Is EQUITY WORLD safe?

Pros

Cons

Is Equity World A Scam?

Introduction

Equity World is a forex broker that positions itself within the competitive landscape of the foreign exchange market. As trading platforms proliferate, traders must exercise caution and conduct thorough evaluations before engaging with any broker. The stakes are high, as the potential for financial loss is significant, and the presence of unscrupulous brokers can lead to devastating outcomes for investors. This article aims to provide a comprehensive assessment of Equity World, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The evaluation draws on various online sources, user reviews, and regulatory data to paint an accurate picture of whether Equity World is safe for traders.

Regulation and Legitimacy

The regulatory environment is crucial for any trading broker, as it serves as a safety net for traders' funds and ensures compliance with industry standards. Equity World claims to operate under the oversight of regulatory authorities, but the specifics of its licensing and regulatory status require careful examination.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 850/Bappebti/SI/12/2005 | Indonesia | Verified |

Equity World is regulated by the Badan Pengawas Perdagangan Berjangka Komoditi (Bappebti), which is the Indonesian authority responsible for overseeing commodity futures trading. The presence of a regulatory body is a positive sign, as it indicates that the broker is subject to certain operational guidelines and standards aimed at protecting traders. However, it is essential to note that the quality of regulation can vary significantly. While Bappebti does provide a framework for oversight, it may not be as stringent as regulators in more established financial markets, such as the FCA in the UK or the SEC in the USA.

Historically, there have been mixed reviews regarding the compliance of brokers regulated by Bappebti. Some users have reported issues related to fund withdrawals and customer service responsiveness, raising concerns about whether Equity World is safe for trading. Therefore, while the regulatory status is a positive factor, it should not be the sole consideration for traders.

Company Background Investigation

Equity World was established in 2005 and has since expanded its operations in the Indonesian market. The company claims to focus on providing quality trading services, particularly in the futures and forex sectors. However, the ownership structure and management team warrant further scrutiny.

The management team at Equity World comprises individuals with backgrounds in finance and trading, although specific details regarding their professional experiences are limited. This lack of transparency can be a red flag for potential investors. A brokers credibility is often bolstered by the expertise of its management team, and without clear information, traders may find it challenging to assess the competence of those at the helm.

Furthermore, the companys transparency in disclosing operational information is essential. Equity World provides basic details about its services, but more comprehensive insights into its financial health, ownership, and operational practices would enhance its credibility. The absence of such information may lead traders to question whether Equity World is safe or if it operates with a lack of accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for any trader. Equity World presents a range of trading options, but the overall fee structure and potential hidden costs require careful consideration.

| Fee Type | Equity World | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 1.5% | 0.5% |

Equity Worlds spread for major currency pairs appears to be higher than the industry average, which could significantly impact trading profitability. Moreover, the absence of a commission model may initially seem appealing; however, higher spreads can effectively serve as a hidden cost. Additionally, the overnight interest rates are notably higher than average, which could affect traders who hold positions overnight.

While the trading conditions might attract some traders, it is essential to scrutinize whether these terms align with the expectations of a reliable broker. The combination of high spreads and elevated overnight rates raises questions about the overall cost-effectiveness of trading with Equity World, leading to concerns about whether Equity World is safe for long-term investments.

Customer Funds Security

The safety of customer funds is paramount when evaluating a brokers reliability. Equity World has made claims regarding its measures for securing client funds, but a detailed analysis is necessary to determine their effectiveness.

Equity World states that it employs fund segregation practices, ensuring that client funds are kept separate from the companys operational funds. This is a standard practice among reputable brokers and serves as a safeguard for traders. However, the specifics of these measures, such as the banking institutions used for fund storage and any investor protection schemes in place, are not adequately disclosed.

Additionally, there have been reports of customers experiencing difficulties when attempting to withdraw their funds, which raises significant concerns about the broker's commitment to fund security. Historical issues regarding fund accessibility can be indicative of deeper problems within the brokers operational framework. Therefore, potential traders should carefully consider these factors when assessing whether Equity World is safe for their investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the real-world experiences of traders with a particular broker. Equity World has received mixed reviews, with some users expressing satisfaction with the trading platform while others highlight significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Account Management Problems | High | Poor |

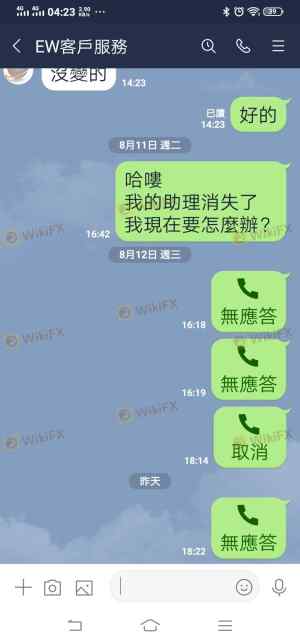

A common theme in customer complaints revolves around withdrawal difficulties. Numerous users have reported being unable to access their funds, which is a serious concern for any potential investor. Additionally, the response quality from customer service has been criticized, with many users experiencing long wait times or inadequate assistance.

Several specific cases highlight these issues: one user reported a prolonged withdrawal process that ended in frustration, while another indicated that their account manager became unresponsive after they attempted to withdraw funds. Such experiences raise significant doubts about whether Equity World is safe for traders who prioritize reliable access to their capital.

Platform and Trade Execution

The trading platform's performance is another critical aspect of a broker's reliability. Equity World offers a trading platform that claims to be user-friendly and efficient, but its actual performance needs thorough evaluation.

Users have noted that the platform provides basic functionalities, but there are concerns regarding its stability and execution quality. Instances of slippage and rejected orders have been reported, which can severely impact trading outcomes. Furthermore, any indications of potential manipulation or unfair practices would further diminish the broker's credibility.

The overall user experience on the platform should be seamless, allowing traders to execute orders swiftly and efficiently. However, if traders encounter frequent technical issues or execution delays, it raises questions about whether Equity World is safe for conducting trades.

Risk Assessment

When considering any broker, it is essential to evaluate the associated risks. Equity World presents several risk factors that potential traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Oversight by a less stringent regulator |

| Financial Risk | High | High spreads and fees impact profitability |

| Operational Risk | Medium | Customer complaints about withdrawals |

The regulatory risk stems from Equity World being overseen by Bappebti, which may not provide the same level of protection as more established regulators. Additionally, the financial risks posed by high trading costs can erode profitability, making it challenging for traders to achieve their financial goals.

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a demo account, and remain vigilant regarding their trading activities. By doing so, they can better assess whether Equity World is safe for their trading endeavors.

Conclusion and Recommendations

In conclusion, the evaluation of Equity World presents a mixed picture. While the broker is regulated by Bappebti, concerns regarding its operational practices, customer service responsiveness, and overall trading conditions raise significant red flags. The history of customer complaints related to fund withdrawals and the lack of transparency regarding management and operational practices further complicate the assessment.

For traders considering Equity World, it is crucial to weigh these factors carefully. If you prioritize security and transparency, you may want to explore alternative brokers with stronger regulatory oversight and a better reputation for customer service. Some reliable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which are known for their stringent compliance standards.

Ultimately, potential traders should approach Equity World with caution, as the evidence suggests that there are significant risks associated with trading through this broker. It is essential to stay informed and make decisions based on thorough research and consideration of all factors involved.

Is EQUITY WORLD a scam, or is it legit?

The latest exposure and evaluation content of EQUITY WORLD brokers.

EQUITY WORLD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EQUITY WORLD latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.