Regarding the legitimacy of Seventy Brokers forex brokers, it provides VFSC and WikiBit, (also has a graphic survey regarding security).

Is Seventy Brokers safe?

Business

License

Is Seventy Brokers markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Seventy Investech (Vanuatu) Co., Limited

Effective Date:

2021-03-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Floor 32, 8 Marina View, Asia Square Tower 1, Singapore 018960Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Seventy Brokers Safe or Scam?

Introduction

Seventy Brokers is a relatively new player in the forex market, claiming to provide a range of trading services to clients globally. Established in 2021, it positions itself as a competitive option for traders looking for diverse investment opportunities. However, the rise of unregulated brokers has made it essential for traders to carefully evaluate the legitimacy and safety of any trading platform before engaging. This article aims to provide an in-depth analysis of Seventy Brokers, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on data collected from various reputable financial review sites and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its safety and reliability. Seventy Brokers claims to be regulated by several authorities, including the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC). However, after thorough research, it appears that these claims are misleading.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 14885 | Vanuatu | Not Found |

| ASIC | 001301806 | Australia | Revoked |

| NFA | 0515151 | United States | Unauthorized |

The lack of a valid regulatory license raises significant concerns regarding the safety of funds and overall trustworthiness. The ASIC license mentioned was revoked, and there are no records to confirm the VFSC regulation. This absence of credible oversight suggests that Seventy Brokers operates without the necessary safeguards that protect traders from fraud and malpractice.

Company Background Investigation

Seventy Brokers is associated with Seventy Investech, which claims to operate from Singapore. However, discrepancies in its registration details and the lack of transparency regarding its ownership structure cast doubt on its credibility. The company's history is relatively short, having been established in 2021, which raises questions about its stability and reliability in the long term.

The management team behind Seventy Brokers has not been adequately disclosed, leaving potential investors in the dark about their qualifications and experience in the financial services industry. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their leadership and operational history.

Trading Conditions Analysis

The trading conditions offered by Seventy Brokers are another critical aspect to consider. While the broker advertises competitive spreads and a variety of account types, the absence of clear information about trading costs can lead to unexpected fees.

| Fee Type | Seventy Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | Not Specified | $5 per lot |

| Overnight Interest Range | Not Specified | 2-3% |

The lack of transparency regarding spreads and commissions is a significant red flag. Traders may find themselves facing hidden charges that could affect their profitability. Furthermore, the broker's high leverage of up to 1:500 is concerning, especially since regulated brokers in Australia and Singapore typically cap leverage at much lower levels, often around 1:30.

Customer Funds Safety

When assessing whether Seventy Brokers is safe, understanding its measures for protecting customer funds is paramount. The broker claims to use segregated accounts to keep client funds separate from its operational funds; however, without regulatory oversight, the effectiveness of such measures is questionable.

Additionally, there is no indication of investor protection schemes or negative balance protection, which are standard features offered by reputable brokers to safeguard traders against significant losses. Historical issues related to fund security have also been reported, with numerous complaints from users regarding delayed withdrawals and account freezes.

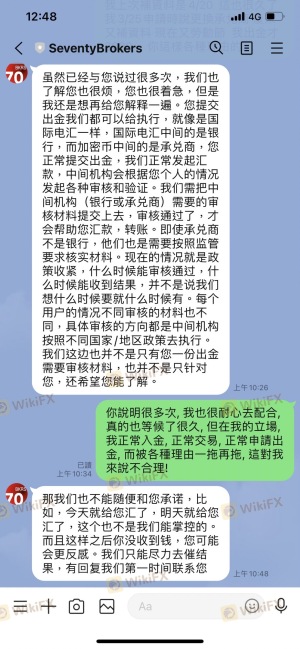

Customer Experience and Complaints

Customer feedback plays a vital role in evaluating the reliability of a broker. Many users have reported negative experiences with Seventy Brokers, particularly concerning withdrawal delays and lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Freezes | High | Poor |

| Lack of Transparency | Medium | Inadequate |

Several users have shared their struggles with accessing their funds, with some waiting months for withdrawals to be processed. These complaints suggest systemic issues within the brokers operational framework, raising further concerns about its legitimacy and safety.

Platform and Trade Execution

The trading platform offered by Seventy Brokers is the widely recognized MetaTrader 5 (MT5). While MT5 is known for its robust features and user-friendly interface, the broker's overall performance on the platform raises questions. Reports of slippage and order rejections have surfaced, indicating potential manipulation or inefficiencies in trade execution.

Risk Assessment

Using Seventy Brokers comes with a variety of risks that traders should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Complaints about withdrawal issues |

To mitigate these risks, it is advisable to conduct thorough due diligence before investing. Traders should consider using regulated brokers with transparent practices and robust customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Seventy Brokers is not a safe trading option. The lack of credible regulation, transparency issues, and numerous customer complaints indicate that it may operate more like a scam than a legitimate broker.

For traders seeking reliable alternatives, it is recommended to explore well-regulated brokers with proven track records in customer service and fund safety. Always prioritize platforms that offer clear information on fees, regulatory compliance, and customer protection measures.

In summary, considering the findings, is Seventy Brokers safe? The answer appears to be a resounding no, and potential investors should exercise extreme caution.

Is Seventy Brokers a scam, or is it legit?

The latest exposure and evaluation content of Seventy Brokers brokers.

Seventy Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Seventy Brokers latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.