Ring Financial 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Ring Financial positions itself as an accessible trading platform for those interested in forex and Contracts for Difference (CFDs). With high leverage options and a low minimum deposit requirement, it attracts traders seeking a cost-effective entry point into these markets. However, the significant absence of regulation raises alarms about the platform's legitimacy and the safety of user investments. This report caters to high-risk tolerant traders familiar with unregulated environments, while simultaneously warning cautious investors and newcomers to steer clear of Ring Financial due to its questionable operational practices.

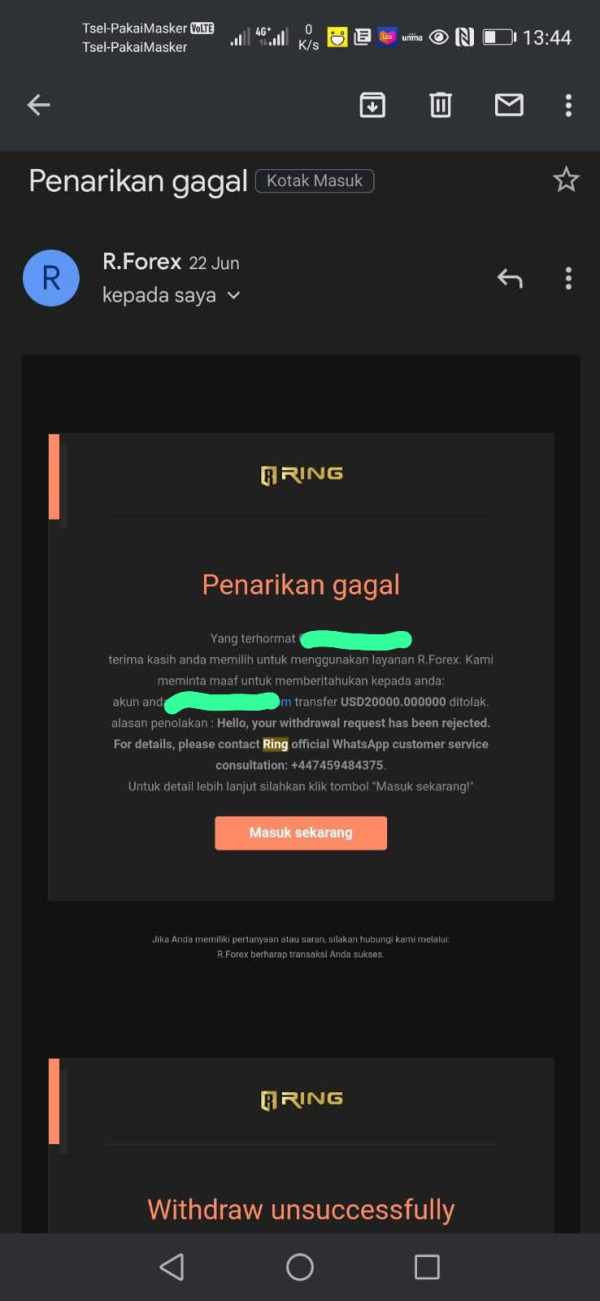

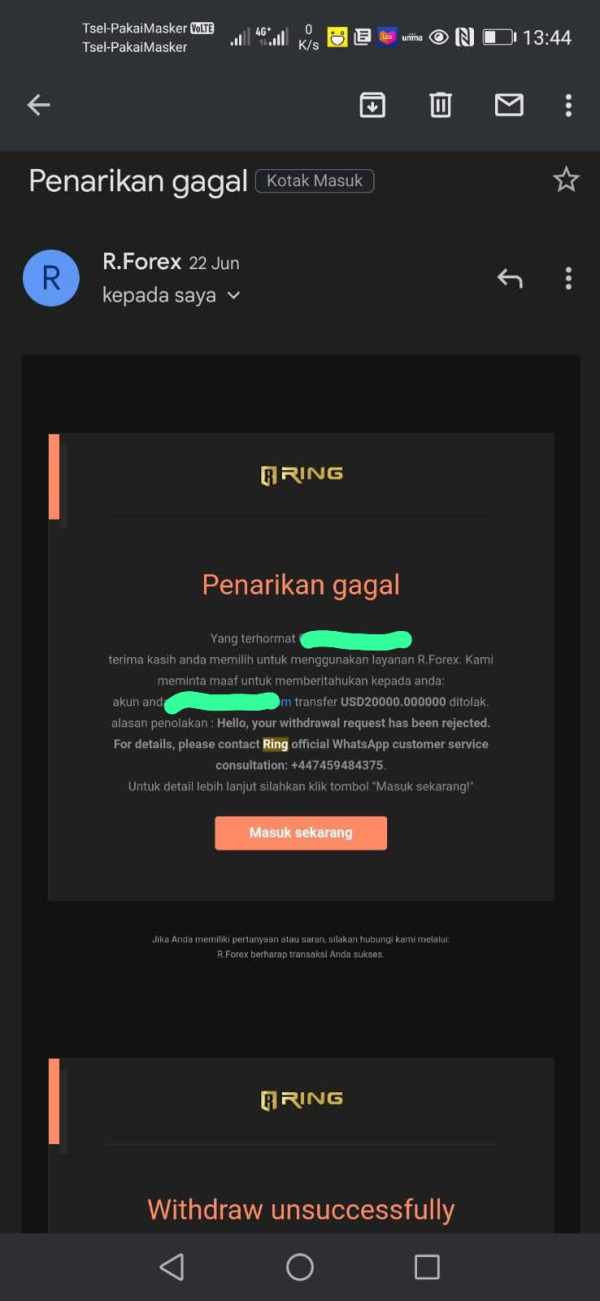

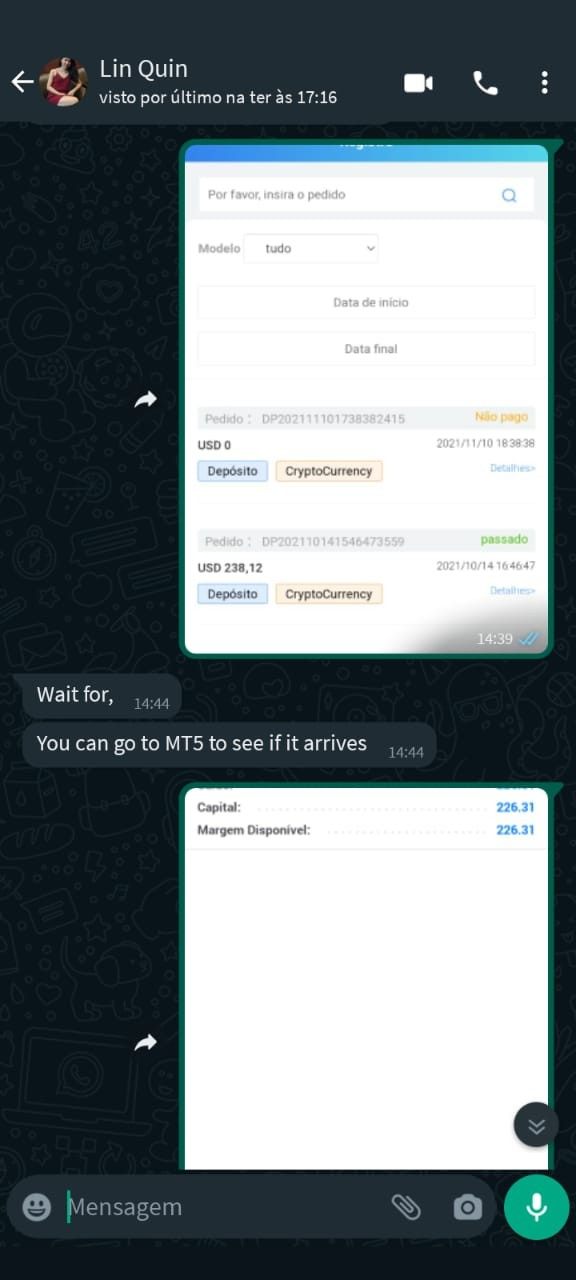

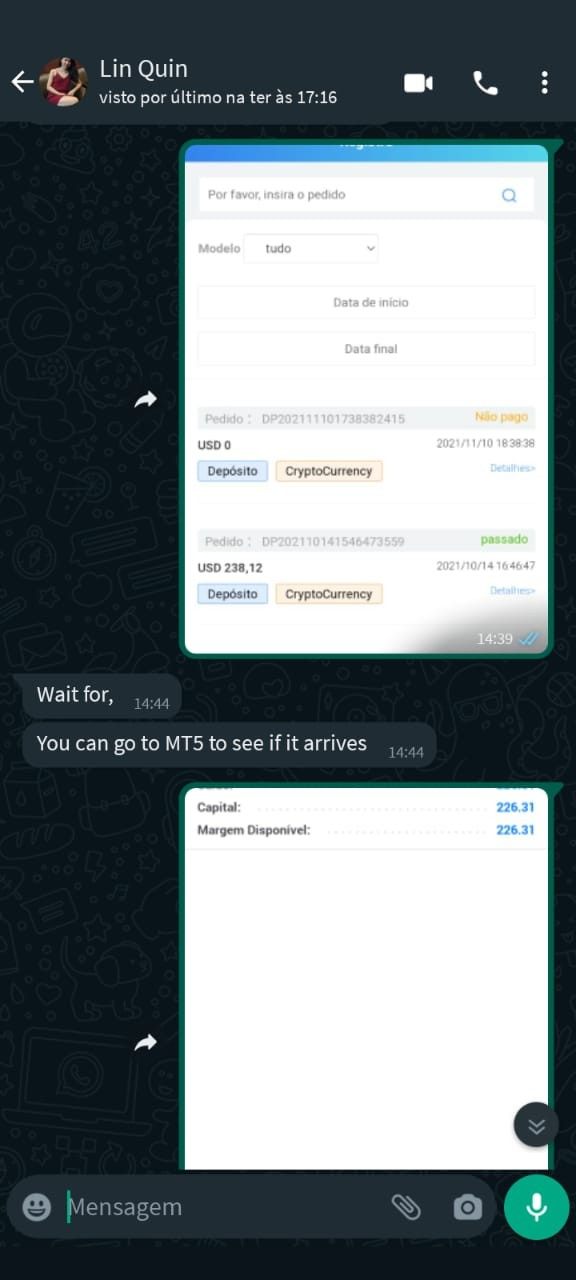

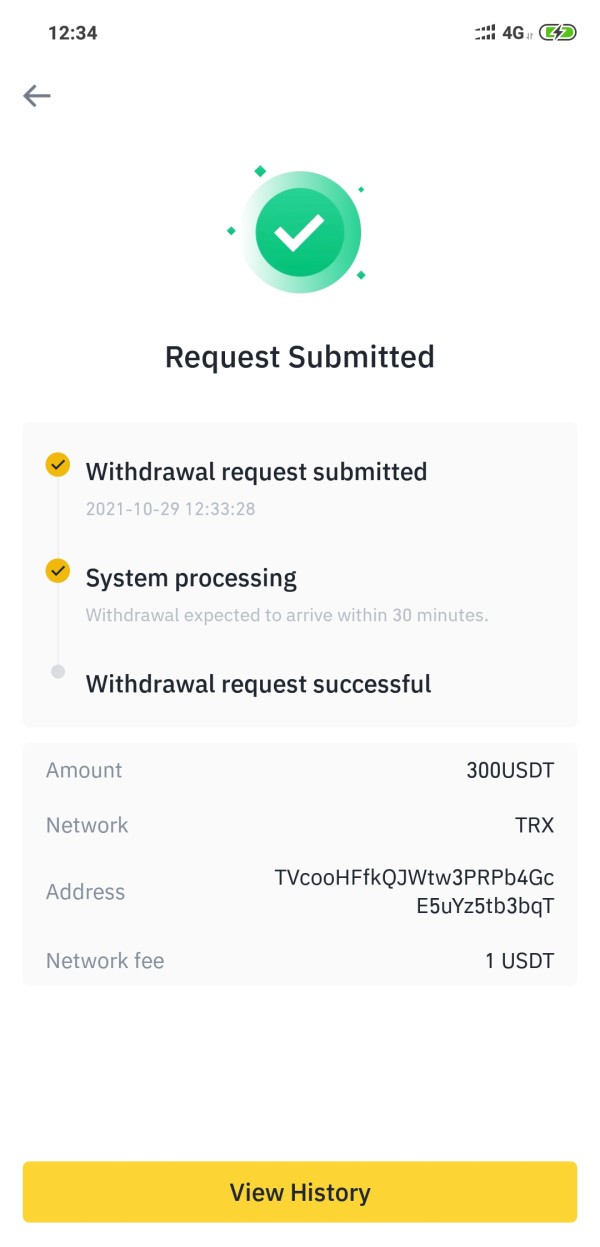

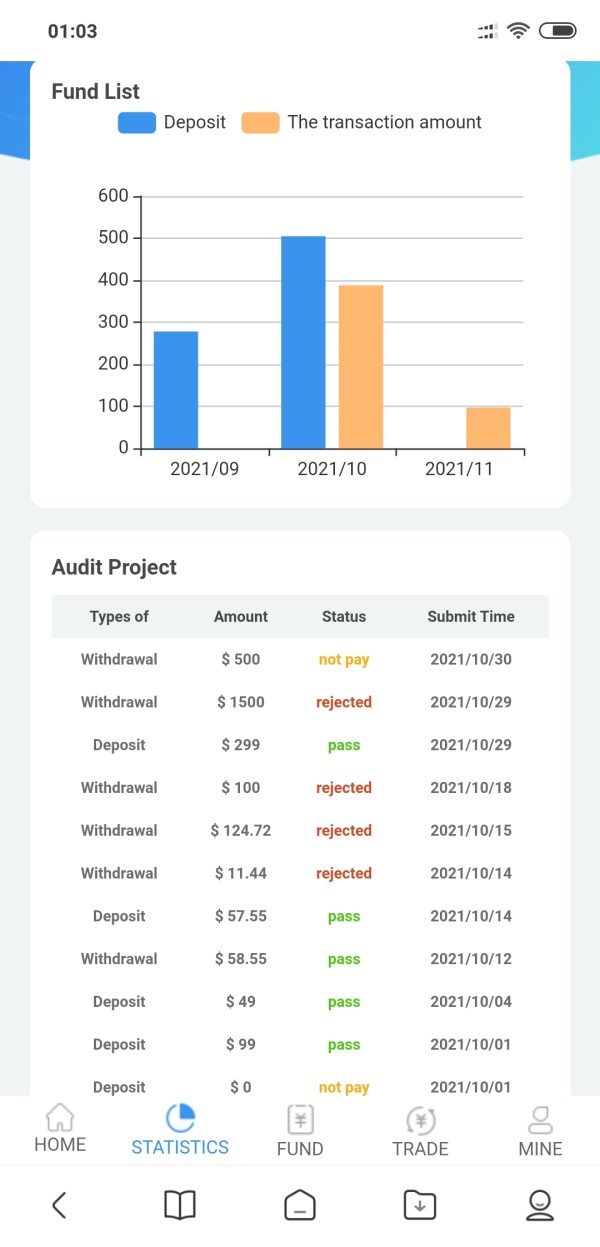

Numerous complaints highlight users difficulties with fund withdrawals and unresponsive customer service, indicating systemic issues that prospective investors should consider. This comprehensive review delves into the broker's operations, safety, user experiences, and cost structures to evaluate whether the enticing trading conditions offered by Ring Financial are worth the associated risks.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Investing with Circle Financial could result in financial losses due to its unregulated status and multiple user complaints about withdrawal issues and customer service.

Potential Harms:

- Difficulty in withdrawing funds.

- Potential for fraud or scam practices.

- Lack of recourse in case of disputes due to absence of regulation.

How to Self-Verify:

- Check Regulatory Status:

- Visit reputable regulatory websites (like NFA, FCA).

- Search for Ring Financial or related licensing information.

- Research Company Background:

- Look for reviews on consumer complaint platforms.

- Investigate prior legal actions or warnings against the broker.

- Read User Experiences:

- Analyze user feedback on social media, forums, and review sites.

- Evaluate whether issues raised by other users align with your concerns.

