ProMarkets 2025 Review: Everything You Need to Know

Executive Summary

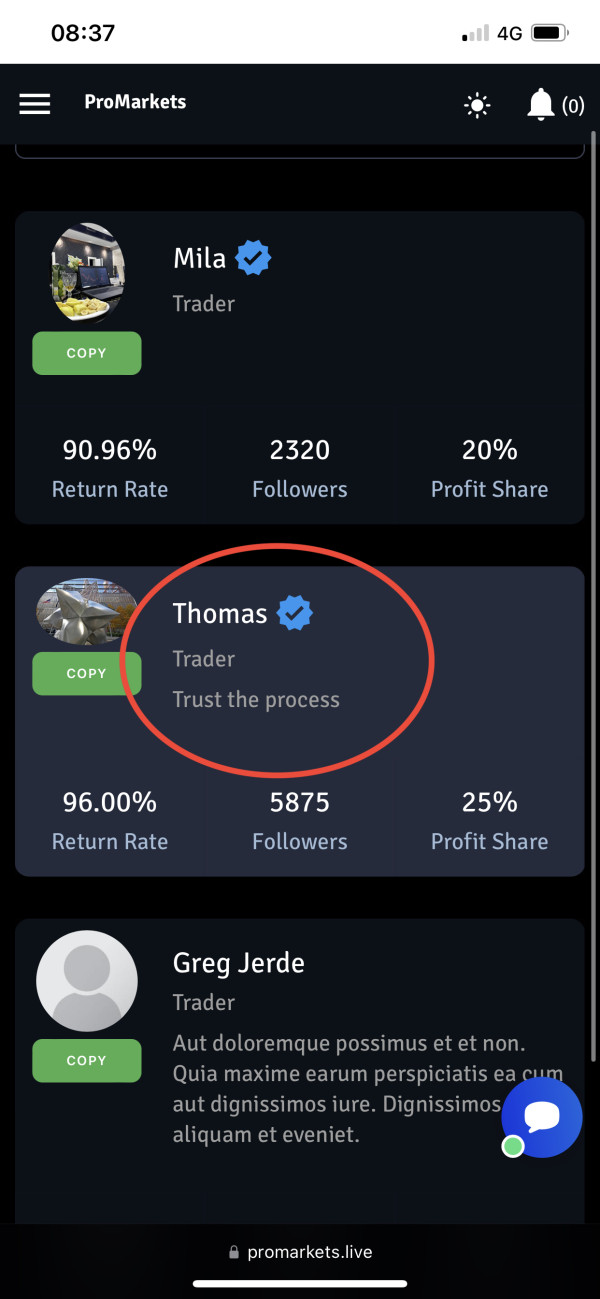

This comprehensive promarkets review reveals significant concerns about the broker's credibility and operational transparency. ProMarkets presents itself as a forex and CFD trading platform offering MetaTrader 4 access, but multiple indicators suggest heightened risk for potential clients. With a Trust Score of 40 and the promarkets.fm domain flagged as a low-trust website, this broker raises substantial red flags regarding potential fraudulent activities.

The broker's primary offering centers around MetaTrader 4 platform access for forex and CFD trading. Detailed information about account structures, regulatory compliance, and operational procedures remains notably absent from available sources. User reviews from various platforms present a mixed picture, though the overall assessment leans heavily negative due to trust and transparency issues.

ProMarkets appears to target traders with higher risk tolerance. This positioning comes with considerable warnings. The lack of clear regulatory information, combined with low trust ratings from multiple assessment sources, suggests that this broker may not meet the safety standards expected by professional traders or regulatory bodies.

Important Notice

This review is based on available information from multiple user review platforms and trust assessment websites. Due to limited official disclosure from ProMarkets, some aspects of their service offering could not be independently verified. The evaluation methodology relies primarily on Trust Score analysis, user feedback compilation, and cross-referencing information across different review platforms.

Traders should exercise extreme caution when considering ProMarkets. The broker's low trust rating and potential fraud indicators suggest significant operational risks. The absence of clear regulatory information in available sources further compounds these concerns.

Rating Framework

Broker Overview

ProMarkets operates as a forex and CFD trading broker. Specific details about its establishment date and corporate background remain unclear from available sources. The company's lack of transparency regarding its founding, corporate structure, and operational history represents a significant concern for potential clients seeking reliable trading partnerships.

The broker's business model appears to focus on providing access to forex and CFD markets through the MetaTrader 4 platform. However, the absence of detailed information about their market-making or ECN model, liquidity providers, and execution methodology raises questions about their operational sophistication and commitment to transparency.

From a regulatory perspective, available sources do not provide clear information about ProMarkets' licensing or oversight by recognized financial authorities. This regulatory ambiguity, combined with the broker's low trust ratings, suggests that traders should approach this promarkets review with considerable skepticism and conduct additional due diligence before considering any engagement.

