Is SUSHI safe?

Pros

Cons

Is Sushi Safe or Scam?

Introduction

Sushi, a relatively new player in the forex market, has garnered attention for its trading services. However, as with any trading platform, it is crucial for traders to carefully evaluate the credibility and safety of the broker they choose. The forex market is rife with scams and unregulated entities, making it essential for traders to conduct thorough research before committing their funds. This article aims to provide an objective analysis of Sushi, assessing its safety, legitimacy, and overall trustworthiness. Our investigation is based on a comprehensive review of various sources, including user testimonials, regulatory information, and industry comparisons.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. Sushi, unfortunately, lacks any valid regulatory oversight, which raises significant concerns for potential investors. Below is a summary of Sushi's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Sushi does not have to adhere to any financial standards or practices that protect traders. This lack of regulation is particularly concerning given the history of scams associated with unregulated brokers. Traders should be aware that without regulation, there is little recourse for recovering funds in the event of a dispute.

Company Background Investigation

Sushi is operated by Sushi Global Investing Limited, a company that has not provided comprehensive details regarding its ownership structure or management team. Established in 2024, the broker claims to offer a range of trading instruments, including forex currency pairs, commodities, and cryptocurrencies. However, the lack of transparency about its operational history and the individuals behind the company raises red flags.

The management team's background and professional experience are crucial in assessing the broker's credibility. Unfortunately, there is minimal information available, which adds to the uncertainty surrounding Sushi's legitimacy. A broker's transparency in disclosing its operational details is a vital indicator of its trustworthiness.

Trading Conditions Analysis

Sushi's trading conditions are another area of concern. The platform imposes a minimum deposit requirement of $1,000, which is relatively high compared to industry standards. Additionally, the fee structure lacks clarity, with reports of unusual fees associated with withdrawals and account maintenance. Below is a comparison of Sushi's core trading costs against industry averages:

| Fee Type | Sushi | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of a clear commission model and the potential for hidden fees can lead to unexpected costs for traders. These factors contribute to the overall perception that Sushi may not be operating with the best interests of its clients at heart.

Client Fund Security

The safety of client funds is paramount when choosing a trading platform. Sushi does not provide adequate information regarding its fund security measures. There are no indications of segregated accounts or investor protection policies in place, which are standard practices among reputable brokers. The absence of these protections raises concerns about the safety of traders' funds.

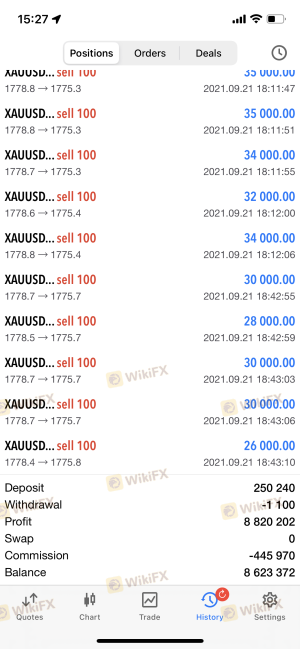

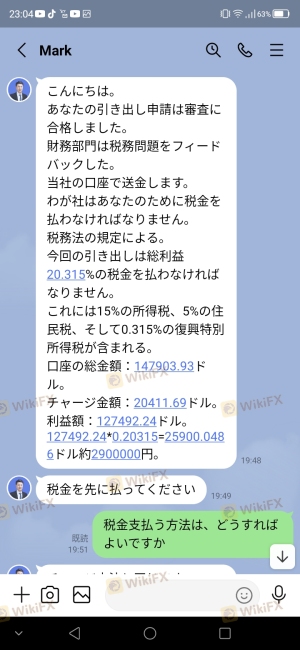

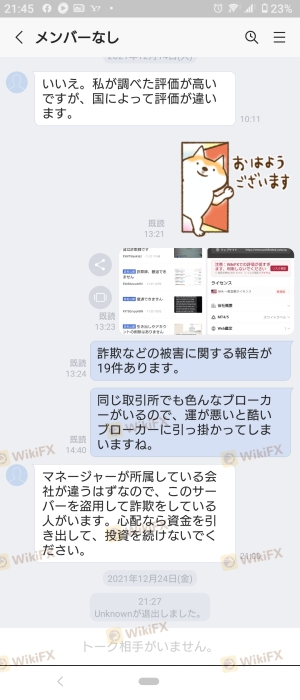

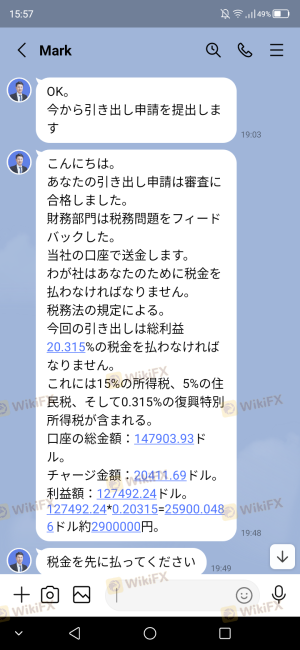

Additionally, there have been allegations of embezzlement and fraudulent activities linked to Sushi. Reports from users indicate that they have faced difficulties in withdrawing their funds, with claims of being required to pay additional taxes before processing withdrawals. Such practices are often indicative of a scam, further questioning whether Sushi is safe for traders.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Many users have reported negative experiences with Sushi, highlighting issues such as withdrawal difficulties and unresponsive customer service. Below is a summary of common complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Fraudulent Activity Claims | High | Unaddressed |

Typical cases include users being unable to withdraw funds for extended periods and being pressured to pay additional fees. These patterns suggest a concerning trend that potential traders should consider seriously.

Platform and Execution Quality

The trading platform offered by Sushi is built on the MT5 framework, which is generally regarded as reliable. However, user reviews indicate that the platform may have stability issues, leading to concerns regarding order execution quality. Reports of slippage and rejected orders have surfaced, raising questions about whether Sushi is safe for executing trades.

The potential for platform manipulation is another issue that traders must consider. Without regulatory oversight, there is little accountability for the broker's actions, and traders may find themselves at risk of unfair practices.

Risk Assessment

Using Sushi as a trading platform comes with inherent risks. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for hidden fees and scams |

| Operational Risk | Medium | Platform stability and execution issues |

To mitigate these risks, traders should approach Sushi with caution. It is advisable to only invest funds that one can afford to lose and to consider alternative, more reputable brokers with established track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sushi exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, transparency issues, and numerous user complaints indicate that potential traders should exercise extreme caution.

For traders seeking a safer environment, it may be prudent to consider alternative brokers that are regulated and have demonstrated a commitment to client protection. Some reputable options include well-established firms with a proven track record in the forex market. Ultimately, whether Sushi is safe or a scam remains a significant concern that should not be overlooked by potential investors.

Is SUSHI a scam, or is it legit?

The latest exposure and evaluation content of SUSHI brokers.

SUSHI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUSHI latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.