USDETF 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive usdetf review reveals significant concerns about the platform's legitimacy and regulatory status. USDETF presents itself as a trading platform offering access to multiple asset classes, but our analysis indicates substantial red flags that potential traders must consider.

The platform claims to be licensed by the Securities Commission of the Bahamas, yet regulatory warnings suggest this may be misleading or fraudulent. USDETF targets novice traders with a relatively low minimum deposit requirement of $250 and promises access to over 100 trading instruments across various markets including forex, commodities, stocks, ETFs, indices, and cryptocurrencies.

However, the platform's lack of transparency regarding fee structures, leverage ratios, and commission rates raises serious concerns about its operational legitimacy. The most critical finding in this usdetf review is the widespread classification of the platform as a potential scam by industry watchdogs and user communities.

The Securities Commission of the Bahamas has issued warnings about suspicious websites claiming false regulatory authorization, which directly impacts USDETF's credibility claims. User feedback consistently highlights trust issues, poor customer service experiences, and concerns about fund safety.

Important Notice

Regional Entity Variations: USDETF claims to operate from Melbourne, Australia, while simultaneously asserting registration in the Bahamas. This jurisdictional ambiguity creates potential legal and regulatory risks for traders, as the actual regulatory oversight remains unclear.

The discrepancy between claimed operational headquarters and registration location should be a significant concern for potential users.

Review Methodology: This evaluation is based on publicly available information, regulatory warnings, user feedback, and industry reports. Due to the platform's questionable regulatory status, no direct verification or testing of services was conducted.

Traders should exercise extreme caution and conduct independent verification before considering any engagement with this platform.

Rating Framework

Broker Overview

USDETF claims establishment in 2010, positioning itself as an experienced player in the online trading industry. The company presents a complex corporate structure with alleged headquarters in Melbourne, Australia, while maintaining registration in the Bahamas.

This geographical separation between operational claims and legal registration creates immediate transparency concerns that potential traders should carefully consider. The platform's business model centers on providing multi-asset trading opportunities to retail investors, particularly targeting newcomers to financial markets.

USDETF promotes itself as offering comprehensive access to global financial markets through a single platform interface. However, the lack of clear information about the actual trading infrastructure, technology providers, and operational partnerships raises questions about the platform's genuine capabilities and service delivery mechanisms.

Regarding regulatory oversight, USDETF's claims of authorization by the Bahamas Securities Commission have been called into question by regulatory warnings. The platform operates in a regulatory gray area that potentially exposes users to significant risks.

The absence of clear regulatory protection mechanisms, combined with limited transparency about fund segregation and client protection measures, makes this platform unsuitable for serious traders seeking secure trading environments.

Regulatory Status: USDETF claims authorization from the Bahamas Securities Commission, but regulatory warnings suggest this may be fraudulent or misleading. The SCB has issued alerts about suspicious websites making false regulatory claims.

Minimum Deposit Requirements: The platform requires a minimum deposit of $250, which appears competitive for entry-level trading but lacks transparency about additional fees or hidden charges.

Available Trading Assets: USDETF advertises access to forex pairs, stock indices, commodities, ETFs, individual stocks, and cryptocurrency instruments, claiming over 100 available trading options across these categories.

Cost Structure: Critical information about spreads, commissions, overnight fees, and withdrawal charges remains unclear or undisclosed, creating uncertainty about the true cost of trading.

Trading Platforms: Specific information about the trading platform technology, whether proprietary or third-party solutions like MetaTrader, is not clearly disclosed in available materials.

Promotional Offers: Details about welcome bonuses, deposit incentives, or promotional trading credits are not specified in the available information about this platform.

Geographic Restrictions: The platform's availability in different jurisdictions and any regional trading restrictions are not clearly outlined in accessible documentation.

This usdetf review highlights the concerning lack of transparency across multiple operational aspects that legitimate brokers typically disclose prominently.