Rating Framework

Broker Overview

Company Background and Positioning

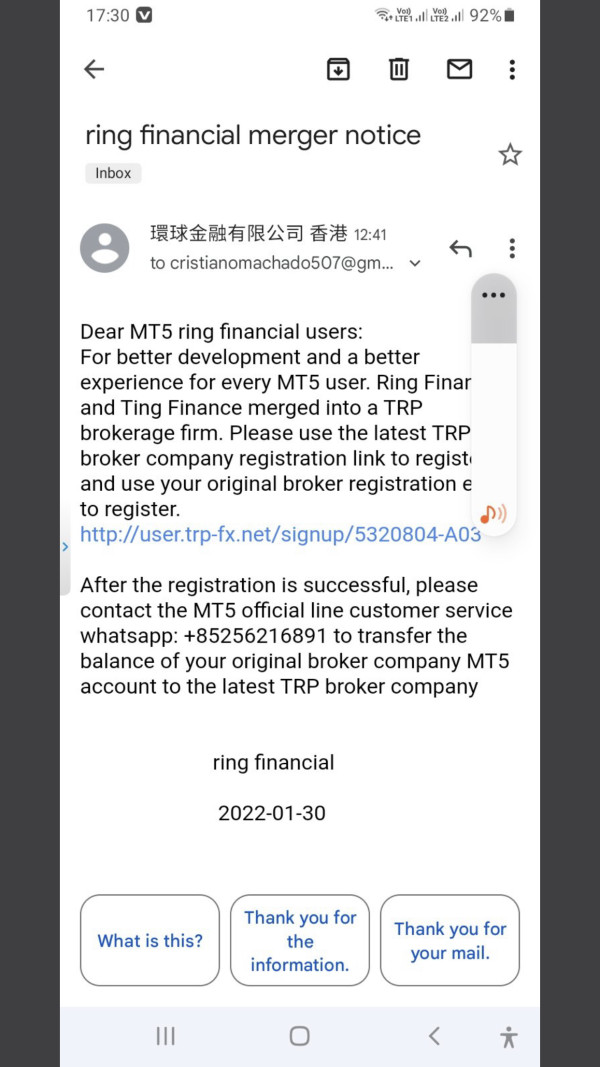

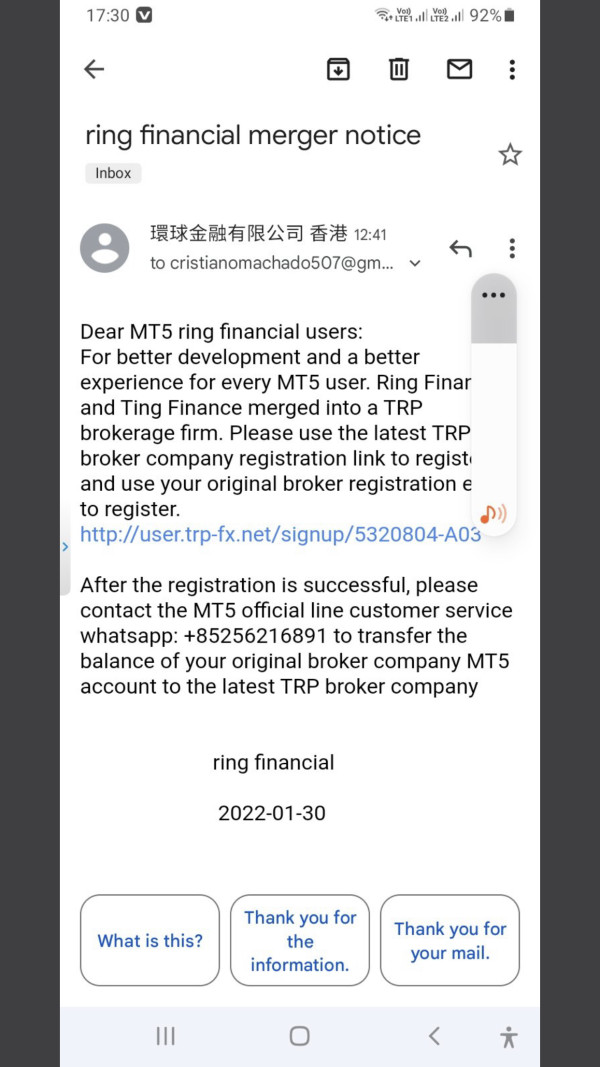

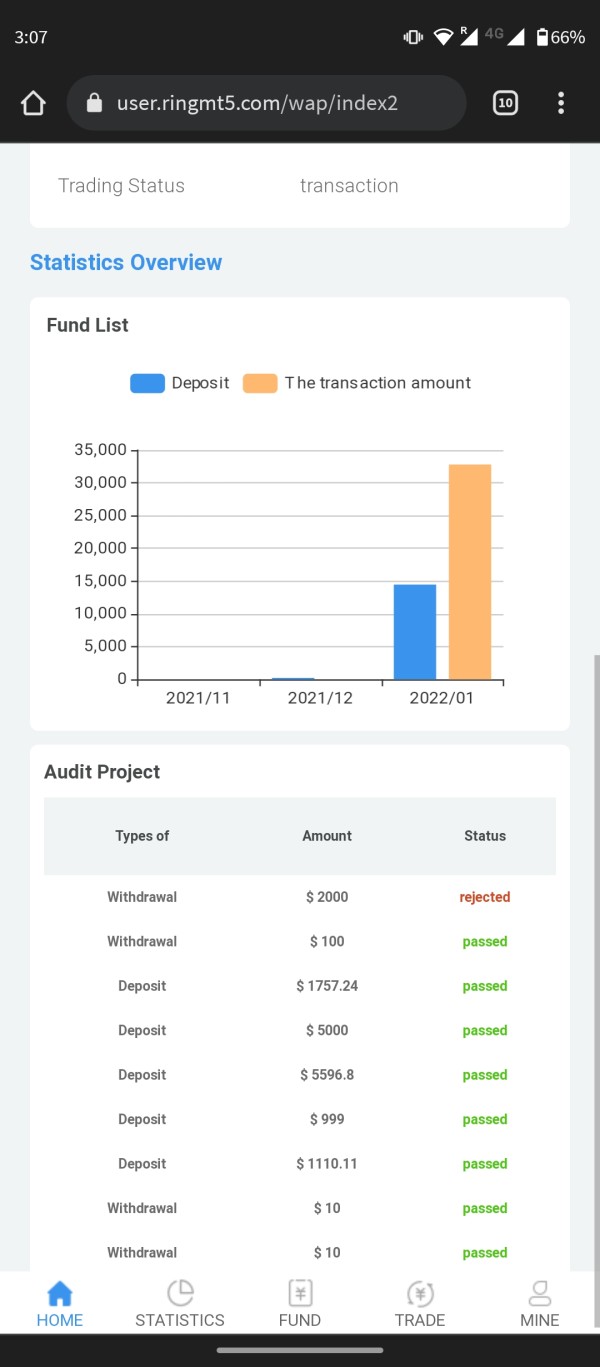

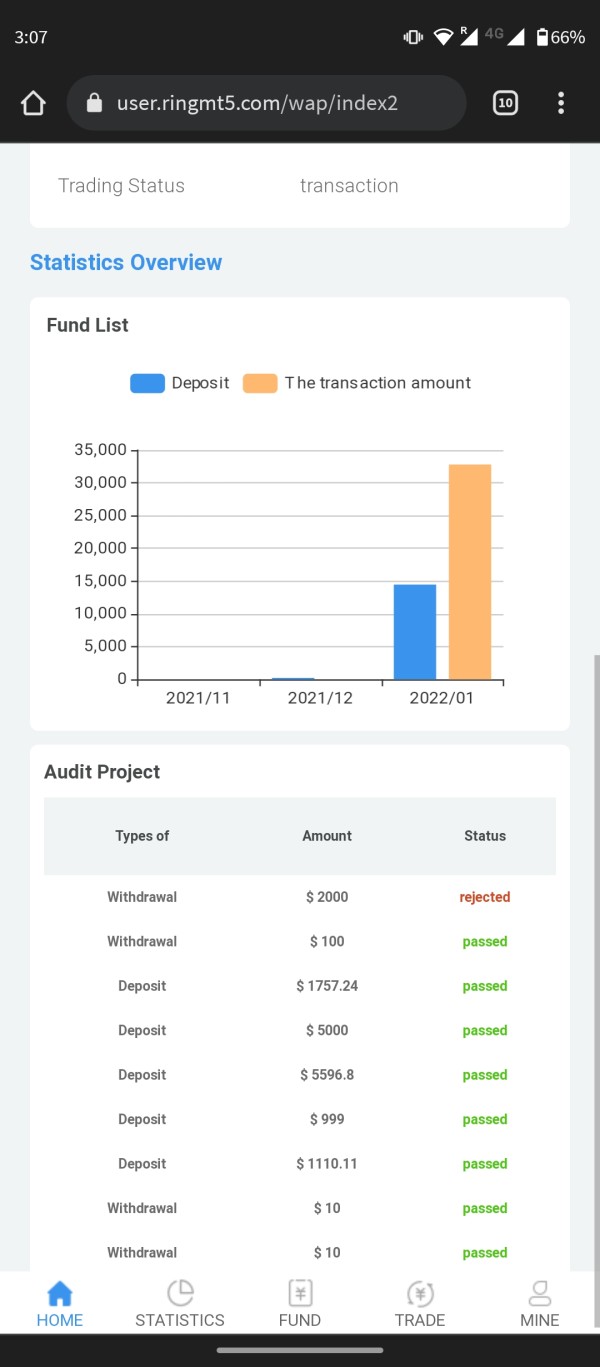

Founded between 2018 and 2021, Ring Financial operates out of Hong Kong. As per user reports and several analysis sources, the broker lacks clear ownership structure and transparency regarding its operational practices. Given its unregulated status, the company has garnered a stable reputation for high-risk activity, as detailed complaints suggest that it frequently faces accusations of fund mishandling and fraud.

