tokeu 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the ever-evolving world of online trading, tokeu positions itself as an appealing option for beginner traders seeking a straightforward, user-friendly platform. With offerings that span Forex, cryptocurrencies, and commodities, tokeu aims to create a diverse trading environment that holds appeal for those prioritizing accessibility and convenience. However, it is crucial for potential users to weigh this convenience against the significant risks associated with trading through an unregulated platform. The absence of regulatory oversight opens users to a landscape fraught with hidden fees, withdrawal issues, and potential scams, making informed decision-making essential before engaging with tokeu.

⚠️ Important Risk Advisory & Verification Steps

Investors should exercise extreme caution when considering trading with tokeu due to its unregulated status. Below are some critical risk signals and verification advice:

- Risk Statement: Trading with an unregulated broker such as tokeu poses significant risks to your capital, including the potential for loss due to fraud or mismanagement of funds.

- Potential Harms:

- Lack of investor protection

- Difficulty in fund withdrawal

- Higher exposure to hidden fees

How to Self-Verify:

- Research Regulatory Status: Visit official regulatory websites (e.g., NFA, FCA).

- Check Registration: Use the registration search option on these sites to verify the broker's legitimacy.

- Review User Feedback: Look at forums and reviews to gauge other traders' experiences.

- Confirm Contact Information: Validate that the brokers contact information is accurate and active.

- Assess Trading Platform: Open a demo account to evaluate the trading experience without financial commitment.

Proceed with caution and consider alternatives that offer stronger regulatory protections.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in recent years, tokeu operates from China, presenting itself as a modern brokerage firm designed to cater to a new generation of traders. Despite its user-centric platform, tokeu lacks any valid regulatory frameworks, raising concerns about its accountability and the safety of client funds. Without regulatory oversight, the firm falls under the category of high-risk brokers, often associated with instances of fraud or mismanagement.

Core Business Overview

tokeu offers a wide array of financial instruments, including Forex pairs, cryptocurrencies, commodities, and indices. Traders may find an engaging user interface and multiple trading platforms like WebTrader. However, the absence of sound regulatory support significantly undermines the overall user experience. Complaints about hidden fees and withdrawal issues from existing users suggest a fundamental lack of transparency in operations.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Understanding a brokerage's trustworthiness is paramount, especially in an unregulated environment like that offered by tokeu.

Regulatory Information Conflicts

The major concern surrounding tokeu is its lack of regulation. Various sources indicate that tokeu does not operate under any recognized regulatory body, raising considerable alarm about the protection of client funds. As there is no comprehensive oversight, users are advised to be diligent.

User Self-Verification Guide

To ensure safety, traders should take an active role in self-verification. Heres how:

- Visit Regulatory Websites: Check authorities like NFA or FCA.

- Search for Broker Registration: Use search tools on their websites to input broker details.

- Review Details: Look for any negative feedback or alerts concerning regulatory issues.

- Engage with Existing Users: Forums and online trading communities often provide insights into brokers operability.

- Validate Financial Disclosures: Ensure the broker is transparent about fees and trades.