Account Conditions Analysis

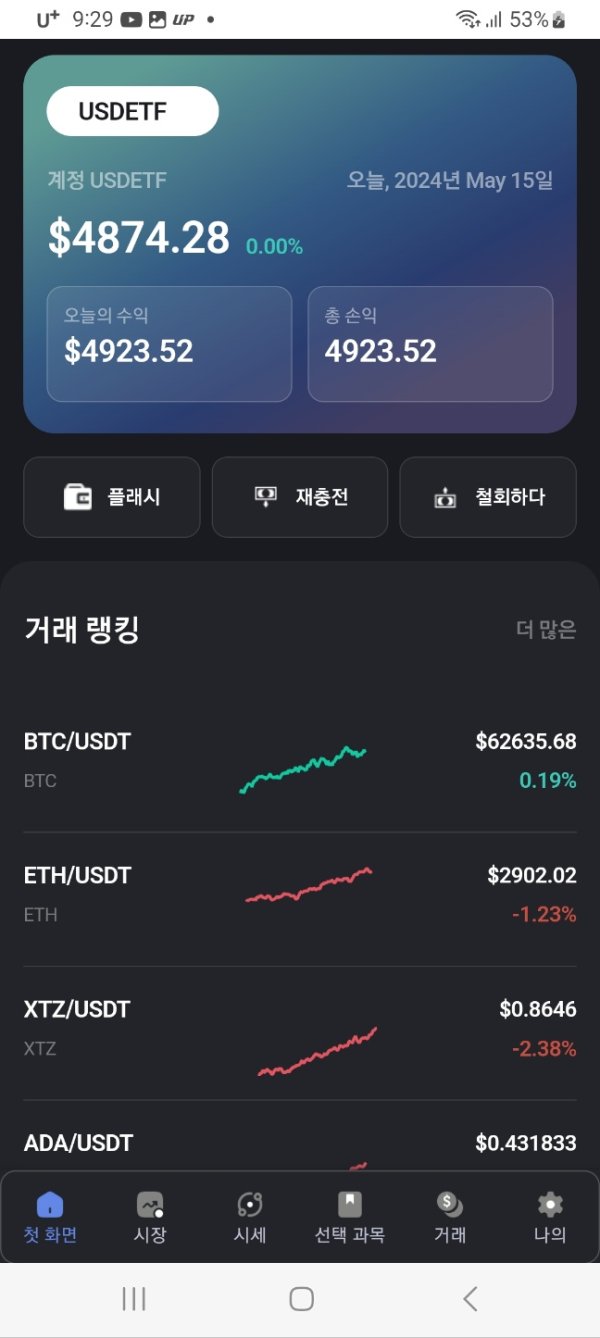

USDETF's account structure appears designed to attract novice traders with its $250 minimum deposit requirement, which falls within the lower range of industry standards. However, this seemingly attractive entry point is overshadowed by the platform's failure to provide transparent information about account types, fee structures, and trading conditions.

Legitimate brokers typically offer detailed breakdowns of different account tiers, each with specific features, benefits, and cost structures. The absence of clear information about leverage ratios, margin requirements, and position sizing rules creates significant uncertainty for potential traders.

Professional trading platforms usually provide comprehensive documentation about risk management tools, stop-out levels, and margin call procedures. USDETF's lack of transparency in these critical areas suggests either poor operational standards or deliberate obfuscation of important trading conditions.

User feedback consistently highlights confusion about account terms and conditions, with many reporting unexpected fees or charges that were not clearly disclosed during the registration process. The platform's failure to provide clear, accessible information about account management procedures, including deposit and withdrawal processes, further undermines confidence in its operational legitimacy.

When compared to established, regulated brokers, USDETF's account conditions lack the transparency and detailed documentation that traders expect from professional trading platforms. This usdetf review emphasizes that the unclear account terms represent a significant risk factor for potential users.

USDETF claims to provide access to multiple market instruments and trading tools, but specific details about the quality, functionality, and reliability of these resources remain largely undisclosed. Professional trading platforms typically offer comprehensive suites of analytical tools, real-time market data, economic calendars, and research resources to support informed trading decisions.