Core Business Overview

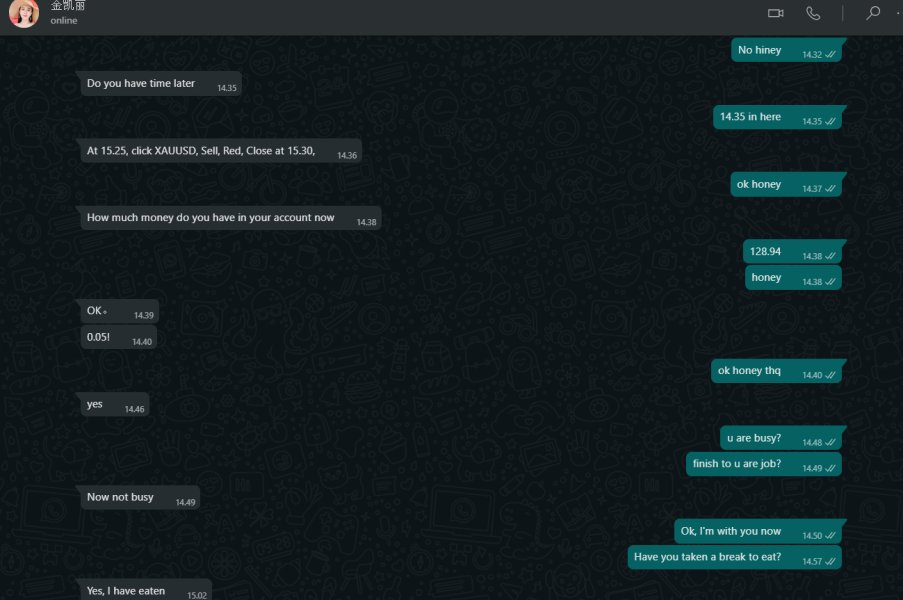

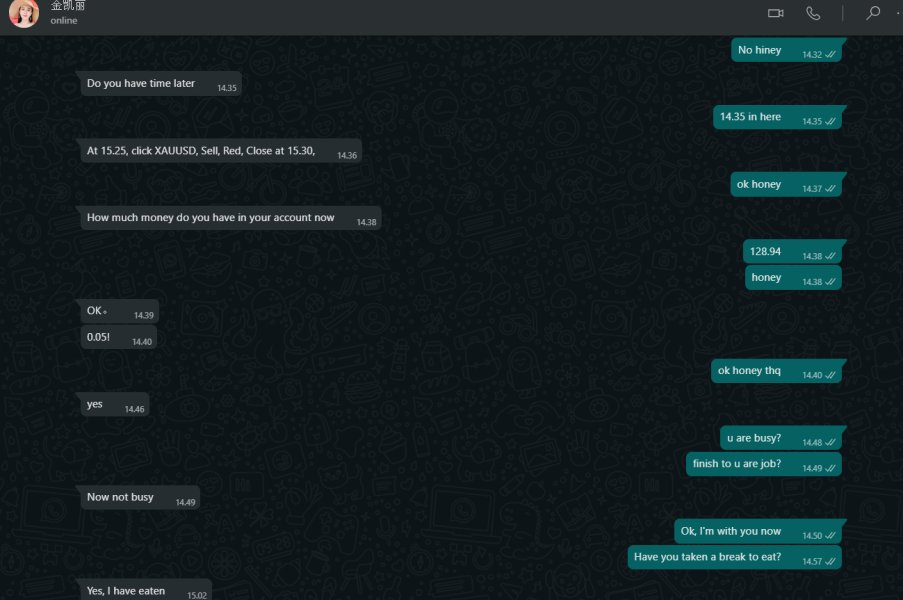

Ring Financial focuses on providing forex and CFD trading services. Leveraging the MetaTrader 5 platform, it claims to cater to a broad spectrum of trading products, including currencies, commodities, and stock CFDs. However, its overall business framework remains murky, and serious questions loom around its lack of valid regulatory licenses, which solidifies the notion that it may engage in misleading marketing behaviors.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Understanding the trustworthiness of a broker is crucial for safeguarding investor funds. For potential traders, assessing regulatory conflicts associated with Ring Financial yields alarming insights.

The unregulated status of Ring Financial has raised many red flags. Various reports cite the absence of a valid registration in contrast to its claims of operating under supposedly recognized financial authorities. This absence means that traders are exposed to the potential for fraud without the safety nets that licensed brokers provide.

User Self-Verification Guide:

Visit the NFA BASIC database (http://www.nfa.futures.org).

Input brokers name in the search query.

Check for licensing status and regulatory compliance.

Review historical data and any previous complaints.

Cross-reference against other governing bodies like FCA or ASIC for warnings or licensing.

"I wanted to withdraw my funds but was met with excuses; my account was frozen for weeks."

- A disgruntled user from an online forum.

Many users have raised similar concerns about fund safety and withdrawal challenges, underscoring the need for potential traders to prioritize self-verification.

