Regarding the legitimacy of PriorFX forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is PriorFX safe?

Business

License

Is PriorFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnsubscribedLicense Type:

Market Making License (MM)

Licensed Entity:

Prior Capital CY Ltd

Effective Date:

2013-12-17Email Address of Licensed Institution:

support@priorcapital.euSharing Status:

Website of Licensed Institution:

www.priorfx.com, priorcapital.euExpiration Time:

--Address of Licensed Institution:

196 Arch. Makariou III Ave., Ariel Corner, 3030 LiMassolPhone Number of Licensed Institution:

+357 25 25 82 20Licensed Institution Certified Documents:

Is PriorFX Safe or Scam?

Introduction

PriorFX is an online forex broker that has been operating in the financial markets since its establishment in 2013. Based in Cyprus, it offers a variety of trading services, including forex, CFDs, and commodities, catering to traders worldwide. However, the forex market is notorious for its risks, and choosing a reliable broker is paramount for traders looking to protect their investments. Therefore, it is essential for prospective clients to carefully assess the legitimacy and safety of brokers like PriorFX before committing their funds. This article employs a comprehensive evaluation framework, analyzing regulatory compliance, company background, trading conditions, and customer experiences to determine whether PriorFX is safe or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a critical factor in assessing the safety of any forex broker. PriorFX claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 221/13. Regulatory bodies like CySEC enforce strict guidelines to protect traders, including maintaining minimum capital requirements and ensuring the segregation of client funds. However, it is crucial to note that PriorFX has faced scrutiny regarding its regulatory status, with reports indicating that its license has been suspended in the past.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 221/13 | Cyprus | Suspended |

The quality of regulation is vital, as it provides traders with a safety net against broker insolvency and malpractice. While PriorFX is registered with CySEC, its previous license suspension raises questions about its compliance history. Traders should be cautious and consider these factors when evaluating whether PriorFX is safe for trading.

Company Background Investigation

PriorFX was founded in 2013 and operates under the ownership of Prior Capital CY Ltd. The broker's management team has varied backgrounds in finance and trading, contributing to its operational capabilities. However, the lack of detailed information about key personnel and their professional experiences can be a red flag. Transparency is crucial in the financial industry, and brokers that do not disclose their management structure may indicate potential risks.

In terms of operational history, PriorFX has navigated through the competitive landscape of forex trading but has faced challenges regarding its regulatory standing. The broker's commitment to transparency and ethical practices is questionable, especially given the mixed reviews from users and the regulatory issues it has encountered. This lack of clarity may lead traders to wonder whether PriorFX is safe for investment.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. PriorFX offers competitive spreads starting from 1.2 pips on major currency pairs and a minimum deposit requirement of $250. While these conditions are relatively standard, the broker's fee structure is crucial to assess.

| Fee Type | PriorFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | $8 per lot (Xchange account) | $10 per lot |

| Overnight Interest Range | Varies | Varies |

Although PriorFX does not charge commissions on standard accounts, the commission for the Xchange account may deter some traders. Additionally, the absence of a clear and transparent fee structure could lead to unexpected costs, raising concerns about whether PriorFX is safe for trading.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. PriorFX claims to implement measures such as segregating client funds from company operational accounts. Furthermore, being a member of the Investor Compensation Fund (ICF) offers some level of protection, as it provides compensation of up to €20,000 in case of broker insolvency.

However, there have been historical concerns regarding the broker's financial stability and regulatory compliance, which may pose risks to client funds. Traders should be wary of any broker that has faced regulatory actions or lacks a solid financial foundation. It is essential to consider whether PriorFX is safe in terms of fund security, especially given the mixed reviews regarding its operational practices.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. PriorFX has received a mix of reviews, with some clients praising its trading platform and customer service, while others have raised significant concerns regarding account management and withdrawal processes. Common complaints include account freezes, delays in withdrawals, and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Account Management Issues | High | Slow response |

| Withdrawal Delays | High | Limited communication |

| Customer Support Quality | Medium | Inconsistent |

For instance, one user reported difficulties withdrawing funds and claimed that their account was blocked without explanation. This lack of responsiveness can lead to a negative trading experience, prompting questions about whether PriorFX is safe for traders seeking reliable support.

Platform and Execution Quality

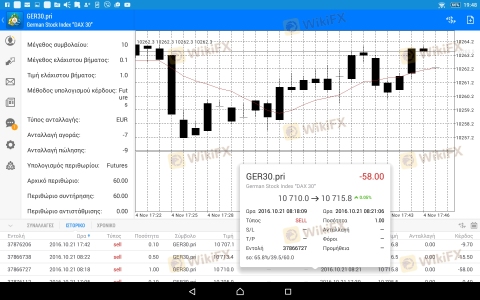

PriorFX utilizes the popular MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. However, users have reported issues with platform stability and execution quality, including slippage and order rejections. These factors can significantly impact a trader's performance and raise concerns about potential manipulation or inefficiencies.

The execution quality of a broker is crucial, as it directly affects trading outcomes. Traders must be aware of any signs of poor execution or platform manipulation when considering whether PriorFX is safe for their trading activities.

Risk Assessment

Using PriorFX comes with inherent risks that traders should carefully evaluate. The broker's regulatory history, customer complaints, and platform performance contribute to a risk profile that may not be suitable for all traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspended license history |

| Customer Support | Medium | Inconsistent responses |

| Platform Stability | High | Reports of crashes and slippage |

To mitigate these risks, traders should consider diversifying their investments and not committing significant capital to a broker with a questionable reputation. Conducting thorough research and seeking alternative brokers with better reviews may be prudent for those considering whether PriorFX is safe.

Conclusion and Recommendations

In conclusion, while PriorFX presents itself as a regulated broker with various trading options, multiple factors raise concerns about its safety and reliability. The broker's regulatory history, customer feedback, and platform performance suggest that traders should exercise caution.

For those seeking a trustworthy trading experience, it may be wise to consider alternative brokers with a stronger regulatory standing and better customer reviews. Ultimately, while PriorFX may offer some appealing features, the potential risks associated with trading with this broker warrant careful consideration before proceeding.

Is PriorFX a scam, or is it legit?

The latest exposure and evaluation content of PriorFX brokers.

PriorFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PriorFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.