The platform's promotional materials mention various trading instruments across different asset classes, but lack detailed specifications about execution quality, data feed sources, or analytical capabilities. Users report uncertainty about the actual functionality of available tools and question whether the platform provides genuine market access or operates as a dealing desk with potential conflicts of interest.

Educational resources, which are crucial for the novice traders that USDETF appears to target, are not clearly documented or promoted. Legitimate brokers typically invest significantly in educational content, webinars, tutorials, and market analysis to support client success.

The absence of visible educational infrastructure raises questions about the platform's commitment to client development and success. Automated trading support, API access, and third-party tool integration capabilities are not clearly specified, limiting advanced traders' ability to implement sophisticated trading strategies.

This lack of technical depth suggests the platform may not be suitable for serious traders requiring professional-grade tools and resources.

Customer Service and Support Analysis

Customer service represents one of the most concerning aspects highlighted in this usdetf review. User feedback consistently reports poor responsiveness, unprofessional communication, and inadequate problem resolution from the platform's support team.

Many users describe difficulties in reaching customer service representatives and receiving unsatisfactory responses to legitimate inquiries. The platform's customer support infrastructure appears limited, with unclear information about available contact methods, support hours, and escalation procedures.

Professional brokers typically offer multiple communication channels including live chat, phone support, email tickets, and comprehensive FAQ sections. USDETF's apparent lack of robust customer service infrastructure suggests inadequate investment in client support systems.

Response times for customer inquiries are reportedly poor, with users experiencing delays in receiving answers to account-related questions, technical issues, and withdrawal requests. This slow response pattern is particularly concerning given the time-sensitive nature of trading activities and the need for prompt resolution of account issues.

Language support and regional customer service capabilities are not clearly defined, potentially creating additional barriers for international users. The absence of clear escalation procedures and complaint resolution mechanisms further undermines confidence in the platform's ability to address serious client concerns effectively.