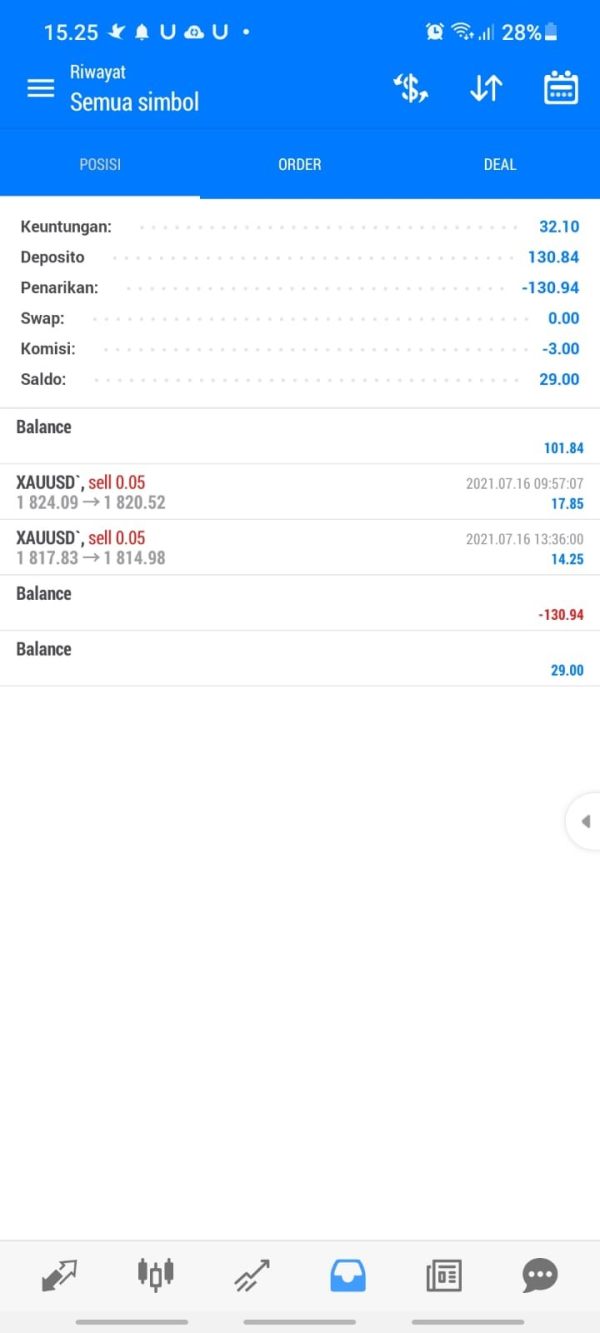

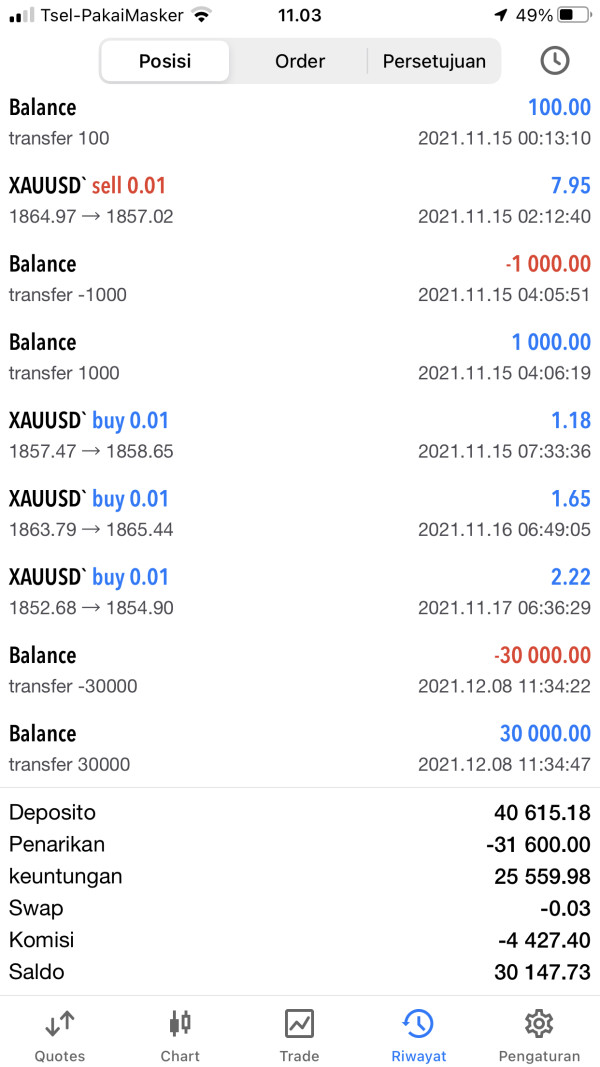

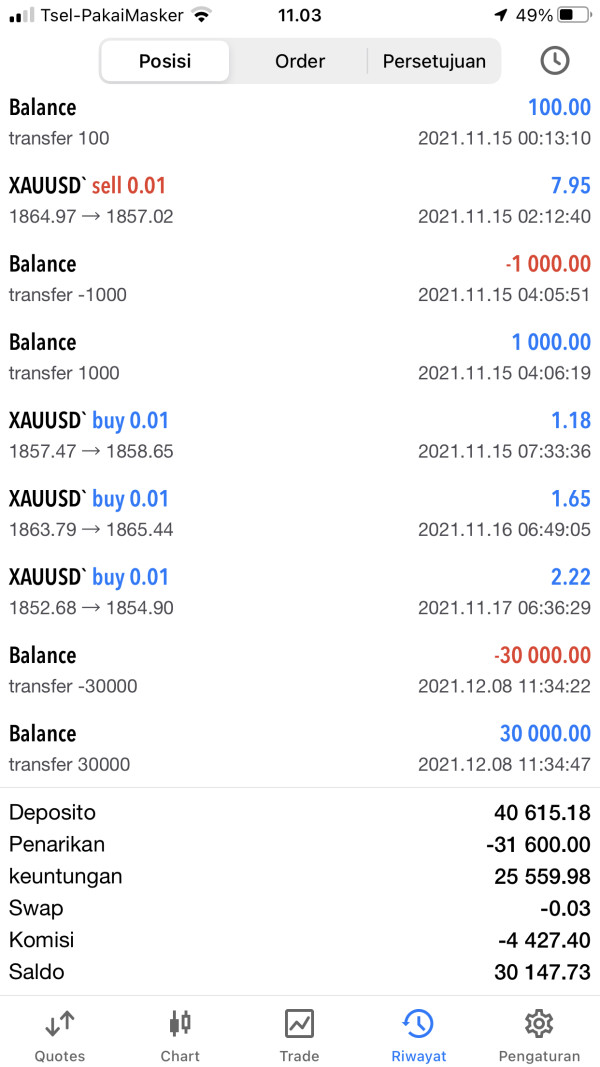

Trading Costs Analysis

Evaluating trading costs can mean the difference between gaining an edge or crippling a trading strategy.

