United Financial 2025 Review: Everything You Need to Know

Executive Summary

This united financial review presents a comprehensive analysis of a trading platform that has been operating since 2015. The platform targets retail traders with a diverse range of financial instruments. United Financial positions itself as a multi-asset broker offering forex, commodities, and CFD trading services to individual investors who seek diversified trading opportunities.

However, our evaluation reveals significant transparency concerns. These concerns impact the overall assessment. The lack of specific regulatory information, detailed fee structures, and comprehensive trading conditions creates uncertainty for potential clients.

While the broker claims to provide various trading instruments, the absence of concrete details about account types, minimum deposits, spreads, and commission structures makes it challenging for traders to make informed decisions. The platform appears to cater primarily to retail traders looking for exposure to multiple asset classes. But the limited available information about customer support quality, platform stability, and regulatory compliance raises questions about its suitability for serious trading activities.

Without clear regulatory oversight or detailed operational transparency, United Financial presents a mixed proposition for traders considering their services in 2025.

Important Notice

This review is based on limited publicly available information about United Financial. The broker has not provided comprehensive details about its regulatory status, which may vary across different jurisdictions. Potential clients should exercise caution and conduct additional due diligence before engaging with any financial services provider that lacks clear regulatory disclosure.

Our evaluation methodology relies on available data sources. However, we acknowledge that complete information about United Financial's operations, fees, and services remains limited. Traders should verify all terms and conditions directly with the broker before making any investment decisions.

Rating Framework

Broker Overview

United Financial entered the financial services market in 2015. The company established itself as a trading platform focused on providing retail investors access to multiple asset classes including forex, commodities, and contracts for difference. The company has positioned itself to serve individual traders seeking diversified investment opportunities across various financial markets.

Despite nearly a decade in operation, United Financial maintains a relatively low profile in the competitive online trading landscape. The broker's business model centers on facilitating retail trading activities. However, specific details about its corporate structure, headquarters location, and ownership remain unclear from publicly available sources.

The platform's approach to serving retail traders includes offering multiple trading instruments. However, comprehensive information about trading platforms, account types, and specific service features is not readily available. This united financial review finds that while the broker claims to provide access to various financial markets, the lack of detailed operational information may concern potential clients seeking transparency in their trading relationships.

United Financial's target demographic appears to be individual traders interested in multi-asset trading opportunities. These traders particularly seek exposure to forex and commodity markets through CFD instruments. However, the absence of clear regulatory disclosure and limited publicly available operational details suggest that traders should carefully evaluate their options before committing to this platform.

Regulatory Status

Available information does not specify which regulatory authorities oversee United Financial's operations. This lack of regulatory transparency represents a significant concern for potential clients. These clients seek regulated trading environments and investor protection measures.