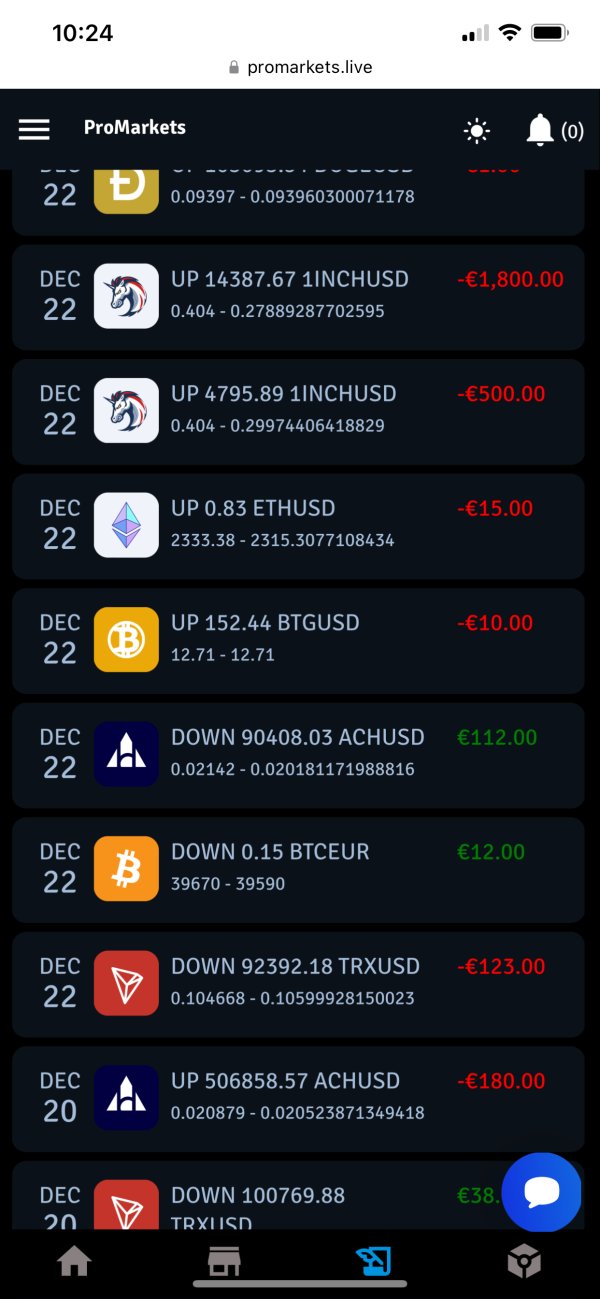

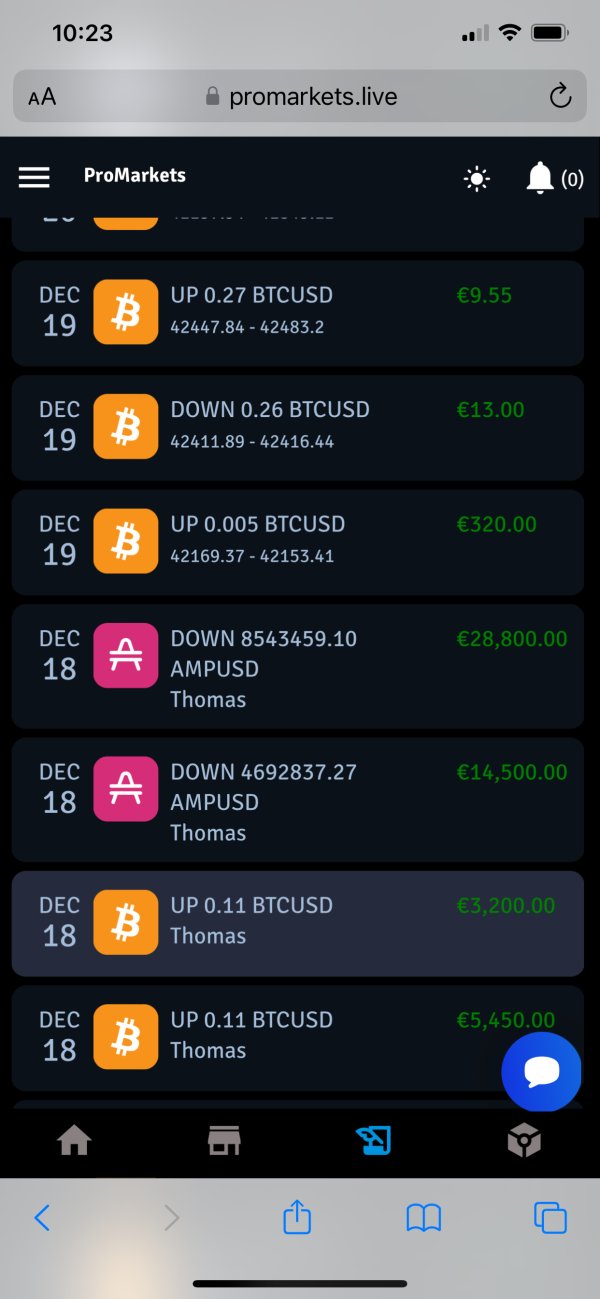

The broker's asset offering reportedly includes forex pairs and CFDs. Specific details about available instruments, market coverage, and trading conditions remain insufficiently documented in accessible sources.

Regulatory Status: Available information does not specify clear regulatory oversight or licensing from recognized financial authorities, representing a significant transparency gap.

