Is PROMARKETS safe?

Pros

Cons

Is Promarkets A Scam?

Introduction

Promarkets is an online forex broker that has attracted attention in the trading community for its various offerings and claimed advantages. Operating in the highly competitive forex market, Promarkets positions itself as a platform that provides traders with access to a wide range of financial instruments and trading tools. However, the forex trading landscape is fraught with risks, and traders must exercise caution when selecting a broker. The lack of regulation and oversight can lead to potential scams, making it essential for traders to conduct thorough evaluations before committing their funds. This article investigates the legitimacy of Promarkets, employing a structured assessment framework that includes regulatory status, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy. Promarkets operates without any recognized regulatory oversight, which raises significant red flags for potential investors. The absence of regulation means that the broker is not held accountable to any governing body, increasing the risk of fraudulent activities. Below is a summary of the regulatory information concerning Promarkets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework means that Promarkets does not adhere to any financial standards or practices that protect investors. This absence of oversight can lead to severe implications, such as the inability to recover funds in case of disputes or fraudulent activities. Historical compliance records show that unregulated brokers often engage in dubious practices, including misleading advertising and the manipulation of trading conditions. Therefore, it is crucial to approach Promarkets with caution, as the question "Is Promarkets safe?" remains unanswered in the context of regulatory protection.

Company Background Investigation

Promarkets is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. The company operates under the name Promarkets Online Ltd., but detailed information about its history and ownership structure is scarce. The lack of transparency regarding the management team and their professional backgrounds further compounds the uncertainty surrounding this broker.

In the financial services industry, a reputable broker typically provides clear information about its founders and management team, including their qualifications and experience. However, Promarkets fails to disclose such critical details, raising concerns about its legitimacy. The absence of transparent information can lead to mistrust among potential investors, as they have no way of verifying the broker's claims or assessing its credibility.

Given these factors, traders should be wary of investing with Promarkets. The question "Is Promarkets safe?" becomes even more pertinent when considering the company's opaque background and lack of regulatory compliance.

Trading Conditions Analysis

Promarkets claims to offer competitive trading conditions, but the specifics of its fee structure and trading costs are not clearly outlined. This lack of clarity is a significant concern, as it may indicate hidden fees or unfavorable trading conditions that could impact traders' profitability. Below is a comparative analysis of core trading costs:

| Fee Type | Promarkets | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The absence of specific data regarding spreads, commissions, and overnight interest rates raises questions about the overall cost of trading with Promarkets. Traders should be cautious of brokers that do not provide transparent information about their fees, as this can lead to unexpected costs and reduced profitability. The question "Is Promarkets safe?" is further complicated by the potential for undisclosed fees that could diminish the value of traders' investments.

Client Funds Safety

The safety of client funds is paramount when evaluating a broker's legitimacy. Promarkets does not provide sufficient information regarding its fund protection measures, such as segregated accounts or investor compensation schemes. Without these safeguards, traders' funds may be at risk, especially in the event of the broker's insolvency or fraudulent activities.

Historically, unregulated brokers like Promarkets have faced allegations of misappropriating client funds, leading to significant financial losses for traders. The lack of a clear policy on negative balance protection also raises concerns, as traders could end up owing more than their initial investment if market conditions turn unfavorable.

Given these factors, it is crucial for potential investors to ask themselves: "Is Promarkets safe?" The answer appears to be negative, as the absence of robust fund protection measures poses a significant risk to traders' capital.

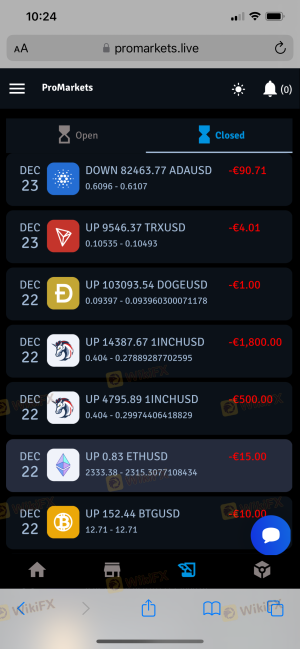

Customer Experience and Complaints

User feedback is a vital component in assessing a broker's reliability. Many reviews and complaints regarding Promarkets indicate a pattern of negative experiences among clients. Common complaints include issues with withdrawal requests, unresponsive customer support, and misleading advertising practices. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | High | Poor |

| Misleading Information | Medium | Poor |

Several users have reported difficulties in withdrawing their funds, with some claiming that their accounts were frozen without explanation. The lack of effective customer support exacerbates these issues, leaving traders feeling abandoned and frustrated.

In light of these complaints, the question "Is Promarkets safe?" becomes increasingly relevant. The negative user experiences and the company's inadequate response to complaints suggest a troubling pattern that potential investors should consider before engaging with this broker.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Promarkets offers access to popular trading platforms, but user reviews indicate that there may be issues related to stability and execution quality. Traders have reported instances of slippage and delayed order execution, which can significantly impact trading outcomes.

Moreover, any signs of platform manipulation, such as sudden price spikes or unexplainable trading halts, could indicate a lack of integrity in the trading environment. Traders must be vigilant and assess whether their trading experience aligns with their expectations.

The question "Is Promarkets safe?" is further complicated by these potential issues with platform reliability and execution quality, as they can directly affect traders' financial outcomes.

Risk Assessment

Engaging with Promarkets presents several risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | Potential for loss of funds due to unregulated practices. |

| Operational Risk | Medium | Issues with platform stability and execution. |

| Customer Support Risk | High | Poor responsiveness to client inquiries. |

To mitigate these risks, traders should conduct thorough due diligence, consider using regulated brokers, and avoid depositing significant funds until they are confident in the broker's legitimacy. The question "Is Promarkets safe?" clearly indicates a high level of risk associated with this broker.

Conclusion and Recommendations

In conclusion, the investigation into Promarkets reveals several concerning factors that suggest it may not be a safe trading option for potential investors. The lack of regulation, transparency, and negative user experiences raise significant red flags. Therefore, it is advisable for traders to exercise extreme caution when considering Promarkets as their trading platform.

For those seeking safer alternatives, it is recommended to look for brokers that are regulated by reputable financial authorities, such as the FCA, ASIC, or CySEC. These brokers typically provide better protection for client funds, transparent trading conditions, and reliable customer support.

In summary, the question "Is Promarkets safe?" can be answered with a resounding no, and traders are encouraged to seek reputable alternatives to safeguard their investments.

Is PROMARKETS a scam, or is it legit?

The latest exposure and evaluation content of PROMARKETS brokers.

PROMARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROMARKETS latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.