Regarding the legitimacy of ASI forex brokers, it provides ASIC, CYSEC, FCA and WikiBit, .

Is ASI safe?

Pros

Cons

Is ASI markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

PLUS500AU PTY. LTD.

Effective Date:

2012-10-09Email Address of Licensed Institution:

complaints@plus500.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

PLUS500AU PTY LTD L 39 264-278 GEORGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0292621554Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Plus500CY Ltd

Effective Date:

2014-10-10Email Address of Licensed Institution:

compliance@plus500.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.plus500.com.cy, www.plus500.com, www.plus500.nl, www.plus500.pl, www.plus500.at, www.plus500.be, www.plus500.ch, www.plus500.ee, www.plus500.li, www.plus500.ro, www.plus500.lv, www.plus500.lt, www.plus500.dk, www.plus500.ru, www.plus500.it, www.plus500.ae, www.plus500.cz, www.plus500.gr, www.plus500.fr, www.plus500.se, www.plus500.hu, www.plus500.no, www.plus500.es, www.plus500.pt, www.plus500.si, www.plus500.ie, www.plus500.fi, www.plus500.bg, www.plus500.lu, www.plus500.com.hr, www.plus500.com.mt, www.plus500.com.uy, www.plus500.is, www.plus500.eu, www.plus500.rs, www.plus500.de, www.plus500.sk, www.plus500.com.my, www.plus500.hr, www.plus500.com.mx, www.plus500.coExpiration Time:

--Address of Licensed Institution:

169-171 Avenue Arch. Makarios III, Cedars Oasis Tower, Floor 1, 3027, LimassolPhone Number of Licensed Institution:

+357 25 344 544Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Plus500UK Ltd

Effective Date:

2010-06-29Email Address of Licensed Institution:

compliance@plus500.co.uk, disputes@plus500.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.plus500.com/en/Expiration Time:

--Address of Licensed Institution:

8 Angel Court Copthall Avenue London EC2R 7HJ UNITED KINGDOMPhone Number of Licensed Institution:

+442038761640Licensed Institution Certified Documents:

Is ASI Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, the choice of a trading broker is crucial for traders aiming to achieve financial success. ASI, a broker purportedly based in Taiwan, has garnered attention for its operations in the forex trading space. However, the question remains: is ASI safe or a scam? This article aims to provide an objective analysis of ASI by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. By employing a structured evaluation framework, we will help traders make informed decisions regarding their engagement with ASI.

Regulation and Legitimacy

The regulatory framework within which a broker operates plays a vital role in ensuring the safety and security of traders' funds. A regulated broker is typically subject to stringent oversight, which can provide traders with a layer of protection against fraudulent activities. Unfortunately, ASI appears to lack proper regulation, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | Taiwan | Not Verified |

The absence of a valid regulatory license is a red flag for potential investors. In the forex industry, brokers regulated by top-tier authorities such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia are generally deemed safer. Without such oversight, ASI's operations are shrouded in uncertainty, making it difficult to ascertain whether it adheres to industry standards or engages in potentially fraudulent practices.

Company Background Investigation

Understanding the companys history and ownership structure is essential for assessing its reliability. ASI's lack of transparency regarding its ownership and operational history raises more questions than answers. According to various reviews, the broker's website has been reported as inaccessible, further complicating any attempts to verify its legitimacy.

Moreover, the management team behind ASI remains largely unknown, with no verifiable information available regarding their professional backgrounds or experience in the financial industry. This lack of transparency can be concerning for potential traders, as a well-established management team is crucial for the effective operation of a brokerage.

In summary, the opaque nature of ASI's operations and management raises significant concerns about its credibility. This lack of transparency is compounded by the absence of a regulatory framework, making it imperative for traders to exercise extreme caution when considering ASI as their trading partner.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are a critical factor in determining their overall suitability. ASI's fee structure and trading conditions have been scrutinized, and several negative reviews highlight potential issues.

| Fee Type | ASI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0-5% |

The lack of clear information regarding spreads and commissions at ASI is alarming. In a typical trading environment, traders expect transparency about costs and fees, as these directly impact profitability. The absence of such information could indicate hidden fees or unfavorable trading conditions that traders may not be aware of until it is too late. This ambiguity is a significant concern for anyone considering trading with ASI.