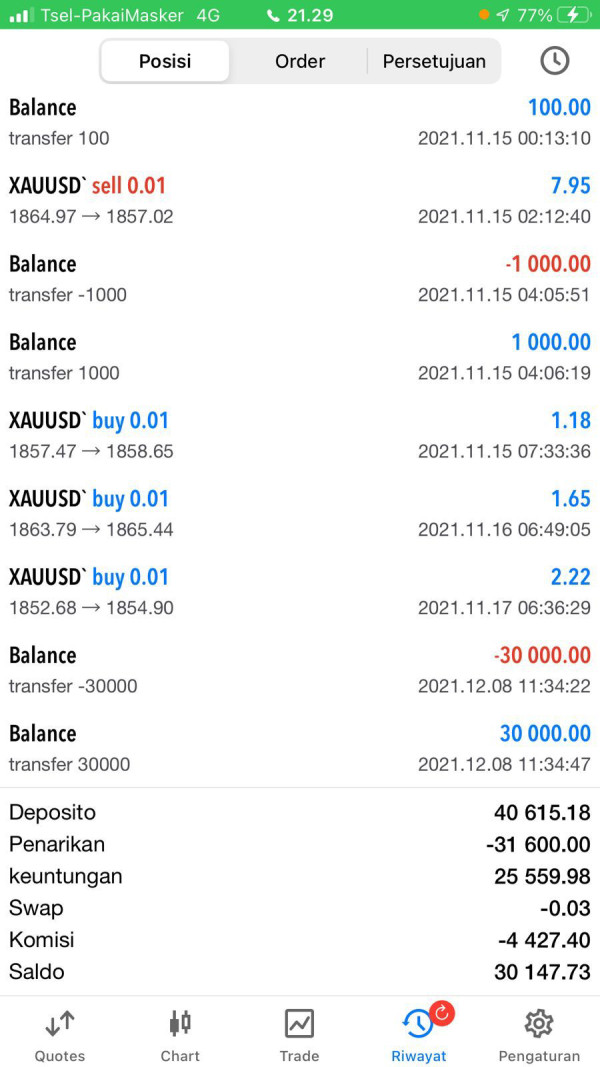

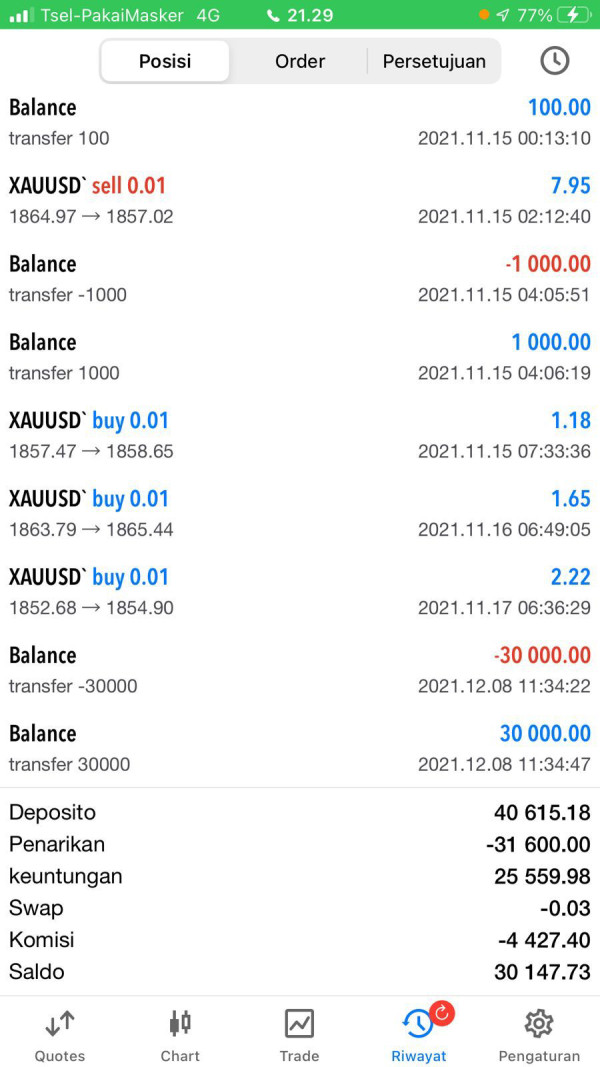

Ring Financial presents a competitive commission structure, with fees reported to be around 0.05%. Such options can appeal to cost-sensitive traders.