Trading Experience Analysis

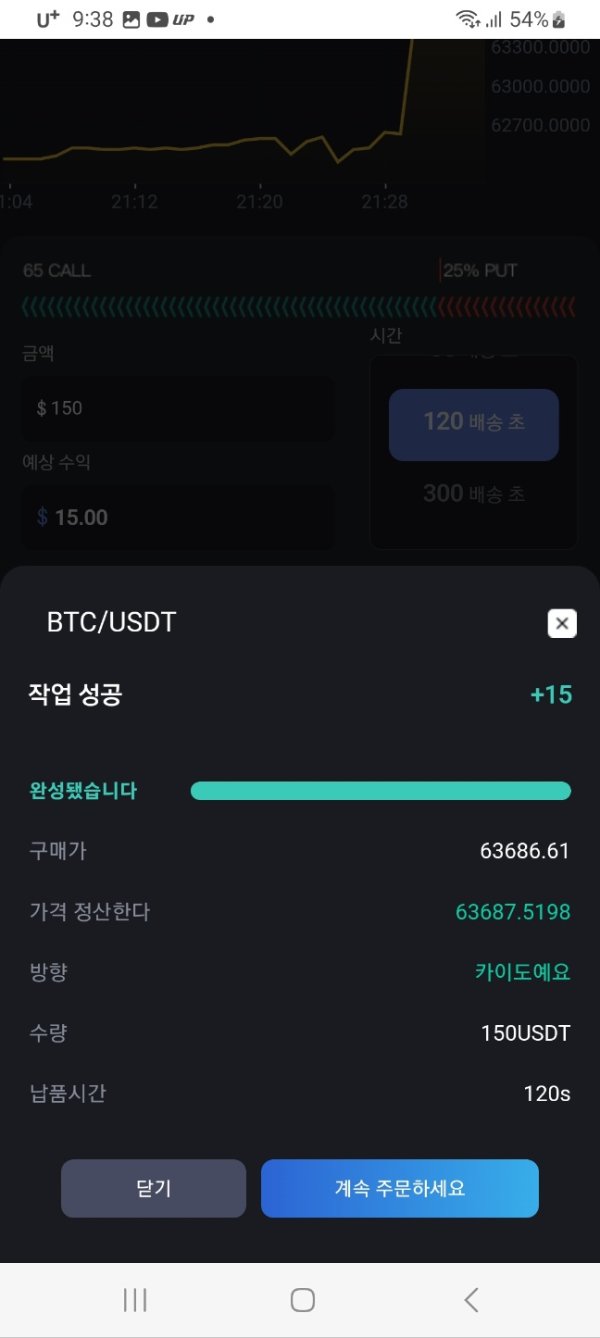

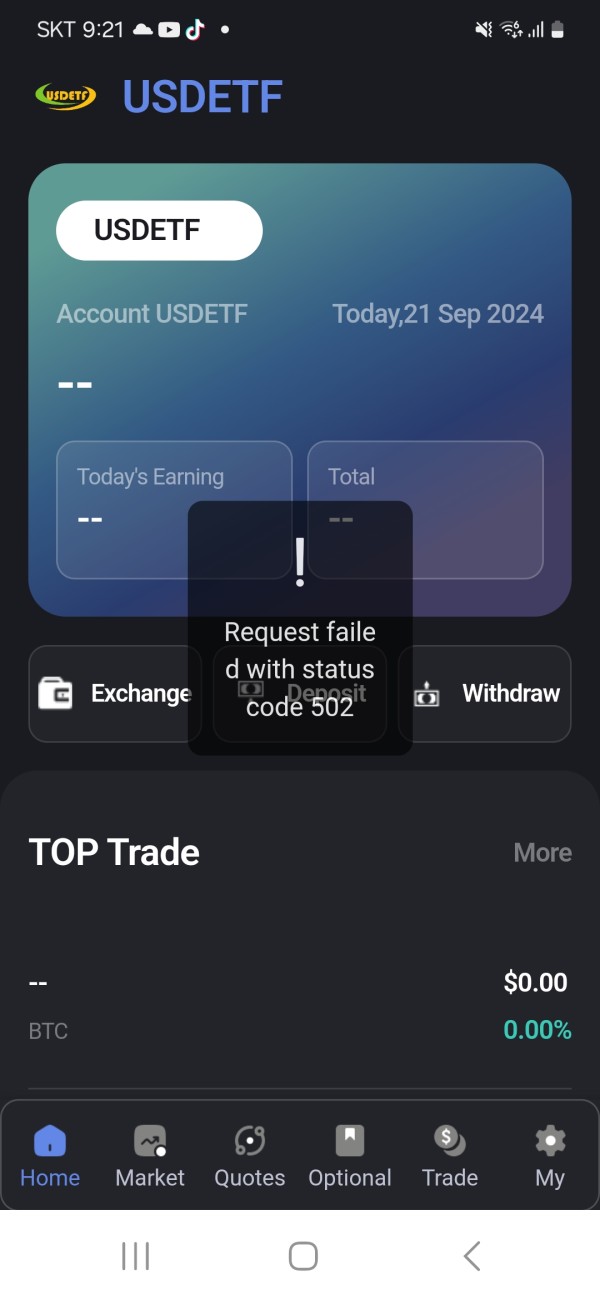

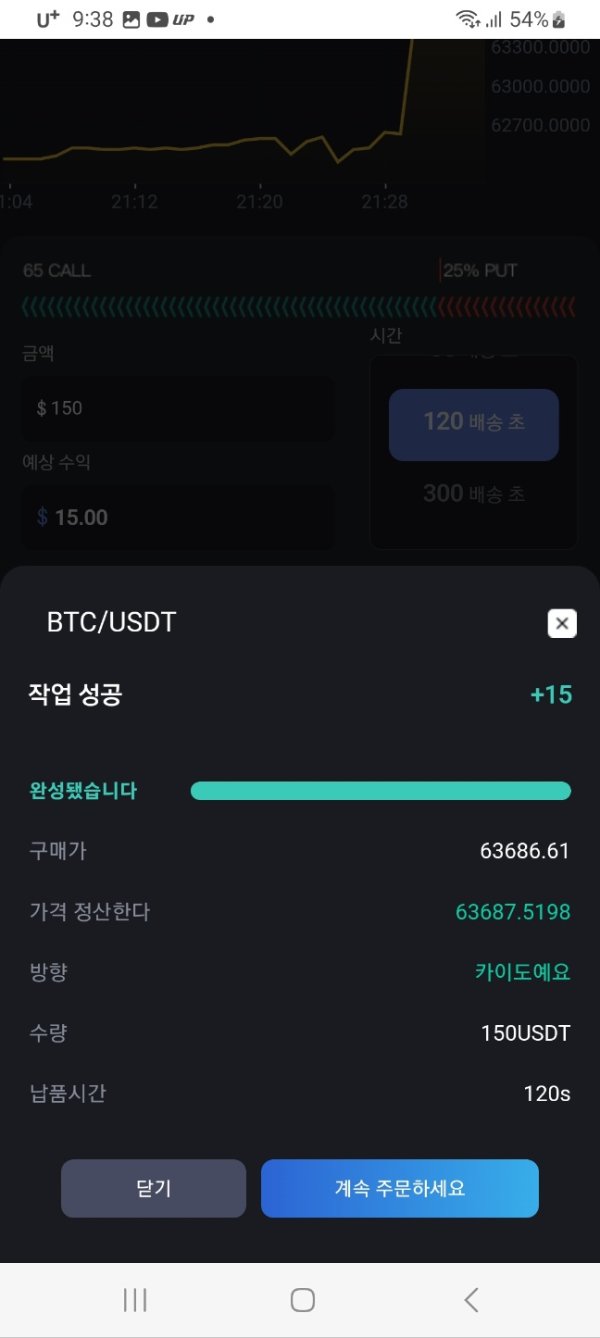