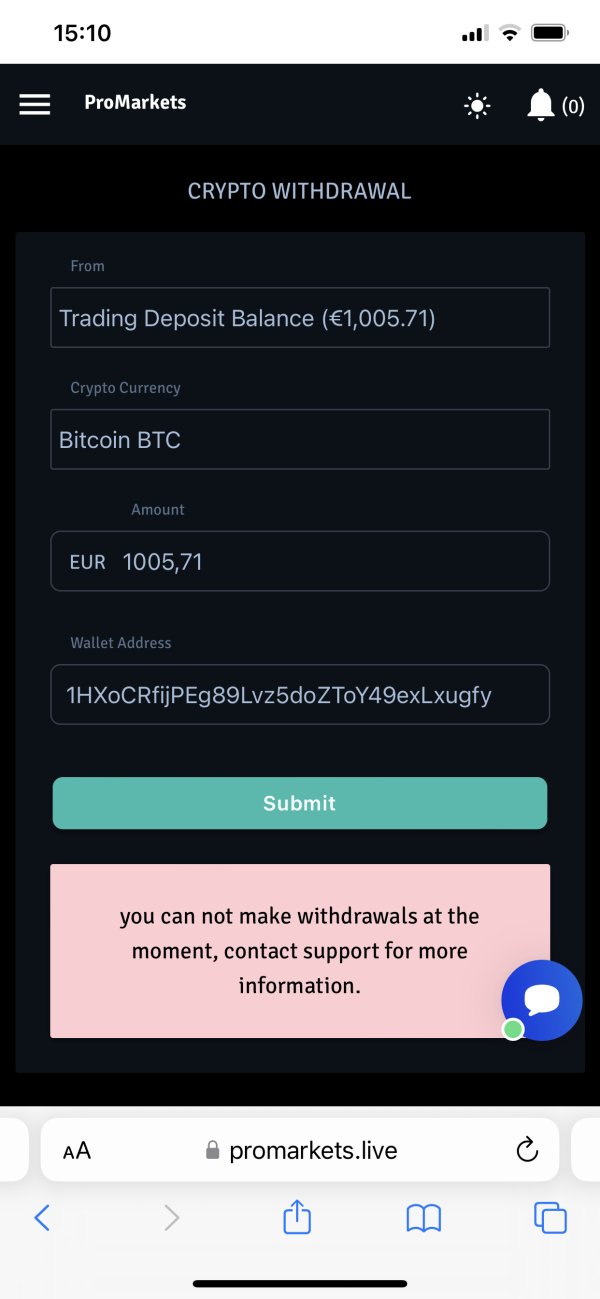

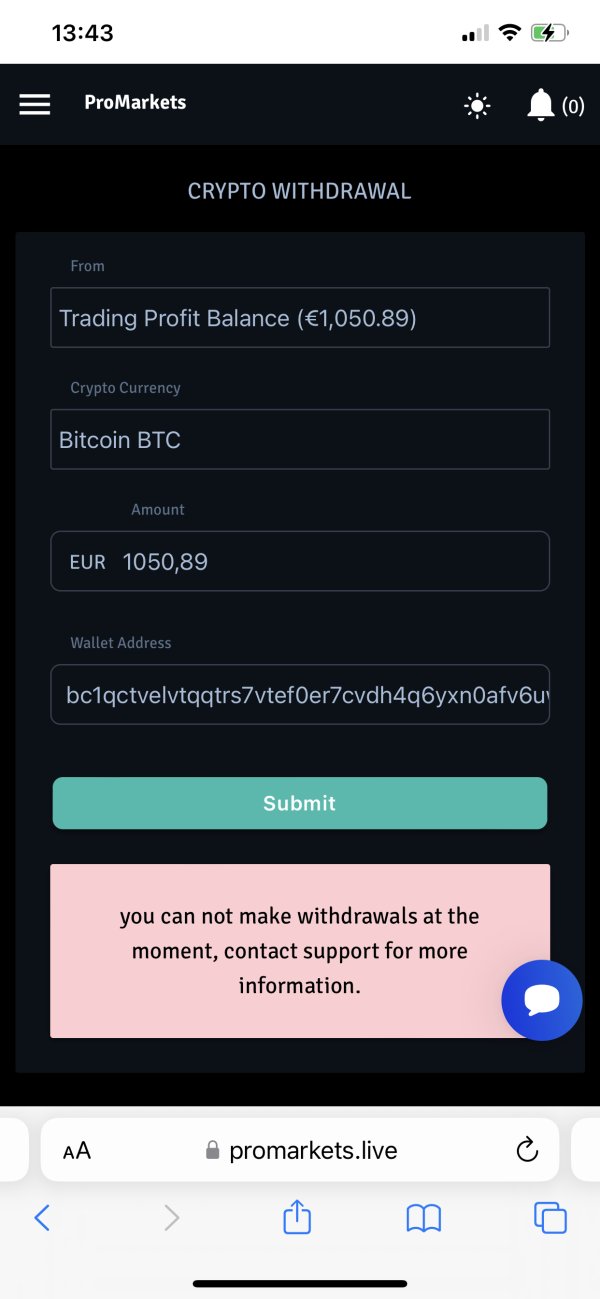

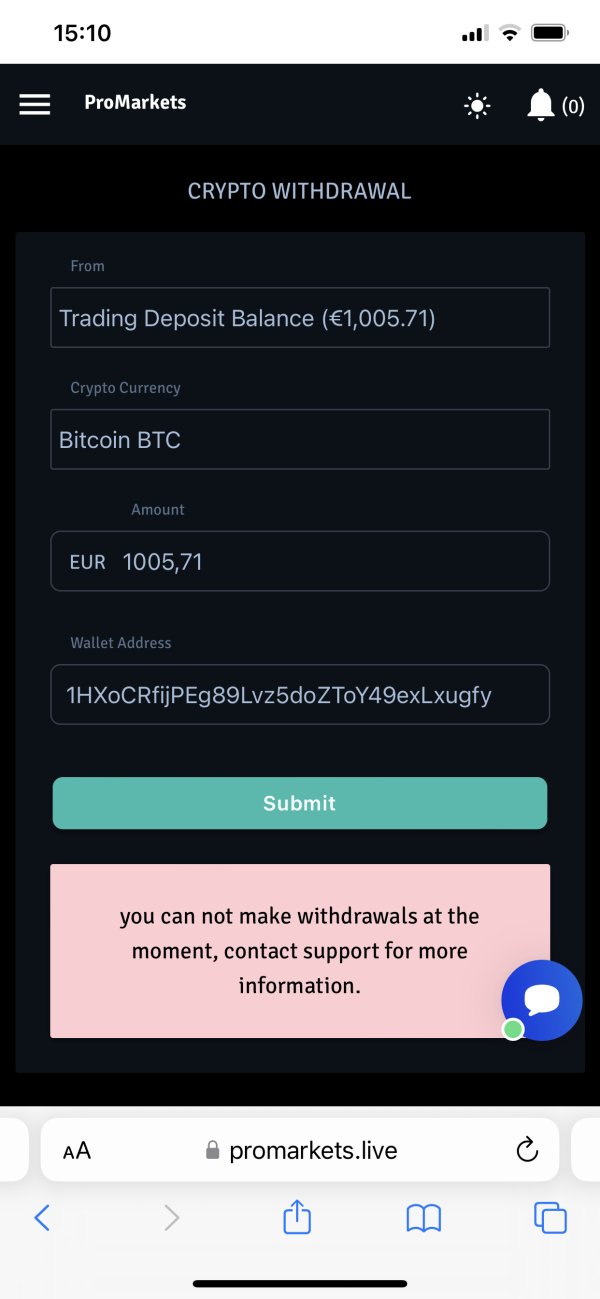

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources.

