Is EMCM safe?

Pros

Cons

Is Emcm Safe or Scam?

Introduction

Emcm is a forex broker that has emerged in the market since its establishment in 2019. Based in Saint Vincent and the Grenadines, Emcm aims to cater primarily to the Chinese market, offering trading services across various asset classes. However, potential traders must exercise caution when evaluating forex brokers like Emcm, as the forex market is notorious for scams and unregulated entities. The importance of due diligence cannot be overstated; traders need to ensure that their chosen broker is trustworthy and operates within a framework of regulatory compliance.

In this article, we will investigate the safety and legitimacy of Emcm by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. Our evaluation will be based on data gathered from various credible sources, including regulatory databases and user reviews, to provide a comprehensive understanding of whether Emcm is safe for trading or potentially a scam.

Regulation and Legitimacy

The regulatory environment for forex brokers is crucial in establishing their legitimacy and trustworthiness. A regulated broker is typically subject to oversight by financial authorities, which helps protect traders' interests and ensures that the broker adheres to industry standards. Unfortunately, Emcm does not appear to be regulated by any reputable financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Not Verified |

The absence of regulation means that Emcm is not bound by the strict operational guidelines that regulated brokers must follow. This lack of oversight can lead to higher risks for traders, as unregulated brokers may engage in unethical practices without fear of repercussions. Furthermore, traders using unregulated brokers like Emcm may find it difficult to seek recourse if issues arise, as there is no regulatory body to intervene on their behalf. Given these factors, it is imperative for potential clients to consider whether the absence of regulatory oversight makes Emcm a safe choice for trading.

Company Background Investigation

Emcm was founded in 2019, positioning itself as a relatively new player in the forex market. The company operates from Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulations on financial services. This lack of stringent oversight can be a double-edged sword; while it allows for easier market entry for brokers, it also opens the door to potential scams and fraudulent activities.

The ownership structure of Emcm remains opaque, with limited information available about its founders or key stakeholders. This lack of transparency can be a red flag for potential traders, as a reputable broker typically offers clear information about its management team and corporate governance. The management teams professional experience and background are crucial indicators of the broker's credibility, yet Emcm fails to provide this information, further complicating the assessment of its safety.

Moreover, the level of information disclosure from Emcm is concerning. Reliable brokers usually maintain an informative website, detailing their services, trading conditions, and company policies. In contrast, Emcm's website lacks comprehensive information, which can lead to skepticism regarding its operations. In summary, the company's lack of transparency and the absence of a well-defined ownership structure significantly undermine any claims of safety associated with Emcm.

Trading Conditions Analysis

When evaluating whether Emcm is safe, it is essential to consider its trading conditions, particularly its fee structure and trading costs. A broker's fees can significantly impact a trader's profitability, and understanding these costs is crucial in making an informed decision.

Emcm primarily offers trading through the MetaTrader 5 (MT5) platform, which is known for its user-friendly interface and robust features. However, the overall fee structure appears to be less competitive compared to industry standards. Traders should be wary of hidden fees or unusual charges that could erode their capital.

| Fee Type | Emcm | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | 2.0% - 5.0% |

The lack of transparency regarding spreads, commissions, and overnight interest rates raises concerns about Emcm's trading conditions. Without clear information on these costs, traders may find themselves facing unexpected charges that could lead to significant losses. Additionally, the absence of a defined commission model may indicate that Emcm does not adhere to industry standards, further questioning its credibility.

Client Fund Security

The safety of client funds is a paramount concern for any trader. A reputable broker should have stringent measures in place to protect client deposits, including segregated accounts, investor protection schemes, and negative balance protection policies. However, Emcm's lack of regulatory oversight means that there is no guarantee that such protections are in place.

Emcm does not provide clear information regarding its fund security measures, which is concerning. Traders need to know how their funds are managed and whether they are protected in the event of a broker insolvency. The absence of investor protection mechanisms can leave traders vulnerable to significant financial losses.