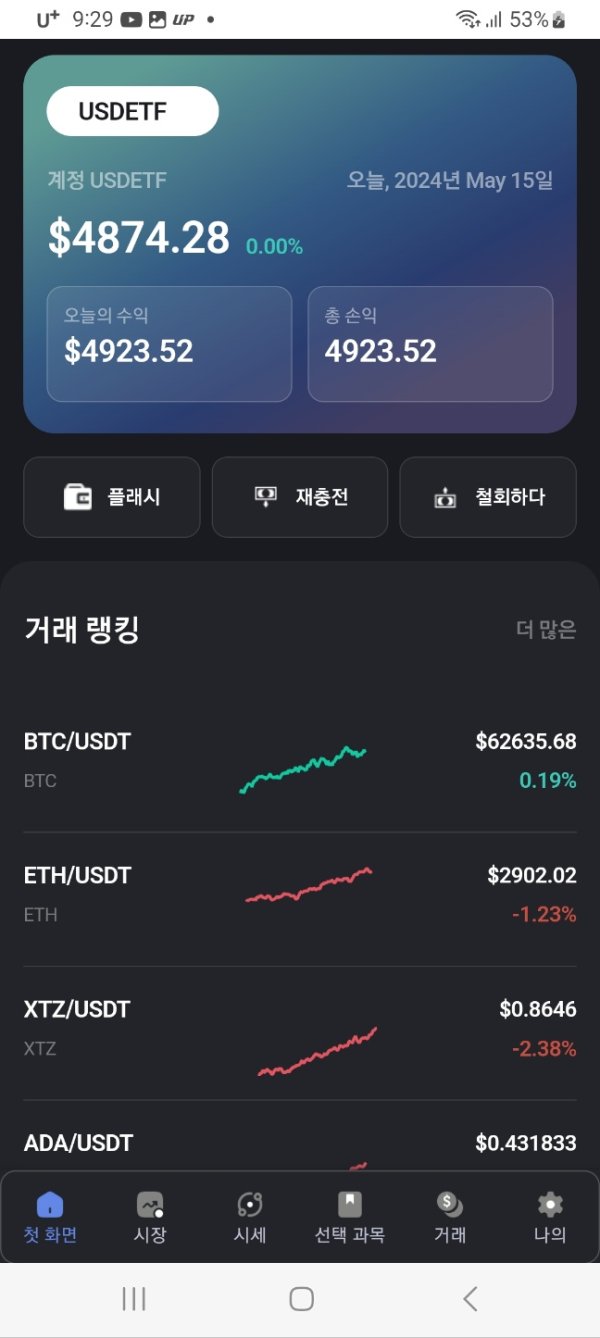

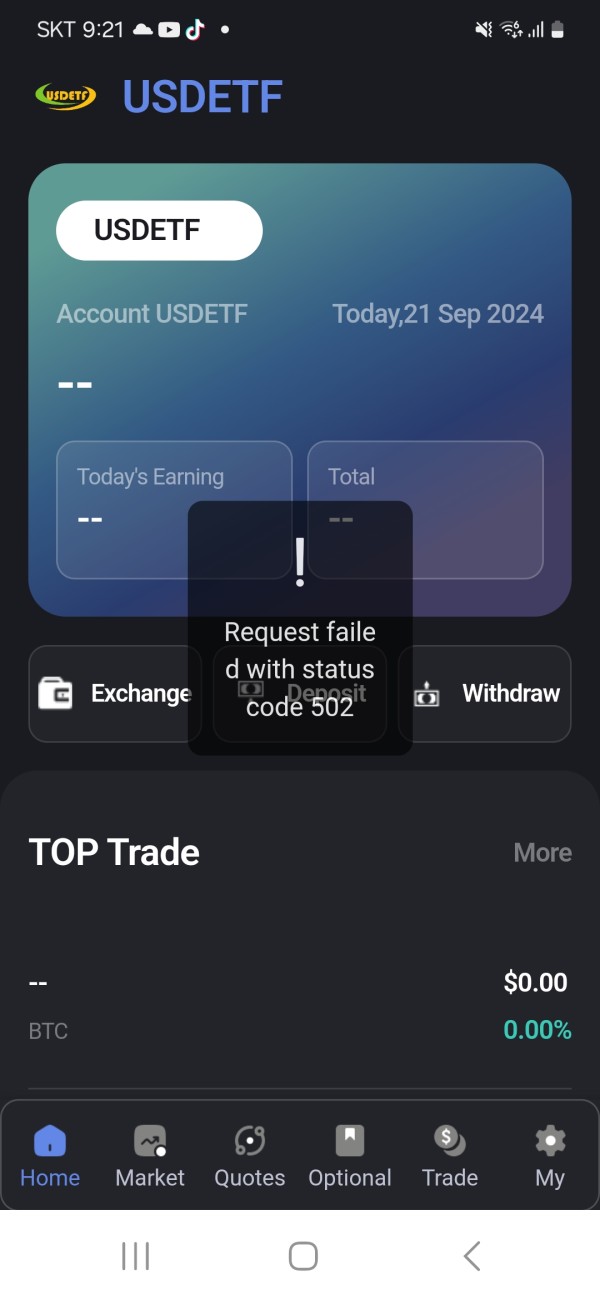

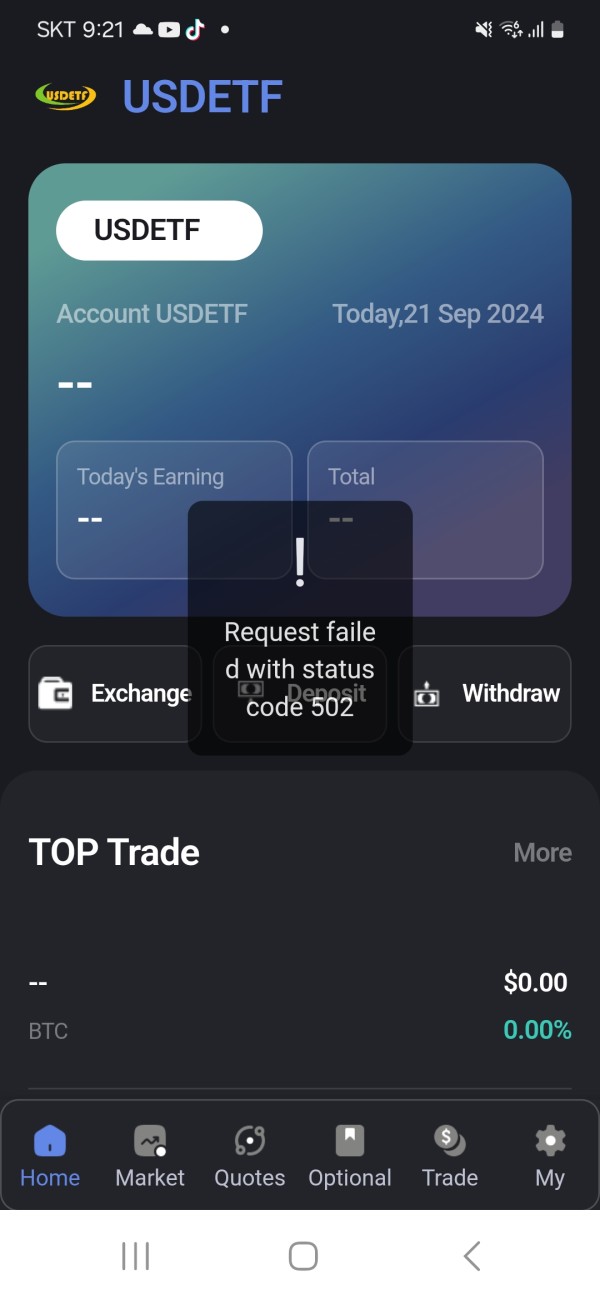