Minimum Deposit Requirements: The minimum capital requirements for account opening are not clearly specified in accessible documentation.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not available in current sources.

Tradeable Assets: The broker reportedly offers forex and CFD trading. Comprehensive asset lists and specific instrument availability remain undocumented.

Cost Structure: Specific information about spreads, commissions, swap rates, and other trading costs is not available in reviewed sources.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not clearly specified.

Platform Options: MetaTrader 4 is the primary trading platform offered, providing standard charting and execution capabilities.

Geographic Restrictions: Information about service availability across different jurisdictions is not specified in available sources.

Customer Support Languages: Available support languages and communication channels are not detailed in accessible documentation.

This promarkets review reveals significant information gaps that potential clients should consider carefully before making any trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by ProMarkets remain largely undocumented in available sources. This creates significant transparency concerns for potential clients. Without clear information about account types, minimum deposit requirements, or specific terms and conditions, traders cannot make informed decisions about the broker's suitability for their trading needs.

The absence of detailed account structure information suggests either poor communication practices or intentional opacity regarding trading conditions. Professional brokers typically provide comprehensive account specifications, including different tier options, minimum capital requirements, and associated benefits or restrictions.

Available sources do not reference specific user feedback regarding account opening processes, verification requirements, or account management experiences. This lack of user testimonials about practical account conditions further compounds the uncertainty surrounding ProMarkets' service delivery.

The broker's failure to clearly communicate account conditions aligns with the overall pattern of limited transparency that characterizes this promarkets review. Traders seeking reliable account structures with clear terms should consider this informational deficit as a significant warning sign.

ProMarkets' primary strength lies in providing access to the MetaTrader 4 trading platform. This platform offers standard charting tools, technical indicators, and automated trading capabilities through Expert Advisors. MT4 represents a well-established platform choice that many traders find familiar and functional for basic trading operations.

However, beyond MT4 access, available information does not detail additional trading tools, research resources, or educational materials that the broker might provide. Professional trading environments typically offer market analysis, economic calendars, trading signals, and educational content to support trader development.

The absence of information about proprietary tools, third-party research partnerships, or value-added services suggests a basic service offering. This may not meet the needs of more sophisticated traders. Advanced features like VPS hosting, API access, or premium analytical tools are not mentioned in available sources.

User feedback specifically regarding tool quality, platform stability, or resource usefulness is not available in reviewed sources. This makes it difficult to assess the practical value of ProMarkets' technological offerings beyond the standard MT4 functionality.

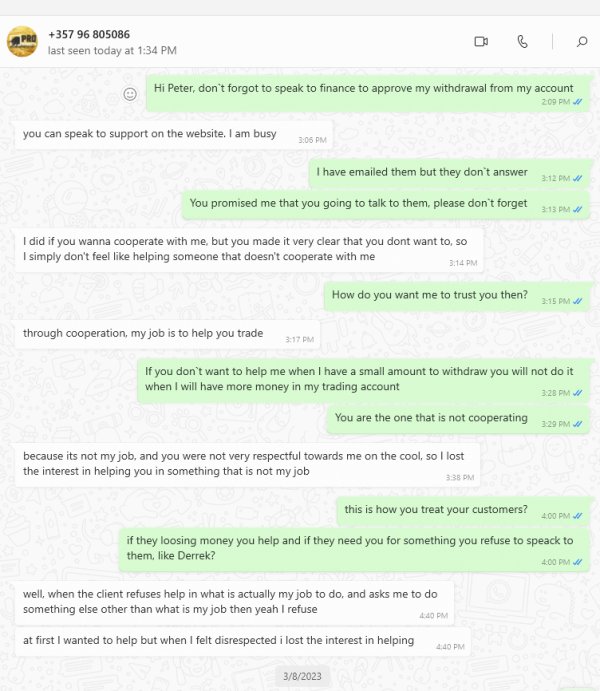

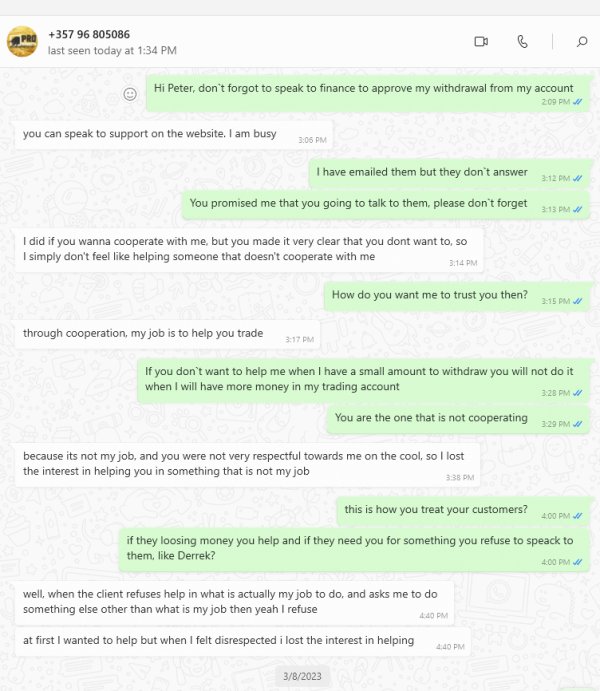

Customer Service and Support Analysis

Customer service quality and availability represent critical concerns in this ProMarkets evaluation. Available sources provide insufficient information about support channels, response times, or service quality standards. The absence of clear customer service information creates uncertainty about the broker's commitment to client support.

Professional brokers typically offer multiple communication channels including live chat, email support, phone assistance, and comprehensive FAQ resources. The lack of detailed support information in available sources suggests either inadequate service infrastructure or poor communication about available support options.

Response time expectations, support availability hours, and multilingual capabilities are not specified in accessible documentation. These service parameters are essential for traders who require reliable assistance with technical issues, account management, or trading-related inquiries.

Without user testimonials or feedback about customer service experiences, potential clients cannot assess the practical quality of support they might receive. This informational gap, combined with the broker's overall trust concerns, suggests that customer service may not meet professional standards expected by serious traders.

