Is Tradenitro safe?

Pros

Cons

Is Tradenitro Safe or Scam?

Introduction

Tradenitro is an online trading platform that positions itself within the forex market, offering various trading instruments including binary options and cryptocurrencies. As the financial landscape becomes increasingly digital, traders must exercise caution in selecting brokers, as the risk of falling victim to scams is significant. The necessity for thorough evaluations stems from the prevalence of unregulated and offshore brokers that may compromise the safety of traders' funds. In this article, we will investigate Tradenitro's legitimacy by analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk assessment. Our methodology includes a comprehensive review of available data, user testimonials, and comparisons with industry standards to provide a balanced perspective on whether Tradenitro is safe or a potential scam.

Regulation and Legitimacy

The regulatory framework governing a trading platform is crucial for assessing its legitimacy. Tradenitro operates as an offshore broker, registered in the Marshall Islands, which is known for its lax financial regulations. This lack of oversight raises serious concerns regarding the safety of clients' funds and the overall reliability of the broker. Below is a summary of the regulatory status of Tradenitro:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unverified |

The absence of regulation means that Tradenitro is not held accountable by any financial authority, leaving traders without the protection that comes from regulated entities. This can lead to significant risks, including the potential for fund misappropriation and lack of recourse in the event of disputes. Furthermore, the company does not provide any transparency regarding its operational practices or compliance history, which is a red flag for potential investors. The quality of regulation is paramount; without it, traders are exposed to higher risks, including fraud and financial loss. Therefore, it is critical to consider whether Tradenitro is safe before committing any funds.

Company Background Investigation

Tradenitro Ltd., the entity behind Tradenitro, has a vague and unremarkable history. The company is registered in the Marshall Islands, a jurisdiction that often attracts businesses looking to evade stringent regulatory frameworks. The ownership structure remains obscure, with limited information available about the management team. This lack of transparency raises concerns about the qualifications and experience of those running the platform.

The absence of publicly available information about the company's leadership and operational history is troubling. A reputable broker typically provides details about its management team, including their professional backgrounds and industry experience. In contrast, Tradenitro's anonymity could indicate an attempt to shield itself from accountability. This opacity is compounded by the fact that the broker does not disclose its physical address, further diminishing trustworthiness. As such, potential traders should be wary and consider whether Tradenitro is safe for investment.

Trading Conditions Analysis

Tradenitro presents a variety of trading conditions, but a closer examination reveals several concerning aspects. The broker requires a minimum deposit of $250, which may seem reasonable but is relatively high compared to industry standards. Additionally, the fee structure lacks clarity, with claims of zero deposit and withdrawal fees contradicted by terms that suggest otherwise. Traders have reported unexpected charges during the withdrawal process, including a fixed fee of $50 and a 20% fee for withdrawing without trading.

To provide a clearer picture of the trading costs associated with Tradenitro, the following table compares its fees with industry averages:

| Fee Type | Tradenitro | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not specified | 1.0 - 1.5 pips |

| Commission Model | Not applicable | Varies |

| Overnight Interest Range | Not disclosed | 0.5% - 2% |

The lack of transparency regarding spreads and commissions is concerning, as traders may find themselves facing unexpected costs that can erode their profits. Such practices are often indicative of untrustworthy brokers. Therefore, potential investors should carefully consider whether Tradenitro is safe and if they are willing to engage with a broker that may impose hidden fees.

Customer Funds Security

The safety of customer funds is a critical aspect of any trading platform, and Tradenitro's measures in this area are insufficient. The broker does not offer segregated accounts, which are essential for protecting clients' funds from being misused. Furthermore, there is no indication that Tradenitro provides negative balance protection, which can safeguard traders from losing more than their initial investment.

The absence of investor protection mechanisms is a significant concern, especially considering the broker's offshore status. In the event of insolvency or fraudulent activities, clients may find it challenging to recover their funds. Historically, unregulated brokers have been linked to various financial disputes and controversies, further emphasizing the need for caution. Traders must seriously question whether Tradenitro is safe and if their funds would be secure with this broker.

Customer Experience and Complaints

User feedback is a vital component in assessing the reliability of a trading platform. Unfortunately, Tradenitro has garnered numerous negative reviews from clients. Common complaints include difficulty withdrawing funds, lack of responsive customer support, and aggressive sales tactics from representatives. The following table summarizes the main types of complaints associated with Tradenitro:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Inaccessibility | Medium | Poor |

| Misleading Promotional Practices | High | Poor |

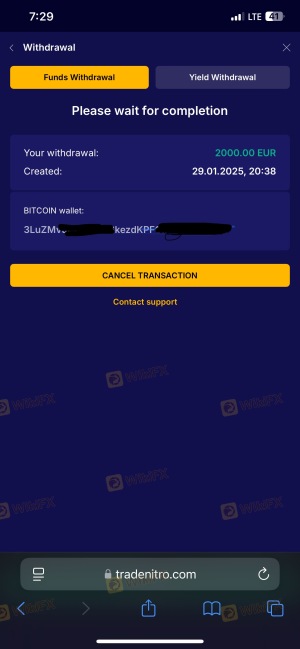

Many users report that once they deposit funds, communication with the broker becomes increasingly difficult. This pattern of behavior is often indicative of a scam, where brokers aim to retain clients' funds by complicating the withdrawal process. A few notable cases highlight the severity of these complaints, with some traders claiming they waited months for withdrawals that were ultimately denied. Given this information, potential clients should carefully evaluate whether Tradenitro is safe and consider the implications of potentially losing access to their funds.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Tradenitro claims to offer a user-friendly interface and efficient trade execution. However, user experiences suggest otherwise. Traders have reported issues with order execution, including slippage and rejections of trades, which can severely impact trading outcomes.

Additionally, concerns have been raised about the potential for platform manipulation, a common tactic employed by unscrupulous brokers to enhance their profits at the expense of traders. The reliability and stability of the trading platform are essential for successful trading, and any signs of manipulation can be a significant red flag. Therefore, traders must question whether Tradenitro is safe, especially if they encounter issues that could jeopardize their investments.

Risk Assessment

Using Tradenitro poses a variety of risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | Lack of fund protection and withdrawal issues |

| Operational Risk | Medium | Platform performance issues and potential manipulation |

| Transparency Risk | High | Vague company information and opaque fee structures |

Given these factors, the overall risk associated with trading through Tradenitro is substantial. To mitigate these risks, traders should conduct thorough research, avoid making large initial deposits, and consider using regulated brokers with transparent practices. Evaluating whether Tradenitro is safe should be a top priority for any prospective trader.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tradenitro operates as an unregulated offshore broker, raising significant concerns about its legitimacy and safety. The lack of regulatory oversight, opaque fee structures, and numerous customer complaints indicate that traders may be at risk of financial loss and fraud. Therefore, it is crucial for potential clients to exercise caution and skepticism when considering whether Tradenitro is safe.

For traders looking for reliable alternatives, it is advisable to choose brokers that are regulated by reputable authorities, offer transparent trading conditions, and provide robust customer support. Brokers such as OANDA, IG, and Forex.com are examples of platforms that prioritize client safety and regulatory compliance. Ultimately, ensuring the security of your investments should be the primary concern when selecting a trading platform.

Is Tradenitro a scam, or is it legit?

The latest exposure and evaluation content of Tradenitro brokers.

Tradenitro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradenitro latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.