Furthermore, any historical incidents involving fund security or disputes should be taken into account. While there are no publicly reported incidents directly linked to Emcm, the lack of transparency and regulatory oversight increases the risk of potential issues going forward. In this context, it is essential for traders to carefully consider whether they feel comfortable entrusting their funds to a broker like Emcm.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. A review of various platforms reveals a mixed bag of experiences from Emcm users. While some traders report satisfactory experiences, a significant number have expressed concerns regarding customer support and responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

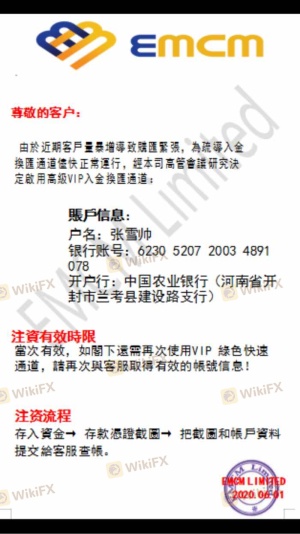

| Withdrawal Issues | High | Slow response |

| Lack of Communication | Medium | Inconsistent |

| Misleading Information | High | Unresolved |

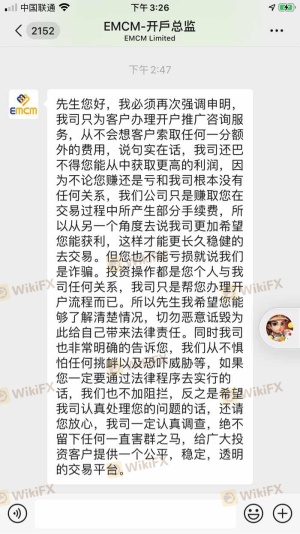

Common complaints include difficulties in withdrawing funds, slow customer support responses, and instances of misleading information regarding trading conditions. For example, one user reported losing a substantial amount of money after following the broker's recommendations, only to find that their account director was unresponsive when they sought assistance.

These complaints highlight potential red flags regarding Emcm's operational practices. A trustworthy broker should prioritize customer service and ensure that traders can easily access their funds and receive timely support. The ongoing issues experienced by some clients raise questions about Emcm's commitment to maintaining a high standard of customer care.

Platform and Execution

The performance and stability of a trading platform can significantly influence a trader's experience. Emcm utilizes the MT5 platform, which is generally well-regarded in the industry. However, user feedback indicates that traders have experienced issues with order execution, including slippage and rejected orders.

The quality of order execution is crucial for traders, particularly in the fast-paced forex market. If a broker consistently fails to execute trades at the desired price, it can lead to significant losses. Additionally, any signs of platform manipulation should be carefully scrutinized. While there are no direct allegations against Emcm regarding manipulation, the combination of poor execution and unresolved customer complaints raises concerns about the overall reliability of the trading environment.

Risk Assessment

Given the various factors discussed, it is essential to conduct a comprehensive risk assessment for potential traders considering Emcm.

| Risk Category | Risk Level | Summary |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Security Risk | High | Lack of transparency in fund safety |

| Customer Service Risk | Medium | Slow responses to complaints |

| Trading Execution Risk | Medium | Reports of slippage and rejections |

In light of these risks, potential traders should approach Emcm with caution. It is advisable to conduct thorough research and consider alternative brokers that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that Emcm may not be a safe choice for traders. The lack of regulatory oversight, combined with transparency issues and negative customer feedback, raises significant concerns about the broker's credibility. While there may be some positive aspects to their platform, the risks associated with trading with Emcm outweigh the potential benefits.

For traders seeking a reliable and trustworthy forex broker, it is recommended to consider alternatives that are regulated by reputable financial authorities. Brokers with established regulatory frameworks can provide better protection for client funds and a more transparent trading environment. Potential alternatives may include brokers regulated by the FCA, ASIC, or other top-tier authorities.

In summary, if you are asking, "Is Emcm safe?" the answer leans towards caution. It is essential to prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is EMCM a scam, or is it legit?

The latest exposure and evaluation content of EMCM brokers.

EMCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EMCM latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.