Is tradepluss safe?

Business

License

Is Tradepluss A Scam?

Introduction

In the ever-evolving landscape of the foreign exchange market, traders are constantly seeking reliable brokers to facilitate their trading activities. One such entity that has garnered attention is Tradepluss, a broker that positions itself as a provider of various trading services. However, with a plethora of options available, it is essential for traders to exercise caution when evaluating forex brokers. The potential for scams and unreliable trading environments necessitates a thorough assessment of any broker before entrusting them with hard-earned capital.

This article aims to provide an objective analysis of Tradepluss, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation will be based on data gathered from reputable financial websites, user reviews, and regulatory sources, ensuring a comprehensive evaluation of whether Tradepluss is a safe broker or potentially a scam.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety and legitimacy of a forex broker. A broker's regulatory status provides insights into its adherence to industry standards and the level of protection offered to clients. Unfortunately, Tradepluss does not appear to be regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation by a reputable authority means that Tradepluss lacks the oversight that would typically ensure fair trading practices and investor protection. In the forex industry, top-tier regulators such as the FCA (UK), ASIC (Australia), and SEC (USA) enforce stringent rules to protect traders. Without such oversight, traders may face increased risks of fraud or unethical practices. Given its unregulated status, it is advisable for potential clients to approach Tradepluss with caution and consider the implications of trading with an unregulated broker.

Company Background Investigation

Tradepluss is an online trading platform operated by Navia Markets Ltd., a company that has been in the financial services industry since 1983. The broker transitioned to a discount brokerage model in 2014, offering a range of trading services across multiple asset classes, including forex, commodities, and equities. Despite its longstanding presence in the market, the lack of transparency regarding its ownership structure and management team raises questions about its operational integrity.

The management teams background and experience are crucial in assessing the broker's reliability. However, there is limited publicly available information about the specific individuals leading Tradepluss. This lack of transparency can be a red flag for potential investors, as it is often indicative of a broker's unwillingness to disclose important information that could affect client trust.

Furthermore, the company's commitment to transparency and information disclosure is also questionable. A reputable broker typically provides detailed information about its services, fees, and operational practices. In contrast, Tradeplusss website lacks comprehensive educational resources and clear communication regarding its policies, which can hinder traders' ability to make informed decisions.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall value proposition. Tradepluss employs a unique pricing model that includes fixed monthly fees for trading across various segments. While this may appeal to frequent traders, it also raises concerns about hidden costs that could impact profitability.

| Fee Type | Tradepluss | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | Flat fee | Variable fee |

| Overnight Interest Range | 3% - 5% | 2% - 4% |

The fee structure indicates that Tradepluss charges a fixed monthly fee for trading, which can be beneficial for high-volume traders. However, the potential for hidden fees, such as software charges and transaction fees, may complicate the overall cost structure. Traders should carefully review the fine print and assess how these fees compare to industry standards to avoid unexpected expenses.

Moreover, the lack of a clear commission model can lead to confusion for traders who are accustomed to traditional per-trade fees. This ambiguity can make it difficult for traders to accurately calculate their trading costs and assess the broker's overall competitiveness.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. A secure broker should implement stringent measures to protect client deposits, including segregated accounts and investor protection schemes. Unfortunately, Tradepluss does not provide sufficient information regarding its fund safety protocols.

The absence of regulatory oversight raises concerns about the security of client funds. Without regulatory frameworks in place, there is no guarantee that client deposits are held in segregated accounts, which would otherwise protect traders' funds in the event of the broker's insolvency. Additionally, the lack of information regarding negative balance protection policies further intensifies the risks associated with trading with Tradepluss.

Historical issues related to fund safety or disputes can serve as warning signs for potential investors. However, the limited availability of such data regarding Tradepluss means that traders must exercise heightened caution when considering this broker.

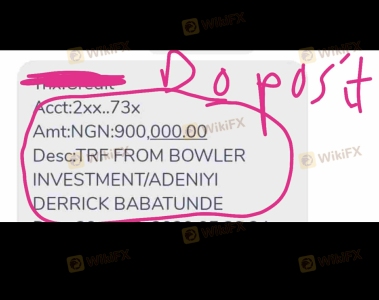

Customer Experience and Complaints

Customer feedback plays a crucial role in evaluating a broker's reliability and service quality. Reviews of Tradepluss reveal a mixed bag of experiences, with several users expressing dissatisfaction with the broker's customer service and trading platform performance.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Poor Customer Support | High | Slow response |

| Platform Glitches | Medium | Inconsistent |

| Hidden Fees | High | Unresolved |

Common complaints include difficulties in reaching customer support during peak trading hours and issues with the trading platform, such as lagging performance and order execution problems. These issues can significantly impact the trading experience, particularly for those engaged in high-frequency trading or time-sensitive strategies.

Several user testimonials highlight the frustration of dealing with unresolved issues, which can lead to significant financial losses. The overall sentiment suggests that while Tradepluss may offer attractive fee structures, the quality of customer service and platform reliability leaves much to be desired.

Platform and Trade Execution

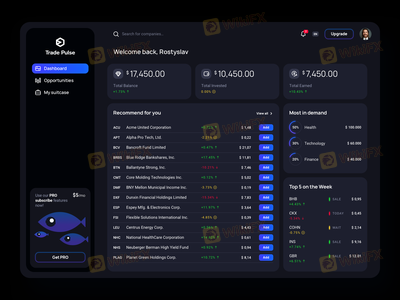

The performance of a broker's trading platform is critical to a trader's success. A reliable platform should provide seamless access to market data, efficient order execution, and minimal downtime. Evaluating Tradepluss's trading platform reveals several shortcomings.

Users have reported issues with order execution quality, including instances of slippage and rejected orders during volatile market conditions. Such problems can be detrimental to traders, particularly those employing strategies that rely on precise entry and exit points. Additionally, frequent platform glitches can hinder trading activities and lead to missed opportunities.

The lack of robust trading tools and analytics features can also limit a trader's ability to make informed decisions. While Tradepluss offers basic charting capabilities, the absence of advanced analytical tools may disadvantage traders seeking to develop and execute comprehensive trading strategies.

Risk Assessment

Engaging with Tradepluss presents a range of risks that traders should carefully consider. The broker's unregulated status, coupled with its opaque operational practices, heightens the level of risk associated with trading.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker lacks oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Service Risk | Medium | Complaints about responsiveness and support quality. |

| Platform Reliability Risk | High | Reports of glitches and execution issues. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with established regulatory oversight and a solid reputation. Additionally, implementing risk management strategies, such as setting stop-loss orders and limiting exposure, can help safeguard capital.

Conclusion and Recommendations

In conclusion, the analysis of Tradepluss raises significant concerns about its safety and reliability as a forex broker. The lack of regulatory oversight, combined with customer complaints regarding service quality and platform performance, suggests that traders should exercise caution when considering this broker.

While Tradepluss may offer appealing fee structures, the potential risks associated with trading through an unregulated entity cannot be overlooked. For traders seeking a safer trading environment, it may be prudent to explore alternative brokers that are regulated by reputable financial authorities and offer robust customer support.

In summary, if you are contemplating trading with Tradepluss, it is crucial to weigh the potential risks against the benefits. For those who prioritize safety and regulatory compliance, consider exploring brokers such as Zerodha or Upstox, which have established reputations and regulatory oversight. Always conduct thorough research and ensure that any broker you choose aligns with your trading goals and risk tolerance.

Is tradepluss a scam, or is it legit?

The latest exposure and evaluation content of tradepluss brokers.

tradepluss Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

tradepluss latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.