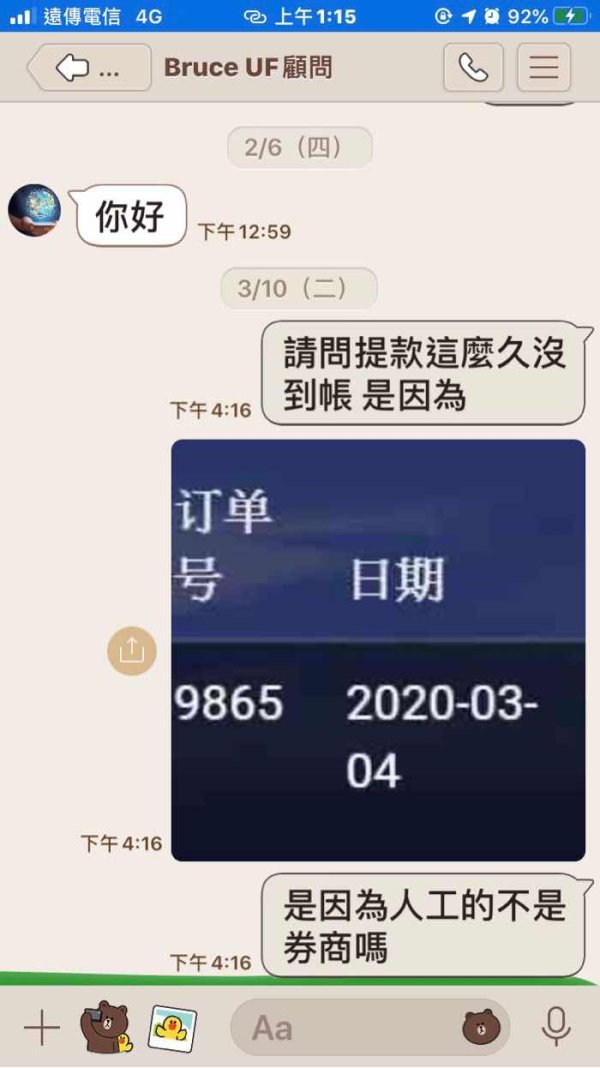

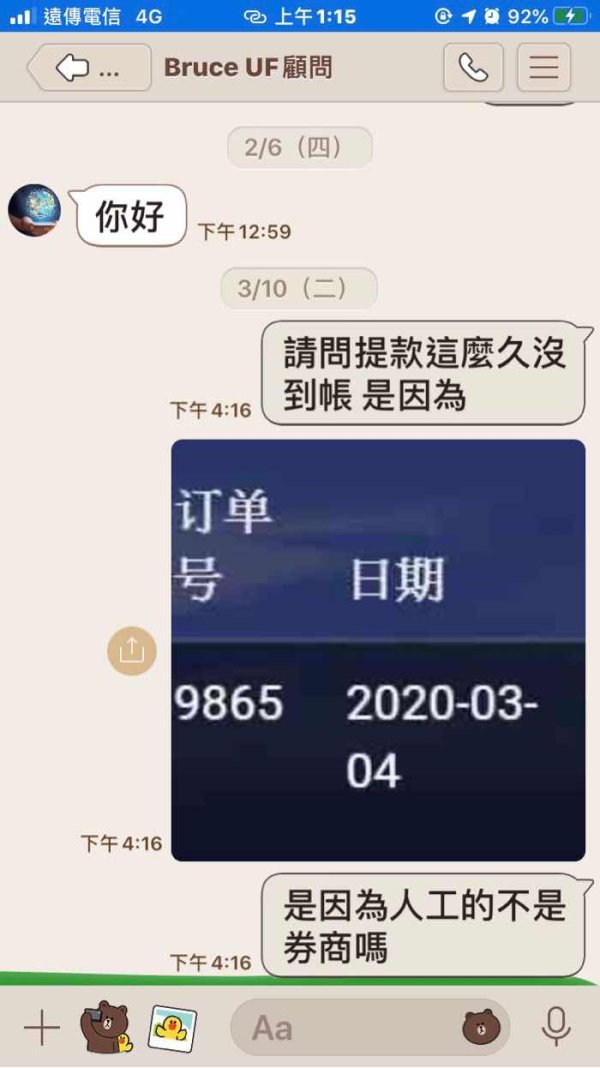

Deposit and Withdrawal Methods

Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources. This creates uncertainty about the practical aspects of funding trading accounts.

Minimum Deposit Requirements

The broker has not disclosed minimum deposit amounts for different account types. This makes it difficult for potential clients to understand entry-level requirements for accessing their services.

No specific information is available regarding promotional offers, welcome bonuses, or ongoing incentive programs. These programs may be available to new or existing clients.

Tradeable Assets

United Financial offers trading opportunities in forex markets, commodities, and CFDs. This provides clients with access to multiple asset classes for portfolio diversification. However, specific details about the number of available instruments and market coverage remain unspecified.

Cost Structure

Critical pricing information including spreads, commission rates, overnight financing charges, and other trading-related fees is not clearly disclosed in available materials. This united financial review identifies this as a major transparency gap. The gap affects trader decision-making.

Leverage Ratios

Information about maximum leverage ratios available for different asset classes and account types is not specified. This leaves potential clients uncertain about available trading flexibility.

The specific trading platforms offered by United Financial are not detailed in available information sources. These platforms could be proprietary or third-party solutions like MetaTrader 4 or 5.

Geographic Restrictions

Details about countries or regions where United Financial's services may be restricted or unavailable are not clearly specified. This information is not found in accessible materials.

Customer Support Languages

Information about multilingual support options and available customer service languages is not provided. Current sources do not include this information.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions evaluation for United Financial reveals significant information gaps. These gaps negatively impact the overall assessment. Without specific details about account types, minimum deposit requirements, or fee structures, potential clients cannot adequately assess whether the broker's offerings align with their trading needs and financial capabilities.

The absence of clear information about different account tiers, their respective features, and qualification requirements creates uncertainty for traders. These traders attempt to understand what services they can access. Most reputable brokers provide comprehensive account comparison charts detailing spreads, commissions, minimum deposits, and special features for each account type.

Furthermore, the lack of transparency regarding account opening procedures, verification requirements, and approval timelines suggests that United Financial may not prioritize clear communication with potential clients. This united financial review finds that without basic account information readily available, traders face unnecessary obstacles in evaluating the broker's suitability for their needs.

The scoring reflects these substantial information deficiencies. These deficiencies create barriers to informed decision-making and suggest limited commitment to customer transparency in account-related matters.

United Financial's tools and resources receive a moderate rating based on their claimed offering of multiple trading instruments. These instruments include forex, commodities, and CFDs. The availability of diverse asset classes provides traders with opportunities for portfolio diversification and exposure to different market sectors.

However, the evaluation is limited by the lack of specific information about research resources, market analysis tools, educational materials, or trading aids that might be available to clients. Most competitive brokers provide comprehensive market research, technical analysis tools, economic calendars, and educational resources. These resources support trader development and decision-making.

