Regarding the legitimacy of USDETF forex brokers, it provides SCB and WikiBit, .

Is USDETF safe?

Business

License

Is USDETF markets regulated?

The regulatory license is the strongest proof.

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Pepperstone Markets Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Pineapple House, Old Fort Bay, Western Road, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is USDETF Safe or Scam?

Introduction

USDETF is a relatively new player in the forex market, positioning itself as a broker that offers trading in various currency pairs and financial instruments. With the rise of online trading, the influx of new brokers has made it increasingly important for traders to carefully evaluate the legitimacy and safety of these platforms. This is particularly crucial given the prevalence of scams in the industry, where unscrupulous entities can exploit unsuspecting traders. In this article, we will delve into the various aspects of USDETF, employing a comprehensive investigative approach that includes regulatory status, company background, trading conditions, customer safety measures, and user feedback to determine whether USDETF is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Brokers that operate under strict regulatory oversight are generally considered safer for traders, as they are required to adhere to specific standards and practices designed to protect investor funds. In the case of USDETF, the broker has come under scrutiny for its lack of proper regulation. The Securities Commission of The Bahamas (SCB) has added USDETF to its warning list, citing that it offers financial services without the necessary permissions. This lack of regulation raises significant concerns about the safety of funds deposited with USDETF.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SCB | N/A | Bahamas | Warning Issued |

The absence of a valid license and the SCB's warning indicate that USDETF operates in a high-risk environment. This situation is compounded by the fact that the broker has been labeled as unregulated by multiple sources, which further diminishes its credibility. Without oversight from a reputable regulatory body, traders are left without the legal protections that are typically in place to safeguard their investments. Therefore, it is essential for traders to tread carefully and consider the implications of trading with USDETF. The evidence suggests that USDETF is not safe for traders looking to protect their investments.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide valuable insights into its reliability. Unfortunately, information about USDETF's history and ownership is sparse, contributing to its dubious reputation. The broker does not provide clear details about its founding, management team, or operational practices, which raises red flags regarding transparency. A reputable broker typically discloses such information to build trust with its clients.

Additionally, the management team's background is often indicative of a broker's reliability. In the case of USDETF, there is a lack of information regarding the qualifications and experience of its leadership. This absence of transparency can lead to skepticism among potential clients, as a strong management team with a proven track record is essential for ensuring ethical business practices. Overall, the limited information available about USDETF's company background leads to concerns about its credibility and operational integrity, reinforcing the notion that USDETF may not be safe for traders.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can greatly influence a trader's experience. USDETF claims to provide competitive trading conditions, yet the actual costs associated with trading on their platform remain unclear. A thorough examination of the fee structure is crucial for understanding the potential costs that traders may incur.

| Fee Type | USDETF | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads, commissions, and overnight interest rates is concerning. Traders may find themselves subject to unexpected fees or unfavorable trading conditions, which can significantly impact their profitability. Additionally, if USDETF employs any unusual or excessive fees, this could further indicate a lack of integrity. Therefore, the overall ambiguity surrounding USDETF's trading conditions raises questions about its reliability and safety, leading to the conclusion that USDETF may be a scam.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. USDETF's approach to managing client funds remains unclear, particularly concerning whether client funds are held in segregated accounts. Segregation of funds is crucial, as it ensures that client money is kept separate from the broker's operational funds, providing a layer of protection in case the broker faces financial difficulties.

Furthermore, it is essential to evaluate the broker's policies regarding investor protection and negative balance protection. Unfortunately, USDETF does not provide adequate information on these safety measures. In the absence of such protections, traders risk losing their entire investment, especially in volatile market conditions. Historical incidents involving fund mismanagement or loss can severely tarnish a broker's reputation, and there is no evidence to suggest that USDETF has taken the necessary steps to ensure client fund safety. Therefore, the lack of clear information about fund safety measures further indicates that USDETF is not safe.

