Is BREAKAWAY safe?

Pros

Cons

Is Breakaway Safe or Scam?

Introduction

Breakaway is a relatively new entrant in the forex market, having been established in 2024. The broker positions itself as a platform for trading various financial instruments, including currency pairs, commodities, and cryptocurrencies. With the growing number of forex brokers in the market, traders must exercise caution and thoroughly evaluate their options before investing their hard-earned money. This article aims to provide a comprehensive analysis of Breakaway, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The evaluation is based on extensive research, including reviews from reputable financial websites and customer feedback.

Regulation and Legitimacy

Understanding the regulatory environment is crucial when assessing whether Breakaway is safe. Regulation ensures that brokers adhere to specific standards, providing a level of protection for traders. Breakaway claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent oversight of financial markets.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001311740 | Australia | Verified |

ASIC regulation is generally considered a positive sign, as it signifies that the broker must comply with strict financial standards and operational practices. However, it is essential to note that Breakaway has only been operational for a year, which raises questions about its historical compliance and reliability. A broker with a longer track record of adherence to regulatory guidelines is often viewed as a safer option. Therefore, while Breakaway is regulated, its relatively short history necessitates a cautious approach.

Company Background Investigation

Breakaway Ltd. was founded in March 2024 and is registered in Australia. The company operates under the ownership of Breakaway (Aust) Pty Ltd, which adds a layer of legitimacy to its operations. However, the management teams background is crucial in assessing the broker's credibility. A strong management team with relevant industry experience generally indicates a higher likelihood of trustworthy practices.

Unfortunately, detailed information about the management team is scarce, which could be a red flag. Transparency in disclosing management credentials and company history is vital for building trust with potential clients. Additionally, the company's physical address is listed in Saint Lucia, which is often associated with less stringent regulatory environments. This discrepancy may lead to concerns regarding the overall transparency and accountability of Breakaway.

Trading Conditions Analysis

When evaluating whether Breakaway is safe, analyzing its trading conditions is essential. The broker offers a variety of account types, including micro, standard, and ECN accounts, with a minimum deposit requirement of just $10. This low barrier to entry may attract novice traders, but it also raises questions about the broker's ability to provide adequate support and resources.

Breakaway's fee structure is competitive, with spreads starting as low as 0 pips on ECN accounts. However, traders should be wary of potentially hidden fees or commissions that could affect overall profitability.

| Fee Type | Breakaway | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0 pips | 1-2 pips |

| Commission Model | Not specified | Typically $5-10 per trade |

| Overnight Interest Range | Variable | Typically 2-5% |

While the spreads may seem attractive, the lack of transparency regarding commission structures could indicate potential pitfalls for traders. Therefore, it is essential to scrutinize the terms and conditions carefully before committing to trading with Breakaway.

Customer Funds Safety

The safety of customer funds is a critical aspect when considering whether Breakaway is safe. The broker claims to implement measures such as segregated accounts to protect client funds. This means that traders' money is kept separate from the company's operational funds, which is a standard practice among reputable brokers.

Additionally, Breakaway states that it offers negative balance protection, ensuring that clients cannot lose more than their initial investment. However, the efficacy of these measures can only be assessed through customer experiences and historical performance.

There have been no significant reports of fund safety issues with Breakaway so far, but given its short operational history, traders should remain vigilant. Continuous monitoring of the broker's practices and any changes in its regulatory status is advisable to ensure ongoing safety.

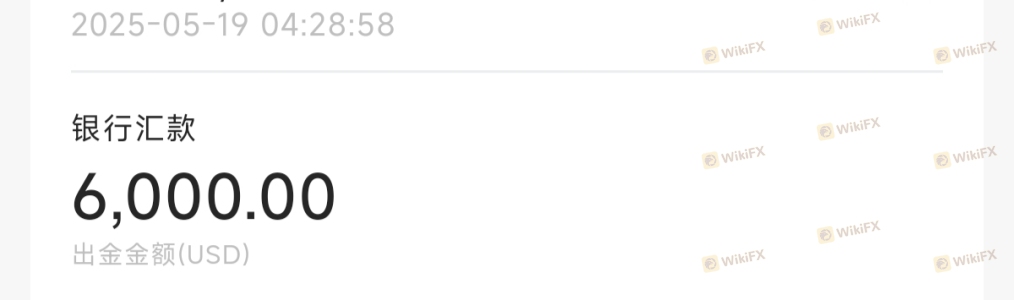

Customer Experience and Complaints

Customer feedback is invaluable in determining whether Breakaway is safe. An analysis of user reviews reveals a mixed bag of experiences. While some users praise the broker for its user-friendly platform and responsive customer service, others report concerns regarding withdrawal processes and lack of communication during trading issues.

Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Inconsistent |

| Poor Customer Support | High | Delayed replies |

For instance, one user reported difficulties in withdrawing funds, citing a lack of response from customer support. Such experiences highlight the importance of evaluating customer service quality before engaging with any broker. A broker that is unresponsive during critical moments may pose a risk to traders' investments.

Platform and Trade Execution

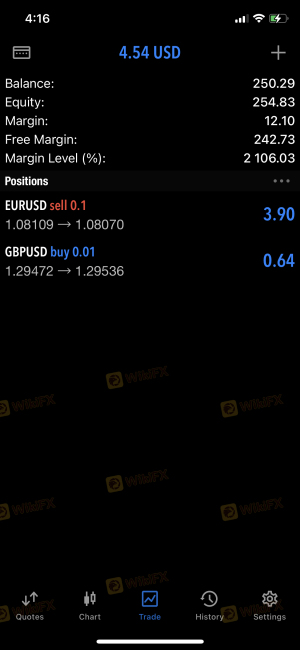

The performance of the trading platform is another crucial factor in assessing whether Breakaway is safe. The broker utilizes the MetaTrader 5 (MT5) platform, which is known for its reliability and user-friendly interface. However, the platform's performance can vary based on server stability and execution speed.

Traders have reported mixed experiences regarding order execution, with some noting instances of slippage and delayed order processing. High slippage can significantly impact trading outcomes, especially for those utilizing scalping strategies. Therefore, it is vital to test the platform thoroughly using a demo account before committing real funds.

Risk Assessment

Using Breakaway involves several risks that traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited history and transparency |

| Operational Risk | Medium | Potential withdrawal issues |

| Market Risk | High | High leverage (up to 1:1000) |

To mitigate these risks, traders are advised to implement risk management strategies, such as setting stop-loss orders and only trading with funds they can afford to lose. Additionally, conducting ongoing research and staying updated on regulatory changes will help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, while Breakaway is regulated by ASIC, its relatively short operational history and mixed customer feedback raise concerns about its overall safety. The broker does offer competitive trading conditions and safety measures for customer funds, but potential traders should remain cautious.

For those considering trading with Breakaway, it is advisable to start with a demo account to assess the platform's performance and customer service quality. If you are risk-averse or prefer established brokers, consider alternatives such as IG Group or OANDA, which have longer track records and more robust regulatory oversight. Always prioritize safety and due diligence when choosing a forex broker, as the forex market can be fraught with risks.

Is BREAKAWAY a scam, or is it legit?

The latest exposure and evaluation content of BREAKAWAY brokers.

BREAKAWAY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BREAKAWAY latest industry rating score is 1.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.