Is Ring Financial safe?

Pros

Cons

Is Ring Financial Safe or Scam?

Introduction

Ring Financial is a forex broker that has positioned itself as a player in the online trading market since its inception in 2012. Operating primarily through its platform, it offers various trading products, including forex and CFDs on stocks, indices, and commodities. As the forex market continues to grow, traders must exercise caution when selecting brokers. The potential for fraud and mismanagement is significant, especially with unregulated entities. This article aims to provide an objective analysis of Ring Financial by evaluating its regulatory status, company background, trading conditions, customer safety, and user experiences. The assessment is based on a comprehensive review of multiple sources, focusing on factual data and user feedback.

Regulation and Legitimacy

Understanding a broker's regulatory status is crucial for assessing its safety. Regulation serves as a protective mechanism for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, Ring Financial is classified as an unregulated broker, which raises significant concerns regarding its legitimacy and the safety of traders' funds.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Ring Financial is not subject to any government oversight. This lack of regulatory compliance can lead to higher risks for traders, as they have no recourse in the event of disputes or financial mishaps. Historical compliance issues have been noted, including warnings from financial authorities about potential fraudulent activities associated with the broker. The unregulated status of Ring Financial is a significant red flag, indicating that traders should approach this broker with extreme caution.

Company Background Investigation

Ring Financial claims to be based in the United Kingdom, but its actual operational transparency is questionable. The company lacks clear information regarding its ownership structure and management team, which is critical for establishing trustworthiness. The absence of identifiable leadership raises concerns about accountability and transparency.

The company's history is relatively short, having been established in 2012. However, the lack of verifiable information regarding its founders and operational changes over the years makes it difficult to assess its credibility. Furthermore, the companys website offers minimal insights into its operations, which is a significant concern for potential clients looking for reliable and transparent brokers. Overall, the opacity surrounding Ring Financial's background and ownership structure contributes to doubts about its legitimacy.

Trading Conditions Analysis

The trading conditions offered by Ring Financial are another area of concern. While the broker provides access to various trading products, the overall fee structure and potential hidden charges warrant scrutiny. Understanding the cost of trading is essential for traders to evaluate whether a broker is suitable for their needs.

| Fee Type | Ring Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Structure | 0.05% | 0.1-0.3% |

| Overnight Interest Range | Variable | 2-5% |

The spreads offered by Ring Financial are variable, which means they can fluctuate based on market conditions. While lower spreads can be appealing, the lack of transparency in how these spreads are determined raises questions. Additionally, the commission structure is not competitive compared to industry standards, which may indicate that traders could incur higher costs than anticipated.

Customer Funds Safety

When evaluating whether Ring Financial is safe, it's essential to consider the measures in place for customer funds' security. Unfortunately, Ring Financial does not provide adequate information regarding its fund protection policies, which is concerning for potential clients.

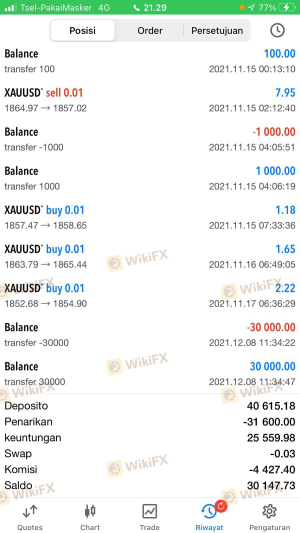

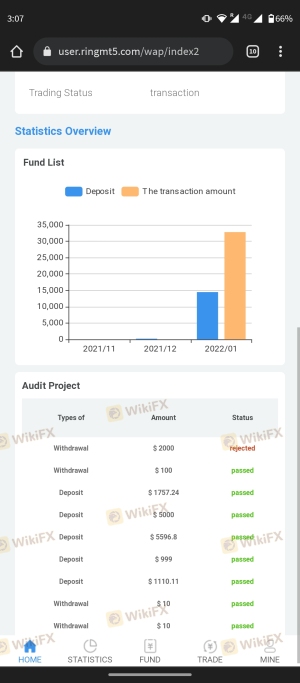

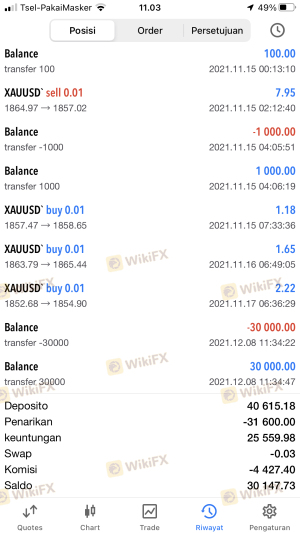

The absence of segregated accounts, investor protection schemes, and negative balance protection are significant risks. Traders may find themselves vulnerable to losses that exceed their initial deposits, especially in volatile market conditions. Furthermore, there have been reports of funds being difficult to withdraw, adding to the unease surrounding the safety of customer funds with Ring Financial.

Customer Experience and Complaints

Customer feedback and experiences are vital indicators of a broker's reliability. A review of user experiences with Ring Financial reveals a pattern of dissatisfaction and complaints. Many users have reported challenges in withdrawing funds, which raises questions about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Poor Customer Support | Medium | Average |

| Misleading Information | High | Unresponsive |

Common complaints include withdrawal delays, unresponsive customer support, and misleading promotional claims. One typical case involved a trader who found it nearly impossible to withdraw their funds after several attempts, resulting in frustration and financial loss. Customer support has been reported as unhelpful, further exacerbating the situation for affected traders.

Platform and Trade Execution

The trading platform is a critical aspect of any broker's service offering. Ring Financial utilizes the popular MetaTrader 4 (MT4) platform, which is generally well-regarded in the trading community. However, user experiences regarding platform stability and order execution quality vary significantly.

Many users have reported issues with slippage and delayed order execution, which can lead to unfavorable trading outcomes. Additionally, there are concerns about potential platform manipulation, as some traders have experienced unexplained changes in their account balances. Overall, while the platform itself is reputable, the execution quality and reliability associated with Ring Financial are questionable.

Risk Assessment

Using Ring Financial poses several risks that potential traders should consider. The unregulated status, lack of transparency, and negative user experiences contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation, high risk of fraud |

| Fund Security | High | Lack of protection and withdrawal issues |

| Customer Support | Medium | Inconsistent support and response times |

To mitigate risks, traders should exercise extreme caution. It is advisable to only invest funds that they can afford to lose and to consider alternative brokers that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ring Financial is not a safe broker. Its unregulated status, lack of transparency, and negative user feedback indicate significant risks for traders. While the broker offers various trading products and a recognizable platform, the potential for fraud and financial loss is high.

Traders should be particularly wary of any dealings with Ring Financial and consider alternative options. Recommended brokers are those with robust regulatory oversight, transparent operations, and positive user experiences. It is crucial to prioritize safety and security in trading, and in this case, Ring Financial does not meet those essential criteria.

Is Ring Financial a scam, or is it legit?

The latest exposure and evaluation content of Ring Financial brokers.

Ring Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ring Financial latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.