Customer Experience and Complaints

Analyzing customer feedback and complaints can offer valuable insights into a broker's reliability. USDETF has garnered a number of negative reviews and complaints from users, highlighting issues such as withdrawal difficulties and poor customer service. Common complaints include users being unable to withdraw their funds after reaching certain trading thresholds, which is a significant concern for any trader.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

The severity of withdrawal issues indicates that many traders have faced significant challenges when attempting to access their funds. Additionally, the lack of a satisfactory response from the company regarding these complaints exacerbates the situation. Such patterns of negative feedback are often indicative of deeper issues within the broker's operational practices and can serve as a warning sign for potential clients. Consequently, the evidence suggests that USDETF may not be a trustworthy broker.

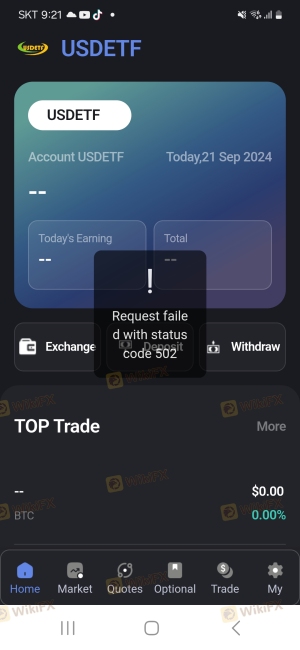

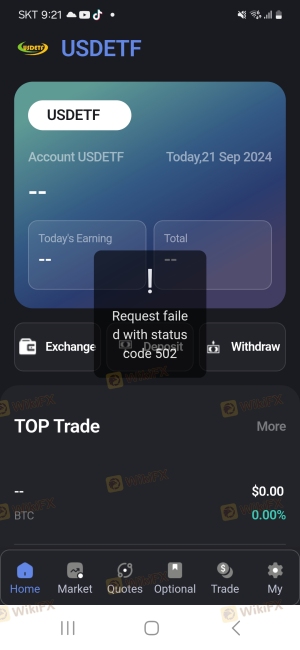

Platform and Trade Execution

The performance and reliability of a trading platform are critical components of a trader's experience. USDETF's platform claims to provide seamless trading capabilities; however, there are few user reviews available to substantiate these claims. As with any trading platform, the quality of order execution, slippage, and rejection rates are crucial factors that can affect a trader's profitability.

There are no clear indications of platform manipulation or significant execution issues reported by users, but the lack of comprehensive feedback raises concerns about the overall user experience. A reliable broker should provide a stable and efficient trading environment, and the absence of such information about USDETF suggests that traders may encounter difficulties when executing trades. This uncertainty contributes to the overall risk associated with trading on the platform, leading to the conclusion that USDETF is potentially unsafe.

Risk Assessment

When considering whether to engage with a broker, it is essential to assess the overall risks involved. USDETF presents several risk factors that could impact traders' experiences and investments. The lack of regulation, transparency issues, and negative user feedback all contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Transparency Risk | High | Limited information about the broker |

| Customer Service Risk | Medium | Poor response to user complaints |

Given these risk factors, it is advisable for traders to exercise caution when considering USDETF as their broker. Engaging with an unregulated and poorly-reviewed broker can lead to significant financial losses. Traders should seek alternatives that provide better regulatory oversight and a proven track record of reliability.

Conclusion and Recommendations

In summary, the investigation into USDETF reveals numerous red flags that indicate it may not be a safe trading option for forex traders. The lack of regulation, transparency issues, and negative user experiences collectively suggest that USDETF is likely a scam. Potential traders should approach this broker with caution and consider seeking alternatives that offer a more secure trading environment.

For traders looking for reliable alternatives, it is recommended to consider brokers that are well-regulated and have positive user reviews. Brokers such as Forex.com, IG Group, and OANDA have established reputations and offer robust regulatory oversight, ensuring a safer trading experience. Ultimately, thorough research and due diligence are essential in the forex market to protect investments and ensure a positive trading experience.

Is USDETF a scam, or is it legit?

The latest exposure and evaluation content of USDETF brokers.

USDETF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USDETF latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.