Trading Experience Analysis

The trading experience offered by ProMarkets centers around MetaTrader 4 platform access. This provides basic functionality for order execution, chart analysis, and automated trading. However, critical aspects of the trading environment including execution quality, platform stability, and order processing efficiency remain undocumented in available sources.

Platform performance metrics such as uptime statistics, execution speed data, and slippage rates are not available for review. These technical performance indicators are essential for assessing whether the broker can provide reliable trading conditions, particularly during volatile market periods.

Mobile trading capabilities, while presumably available through standard MT4 mobile applications, are not specifically detailed in terms of functionality or user experience optimization. Modern traders expect seamless mobile access with full platform capabilities.

The absence of user feedback about practical trading experiences, including order execution quality, platform reliability, and overall trading environment satisfaction, makes it difficult to assess the real-world performance of ProMarkets' trading infrastructure. This promarkets review cannot provide confidence about the actual trading experience quality.

Trust and Safety Analysis

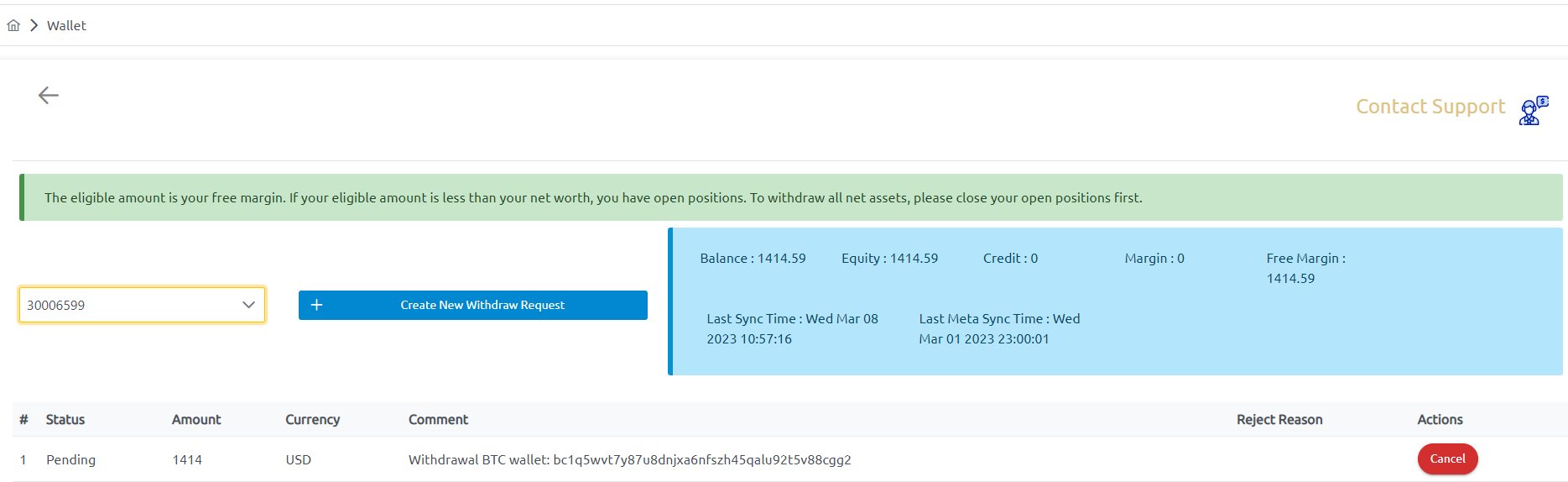

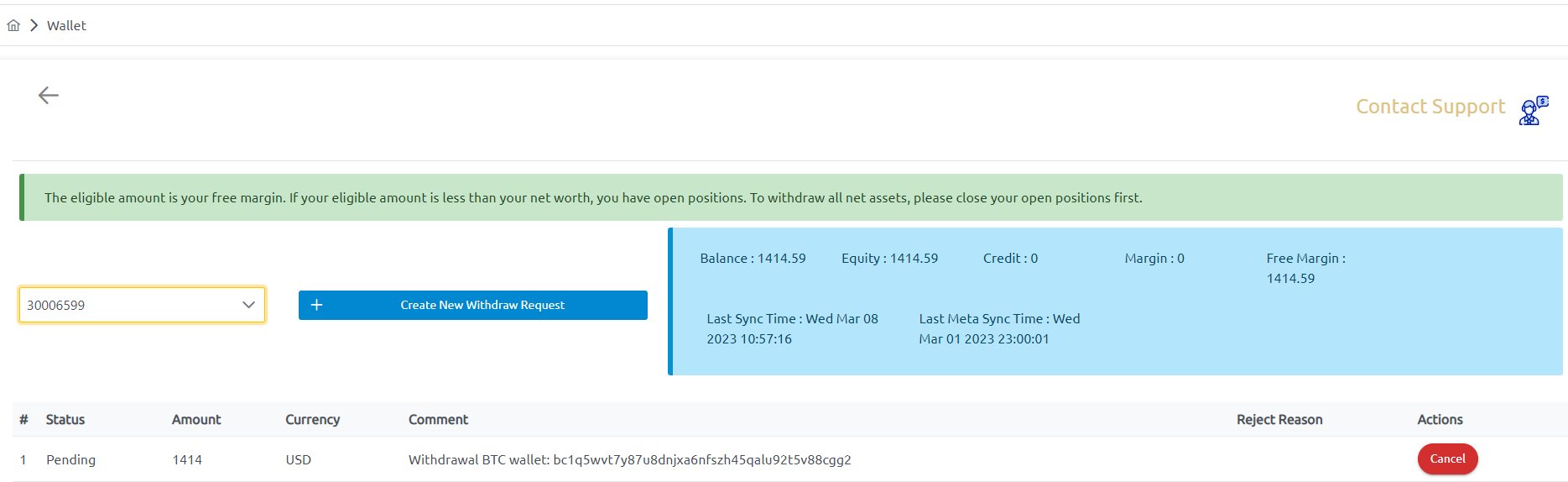

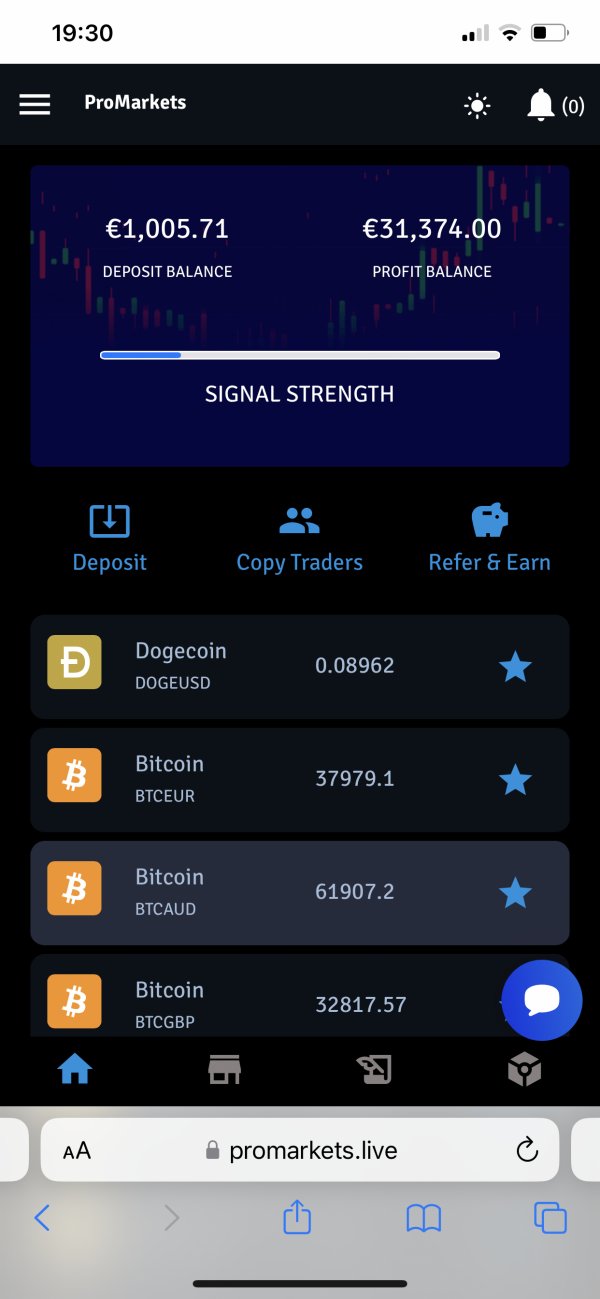

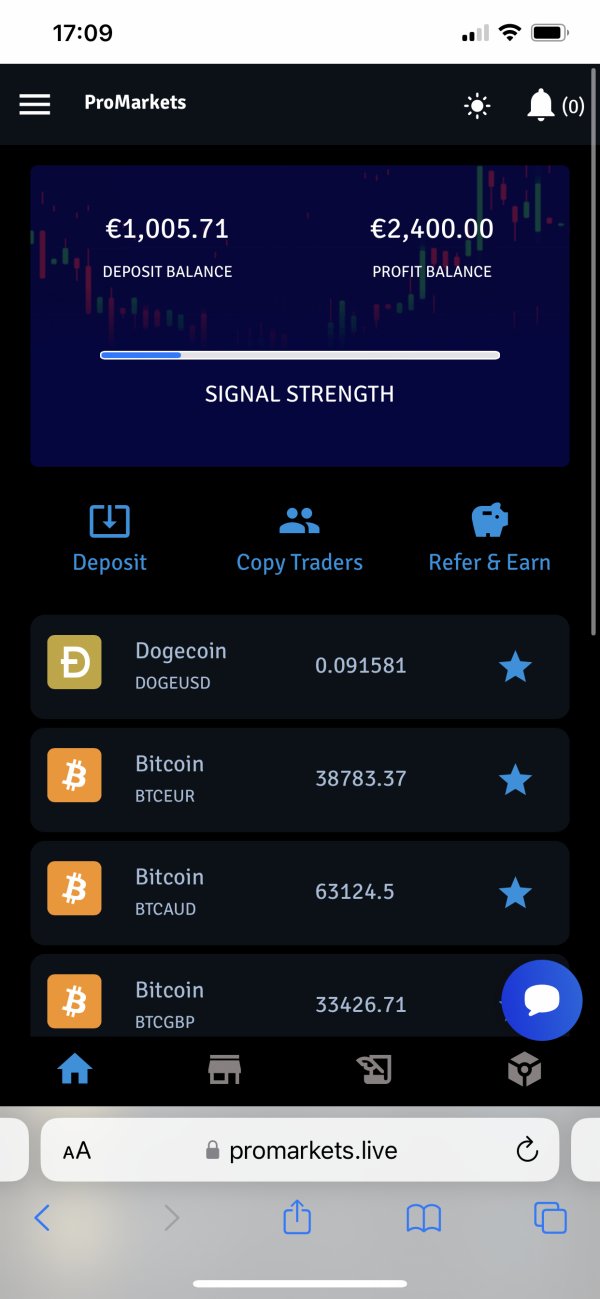

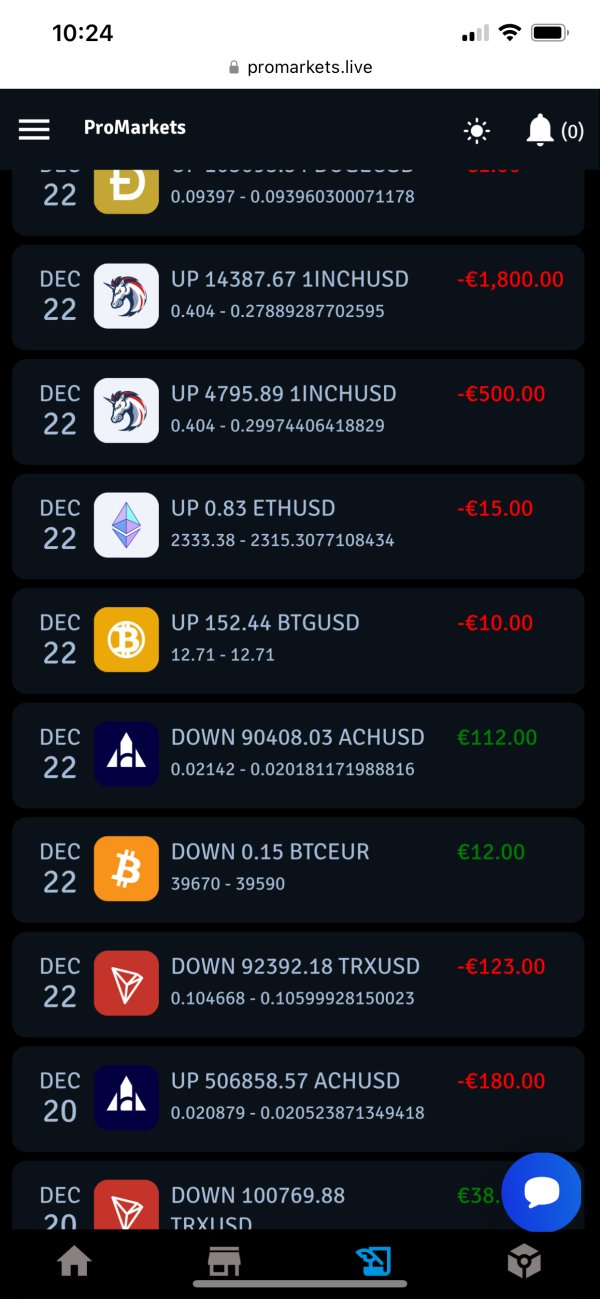

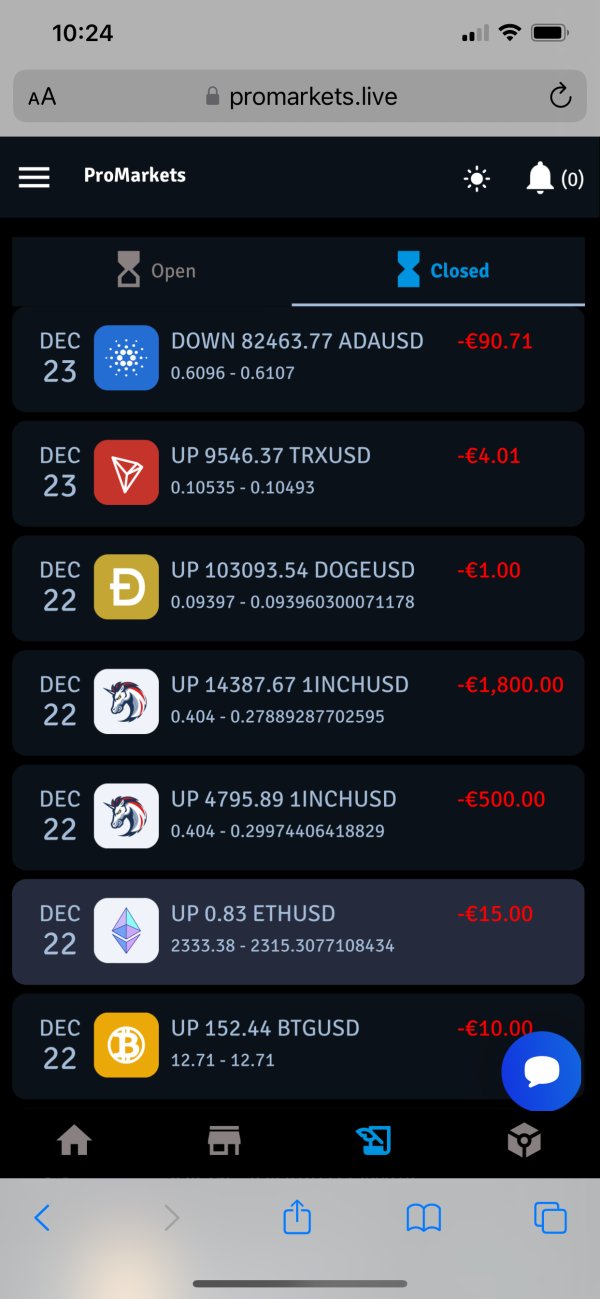

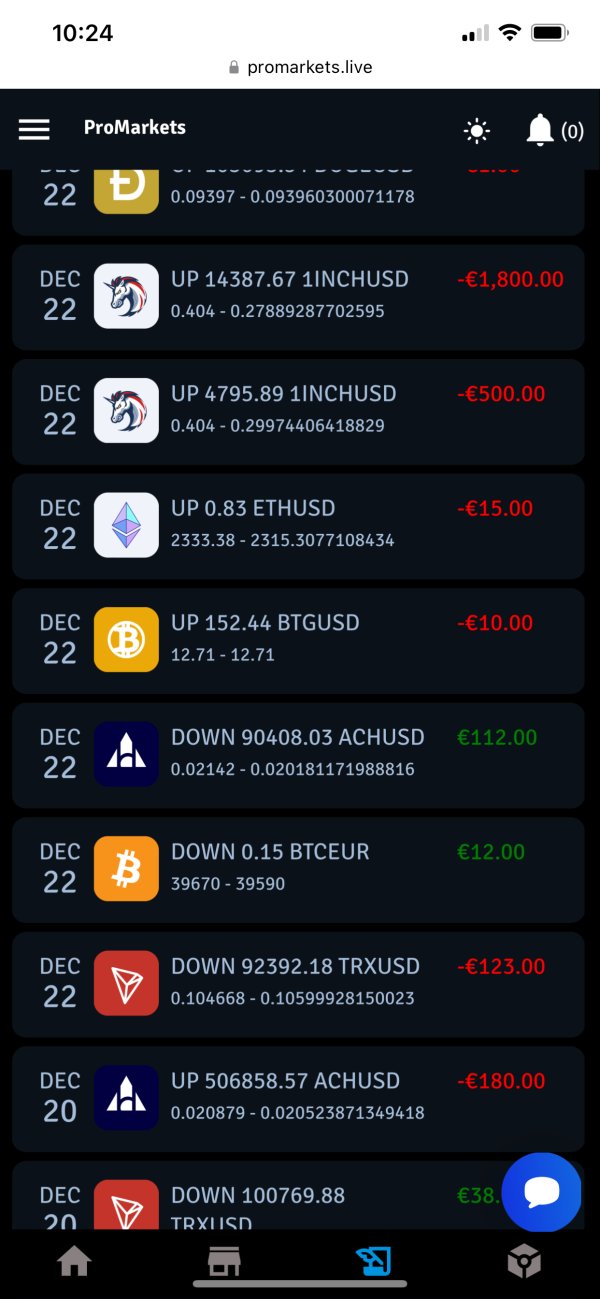

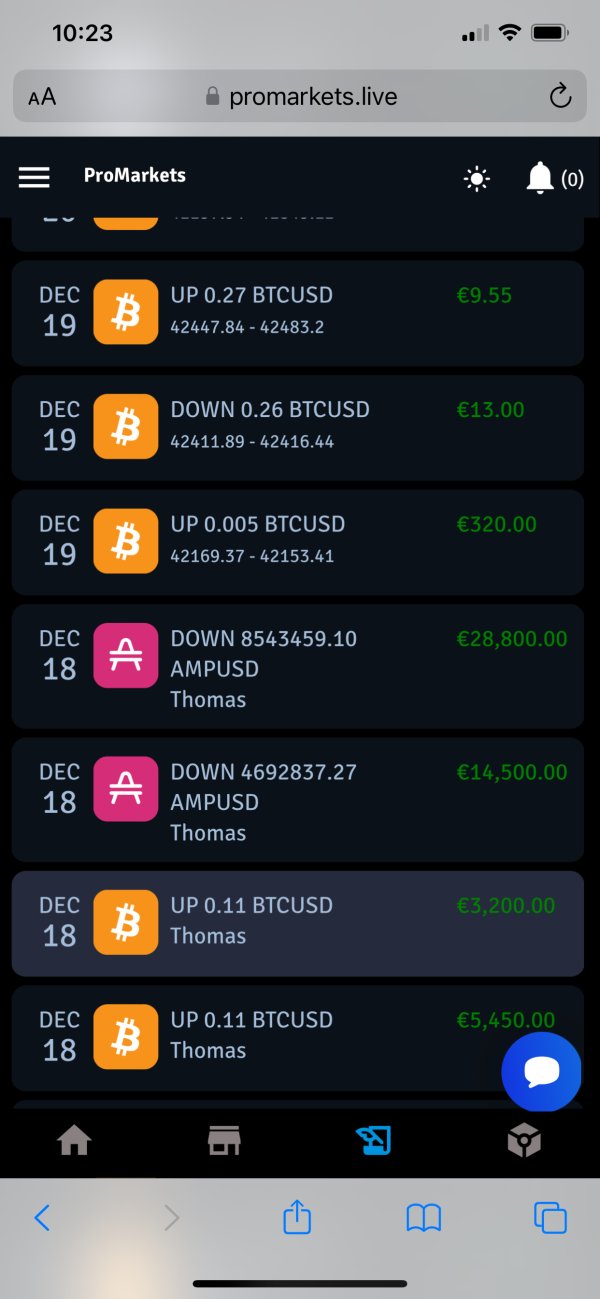

Trust and safety represent the most concerning aspects of ProMarkets' offering. Multiple indicators suggest significant risks for potential clients. The broker's Trust Score of 40 and the flagging of promarkets.fm as a low-trust website with potential fraud risks create serious credibility concerns.

The absence of clear regulatory information compounds these trust issues significantly. Legitimate brokers typically maintain transparent regulatory compliance, displaying license numbers, regulatory body oversight, and adherence to industry standards. ProMarkets' failure to provide clear regulatory credentials suggests potential operational irregularities.

Fund security measures, client money segregation policies, and investor protection schemes are not detailed in available sources. These safeguards are fundamental requirements for legitimate financial service providers and their absence raises substantial safety concerns.