Industry Reputation and Summary

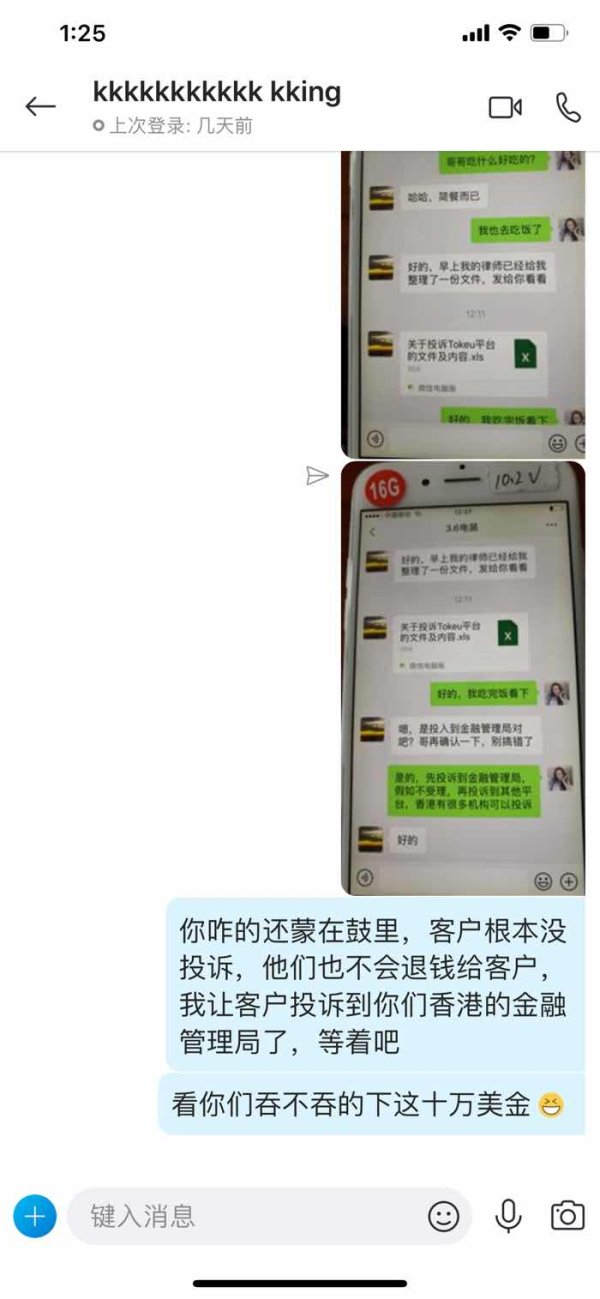

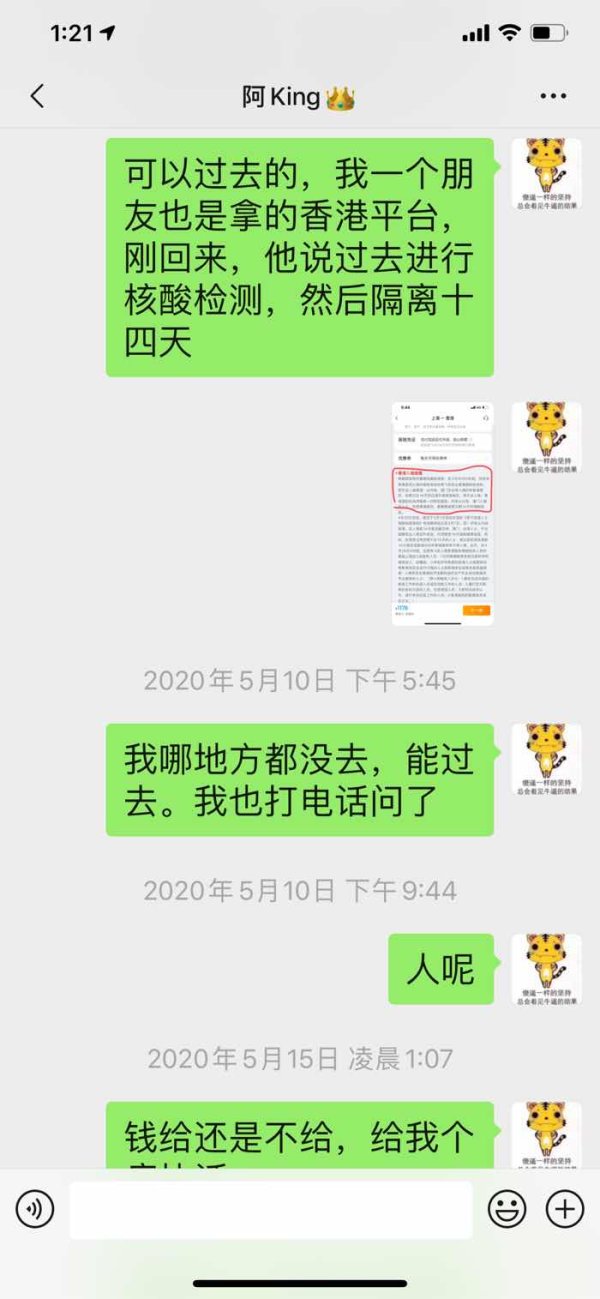

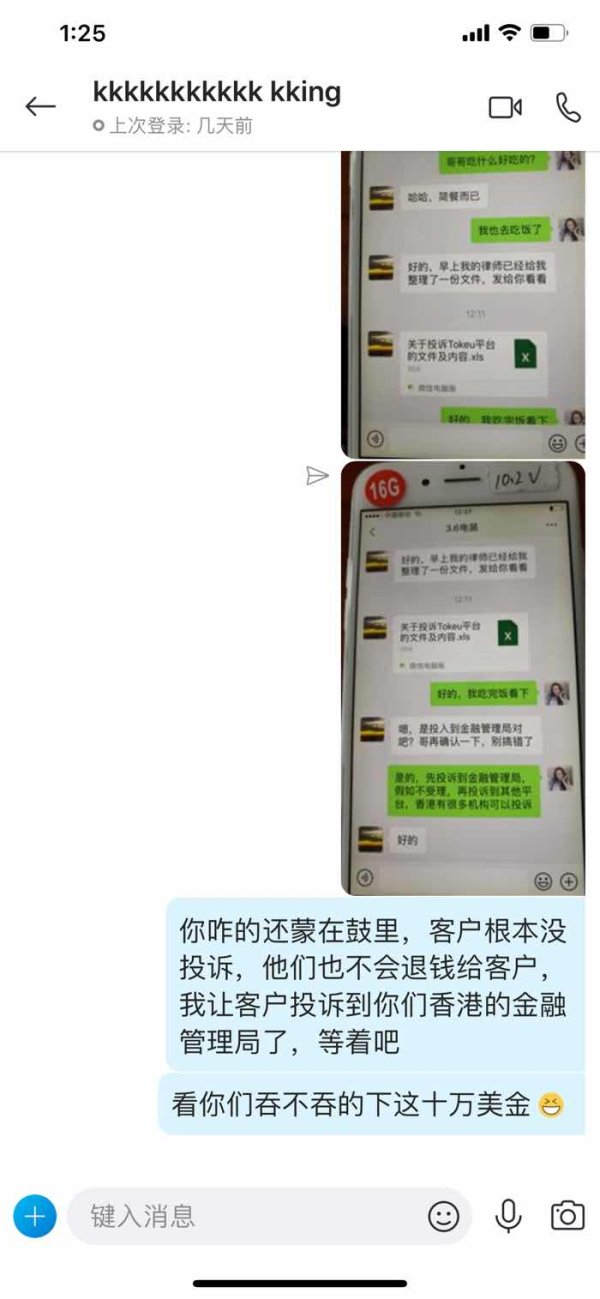

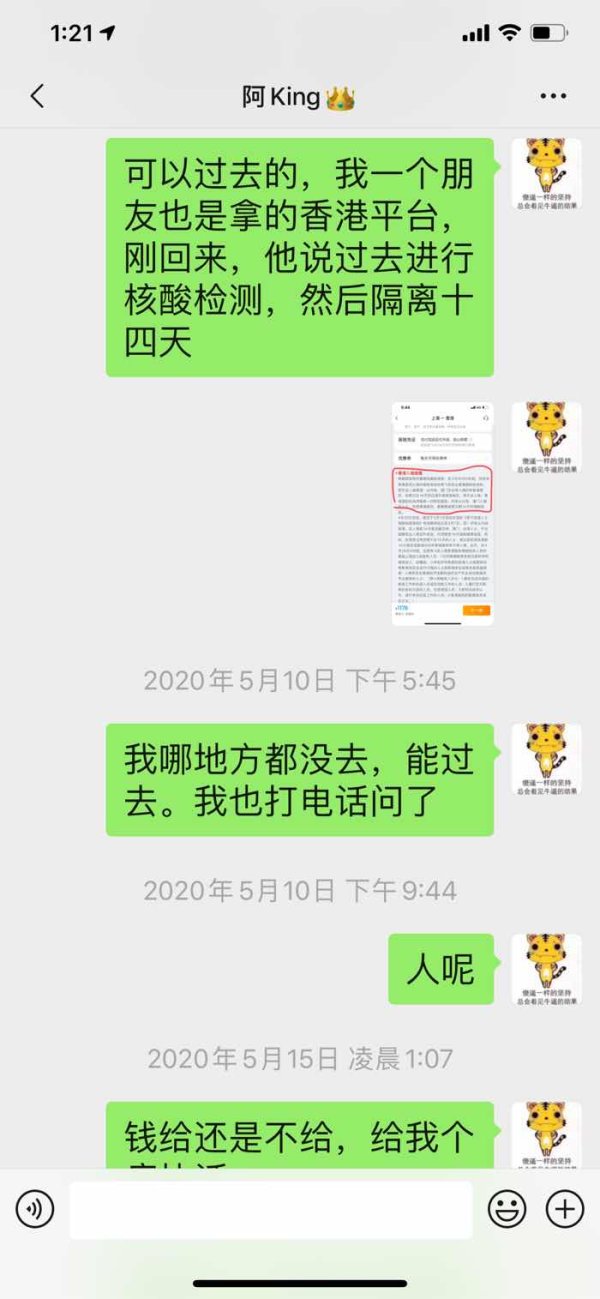

User feedback about tokeu generally reflects a negative sentiment about fund safety. One user commented:

"Withdrawing funds from tokeu feels like pulling teeth. Ive had issues with hidden fees, and communication is sparse."

These concerns highlight the necessity of thorough pre-trading research.

Trading Costs Analysis

The cost landscape at tokeu is characterized by a mixture of competitive and alarming features.

Advantages in Commissions

Low commissions can be a draw for new traders. Tokeu reportedly offers lower-than-average commission rates for certain instruments, which could attract users looking to maximize trading volume on a budget.

The "Traps" of Non-Trading Fees

However, users have expressed serious concerns regarding the hidden costs associated with withdrawals. Reports highlight withdrawal fees of up to $30, which can detract significantly from any potential profits. One review stated:

"I was shocked to see a $30 withdrawal fee after my first profits. It definitely wasn't mentioned upfront."

Cost Structure Summary

To summarize, traders need to weigh the low commission rates against the much higher non-trading fees that often surface post-trade. This double-edged sword can catch many by surprise.

With multiple trading options available, tokeu claims to have established a user-friendly environment.

