Is TOKEU safe?

Pros

Cons

Is Tokeu A Scam?

Introduction

Tokeu is a relatively new entrant in the forex market, positioning itself as a platform for traders seeking to engage in foreign exchange and CFD trading. As the online trading landscape grows, it becomes increasingly crucial for traders to assess the credibility of brokers like Tokeu. With numerous reports of scams and fraudulent activities in the forex industry, understanding the legitimacy and safety of a trading platform is paramount. This article aims to investigate whether Tokeu is a safe broker or a potential scam. To achieve this, we will analyze various aspects of the broker, including its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is one of the most critical factors in determining its legitimacy. Tokeu claims to operate under certain regulatory guidelines; however, scrutiny reveals significant gaps in its compliance and oversight. The lack of a strong regulatory framework raises concerns about the safety of traders' funds and the transparency of the broker's operations.

Here is a summary of Tokeu's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a regulatory license from a reputable authority like the FCA, ASIC, or CFTC is alarming. Regulatory bodies are essential as they enforce strict compliance measures that protect traders from fraud and malpractice. Brokers operating without regulation often lack accountability, making it difficult for traders to seek recourse in case of disputes. Furthermore, Tokeu's history shows no evidence of compliance with even minor regulatory standards, which is a red flag for potential investors.

Company Background Investigation

Tokeu's company background reveals a lack of transparency regarding its ownership and operational history. Established only a few years ago, Tokeu has not built a robust reputation in the forex trading community. The absence of detailed information about its management team and their qualifications raises questions about the broker's credibility.

The management team plays a crucial role in a broker's operations, and their expertise can significantly impact the quality of service provided to traders. Unfortunately, Tokeu does not provide sufficient information about its team, making it difficult for potential clients to evaluate their experience and competence. A lack of transparency in ownership and operational details can indicate a broker's unwillingness to adhere to ethical business practices.

Additionally, the limited information available about Tokeu's financial stability and operational practices further compounds the concerns regarding its legitimacy. Without a solid foundation and clear communication, it becomes challenging for traders to trust the broker with their investments.

Trading Conditions Analysis

When assessing whether Tokeu is safe, understanding its trading conditions is vital. Tokeu offers various trading instruments, including forex pairs, commodities, and indices, but the overall fee structure appears to be less competitive than industry standards.

Here is a comparison of Tokeu's core trading costs:

| Fee Type | Tokeu | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread offered by Tokeu is higher than the industry average, which could significantly impact profitability for traders. Additionally, the absence of a clear commission structure raises questions about hidden fees that could further erode traders' returns. Such practices are often associated with less reputable brokers, making it crucial for potential clients to approach Tokeu with caution.

Moreover, the lack of transparency regarding overnight interest rates can lead to unexpected costs for traders, especially those who engage in long-term positions. This lack of clarity in fee structures is a common issue with brokers that may not prioritize client interests.

Customer Fund Security

The safety of client funds is a primary concern for any trader. Tokeu's approach to fund security is questionable, as there is little information available about its measures for safeguarding client deposits. The absence of fund segregation practices, which separate client funds from the broker's operational funds, raises significant concerns about the security of traders' investments.

Traders should be aware of the following aspects regarding Tokeu's fund security:

Fund Segregation: Tokeu does not provide clear information on whether it practices fund segregation, which is a critical safety measure.

Investor Protection: There is no evidence that Tokeu participates in any investor protection schemes, which are essential for safeguarding client assets in the event of broker insolvency.

Negative Balance Protection: The lack of information regarding negative balance protection policies is concerning, as it could expose traders to unlimited losses.

Platform Stability: Several users have noted that the platform experiences regular downtime, particularly during peak trading hours.

Order Execution Quality: Reports of slippage and rejected orders have surfaced, indicating potential issues with the broker's execution capabilities.

Manipulation Signs: There are concerns regarding potential price manipulation, as some traders have observed discrepancies between Tokeu's pricing and that of other brokers.

Historically, brokers without robust fund security measures have faced significant issues, leading to client losses and legal disputes. Therefore, the absence of clear policies regarding fund security at Tokeu is a major red flag for potential investors.

Customer Experience and Complaints

Analyzing customer experiences is crucial in determining whether Tokeu is a safe option for trading. Reviews and feedback from existing clients reveal a mixed bag of experiences, with several users expressing dissatisfaction with the broker's services.

Here is a summary of common complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Platform Stability | High | Unresolved |

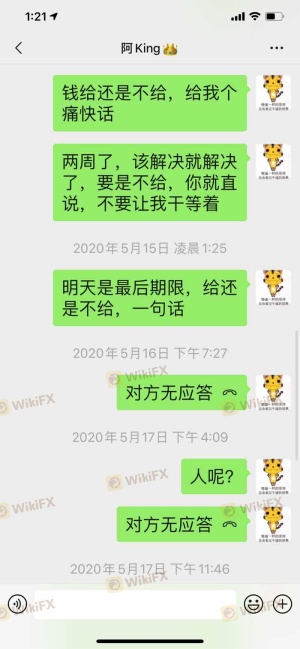

Many traders have reported difficulties in withdrawing their funds, which is a significant concern for anyone considering trading with Tokeu. A broker that hampers withdrawal requests can be indicative of deeper financial issues or a lack of integrity. Additionally, the slow response times from customer support further exacerbate the frustration of clients seeking assistance.

Specific case studies highlight these issues, with one trader reporting a prolonged withdrawal process that took weeks to resolve, while another faced technical difficulties during critical trading periods. Such experiences contribute to a growing sentiment that Tokeu may not prioritize customer satisfaction, raising further questions about its reliability.

Platform and Trade Execution

The trading platform is a vital component of a broker's service, and Tokeu's platform performance has been a topic of concern. Users have reported frequent outages and technical glitches, which can severely impact trading performance.

Key aspects to consider include:

These factors contribute to a negative perception of Tokeu's platform, leading many traders to question whether it is a safe environment for trading.

Risk Assessment

In evaluating whether Tokeu is a scam, it is essential to consider the overall risk associated with using this broker. A comprehensive risk assessment reveals several areas of concern.

Here is a risk summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns. |

| Financial Stability | High | Limited information about financial health. |

| Fund Security | High | No clear policies on fund protection. |

| Customer Support | Medium | Slow responses and unresolved issues. |

Given these risks, traders should exercise caution when considering Tokeu for their trading activities. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory oversight and better customer service.

Conclusion and Recommendations

In conclusion, the investigation into Tokeu reveals several alarming signs that suggest it may not be a safe broker for trading. The lack of regulation, transparency regarding company operations, questionable trading conditions, and numerous customer complaints all point to potential risks associated with this broker.

Traders should be particularly wary of Tokeu's operational practices, which raise red flags regarding its legitimacy. For those looking for safer trading options, it is recommended to consider brokers that are regulated by reputable authorities, offer transparent trading conditions, and have a proven track record of positive customer experiences.

Ultimately, while Tokeu may present itself as a viable trading platform, the evidence suggests that it is prudent for traders to seek alternatives that prioritize safety, transparency, and customer satisfaction.

Is TOKEU a scam, or is it legit?

The latest exposure and evaluation content of TOKEU brokers.

TOKEU Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TOKEU latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.