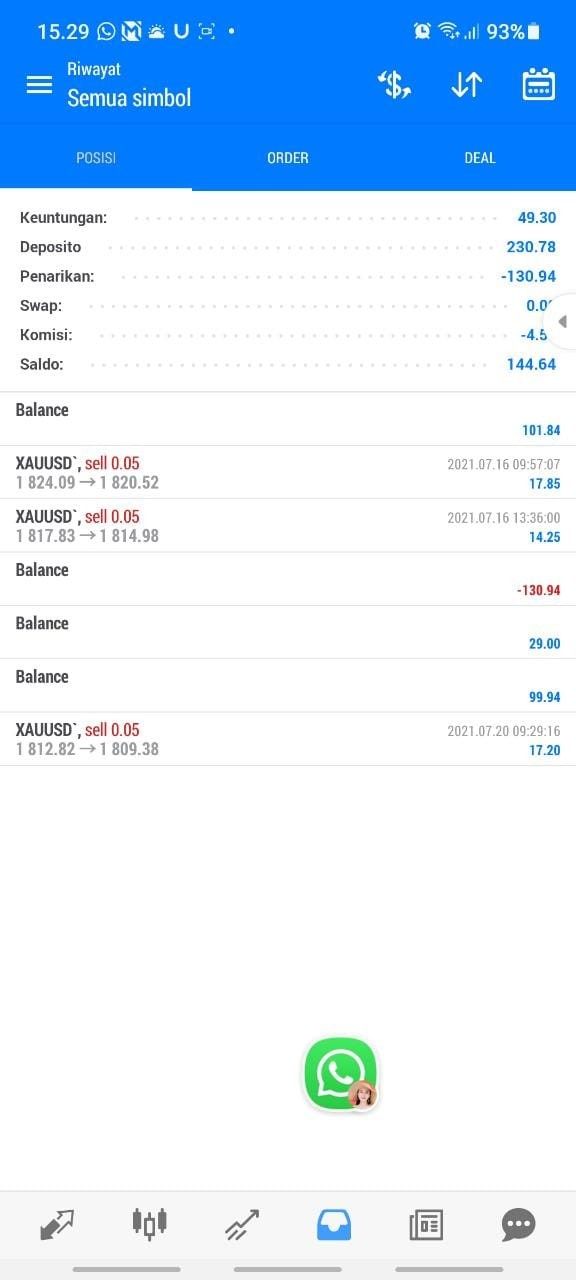

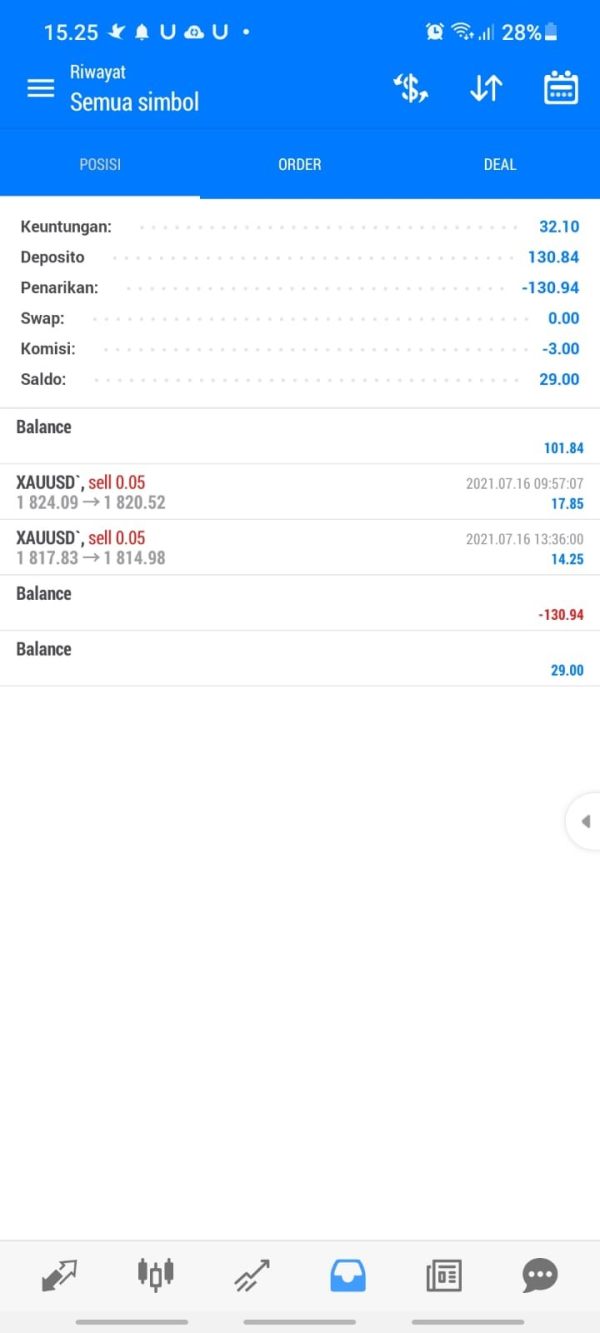

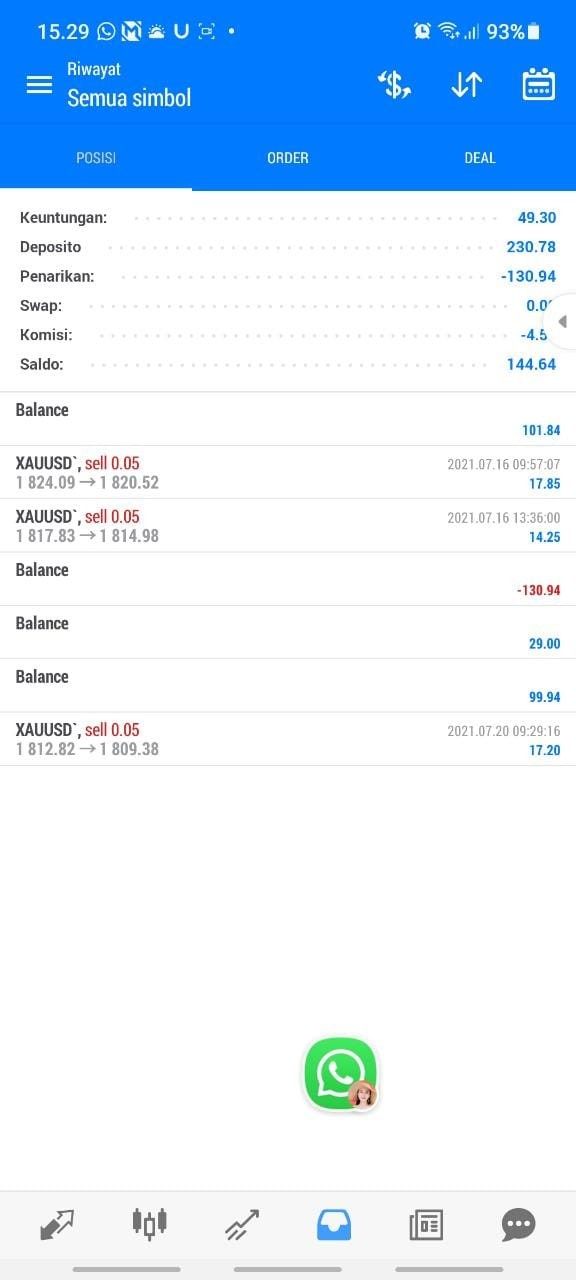

However, hidden costs and withdrawal fees create a "double-edged sword" situation. For instance, one user reported a $30 withdrawal fee, which, while not stealing, can significantly eat into small profits or exacerbate losses when cashing out.

"They lure you in with low commissions, but good luck trying to get your money out!"

- In summary, while the broker offers low-cost trading opportunities through commissions, the high withdrawal fees may discourage regular trading and lead to unexpected costs for many investors.

The availability of platforms and tools can heavily influence the trading experience for users.

Ring Financial reports access to established trading platforms like MetaTrader 5, which is well-regarded in the industry. This should theoretically provide users with various advanced trading features.

However, evidence suggests variability in platform execution and user experience. Reports of slippage and lag during critical market moves raise suspicion about the reliability of the platform. Several individuals have commented on the usability, citing frustration when it counts.

"I executed a buy order, and it didnt fill until the price surged – totally unexpected!"

- Ultimately, the platform's overall experience may suit casual or novice traders, but experienced individuals seeking robust trading tools may find it lacking.

User Experience Analysis

The user experience encompasses the entire engagement process from onboarding to trading execution.

Account creation on Ring Financial appears to be straightforward, with required details easily completed.

However, once engaged, traders have reported significant challenges around order execution stability. A consistent refrain observes execution delays and glitchy performance on several occasions during peak market hours.

