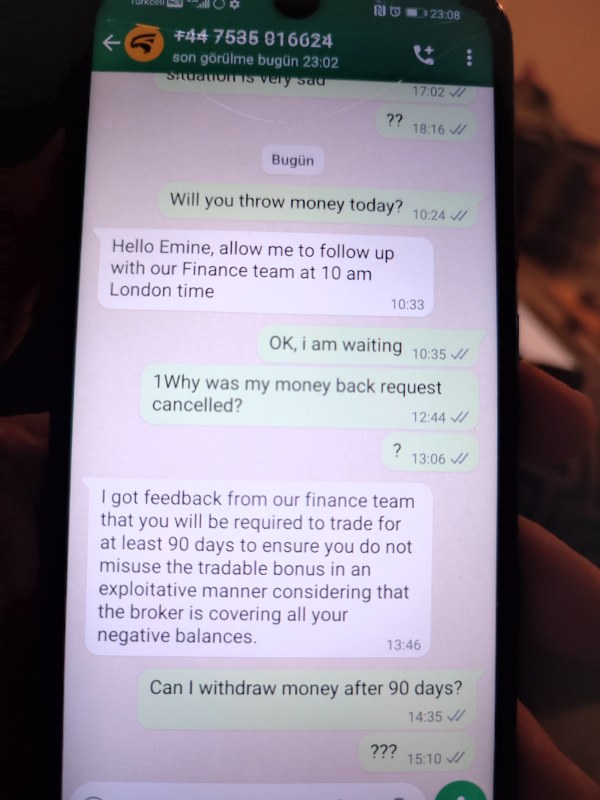

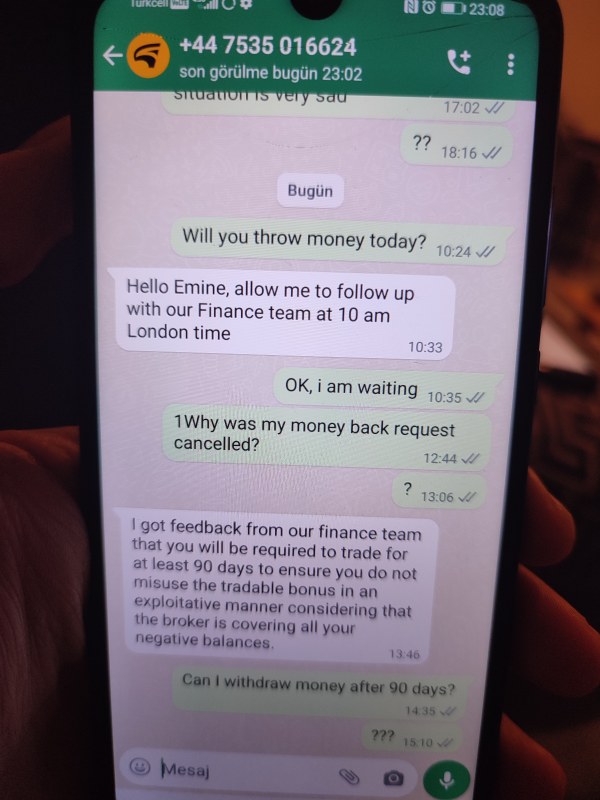

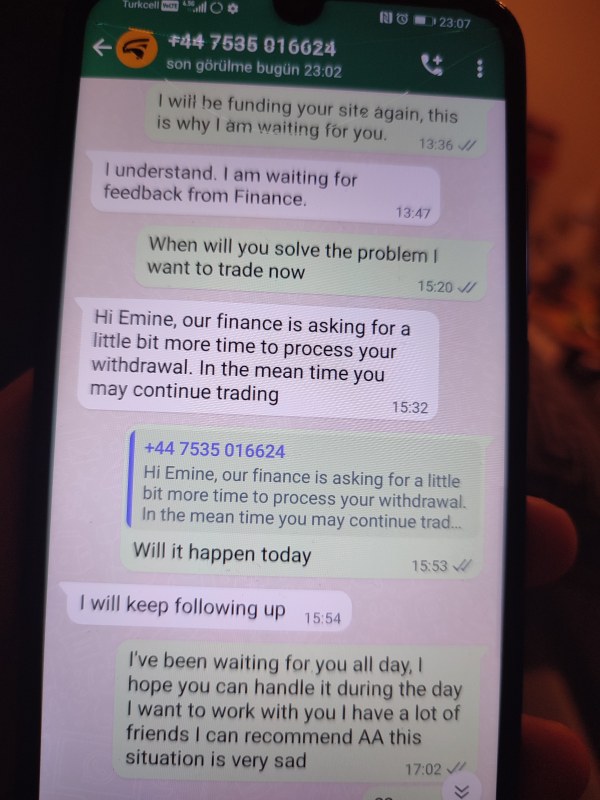

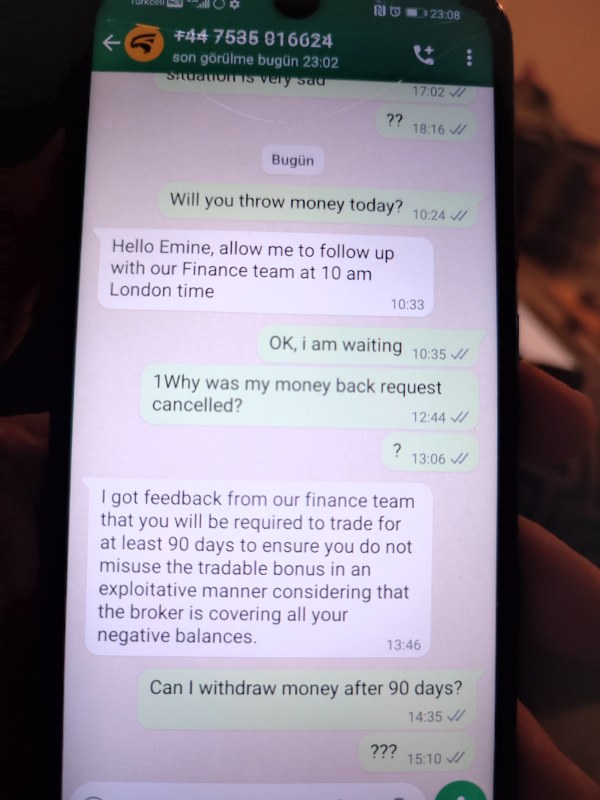

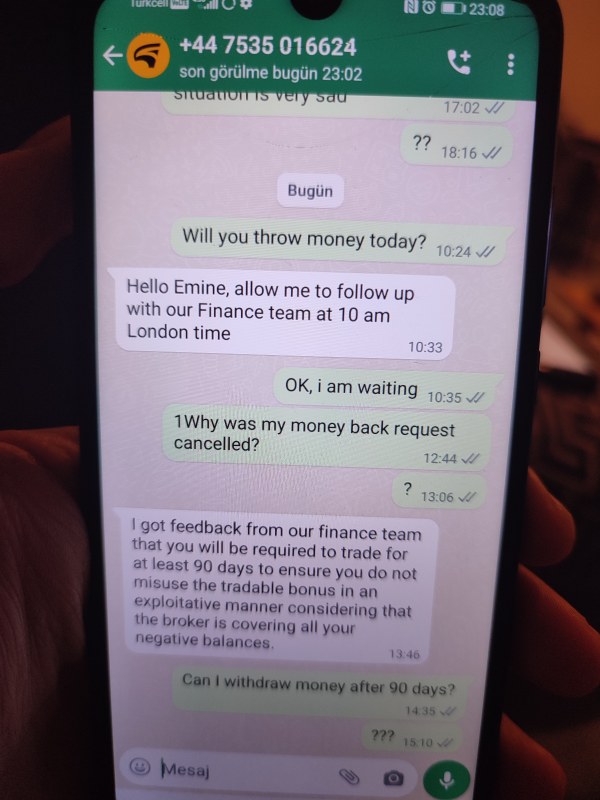

Trust assessment for VFM Brokers reveals significant concerns based on available information and community discussions. Multiple review platforms have raised questions about the broker's legitimacy and reliability, with some sources specifically warning users about potential scam risks. The absence of clear regulatory oversight from recognized financial authorities represents a major red flag for trader protection and fund security.

Regulatory compliance serves as the foundation of broker trustworthiness, providing legal frameworks for dispute resolution, fund segregation, and operational oversight. The lack of verifiable regulatory information makes it impossible to confirm whether VFM Brokers operates under proper financial supervision. Additionally, the limited transparency about company ownership, financial statements, and operational history contributes to trust concerns. Third-party warnings and negative discussions about potential fraudulent activities further diminish confidence in the platform's reliability and safety.

User Experience Analysis

User experience evaluation for VFM Brokers faces challenges due to limited feedback and testimonials from actual traders. Available sources include warnings from review platforms advising users to carefully examine the platform before trading to avoid potential financial losses. This suggests that user experiences may not meet standard industry expectations for safety and reliability.

The overall user satisfaction appears questionable based on community discussions and warning messages found across various review platforms. Professional brokers typically receive detailed user feedback about platform usability, customer service quality, withdrawal experiences, and overall satisfaction levels. The absence of positive user testimonials and the presence of cautionary warnings indicate potential issues with user experience quality. Without comprehensive user feedback data, it becomes difficult to recommend VFM Brokers to traders seeking reliable and satisfactory trading experiences.

Conclusion

This vfm brokers review concludes with a cautious assessment due to significant information gaps and community concerns about the platform's legitimacy. The lack of clear regulatory oversight, transparent trading conditions, and detailed operational information creates substantial uncertainty for potential traders. Multiple warning signs including community discussions about potential scam risks and absence of verifiable regulatory compliance suggest that traders should exercise extreme caution when considering VFM Brokers for their trading activities. The platform's claims of global service across 50+ countries remain unsubstantiated without proper regulatory documentation and transparent operational details.