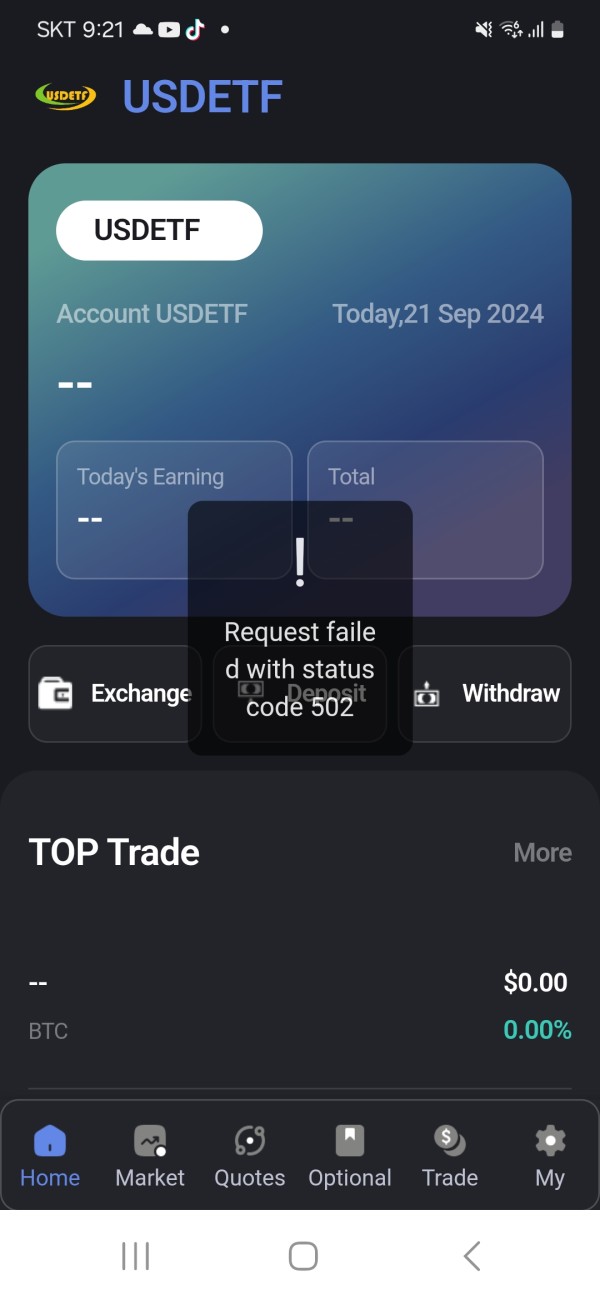

The trading experience on USDETF appears problematic based on available user feedback and platform analysis. Users report concerns about platform stability, order execution quality, and overall reliability of the trading environment.