Overall sentiment tends to err on the negative side, with multiple users expressing how difficult the overall transaction system is and how it hampers their trading strategies.

"I had high hopes, but the complications with withdrawing funds coupled with dodgy customer support just ruined my experience."

Customer Support Analysis

Customer support forms a crucial lifeline, helping traders navigate challenges.

The availability of support seems limited, with several users citing slow responses and unhelpful interaction. Most complaints highlight unresponsive customer service, particularly during urgent situations.

Users have reported waiting days for responses to straightforward inquiries, leading to frustration and a feeling of neglect.

"Trying to contact support is like talking to a wall; I have given up!"

- In summary, the overall sentiment surrounding customer support aligns with low service quality which could become detrimental in case of urgent issues.

Account Conditions Analysis

Account conditions dictate the framework through which trading occurs.

Ring Financial only offers a single account type, characterized by high minimum deposits of $1,000 and a leverage of 1:200, which may be off-putting for emerging traders.

With unclear terms regarding deposit and withdrawal policies reported, many prospective users express hesitancy to engage. The lack of prominent features that segregate or diversify account services raises concerns over user-friendliness.

Many users echo dissatisfaction regarding the unyielding conditions tied to withdraw requests, capturing the essence of the overall negatives that permeate the account setup process.

In conclusion, while Ring Financial showcases attractive trading conditions, its lack of regulation and transparency severely affect its rating as a trustworthy broker. High-risk traders may still consider engaging, but conservative and inexperienced investors should be wary and look for regulated alternatives to safeguard their interests.