Is Forexfx safe?

Pros

Cons

Is Forexfx Safe or Scam?

Introduction

Forexfx is a relatively new player in the foreign exchange market, having been established in 2019. As an online trading platform, it positions itself as a gateway for traders looking to engage in forex trading. However, the rapid growth of the forex market has also attracted a myriad of unscrupulous brokers, making it imperative for traders to exercise caution when selecting a trading partner. Evaluating the safety and legitimacy of a broker like Forexfx is crucial for protecting one's investments and ensuring a fair trading environment.

In this article, we will conduct a comprehensive analysis of Forexfx, employing a structured framework that encompasses regulatory compliance, company background, trading conditions, client fund safety, customer experiences, and risk assessment. Our investigation is based on data gathered from various reputable sources, including user reviews, regulatory filings, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Forexfx claims to be regulated, but the specifics of its regulatory framework are often unclear. A broker's regulatory compliance provides a safety net for traders, ensuring that there are legal repercussions for misconduct.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Unknown | N/A | China | Not Verified |

Forexfx operates out of China, where regulatory oversight may not be as stringent as in other jurisdictions. The absence of a recognized regulatory body, such as the FCA or ASIC, raises questions about its compliance and the level of protection afforded to traders. Furthermore, some reports suggest that Forexfx may be a clone of a regulated entity, which adds another layer of concern regarding its legitimacy.

The quality of regulation is paramount; brokers regulated by top-tier agencies are subject to rigorous standards, including capital requirements and regular audits. In contrast, Forexfx's lack of clear regulatory oversight could expose traders to financial risks, such as the potential for fraud or mismanagement of funds. Historical compliance issues or lack of transparency in its operations could further exacerbate these concerns.

Company Background Investigation

Forexfx was founded in 2019, making it a relatively young entity in the forex market. The ownership structure and management team are critical components in assessing the broker's credibility. A well-established company typically has a history of successful operations and a transparent ownership model.

However, details about Forexfx's founders and key management personnel remain scarce. The lack of publicly available information about the company's leadership raises questions about their experience and qualifications in the financial sector. A transparent company should disclose information about its management team, including their backgrounds and expertise in trading and finance.

Furthermore, the absence of a clear history or development milestones for Forexfx could indicate a lack of stability and reliability. Transparency in operations and a well-defined corporate structure are essential for building trust with clients. Without this information, potential clients may find it challenging to assess the company's credibility and long-term viability.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is crucial. Forexfx offers various trading instruments, but the overall cost structure is a vital aspect of the trading experience.

| Fee Type | Forexfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

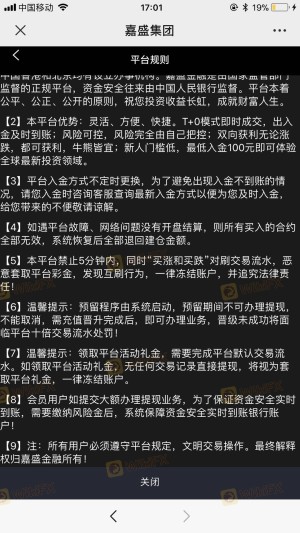

Forexfx's spread for major currency pairs is reported to be higher than the industry average, which could reduce profitability for traders. While the absence of commissions may initially seem attractive, it is essential to consider the overall cost of trading, including spreads and overnight interest rates. Traders should be wary of any unusual fee structures that could affect their bottom line.

Additionally, Forexfx's lack of transparency regarding its fee policies raises concerns. Brokers that do not clearly disclose their fee structures may be attempting to obscure hidden costs, which can lead to unpleasant surprises for traders when they attempt to withdraw funds or calculate their profits.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. Forexfx claims to implement measures to protect client funds, but the specifics of these measures are not well-documented.

A critical aspect of fund safety is the segregation of client funds from the broker's operational funds. This ensures that in the event of the broker's insolvency, client funds remain protected. Additionally, negative balance protection policies are essential to prevent traders from losing more than their initial investment.

However, without clear information on Forexfx's fund safety measures, potential clients may be left in the dark. Historical issues related to fund security, such as reports of delayed withdrawals or frozen accounts, could further erode trust in the broker.

Customer Experience and Complaints

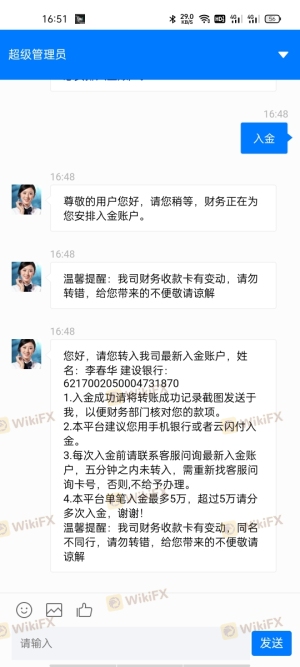

Customer feedback is a valuable indicator of a broker's reliability. Reviews from Forexfx users reveal mixed experiences, with some clients reporting difficulties in withdrawing funds and receiving timely support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Support Availability | Medium | Inconsistent |

Common complaints include challenges with fund withdrawals, which is a significant red flag for any broker. A broker that fails to address withdrawal requests promptly may be engaging in unethical practices. Additionally, the quality of customer support can significantly impact the overall trading experience, and Forexfx's inconsistent responsiveness raises concerns.

Several users have shared stories of their struggles to access their funds after making deposits, suggesting a pattern of behavior that could be indicative of a scam. These experiences highlight the importance of thorough research before engaging with any broker.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. Forexfx offers a trading platform that claims to be user-friendly, but firsthand accounts of its performance vary.

Key aspects to consider include order execution quality, slippage rates, and the frequency of order rejections. Traders expect their orders to be executed promptly and at the expected prices. Any signs of platform manipulation or excessive slippage should be taken seriously, as they can significantly impact trading outcomes.

Risk Assessment

Engaging with Forexfx carries certain risks, primarily due to its unclear regulatory status and mixed customer feedback.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of clear regulation raises concerns. |

| Fund Safety | Medium | Unclear fund protection measures. |

| Customer Support | Medium | Reports of slow responses and unresolved issues. |

To mitigate these risks, traders should proceed with caution. It may be prudent to start with a smaller investment to gauge the broker's reliability before committing more significant capital. Additionally, traders should consider using demo accounts to familiarize themselves with the platform before engaging in live trading.

Conclusion and Recommendations

In conclusion, the analysis of Forexfx raises several red flags regarding its legitimacy and safety. The lack of clear regulatory oversight, mixed customer feedback, and potential issues with fund safety suggest that traders should exercise caution when considering this broker.

While Forexfx may offer trading opportunities, the risks associated with engaging with an unregulated broker cannot be overlooked. For traders seeking safer alternatives, it is advisable to consider well-regulated brokers with established reputations and transparent operations. Some recommended options include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide greater assurance of fund safety and ethical trading practices.

Ultimately, the decision to trade with Forexfx should be made with careful consideration of the potential risks involved.

Is Forexfx a scam, or is it legit?

The latest exposure and evaluation content of Forexfx brokers.

Forexfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forexfx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.