Is P2B safe?

Pros

Cons

Is P2B Safe or Scam?

Introduction

P2B, formerly known as P2PB2B, is a cryptocurrency exchange that was established in 2018 and is based in Vilnius, Lithuania. It has quickly gained traction in the crypto market, primarily due to its focus on new token launches and a user-friendly interface. As the cryptocurrency market continues to expand, traders are increasingly cautious about the platforms they choose for trading. With numerous exchanges available, it is essential for traders to conduct thorough evaluations to ensure they are engaging with a reliable and secure platform. This article aims to provide an objective analysis of P2B, exploring its regulatory status, company background, trading conditions, safety measures, customer feedback, and overall risk assessment to determine whether P2B is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for ensuring that it operates within legal frameworks designed to protect traders. Unfortunately, P2B does not appear to be regulated by any major financial authority, which raises concerns about its legitimacy. The absence of regulatory oversight can lead to potential risks for users, such as difficulties in withdrawing funds or issues with account suspensions. Below is a summary of P2B's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | - | - | Unregulated |

The lack of a regulatory license from a recognized authority means that users might face challenges if disputes arise. Furthermore, the platform's terms of use suggest that users are responsible for ensuring compliance with local laws and regulations, which can be problematic for users in jurisdictions with strict financial regulations. Overall, the absence of regulatory oversight significantly undermines the trustworthiness of P2B and raises questions about its operational integrity.

Company Background Investigation

P2B was founded by Valerii Solodov Nyk, who previously served as the CFO of Next Chain. Since its inception, the exchange has focused on providing a platform for both trading established cryptocurrencies and launching new tokens. The company has positioned itself as a go-to-market engine for crypto projects, having facilitated the launch of over 2,000 tokens. However, the company's ownership structure and transparency levels remain somewhat unclear, which can be a red flag for potential users.

The management team behind P2B has a background in finance and technology, which lends some credibility to the platform. However, the lack of publicly available information regarding their qualifications and experiences raises concerns about transparency. Additionally, P2B has not been forthcoming about its operational practices or financial health, which further complicates the assessment of its reliability. As a result, potential users may find it challenging to gauge the company's commitment to ethical practices and customer service.

Trading Conditions Analysis

When evaluating any trading platform, the fee structure and trading conditions are critical components that can significantly impact a trader's experience. P2B has a relatively straightforward trading fee structure, charging a flat rate of 0.2% for both market and limit orders. This is slightly below the industry average, making it an attractive option for traders. However, the platform has been criticized for its withdrawal fees, particularly for Bitcoin, which are higher than the global average. Below is a comparison of P2B's core trading costs:

| Fee Type | P2B | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | Varies |

| Commission Model | 0.2% | ~0.25% |

| Overnight Interest Range | Not specified | Not specified |

While P2B's trading fees are competitive, the higher withdrawal fees could deter users who frequently withdraw funds. Additionally, the lack of clarity around overnight interest rates and potential hidden fees may lead to unexpected costs for traders. Therefore, it is essential for users to thoroughly understand the fee structure before engaging with the platform to ensure that P2B is safe for their trading activities.

Customer Funds Security

The safety of customer funds is a top priority for any trading platform, and P2B has implemented several measures to protect users' assets. The exchange claims that 96% of its cryptocurrency assets are stored in cold wallets, which significantly reduces the risk of hacking and cyberattacks. Furthermore, P2B employs two-factor authentication (2FA) to enhance account security and protect against unauthorized access. However, the platform's history of security incidents or fund disputes remains unclear, which could be a concern for potential users.

P2B also adheres to certain security protocols, such as using a web application firewall (WAF) to monitor and block suspicious activities. Despite these measures, the lack of detailed information regarding the company's security audits and incident response history creates uncertainty. Users should be aware of the potential risks associated with trading on a platform that lacks comprehensive transparency in its security practices. Therefore, while P2B has taken steps to safeguard customer funds, the overall risk profile remains elevated due to the absence of regulatory oversight and historical security issues.

Customer Experience and Complaints

Understanding customer feedback and experiences is vital for assessing the reliability of a trading platform. P2B has garnered mixed reviews from users, with some praising its user-friendly interface and low trading fees, while others have raised concerns about withdrawal delays and customer support responsiveness. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Lockouts | Medium | Unclear resolution |

| Customer Support Issues | Medium | Inconsistent |

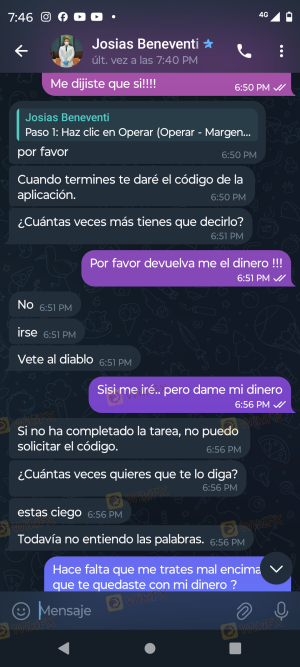

Several users have reported significant delays in processing withdrawals, particularly for larger amounts, which can be frustrating for traders. Additionally, some users have experienced account lockouts without clear explanations, leading to concerns about the platform's reliability. While P2B's customer support team has been responsive in certain cases, the overall quality of service appears inconsistent, which could deter potential users from engaging with the platform.

Platform and Trade Execution

The performance of a trading platform directly affects the user experience, and P2B has made efforts to provide a stable and efficient trading environment. The platform boasts a transaction engine capable of processing up to 10,000 trades per second, which is beneficial for day traders seeking to capitalize on market fluctuations. However, there have been reports of slippage and order rejections during high volatility periods, which can adversely impact trading outcomes.

Additionally, P2B's interface is designed to be intuitive, catering to both novice and experienced traders. However, the lack of advanced trading features, such as margin trading or futures, may limit the appeal for more sophisticated traders. Overall, while P2B's platform is user-friendly, potential users should be cautious about the execution quality and any signs of market manipulation.

Risk Assessment

When considering whether P2B is safe, it's essential to evaluate the overall risk profile associated with using the platform. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated platform |

| Security Measures | Medium | Cold storage and 2FA, but unclear history |

| Customer Support | Medium | Inconsistent responsiveness |

| Withdrawal Issues | High | Frequent complaints about delays |

Given the elevated risks, it is advisable for users to exercise caution when trading on P2B. Implementing risk mitigation strategies, such as limiting the amount of capital invested and diversifying trading platforms, can help protect traders from potential losses.

Conclusion and Recommendations

In conclusion, while P2B presents itself as a user-friendly platform with competitive trading fees, significant concerns regarding its regulatory status, customer support, and withdrawal processes raise red flags. The absence of regulatory oversight and reports of delayed withdrawals suggest that users should approach this platform with caution.

For traders seeking a secure and reliable trading environment, it may be advisable to consider alternative platforms that are well-regulated and have a proven track record of customer satisfaction. Some recommended alternatives include Binance and Kraken, which offer robust regulatory frameworks and comprehensive customer support. Ultimately, potential users must weigh the benefits and risks associated with P2B to make informed decisions about their trading activities.

Is P2B a scam, or is it legit?

The latest exposure and evaluation content of P2B brokers.

P2B Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

P2B latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.