These issues are fundamental to successful trading and represent serious red flags for potential users. Platform performance metrics, including execution speeds, slippage rates, and system uptime statistics, are not transparently reported by USDETF.

Professional brokers typically provide detailed performance data and maintain high standards for execution quality. The absence of such transparency suggests potential issues with the underlying trading infrastructure.

Mobile trading capabilities and cross-device synchronization features are not clearly documented, limiting traders' ability to manage positions effectively across different environments. Modern trading requires seamless integration between desktop and mobile platforms, and USDETF's unclear mobile offering represents a significant limitation.

Technical analysis tools, charting capabilities, and market data quality reports from users suggest limitations compared to established trading platforms. The lack of advanced charting features and comprehensive technical indicators may restrict traders' ability to conduct thorough market analysis and implement sophisticated trading strategies.

This usdetf review emphasizes that the reported trading experience issues make the platform unsuitable for serious trading activities, particularly for users requiring reliable execution and professional-grade trading tools.

Trust and Safety Analysis

Trust and safety concerns represent the most critical issues identified in this usdetf review. The platform's regulatory status remains highly questionable, with the Securities Commission of the Bahamas issuing warnings about suspicious websites making false regulatory claims.

This regulatory uncertainty creates significant risks for user funds and legal protection. Fund segregation practices, client money protection measures, and deposit insurance coverage are not clearly documented or verified.

Legitimate brokers typically maintain strict segregation of client funds in tier-one banking institutions and provide clear documentation about fund protection measures. USDETF's lack of transparency in this crucial area represents a major red flag.

The platform's corporate structure and beneficial ownership remain opaque, making it difficult for users to understand who actually controls their funds and trading accounts. This lack of corporate transparency is inconsistent with legitimate financial services operations and raises serious questions about accountability and oversight.

Industry reputation and third-party assessments consistently classify USDETF as a potential scam or untrustworthy platform. Multiple warning websites and regulatory bodies have flagged concerns about the platform's operations, creating a pattern of negative assessments that potential users must carefully consider.

User Experience Analysis

Overall user satisfaction with USDETF appears extremely low based on available feedback and reviews. Users consistently report negative experiences across multiple aspects of platform interaction, from initial registration through ongoing account management and eventual withdrawal attempts.

The registration and account verification process reportedly lacks clarity and professionalism, with users experiencing confusion about documentation requirements and approval timelines. Professional brokers typically maintain streamlined, transparent onboarding processes with clear communication about each step and expected timelines.

User interface design and platform usability receive poor reviews, with reports of confusing navigation, unclear functionality, and poor overall design quality. Modern trading platforms invest significantly in user experience design to ensure intuitive, efficient interaction with complex trading tools and account management features.

Common user complaints center on withdrawal difficulties, unexpected fees, poor customer service, and concerns about fund safety. The pattern of negative feedback across multiple operational areas suggests systemic issues with the platform's service delivery and operational management.

Based on user feedback analysis, this usdetf review concludes that the platform fails to meet basic expectations for professional trading services and user experience quality.

Conclusion

This comprehensive usdetf review reveals significant concerns that make the platform unsuitable for serious trading activities. The combination of questionable regulatory status, poor user feedback, lack of operational transparency, and industry warnings creates a risk profile that far outweighs any potential benefits.

USDETF's targeting of novice traders appears particularly concerning given the platform's apparent deficiencies in client protection, educational resources, and customer support. New traders require secure, well-regulated environments with comprehensive support systems, which this platform clearly fails to provide.

The platform's main weakness lies in its fundamental lack of trustworthiness and regulatory credibility, while any perceived advantages such as low minimum deposits are overshadowed by the substantial risks involved. Traders seeking reliable, professional trading services should consider well-established, properly regulated alternatives that prioritize client protection and transparent operations.