The combination of low trust ratings, regulatory ambiguity, and limited transparency suggests that ProMarkets may not provide the security standards expected by professional traders. These standards are also required by regulatory authorities in major financial jurisdictions.

User Experience Analysis

User experience assessment for ProMarkets is complicated by limited available feedback and the concerning trust indicators that overshadow operational considerations. The overall user satisfaction picture remains unclear due to insufficient testimonials and reviews in accessible sources.

Interface design and platform usability appear to rely primarily on standard MetaTrader 4 functionality. Broker-specific customizations or user experience enhancements are not documented. Modern trading environments typically offer streamlined interfaces and user-friendly design elements.

Registration and verification processes are not detailed in available sources. This creates uncertainty about account opening procedures and documentation requirements. Efficient onboarding processes are essential for positive initial user experiences.

The lack of comprehensive user feedback about practical experiences with fund operations, customer service interactions, and overall satisfaction levels prevents a thorough assessment of ProMarkets' user experience quality. The trust concerns identified throughout this evaluation suggest that user experience may be secondary to more fundamental operational issues.

Conclusion

This promarkets review reveals significant concerns that outweigh any potential benefits of the broker's MetaTrader 4 platform access. The combination of low trust ratings, regulatory ambiguity, and limited operational transparency creates substantial risks for potential clients.

ProMarkets may appeal only to traders with extremely high risk tolerance who prioritize platform access over safety and regulatory compliance. However, the identified trust and transparency issues suggest that even risk-tolerant traders should consider alternative brokers with stronger credibility profiles.

The primary advantage of MetaTrader 4 access is overshadowed by critical disadvantages. These include low trust scores, potential fraud risks, lack of regulatory clarity, and insufficient operational transparency. These factors combine to create an overall negative assessment that recommends caution for any potential engagement with ProMarkets.