Is United Financial safe?

Pros

Cons

Is United Financial Safe or a Scam?

Introduction

United Financial is an online forex broker that has gained attention in the trading community since its inception in 2015. Positioned as a platform for retail traders, it offers various trading instruments, including forex, commodities, and CFDs. However, as the financial landscape becomes increasingly complex, traders must exercise caution when choosing a broker. The potential for scams in the forex market is significant, with unregulated brokers often posing risks to investors' funds and trading success.

This article aims to objectively evaluate whether United Financial is a safe trading option or a potential scam. Our investigation relies on a comprehensive analysis of various factors, including regulatory status, company background, trading conditions, client fund security, customer feedback, platform performance, and overall risk assessment. By synthesizing data from multiple credible sources, we seek to provide a well-rounded perspective on the safety of United Financial.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that determines its legitimacy and the safety of client funds. A regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and practices. Unfortunately, our research indicates that United Financial operates as an offshore broker and lacks regulation by any major financial authority. This absence of oversight raises significant concerns regarding the safety of traders' investments.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of regulation means that United Financial is not obligated to follow stringent financial guidelines, which can lead to questionable practices. While being unregulated does not inherently mean that a broker is a scam, it does necessitate heightened caution from traders. Without a regulatory body to hold them accountable, clients may find it challenging to seek recourse in case of disputes or issues related to their accounts.

Moreover, the absence of a robust regulatory framework often correlates with a lack of transparency in operations. United Financial's limited disclosure regarding its regulatory status is a red flag for potential investors. In a market where many brokers are regulated by reputable authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), the choice to operate without such oversight could indicate a disregard for client protection.

Company Background Investigation

United Financial was established in 2015 and has since targeted retail traders looking for accessible trading platforms. However, details about the company's ownership structure and management team are sparse, which is concerning. A reputable broker typically provides clear information regarding its founders and executives, including their professional backgrounds and qualifications.

The lack of transparency surrounding United Financial raises questions about its credibility. A broker's management team should ideally possess extensive experience in financial markets and trading operations. In the case of United Financial, the absence of publicly available information about its leadership is a significant drawback. This opacity can lead to skepticism among potential clients, as they may be unsure about who is managing their funds and what qualifications they possess.

Furthermore, the company's history of operations since 2015 does not necessarily imply reliability. Without a track record of compliance with regulatory standards or positive client testimonials, traders may find it challenging to trust United Financial with their investments. Overall, the limited information available about the company's background and leadership raises concerns about its legitimacy and safety.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. United Financial claims to provide competitive spreads, low minimum deposits, and a user-friendly trading platform. However, the absence of comprehensive information about their fee structure and trading conditions is alarming.

| Fee Type | United Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by United Financial appear competitive compared to industry averages, but the lack of clarity regarding commissions and overnight interest rates is concerning. Traders should be wary of hidden fees that can significantly affect their profitability. The absence of detailed information about these costs may indicate a lack of transparency in their pricing structure.

Moreover, the broker's minimum deposit requirement of $0 is enticing for new traders. However, such low barriers to entry can also attract inexperienced traders who may not fully understand the risks associated with forex trading. United Financial's approach to trading conditions raises questions about whether they prioritize client education and support or merely aim to increase their client base.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. United Financial's status as an offshore broker raises significant concerns regarding fund safety. Offshore brokers often lack the same level of investor protection as those regulated by top-tier authorities. Consequently, clients may be exposed to higher risks, including potential loss of funds.

United Financial's policies concerning fund segregation, investor protection, and negative balance protection are unclear. A reputable broker typically maintains segregated accounts to ensure that client funds are kept separate from operational funds. This measure protects clients in the event of the broker's insolvency. However, without clear information from United Financial regarding their fund management practices, it is challenging to assess the safety of clients' investments.

Additionally, the lack of a compensation scheme, which is often provided by regulated brokers, leaves investors vulnerable. In the absence of such protections, traders should be cautious when considering United Financial as their trading partner. Historical issues related to fund security or disputes with clients could further complicate the broker's credibility.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews and testimonials for United Financial are mixed, with some users expressing satisfaction with their trading experience, while others report issues related to withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

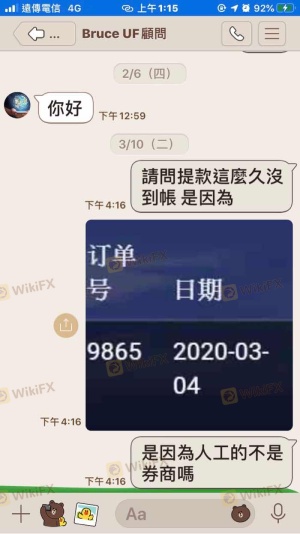

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Limited assistance |

| Account Closure Issues | High | No clear policy |

Common complaints include delays in processing withdrawals and inadequate customer support. These issues can significantly impact a trader's experience and raise concerns about the broker's operational efficiency. Additionally, the severity of complaints suggests that some clients have faced serious challenges when attempting to access their funds or resolve issues related to their accounts.

A couple of notable case studies illustrate these concerns. One user reported a prolonged withdrawal process, taking over a month to receive their funds. They expressed frustration with the lack of communication from the support team, which exacerbated their concerns. Another trader faced unexpected account closure without clear explanations, leading to significant financial losses. These examples highlight the potential risks associated with trading with United Financial and the importance of thorough due diligence.

Platform and Trade Execution

A broker's trading platform is a crucial element of the trading experience. United Financial claims to offer the popular MetaTrader 4 platform, known for its user-friendly interface and robust features. However, the performance and reliability of the platform are essential for successful trading.

Users have reported mixed experiences with the platform's stability, with some experiencing occasional outages or slow execution times. Order execution quality is a critical factor, and reports of slippage or rejected orders can significantly impact trading outcomes. While United Financial markets itself as a reliable platform, potential users should be cautious and consider the implications of any reported performance issues.

Moreover, any signs of platform manipulation or unfair practices should raise alarms. Traders should be vigilant for any discrepancies in order execution, as such practices can compromise the integrity of the trading environment. The overall performance of United Financial's platform remains a point of concern for potential clients.

Risk Assessment

Engaging with a broker like United Financial entails various risks. Given its unregulated status, traders face heightened exposure to potential financial losses and operational challenges. It is essential to assess these risks comprehensively.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight |

| Fund Security Risk | High | Offshore status |

| Customer Support Risk | Medium | Slow response times |

| Platform Performance Risk | Medium | Stability concerns |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers with established regulatory oversight. Diversifying investments and using risk management tools can also help minimize potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that United Financial poses several risks that warrant caution. The lack of regulation, limited transparency, and mixed customer feedback raise significant concerns about its safety. While some traders may find the platform appealing due to its low entry barriers and competitive spreads, the potential for issues related to fund security and customer support cannot be overlooked.

Traders seeking a reliable and safe trading environment should consider brokers regulated by reputable authorities. Alternatives such as eToro or IG, which offer robust regulatory frameworks and positive client feedback, may provide safer trading experiences. Ultimately, conducting thorough due diligence and prioritizing safety is crucial when navigating the complexities of the forex market.

Is United Financial a scam, or is it legit?

The latest exposure and evaluation content of United Financial brokers.

United Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

United Financial latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.