Platform Diversity

Tokeu primarily employs WebTrader, reputed for its ease of use, which might suit beginner traders. However, it lacks some advanced features expected by seasoned professionals. This limitation might dissuade traders looking for depth beyond basic tools.

Quality of Tools and Resources

While the platform provides basic charting tools, it falls short in offering comprehensive educational resources or advanced analytics that new traders often need to navigate complexities effectively.

Platform Experience Summary

Feedback from users indicates that while the platform is simple to navigate, it has significant limitations. “It feels like a basic interface without depth to support serious trading,” shared another trader.

User Experience Analysis

The user experience at tokeu is significant in determining overall satisfaction.

User Interface Evaluation

Many new traders appreciate tokeu for its accessibility. However, frequent complaints regarding the slow withdrawal process create substantial frustrations for many users. The platforms design may look appealing, but it is reportedly full of hidden pitfalls.

Situational Feedback from Users

Users often pointed out:

"The interface is easy to use, but when I made my first withdrawal, it took a week and several follow-ups to get my money."

Customer Support Analysis

Customer support is a crucial aspect of any trading experience, particularly for beginners needing immediate assistance.

Response Quality and Availability

Tokeu primarily provides support through email, which can result in long response times, particularly during peak hours. Users expect faster, more accessible communication channels, such as live chat or phone support, especially when facing urgent issues.

Customer Feedback on Support

One frequent theme among users highlights:

"Email support feels like shouting into a void. I waited days for a simple question to be answered."

Account Conditions

Examining account conditions is essential for potential traders to make informed decisions.

Account Types and Flexibility

Tokeu provides multiple account types, each catering to a different trading strategy. However, the minimum deposit requirement of €250 can pose a barrier for some new traders looking to start small.

Overall Conditions Summary

The firms account types offer certain benefits, but new traders must assess whether the initial capital required is worth the associated risks.

Conclusion

In conclusion, while tokeu presents an intriguing entrance for beginners into online trading with its appealing platform and low commissions, the lurking dangers posed by its unregulated status cannot be ignored. The absence of oversight raises serious concerns about fund safety, the transparency of fees, and the overall reliability of the brokerage.

Traders, particularly beginners, should proceed with caution, conduct thorough research, and consider alternative, regulated brokerage options to ensure the safety and well-being of their investments.