The absence of details about automated trading support, expert advisors, or algorithmic trading capabilities also limits the assessment. Modern traders often require sophisticated tools for strategy implementation and risk management. Without clear information about available resources, it's difficult to evaluate United Financial's competitive position.

While the multi-asset offering provides some value, the lack of comprehensive tool and resource information prevents a higher rating. This suggests that the broker may not prioritize providing extensive trading support materials to its clients.

Customer Service and Support Analysis (5/10)

The customer service evaluation for United Financial is constrained by the absence of specific information about support channels, availability, response times, and service quality. Effective customer support is crucial for trading platforms. Clients need reliable assistance for technical issues, account inquiries, and trading-related questions.

Without details about available contact methods such as live chat, phone support, email assistance, or help desk systems, potential clients cannot assess the accessibility of customer service. The lack of information about support hours, whether 24/7 assistance is available, or coverage during market hours creates uncertainty. This uncertainty concerns when help might be available.

Additionally, no information is provided about multilingual support capabilities. This is important for international clients who may require assistance in their native languages. The absence of customer service quality metrics, response time guarantees, or client satisfaction indicators makes it difficult to evaluate the effectiveness of support services.

The moderate rating reflects these information gaps while acknowledging that customer service capabilities may exist but are not adequately communicated through available channels. Improved transparency about support services would significantly enhance client confidence. This confidence relates to the broker's commitment to customer care.

Trading Experience Analysis (5/10)

The trading experience assessment for United Financial faces limitations due to insufficient information about platform stability, execution quality, order processing speed, and overall trading environment characteristics. These factors are fundamental to trader satisfaction and successful trading outcomes.

Without specific details about the trading platforms used, whether proprietary or established third-party solutions, it's challenging to evaluate the technological foundation of the trading experience. Platform reliability, uptime statistics, and execution speed are critical factors. These factors directly impact trading performance and client satisfaction.

The absence of information about order types supported, execution models, and slippage characteristics makes it difficult to assess the quality of trade execution. Execution models include market maker, ECN, and STP. Additionally, no details are available about mobile trading capabilities, which are increasingly important for traders who require flexibility and mobility.

This united financial review notes that without user feedback, performance metrics, or detailed platform specifications, the trading experience evaluation relies on limited available information. The moderate rating reflects these constraints. It acknowledges that trading capabilities may exist but lack adequate documentation and transparency.

Trust and Reliability Analysis (3/10)

The trust and reliability assessment reveals the most significant concerns in this United Financial evaluation. The absence of clear regulatory disclosure represents a fundamental transparency issue. This issue directly impacts client confidence and investor protection measures.

Regulatory oversight provides essential safeguards including segregated client funds, compensation schemes, dispute resolution mechanisms, and operational compliance standards. Without specific information about regulatory authorities overseeing United Financial's operations, clients cannot verify the level of protection and recourse available for their investments.

The lack of detailed company information, including corporate structure, ownership details, and operational transparency, further compounds trust concerns. Reputable financial services providers typically maintain comprehensive disclosure. This disclosure covers their corporate governance, regulatory status, and operational procedures.

Additionally, the absence of third-party reviews, industry recognition, or verifiable track record information makes it difficult to assess the broker's reputation and reliability within the financial services sector. The low rating reflects these significant transparency deficiencies. These deficiencies impact overall trustworthiness and regulatory compliance assurance.

User Experience Analysis (4/10)

The user experience evaluation is hampered by the lack of specific feedback from actual clients and detailed information about interface design, usability, and overall customer satisfaction. User experience encompasses registration processes, platform navigation, account management, and general ease of use across all client interactions.

Without access to user testimonials, satisfaction surveys, or detailed platform demonstrations, it's challenging to assess how well United Financial meets client expectations for intuitive design and functional efficiency. The absence of information about onboarding processes, account verification procedures, and initial user guidance suggests limited focus on user experience optimization.

Additionally, no details are available about common user complaints, resolution procedures, or continuous improvement initiatives based on client feedback. Modern trading platforms typically prioritize user experience through responsive design, intuitive interfaces, and comprehensive support resources.

The below-average rating reflects these information limitations and the apparent lack of emphasis on communicating user experience priorities. Improved transparency about client satisfaction measures and platform usability would enhance the overall assessment. This assessment concerns United Financial's commitment to positive user experiences.

Conclusion

This comprehensive united financial review reveals a trading platform with limited transparency that significantly impacts its overall assessment for 2025. While United Financial offers access to multiple asset classes including forex, commodities, and CFDs, the lack of essential information about regulatory status, fee structures, and operational details creates substantial concerns for potential clients.

The broker may be suitable for traders specifically seeking multi-asset trading opportunities who are comfortable with limited transparency. However, the absence of clear regulatory oversight and comprehensive service details makes it difficult to recommend for most retail traders. The primary advantages include diverse trading instrument availability, while the significant disadvantages center on transparency deficiencies and limited publicly available operational information that could impact client confidence and trading success.