Customer Funds Security

The safety of customer funds is paramount in the forex trading industry. A reliable broker should implement robust measures to protect traders' investments. Unfortunately, ASI has not provided sufficient information regarding its fund security protocols.

A reputable broker typically segregates client funds from operational funds, ensuring that traders' money is protected in the event of financial difficulties. Furthermore, investor protection schemes are essential for safeguarding traders against broker insolvency. However, ASI's lack of transparency regarding these critical safety measures raises serious concerns about the security of customer funds.

Moreover, there have been no documented instances of ASI addressing past security issues or disputes, which further complicates the evaluation of its trustworthiness. Given these factors, it is crucial for traders to be wary of potential risks associated with entrusting their funds to ASI.

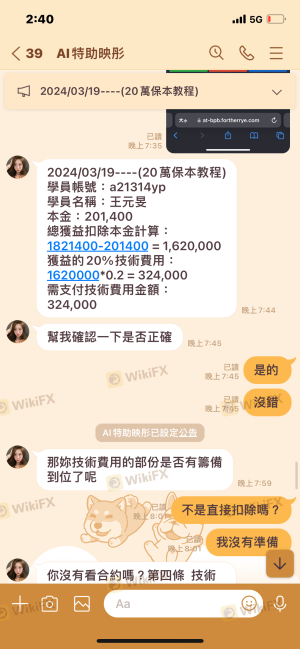

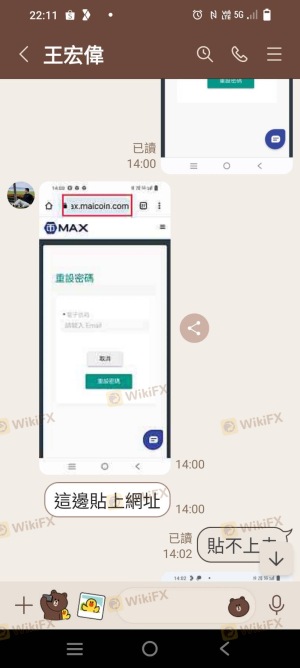

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of ASI reveal a concerning trend of negative experiences among traders. Common complaints include issues related to withdrawal difficulties, poor customer service, and a lack of responsiveness from the broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | Lacking |

Several users have reported significant delays in processing withdrawals, which is a critical issue for any trader. A broker that does not respond promptly to withdrawal requests may indicate deeper operational problems and could potentially be engaging in unethical practices.

Furthermore, the overall sentiment from user reviews suggests a lack of trust in ASI, which is compounded by the brokers insufficient communication regarding complaints. This pattern of negative feedback raises red flags about the broker's reliability and responsiveness to customer concerns.

Platform and Trade Execution

The trading platform is a vital component of a traders experience, influencing everything from execution speed to user interface. ASI's platform performance has been a subject of scrutiny, with reports indicating issues such as slippage and order rejections.

A reliable broker should provide a stable and efficient trading environment, minimizing instances of slippage and ensuring that orders are executed promptly. However, user experiences suggest that ASI may not meet these expectations, leading to frustrations among traders.

While specific data on ASI's execution quality is limited, the anecdotal evidence points to potential flaws in its trading infrastructure, which could significantly impact trading outcomes for users.

Risk Assessment

Engaging with any broker carries inherent risks, and ASI appears to present a unique set of challenges for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Service Risk | Medium | Negative feedback on responsiveness. |

Given these factors, traders should approach ASI with caution. The absence of regulatory oversight, combined with poor customer feedback and a lack of transparency, suggests a high-risk environment for potential investors.

Conclusion and Recommendations

In conclusion, the evidence suggests that ASI is not a safe broker for traders. The broker's lack of regulation, transparency, and negative customer experiences raise significant concerns about its legitimacy and reliability.

For traders seeking a trustworthy forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as FXTM, OANDA, and IG Markets are examples of more reliable options that provide a safer trading environment.

Ultimately, conducting thorough research and due diligence is essential before engaging with any broker. Traders should prioritize their financial security and be wary of potential scams in the forex market.

Is ASI a scam, or is it legit?

The latest exposure and evaluation content of ASI brokers.

ASI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASI latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.